Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Content provided by Credible. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

If you have credit card debt, it may feel like you’ll never be able to climb your way out. Between minimum monthly payments and compounding interest charges, conquering that debt can sometimes seem impossible.

Rather than let credit card balances hold you back, take advantage of strategies to eliminate them once and for all. Let’s take a look at some of the most effective ways you can pay off your credit card debt fast.

A debt consolidation loan is one way to tackle your debt. Check out Credible to compare personal loan rates from various lenders.

Start with one debt at a time

Whether you have two credit card balances to tackle or 12, it’s helpful to take a structured approach to paying off your debt. For many people, that means aggressively focusing on one debt at a time, making the entire process simpler and more manageable.

Debt snowball method

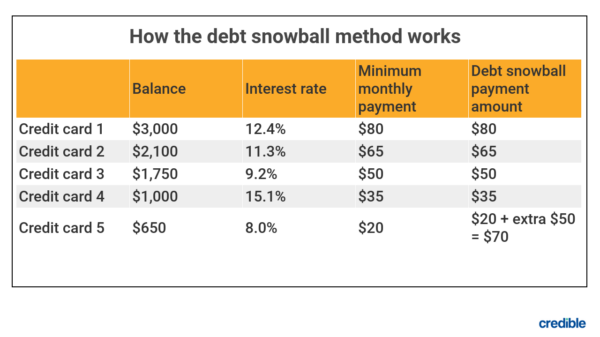

With the debt snowball method, you focus on paying off your smallest debt first. Then, after that one’s eliminated, you move on to your next-smallest balance and repeat until you’ve tackled all your balances.

Let’s say you have $300 to contribute toward debt repayment each month, and you have five credit card balances with a total minimum monthly payment of $250. Initially, you’ll put that extra $50 toward the credit card with the smallest outstanding balance, and you’ll make only the minimum required payment on the other four.

A few months later, that credit card will be paid off. You’ll then take the funds you were contributing toward that balance (in this case, $70) and add it to the minimum payment for the next-smallest balance. Repeat this cycle until your final (biggest) balance is satisfied.

The debt snowball method can be great for motivation, especially if you feel overwhelmed by your credit card debt. Paying off a balance can feel like a serious accomplishment, and focusing on the smallest balance first lets you achieve that result sooner.

The drawback to the debt snowball method is it can sometimes mean paying more in interest over time, since it focuses on the size of the account balance, without considering any other factors. It can also take longer to repay your debts this way.

Debt avalanche method

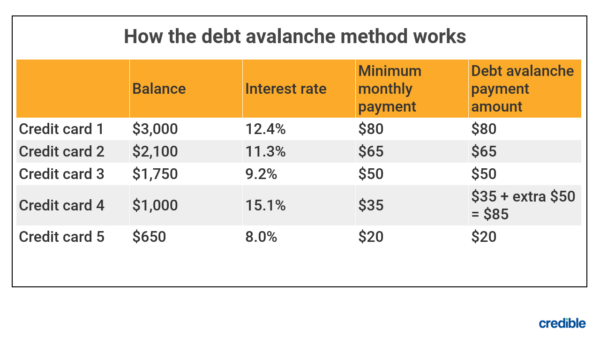

The debt avalanche method focuses on the credit card balance with the highest interest rate first. The idea behind this method is to save as much money on interest charges as possible.

With the same five balances as before, the debt avalanche method would focus on credit card four, since it has the highest APR, at 15.1%. In this case, you’d still make minimum payments on all the other cards, but you’d apply the extra $50 in your budget to card four until it’s repaid.

Once you’ve repaid that balance, you’ll put that extra money ($85, in this example) toward the balance with the next-highest interest rate — in this case, credit card one. You’ll continue this pattern until all $300 of your available funds each month are going toward your only remaining balance (the one with the lowest interest rate).

The biggest downside to the debt avalanche method is that it may take you longer to start eliminating account balances. But this method will save you the most interest in the end by focusing on those high-interest balances.

Get a debt consolidation loan

You can also use a personal loan to consolidate your credit card accounts. Debt consolidation loans have many benefits, including:

- You only have one payment. With a debt consolidation loan, you don’t have to worry about multiple credit cards, due dates, and minimum payments. You’ll have one monthly payment with one due date, and just one balance to track.

- You may lower your interest rate. In August 2021, the average consumer paid more than 17% APR on their credit card, while the average personal loan APR was just over 9%, according to Federal Reserve data. By consolidating credit card debt into a personal loan, you may be able to significantly lower your interest rate.

- You can adjust your monthly minimum payment. When you consolidate your debt with a personal loan, you can adjust your payment to better match your budget by choosing a shorter or longer loan term. With a longer repayment term, you’ll pay less each month, but you’ll likely pay more in interest overall. If you opt for a shorter loan term, you’ll pay more each month but will pay less in total interest.

Debt consolidation loans have downsides, too. Taking out a new loan means opening a brand new debt account, which can negatively affect your credit score. And if your loan has an origination fee, you’ll need to borrow enough money to cover it.

Before you get a debt consolidation loan, shop around and compare lenders to find one that offers the best interest rates and loan terms for your situation.

Check out Credible to compare personal loan rates from multiple lenders, all in one place.

Use a balance transfer credit card

A balance transfer card allows you to shift an existing balance — whether it’s another credit card or a personal loan — onto a new credit card. This enables you to move debt from a higher-interest rate account to one with a lower interest rate, consolidate multiple balances, or both.

Many credit card issuers also have introductory balance transfer offers for new cardholders. This allows you to shift balances onto a new credit card and pay off the balance at 0% interest for a period of time. This can save you a lot of money if you’re able to pay off the entire debt before the 0% introductory period ends.

Keep in mind that even with introductory 0% balance transfer offers, you may still have to pay balance transfer fees. These fees often fall between 3% and 5% of the amount you transfer.

Make more than the minimum payment

When you carry a balance, your credit card issuer requires you to make at least a minimum payment amount each month. While this minimum payment is all you’re required to make, paying extra each month can help you get out of debt much faster.

By contributing more to your principal balance, you’ll also save money on interest, so your debt will cost you less in the end.

Start a side hustle to make some extra money

It doesn’t matter how dedicated you are — your debt repayment efforts will only take you as far as your income allows. Even if you squeeze every available dollar out of your monthly budget, there will eventually be a limit.

Starting a side hustle can allow you to make some extra money in your spare time, which you can then put toward your credit card debt. While it can take up a portion of your free time, this is a good option if you’ve reduced your monthly expenses as much as possible and aren’t able to increase your income in any other way.

Reach out to a credit counseling agency

If you aren’t sure how to tackle your credit card balances or need help creating a debt repayment plan, a credit counseling agency may be the right option for you.

Credit counseling agencies are different from debt settlement agencies — they’re typically nonprofit organizations, whereas debt settlement agencies offer to settle your debts for a fee. A certified credit counselor can assist you by …

- Analyzing your financial situation

- Helping you build a budget

- Offering guidance for your unique situation

- Creating a plan for tackling your debt

Credit card debt can feel stressful and overwhelming. Developing a strategy for tackling your debt — ideally in a shorter period of time, with less interest, or both — can help you get out of debt sooner and reclaim your peace of mind.

With Credible, you can easily compare personal loan rates without affecting your credit.

About the author: Stephanie Colestock is a Washington, D.C.-based writer who has more than 10 years of experience in writing about investing, business, and personal finances. She’s contributed to outlets such as Yahoo! Finance, MSN, Investopedia, Credit Karma, Credible, and more. She holds a bachelor’s degree from Baylor University and is in the process of earning her CFP® certification.