Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Content provided by Credible. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own. Requesting prequalified rates on Credible is free and doesn’t affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.

This article first appeared on the Credible blog.

Whether you need to cover medical bills, home repairs, or another sudden expense, you might have to borrow money to cover the cost.

If you need to take out a personal loan — such as a $30,000 personal loan — be sure to carefully consider all your lender options to find the right loan for you.

Here’s what you should know before getting a $30,000 personal loan. Whatever your credit score, it makes sense to comparison shop to find the best rate available to you. Credible makes it easy to compare personal loan interest rates from multiple lenders in minutes, and without affecting your credit.

Where to get a $30,000 personal loan

Here are a few of your lender options for getting a $30,000 personal loan:

Online lenders

Getting an online loan can be a convenient option, especially if you need to borrow money quickly. The time to fund for online personal loans is typically five days or less — though some lenders offer loan funding as soon as the same or next business day if you’re approved.

Here are Credible’s partner lenders that offer $30,000 personal loans:

Achieve

With Achieve, you borrow $10,000 to $50,000 with a term ranging from two to five years. Keep in mind that you might get a lower rate with Achieve if you plan to use at least 85% of your loan to pay off existing debt or if you can show proof of retirement savings.

Avant

With Avant, you can borrow $2,000 to $35,000 with a term ranging from two to five years. Avant might be a good option for borrowers with poor or fair credit.

Axos

Axos Bank offers personal loans from $10,000 to $50,000 with terms from three to six years. You’ll typically need good to excellent credit to qualify for an Axos Bank loan.

Best Egg

Best Egg personal loans range from $2,000 to $50,000 with either three- or five-year terms. Keep in mind that Best Egg considers other credit attributes and your digital footprint on top of your credit score, which means you might still qualify even if you have less-than-perfect credit.

Discover

If you need a longer loan term, Discover might be a good option — you could have up to seven years to repay your loan. With Discover, you can borrow $2,500 to $35,000.

LendingClub

LendingClub is one of the few personal loan companies that allows borrowers to apply with a cosigner. This could increase your chances of getting approved for a loan even if you have poor credit.

LightStream

With LightStream, you can borrow $5,000 to $100,000. Most LightStream loans have terms from two to seven years, but if you’re using your loan for home improvements, you could have up to 12 years to repay it. Plus, if you’re approved, you could have your loan funded as soon as the same business day.

Payoff

Payoff personal loans are designed specifically for credit card consolidation. With Payoff, you can borrow $5,000 to $40,000 with a term from two to five years.

Prosper

Prosper operates a peer-to-peer lending platform. This means that an investor will need to commit to funding your loan, which can range from $2,000 to $50,000.

Keep in mind that this process might take longer compared to other online lenders, so another lender might be better if you need the funds as soon as possible.

SoFi

With SoFi, you can borrow $5,000 to $100,000 with a term from two to seven years. If you’re approved, you’ll also enjoy access to perks like unemployment protection and career coaching.

Upgrade

Upgrade could be a good choice for borrowers with fair credit. You can borrow $1,000 to $50,000 with two, three, five, or six years to repay the loan.

Upstart

Unlike other personal loan lenders, Upstart will consider your education and job history when reviewing your application.

This means you could qualify even if you have little to no credit history. If you’re approved, you might be able to borrow$1,000 to $50,000.

You can see your prequalified personal loan rates through Credible, which is free to use.

Banks

Many banks offer personal loans. Plus, if you already have a checking or savings account with a bank, you might qualify for a loyalty discount if you apply for a personal loan with them.

Keep in mind: Some major banks — such as Bank of America, Capital One, and Chase — don’t offer personal loans.

If you want to take out a $30,000 personal loan with a bank, here are a few of your options. Note that these aren’t Credible partner lenders.

- Citibank

- HSBC Bank

- Wells Fargo

Credit unions

Because credit unions are nonprofit organizations, they tend to offer better rates and terms compared to banks. They also sometimes have less stringent qualification requirements.

Keep in mind: Credit unions generally have lower loan maximums than other types of lenders, though there are some credit unions that offer $30,000 personal loans. You’ll also need to join the credit union to take out a loan. To be eligible for credit union membership, you might need to live in a certain area, work in a specific field, or join an associated organization.

Here are a few credit unions to consider. Note that these aren’t Credible partner lenders.

- Alliant Credit Union

- First Tech Federal Credit Union

- Navy Federal Credit Union

What to consider when comparing $30,000 loans

Before you apply for a $30,000 personal loan, there are a few factors to consider first. Here’s what to keep in mind:

1. Interest rates

Your interest rate is one of the major factors that will affect how much you’ll pay for your loan in addition to the loan principal. You’ll generally need good to excellent credit to qualify for the lowest rates offered by lenders.

