Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Credible Operations, Inc. NMLS# 1681276, “Credible.” Not available in all states. www.nmlsconsumeraccess.org.

This article first appeared on the Credible blog.

A VA cash-out refinance allows you to pay off your existing home loan — even if it’s not a VA loan — with a new, larger VA home loan. You’ll receive the difference as a lump sum to use for any purpose your lender allows.

You can also use a VA cash-out refinance even if you don’t want cash back — say, you only need enough cash to pay the loan’s closing costs. To qualify for a VA cash-out refinance loan, you’ll first need to be a military service member, veteran, or surviving spouse.

Credible doesn’t offer VA cash-out refinances, but can help you compare home loan rates on conventional refinances and give you a better idea of how much you can afford. In just a few minutes, you can see personalized, prequalified rates from Credible’s partner lenders.

Here’s what else you need to know about VA cash-out refinances:

What is a VA cash-out refinance?

A VA cash-out refinance is one of the two most common VA loan refinancing options. You can use a VA cash-out refinance whether you want to cash out your home equity or not. These loans are available to any qualified veteran homeowner, regardless of what type of mortgage you have.

The other most common option available to veterans is a VA streamline refinance — also known as an interest rate reduction refinance loan (IRRRL). This option works similar to a conventional refinance. It can help you lower your interest rate, shrink your monthly payment, or shorten your term. But you’ll need to have an existing VA loan to use an IRRRL.

How does a VA cash-out refinance work?

A VA cash-out refinance uses a VA mortgage to pay off your existing mortgage, whether it’s a VA loan or not. It also lets you tap into your home equity, which you can use to pay off any other liens on your home or the closing costs of the refinance.

The U.S. Department of Veterans Affairs sets guidelines for income, credit scores, and other borrower characteristics. This helps lenders approve and deny VA loans and set loan terms.

However, lenders often impose stricter guidelines than the VA requires, such as tighter limits on how much equity you can cash out. They do this, in part because the VA only guarantees up to 25% of the loan amount. That means the lenders are still taking most of the risk.

VA cash-out loan limits

VA loans are unique: They allow you to borrow against as much as 100% of your home’s appraised value. In other words, your loan-to-value (LTV) ratio can be as high as 100%.

Here’s an example: Say you owe $240,000 on your mortgage and your home is worth $300,000. That leaves you with $60,000 in home equity, or 20%. With a VA cash-out refinance, you may be able to borrow as much as $300,000, and you’d be able to finance your VA funding fee.

But remember, lenders may have their own rules that are stricter than the VA’s. Don’t be surprised if you can only borrow against 80% of your home’s appraised value. Some conventional lenders will allow you to refinance up to 90%, so it’s a good idea to compare offers for both VA and conventional cash-out refinancing.

VA cash-out refinance rates

Interest rates for 30-year, fixed-rate VA home loans tend to run about 0.25 percentage points lower than conventional loan rates. But as with any mortgage, your interest rate will mostly depend on personal factors like your credit score, debt-to-income ratio, and down payment.

Cash-out refinance rates can be slightly higher than rate-and-term refinance rates since decreasing your home equity can make you a riskier borrower. To get the best deal, it’s important to check pricing with several lenders.

You won’t find VA loans at Credible, but if you’re looking for a great refinance rate on a conventional loan, Credible can help with that. It only takes a few minutes to compare personalized, prequalified mortgage refi rates from Credible’s partner lenders.

Benefits of a VA cash-out refinance

These features of a VA cash-out refinance can make it a uniquely appealing option if you’re eligible:

- You may be able to borrow up to 100% of your home’s appraised value. On top of that, you can finance energy-efficient home improvements and the VA funding fee.

- You can refinance a non-VA loan. Whether you have a VA, conventional, FHA, or USDA loan, you can do a VA cash-out refinance.

- You can use it to pay off delinquent liens. If you’ve fallen behind on property taxes, your first mortgage, or a home equity loan, for example, you can use a VA cash-out refinance to pay off these liens.

Drawbacks of a VA cash-out refinance

Before you get too excited about the benefits of a VA cash-out refinance, you should know there are some cons to this option:

- You’ll pay the VA funding fee. If the cash-out refinance will be your first VA loan, you’ll have to pay a funding fee of 2.3% of the loan amount. If it won’t be your first VA loan, the funding fee will be 3.6% of the loan amount. Veterans with a Purple Heart or service-related disability payments may be exempt from the funding fee.

- Lenders might not let you borrow 100%. The VA allows, but does not require, lenders to set an LTV limit of 100%. Lenders may have tighter requirements and set a borrowing limit of up to 90% of your home’s appraised value, for example.

- Requires more paperwork. One of the main benefits of a VA IRRRL is the lack of paperwork, which allows you to close the loan faster. VA cash-out refinances aren’t as streamlined. Your lender will require you to go through the full underwriting process and provide income statements, tax returns, and a certificate of eligibility (COE), among other documents.

