Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Content provided by Credible. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

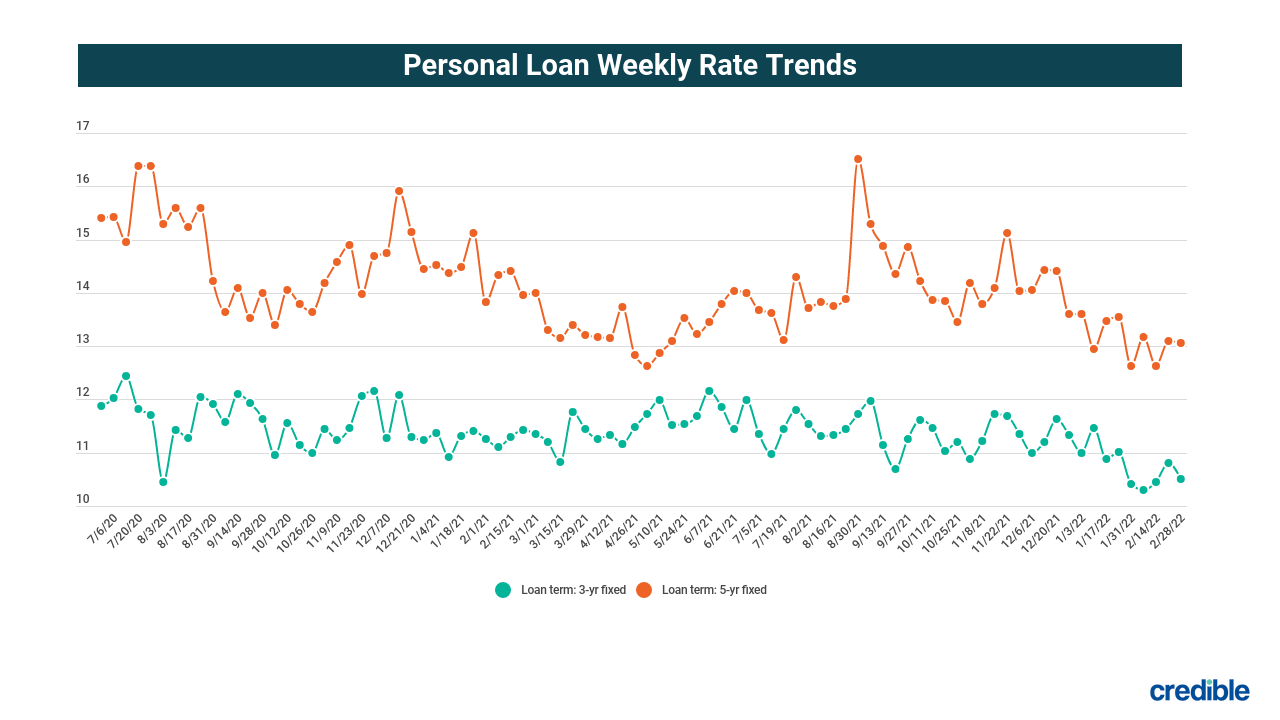

Personal loan interest rates fell for 3-year fixed rates and 5-year fixed rates last week for borrowers with good credit.

Data compiled from borrowers who used the Credible marketplace to shop for a personal loan, show average rates for those with a credit score of 720 or higher were:

- 10.23% for 3-year fixed-rate loans. This was down from 10.93% the prior week. The average rate for the same time in 2021 was 11.36%.

- 13.08% for 5-year fixed-rate loans. This was down from 13.29% the prior week. The average rate for the same time in 2021 was 14.00%.

You can see your prequalified personal loan rates in minutes when you use Credible to compare rates from multiple lenders.

Uses for a personal loan

You can use a personal loan for almost any purpose, including:

- Consolidating and paying off higher-interest types of debt, like credit cards.

- Cover unexpected expenses, like medical bills.

- Finance a major purchase, such as new appliances.

- Pay for home repairs or improvements.

However, some lenders prohibit the use of personal loans to pay education expenses, make a down payment on a house, or cover business expenses. Before taking out a personal loan, be sure to check with the lender to see if it allows its loans to be used for your purpose.

Advantages of a personal loan

Depending on your purpose for getting one, a personal loan can offer many advantages, including:

- Reduce total interest costs by replacing higher-interest debt with a single debt at a lower rate.

- Simplify debt payments by consolidating multiple debts into one.

- Allow you to borrow without putting a home, vehicle or other property at risk — personal loans typically don’t require collateral.

- Make regular, on-time payments to help your credit.

- Spread a big expense into manageable monthly payments with a definitive end date.

What credit score do I need for a personal loan?

