Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Content provided by Credible. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

This article first appeared on the Credible blog.

While you can use student loans and other financial aid to help pay for college, they might not be enough to cover all of your expenses. In some cases, it might make sense to take out a personal loan to fill this kind of financial gap.

Visit Credible to compare personal loan rates from various lenders in minutes.

Here’s what you should know about personal loans for students:

Personal loans for students

While personal loans typically can’t be used for education costs like tuition, they could help cover other expenses. For example, you could use a personal loan to pay for college textbooks, housing, and more.

Here are Credible’s partner lenders that offer personal loans:

Achieve

Achieve personal loans range from $7,500 to $50,000 with repayment terms from two to five years. If you’re approved, you could get your funds in as little as two business days.

Avant

If you have poor or fair credit, Avant might be a good option. You can borrow $2,000 to $35,000 with repayment terms from two to five years.

Axos Bank

Axos Bank offers personal loans from $10,000 to $50,000 with terms from three to six years. If you’re approved, you could get your funds as soon as the next business day.

Best Egg

With Best Egg, you can borrow $2,000 to $50,000 with terms from two to five years. Best Egg offers particularly competitive rates to borrowers with good to excellent credit — however, you might still qualify with Best Egg with poor or fair credit.

Discover

If you’re looking for a longer repayment term, Discover might be a good option — you can borrow $2,500 to $35,000 with terms from three to seven years. Just keep in mind that choosing a longer term means you’ll pay more in interest over time.

LendingClub

If you need a cosigner, LendingClub might be a good option — it’s one of the few lenders that allow cosigners on personal loans. You can borrow $1,000 to $40,000 with a term of three or five years.

LendingPoint

LendingPoint specializes in working with borrowers who have near-prime credit — usually meaning a credit score in the upper 500s or 600s. You can borrow $2,000 to $36,500 with repayment terms from two to six years.

LightStream

LightStream could be a good choice if you need a large loan amount — you can borrow $5,000 to $100,000 with terms from two to seven years. If you’re approved, you could get your funds as soon as the same business day.

OneMain Financial

Unlike many other personal loan lenders, OneMain Financial has no minimum required credit score. It will also consider your financial history, income, expenses, and loan purpose in addition to your credit history to determine your creditworthiness.

You can borrow $1,500 to $20,000 with terms from two to five years. Keep in mind that larger loan amounts might require collateral.

PenFed

If you need to borrow only a small amount, PenFed could be a good choice — you can borrow as little as $600 up to $50,000 with terms from one to five years. Keep in mind that while you don’t have to be a PenFed member to apply, you’ll have to join the credit union if you are approved and decide to accept the loan.

Prosper

With Prosper, you can borrow $2,000 to $50,000 with terms from two to five years. Because Prosper is a peer-to-peer lender, its funding time can sometimes take longer than other lenders — however, you might be able to get your funds in as little as one business day if you’re approved.

SoFi

SoFi is another lender that offers large personal loans — you can borrow $5,000 to $100,000 with terms from two to seven years. Additionally, SoFi borrowers have access to several perks, such as unemployment protection, career coaching, and investing advice.

Upgrade

With Upgrade, you can borrow $1,000 to $50,000 with terms from two to six years. Upgrade also provides free credit monitoring and educational resources, which could help you build your credit as a college student.

Upstart

In addition to your credit score, Upstart will consider your education and job history to determine creditworthiness — which means you might qualify even if you have little to no credit.

Personal loans vs. student loans: Which to choose?