VA cash-out refinance guidelines

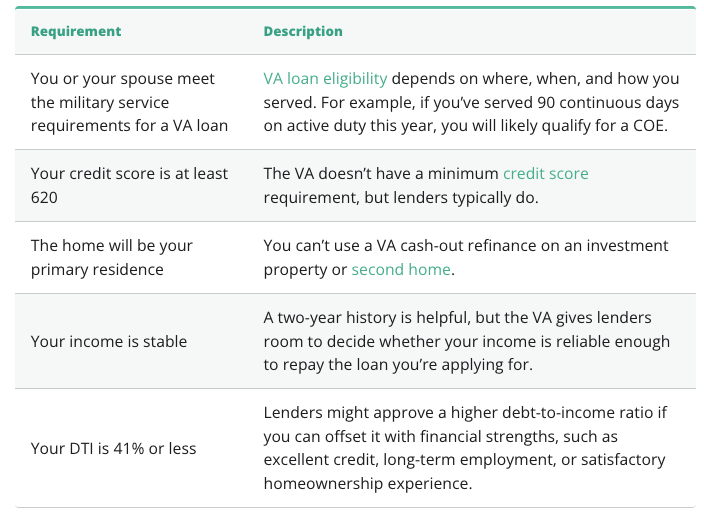

Here are the key criteria you’ll need to meet to qualify for a VA cash-out refinance. They’re the same as VA purchase loan requirements:

Are there costs associated with a VA cash-out refinance?

Yes, you’ll pay closing costs on a VA cash-out refinance, just as you would with a conventional or FHA refinance. These are the costs you can expect to pay:

- VA funding fee: Either $2,300 or $3,600 for every $100,000 borrowed, depending on whether you’re using a VA loan for the first time or a subsequent time

- Origination fee: Generally 0.5% to 1.5% of the loan amount, or $1,000 for every $100,000 borrowed

- Appraisal fee: Usually a few hundred dollars, depending on location and home size

- Credit report fee: Usually less than $30

- Lender’s title insurance fee: About $500 to $1,500, depending on the loan amount and insurer

- Discount points: Points are prepaid interest that reduce your interest rate; this is an optional charge

How to apply for a VA cash-out refinance

These are the steps you’ll need to follow to apply for a VA cash-out refinance.

1. Decide how much cash you need

Just because you may be able to borrow against 100% of your home equity doesn’t mean you should. Zero equity makes you vulnerable to a decline in home prices. You could end up owing more than your home is worth — a potential problem if you decide to sell your home.

2. Gather documents for your lender

You’ll need three categories of documents:

- Identification documents: VA lenders require you to provide two forms of identification. These can include a driver’s license, state ID card, passport, Social Security card, or military ID.

- Financial documents: You’ll need to substantiate your income and assets with W-2s and signed federal income tax returns for the last two years, your two most recent pay stubs, and your two most recent bank statements.

- Military service documents: These include your Certificate of Eligibility (which your lender may be able to pull online), statement of service (if you’re on active duty), and disability award letter (if you receive service-connected disability payments). You may also need to provide your DD-214 or Reserve/Guard points statements.

3. Apply with at least three lenders

The VA doesn’t set mortgage rates and fees; lenders do. To make sure you’re getting the best loan terms, get prequalified quotes from multiple VA lenders.

You should also consider getting offers for a conventional cash-out refinance if you don’t need to access all your equity; it may be cheaper since you won’t have to pay a VA funding fee.

Is a VA cash-out refinance right for you?

If you’re eligible for a VA loan, a VA cash-out refinance may be right for you in these situations:

- You don’t have enough home equity for a conventional cash-out refinance. If your home equity is 20% or less, a VA loan can be a good way to access it.

- You’re paying for mortgage insurance on the loan you have now. VA loans don’t require mortgage insurance.

- Your new mortgage will have a lower rate than your existing mortgage. Ideally, a cash-out refinance doesn’t just give you cash, it also lowers your rate.

- You’re behind on your bills.You can use a VA cash-out refinance to pay off any lien against your property, whether it’s a mortgage, tax lien, or judgment lien.

However, a VA cash-out refinance may not be right for you in the following circumstances:

- You have a lot more home equity than you want to cash out. Instead, consider a conventional cash-out refinance so you don’t have to pay the VA funding fee.

- Your new mortgage would have a higher rate than your existing mortgage. A home equity loan or line of credit could be the more cost-effective option.

- You might sell your home soon. It may not make sense to pay closing costs on a large loan that you won’t keep long enough to break even on. Try a no-closing-cost mortgage, or just ride out your existing loan.

- You need cash quickly. A new mortgage can take up to two months to close. A personal loan may be a better choice if you can’t wait that long.

If a VA cash-out refinance isn’t right for you, Credible lets you see your prequalified rates for a conventional mortgage refinance from various lenders, all in one place.

About the author: Amy Fontinelle is a mortgage and credit card authority and a contributor to Credible. Her work has appeared in Forbes Advisor, The Motley Fool, Investopedia, International Business Times, MassMutual, and more.