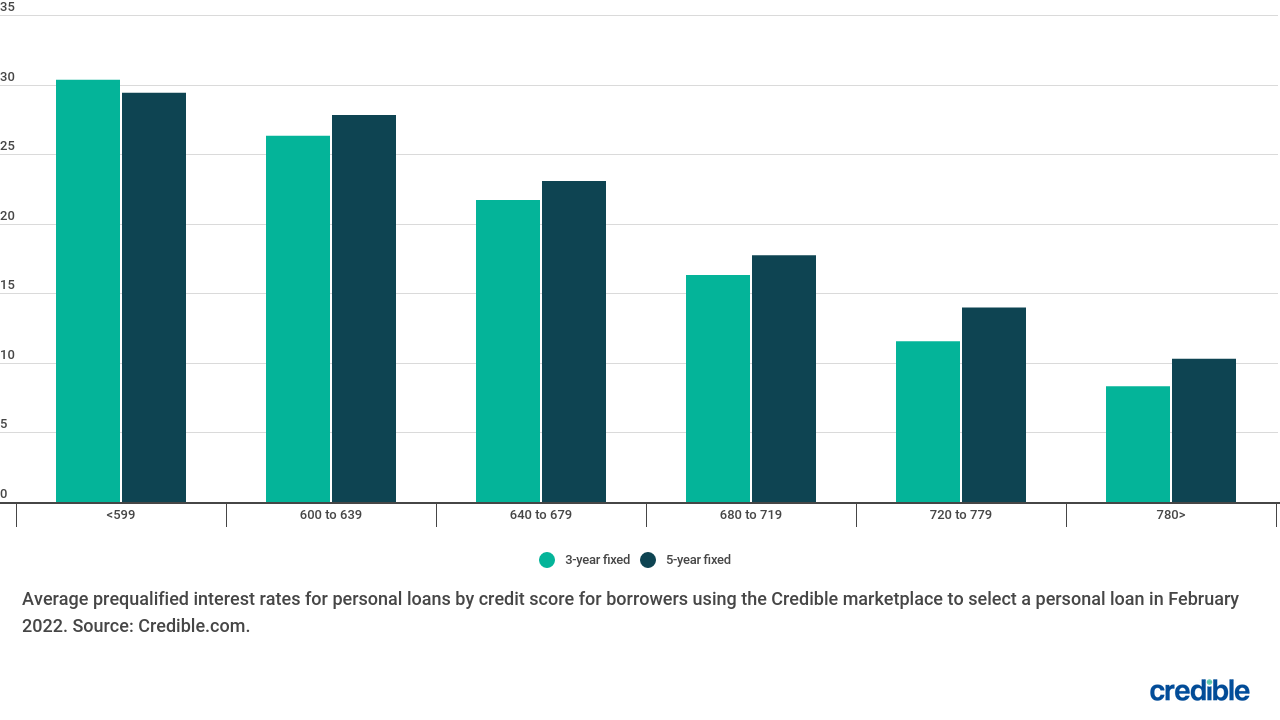

You’ll typically need a credit score of at least 620 to qualify for a personal loan, although some lenders will make loans to borrowers with lower credit scores in the 500s. Generally, borrowers with higher credit scores have access to lower interest rates than those available to borrowers with lower credit scores.

Credible makes it easy to check your prequalified personal loan rates without affecting your credit score.

Current personal loan rates by credit score

How to get a lower interest rate on a personal loan

While many of the factors that influence the interest rate you’ll get are beyond your control, you can take some steps to improve your chance of getting the lowest rate available to you.

Work on your credit

You can help improve your credit score by:

- Paying all your bills on time for the amount due. Payment history is the most important factor in your credit score.

- Review your credit report. If you find errors on your credit report, dispute them with the credit bureau.

- Pay down credit card debt to lower your credit utilization ratio. Lowering your credit utilization ratio can help improve your credit score.

- Don’t open new credit accounts you don’t need. Too many hard inquiries on your credit report can lower your credit score. Plus, the more unnecessary credit accounts you have, the more you may be tempted to overspend.

Take a shorter repayment term

Typically, the lowest interest rates are associated with the shortest repayment periods. That’s because the longer it takes you to repay a loan, the longer the lender’s money is at risk. Lenders often reward the lower risk of a shorter term with lower interest rates. That lower interest rate, and the shorter repayment term, also means you’ll likely pay less total interest over the life of the loan.

Consider a cosigner

If your credit isn’t strong enough to qualify for the best rates on your own, adding a cosigner who shares repayment responsibility may help you get a better rate. Your cosigner will need good to excellent credit to help you secure a lower rate. And don’t forget — if you default on the loan, your cosigner is responsible to repay it.

Comparison shop for rates from different lenders

As with any major financial decision, it’s a good idea to compare offers from several different personal loan lenders to get the lowest rates. You’ll typically find the most competitive rates from online lenders, who can also be quicker to disburse your loan than a brick-and-mortar establishment.

You can learn more about personal loan, comparison shop among multiple lenders, and check your prequalified personal loan rates without affecting your credit score when you use Credible.

About Credible

Credible is a multi-lender marketplace that empowers consumers to discover financial products that are the best fit for their unique circumstances. Credible’s integrations with leading lenders and credit bureaus allow consumers to quickly compare accurate, personalized loan options ― without putting their personal information at risk or affecting their credit score. The Credible marketplace provides an unrivaled customer experience, as reflected by over 4,500 positive Trustpilot reviews and a TrustScore of 4.7/5.