Keep in mind: Most personal loans come with fixed rates, though there are some lenders that offer variable rates as well. Fixed rates stay the same over the life of the loan while variable rates could fluctuate over time.

Before you borrow, be sure to consider how much a personal loan will cost you so you can prepare for any added expenses.

2. Fees

Some lenders charge fees for personal loans. A few common fees you might come across include:

- Origination fees that are deducted before your loan is disbursed to you

- Late fees if you miss a payment

- Prepayment penalties if you pay off your loan ahead of schedule

Tip: As you compare lenders, be sure to take any fees they charge into account. Keep in mind that if you take out a personal loan with one of Credible’s partners, you won’t have to worry about prepayment penalties.

3. Repayment terms

Personal loan terms typically range from one to seven years, depending on the lender. It’s usually a good idea to choose a short repayment term to potentially get a lower interest rate, which could save you money over the life of your loan.

Tip: Shorter loan terms tend to come with lower rates. It’s usually a good idea to choose the shortest term you can afford to save as much as you can on interest charges.

4. Monthly payment

Your payment is a fixed amount you’ll have to pay each month. Before applying for a loan, make sure the monthly payments will fit comfortably in your budget.

Tip: If you need a lower monthly payment, consider opting for a longer repayment term. Just keep in mind that having a longer term means you’ll pay more in interest over time.

5. Total repayment costs

Before you sign for a loan, the lender will send you a Truth in Lending Act (TILA) disclosure, which will show you how much you’ll repay in total over the life of your loan including interest and fees. Be sure to review carefully to understand how much you’ll be responsible for in the future.

Pay special attention to these two numbers:

- The finance charge: This is the cost of your loan, including interest and fees, assuming you make all your payments on time.

- Total payments: This is the sum of all the payments you’ll make to pay off your loan, including the loan principal and finance charges.

Getting a $30,000 loan with fair or bad credit

While you’ll generally need good to excellent credit to get approved for a $30,000 personal loan, you might still be able to qualify even if you have poor or fair credit.

There are several lenders that offer personal loans for bad credit — however, keep in mind that these loans often come with higher rates compared to good credit loans.

If you’re struggling to get approved, you could also consider applying with a cosigner. Not all lenders allow cosigners on personal loans, but some do. Even if you don’t need a cosigner to qualify, having one could get you a lower interest rate than you’d get on your own.

For example: Say you applied for a $30,000 personal loan by yourself and qualified for a three-year loan with a 13% interest rate due to having poor credit. By the end of your term, you’ll have paid a total of $36,389. However, if you applied with a cosigner and qualified for a three-year loan with a 9% interest rate, you’d pay $34,343 instead. This means adding a cosigner saved you $2,046 over the life of the loan.

If you can wait to get your personal loan, you could also consider building your credit first to potentially qualify for better rates in the future.

Cost to repay a $30k loan

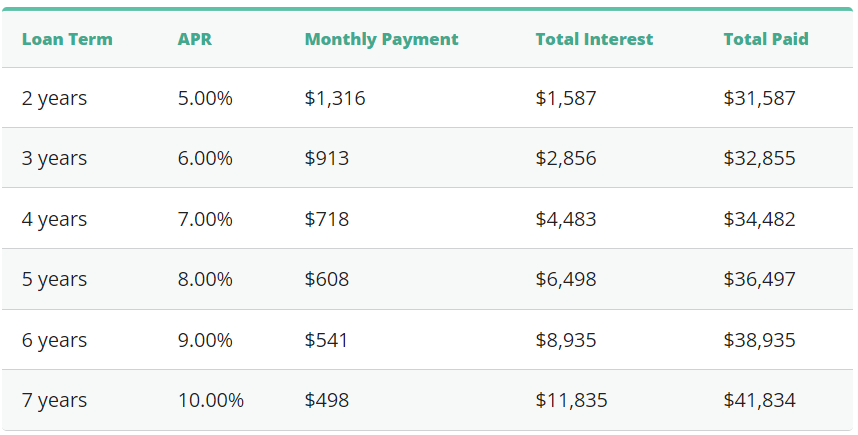

In the table below, you can see how the repayment term, interest rate, and monthly payment affect the total repayment cost of a $30,000 personal loan. The interest rates in these examples are hypothetical and only for illustrative purposes.

If you decide to get a personal loan, remember to consider as many lenders as you can to find the right loan for you. Credible makes this easy — you can compare your prequalified rates from multiple lenders in two minutes.

About the author: Kat Tretina is an authority on student loans. After dealing with student loans and medical debt herself, Kat Tretina is focused on helping people conquer their debt and boost their incomes. Her work has been featured in The Huffington Post, Entrepreneur, MarketWatch, and more.