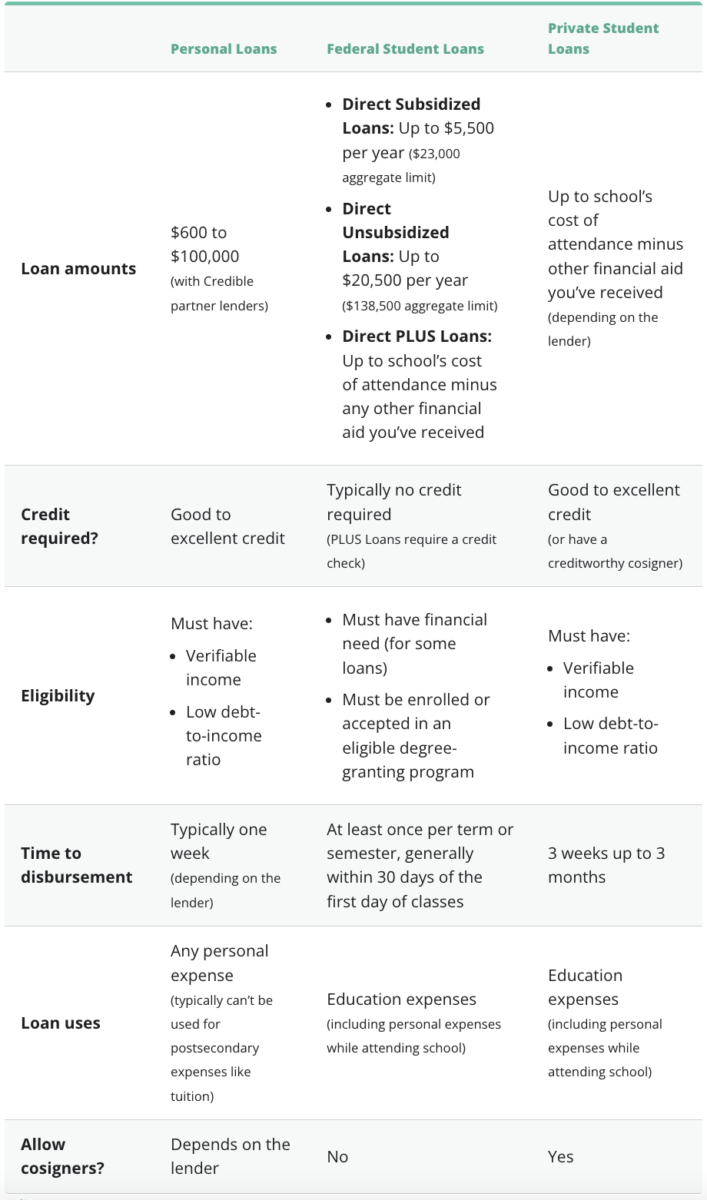

While personal loans and student loans can both be used to cover expenses while attending college, there are differences to keep in mind. Here’s how both types of loans work:

Personal loans

A personal loan can be used for almost any personal expense. Most personal loans are unsecured — meaning you won’t have to worry about collateral — and generally range from $600 to $100,000 or more.

You’ll typically need to have good to excellent credit and verifiable income to get approved for a personal loan.

Personal loans can have much higher interest rates than student loans, which can make them an expensive option by comparison. Additionally, personal loans don’t come with a deferment option, so you’ll have to start making payments as soon as the loan is disbursed.

Student loans

Both federal and private student loans are specifically designed to help borrowers pay for college. It’s usually a good idea to take out federal loans first since they come with federal protections, such as access to income-driven repayment plans and student loan forgiveness programs. You can then use private student loans to fill any financial gaps left over.

Here are the types of student loans you might be able to get:

- Federal Direct Subsidized Loans are available to undergraduate borrowers with financial need. The government pays the interest on subsidized loans while you’re in school.

- Federal Direct Unsubsidized Loans are available to both undergraduate and graduate students regardless of financial need. Unlike with subsidized loans, you’re responsible for all of the interest that accrued on unsubsidized loans.

- Federal Direct PLUS Loans are available to students who need to pay for grad school and parents who want to cover their child’s education costs. Unlike other types of federal student loans, PLUS Loans require a credit check.

- Private student loans are offered by private lenders. To get approved for a private loan, you’ll generally need either good to excellent credit or a creditworthy cosigner.

Using student loans for personal expenses

To attend college, you won’t only have to pay for tuition and fees — you’ll likely also have to cover personal expenses like college housing, textbooks, and transportation. Because of this, both federal and private student loans can be used for personal expenses while you’re going to school.

Keep in mind: Student loan limits can cap how much you’ll actually be able to borrow in student loans. With federal student loans, you can borrow up to an aggregate limit of $23,000 in subsidized loans; an aggregate limit of $138,500 in unsubsidized loans; and up to your school’s cost of attendance (minus other aid you’ve received) in PLUS Loans. With private student loans, you might be able to borrow up to your school’s cost of attendance, depending on the lender.

If you decide to take out a private student loan, be sure to consider as many lenders as possible to find the right loan for your needs. Credible makes this easy — you can compare your prequalified rates from multiple lenders in two minutes.

Can you get a personal loan as a student?

Yes, students might be able to get a personal loan. However, you’ll typically need to have good to excellent credit as well as verifiable income to get approved — this could be difficult for students who have little to no credit history or income.

Tip: If you’re struggling to get approved for a personal loan, consider applying with a cosigner. Not all lenders allow cosigners on personal loans, but some do. Even if you don’t need a cosigner to qualify, having one could get you a lower interest rate than you’d get on your own.

If you decide to take out a personal loan, it’s important to consider how much that loan will cost you. This way, you can be prepared for any added expenses. You can estimate how much you’ll pay for a loan using this personal loan calculator.

Need a personal loan? Compare rates without affecting your credit score.

How can a student get a small loan?

If you need only a small amount to help you pay for your educational or living expenses, there are options available.

- Personal loans are available for as little as $600, depending on the lender. When you apply for a loan, you can ask for only the amount you need.

- Student loans typically come in higher loan amounts. However, you’re welcome to take only as much as you need. If you still end up with more money than you want, you might be able to return it, depending on the type of loan you have. Or you can simply pay it back as a payment to reduce your loan amount.

How to get a personal loan

If you’re ready to apply for a personal loan, follow these four steps:

- Shop around and compare lenders. Be sure to compare as many personal loan lenders as you can to find the right loan for you. Consider not only interest rates but also repayment terms, any fees charged by the lender, and eligibility requirements.

- Choose your loan option. After comparing lenders, pick the loan option that works best for you.

- Complete the application. Once you’ve chosen a lender, you’ll need to fill out a full application and submit any required documentation, such as tax returns or pay stubs.

- Get your funds. If you’re approved, your lender will have you sign for the loan so the funds can be released to you. The time to fund for a personal loan is usually about one week — though some lenders will fund loans as soon as the same or next business day after approval.

How to get a student loan

If you decide to take out a student loan, follow these four steps:

- Fill out the FAFSA. If you need to pay for college, your first step should be completing the Free Application for Federal Student Aid (FAFSA). Your school will use your FAFSA results to determine what federal financial aid you qualify for.

- Apply for scholarships and grants. Unlike student loans, college scholarships and grants don’t have to be repaid — which means they’re essentially free money for school. There’s also no limit to how many scholarships and grants you can get, so it’s a good idea to apply for as many as you might be eligible for. You might also qualify for scholarships from your school, depending on your FAFSA information.

- Accept federal student loans. Once you’ve completed the FAFSA, your school will send you a financial aid award letter detailing the federal student loans and other federal aid you’re eligible for. You can then choose which aid to accept.

- Use private student loans to fill the gaps. After you’ve exhausted your scholarship, grant, and federal student loan options, private student loans can help fill any financial gaps left over. Be sure to shop around and compare as many lenders as possible to find a private loan that best suits your needs.

Regardless of whether you get a federal or private student loan, it’s important to consider how much that loan will cost you in the future. This way, you can be prepared for whatever expenses come your way.

You can find out how much you’ll owe over the life of your federal or private student loans using this student loan calculator.

Need a student loan? Compare rates without affecting your credit score.

About the author: Emily Guy Birken is a Credible authority on student loans and personal finance. Her work has been featured by Forbes, Kiplinger’s, Huffington Post, MSN Money, and The Washington Post online.