Unlike federal student loans, private student loans are funded by private lenders and don’t qualify for student loan forgiveness.

However, there are other options that might help you more easily manage private student loans, such as student loan refinancing.

Can private student loans be forgiven?

Private student loans can’t be forgiven through any government or independent programs. Only federal student loans are eligible for forgiveness under federal programs, laws, and policies.

But some private student loan companies may offer various forms of relief, such as pausing payments temporarily or lowering your monthly interest or payment amount for a brief period. Not every private lender offers relief options, so it’s important to contact your loan servicer directly if you need to discuss your repayment options.

Could President Biden forgive private student loans?

President Joe Biden and other politicians have proposed student loan forgiveness plans for federal student loans — but not for private student loans. If you’ve been crossing your fingers for a private student loan forgiveness COVID-19 relief package, it’s unlikely politicians are considering it.

As for federal student loan forgiveness, how much could potentially be forgiven is still up in the air. Here are the developments so far:

- From Congress: U.S. Senate Majority Leader Chuck Schumer (D-NY), Sen. Elizabeth Warren (D-MA), and Rep. Ayanna Pressley (D-MA) are pushing for $50,000 in loan forgiveness per borrower to stimulate the economy and remove a financial burden from those struggling to pay off their student loan balances. They’ve met with the president multiple times, insisting that he broadly consider who will qualify for forgiveness.

- From the White House: President Biden has backed a more modest cancellation of $10,000 in federal student loan debt per borrower but is facing pressure to cancel that amount and more through executive order. Top White House aides have drafted an order for the cancellation of some student loan debt, but as of this writing, the president has yet to move forward with a decision.

Until a decision is made on how much, if any, student loan debt the government will cancel, it’s unlikely that any private student loan debt will be forgiven. Although some federal student loan debt may be forgiven, that doesn’t mean you should reduce your monthly payments. Your best option is to always pay off your student loans as quickly as possible, whether or not forgiveness may be available in the future.

Keep in mind: It may seem like no progress has been made toward widespread loan forgiveness, but there has been one major development. The American Rescue Plan of 2021 includes the Student Loan Relief Tax Exclusion, which ensures that student loan forgiveness between Jan. 1, 2021, and Dec. 31, 2025, will be tax-free.

Talk to your lender about your options

Private student loan lenders often have programs available for borrowers experiencing financial hardship. These might include temporarily pausing your loan payments, modifying your loan, or exploring private student loan consolidation.

Contacting your lender is usually the best way to see what private student loan repayment options are available to you. Be sure to reach out to your lender before skipping the payments and defaulting on your loans, as this will harm your credit score.

Reminder

If you have a cosigner, missing payments could hurt their credit, too.

Check Out: Defaulted Student Loans: Can You Refinance?

Refinancing your private student loans could help lower your payments

If you’re not excited about a growing student loan balance while in deferment or forbearance, student loan refinancing might be a good alternative. When you refinance your student loans, you pay off your old student loans with one new loan.

With refinancing, you might be able to qualify for a lower interest rate or lower your monthly payment by extending your repayment term. But keep in mind that a longer repayment period also typically comes with a higher interest rate — which means a higher total cost.

For example: If you have a student loan that will take five years to pay off, extending your repayment term to seven or 10 years should lower your monthly payment.

With a $10,000 balance, a five-year loan at 3.5% APR would require a $182 monthly payment. If you refinanced to a 10-year loan with a higher 4% interest rate, your payments would be only $101 per month.

However, while you’d pay a total of $10,920 with the five-year loan, you’d end up paying $12,120 with the 10-year loan. This means you’d pay about $1,200 more over time to get that lower monthly payment.

Review your federal student loan options

Although private student loans don’t qualify for forgiveness, federal options are available if you have a mix of federal and private student loans. These include income-driven repayment and federal student loan forgiveness programs.

For example: You might be able to lower your monthly payments by signing up for an income-driven repayment (IDR) plan for your federal student loans. By lowering your loan payment through an IDR plan, you could free up some of your monthly cash flow to put toward your private student loans and other bills.

On an income-driven repayment plan, you could have the remainder of your federal student loan balance forgiven after 20 to 25 years of payments, depending on the plan.

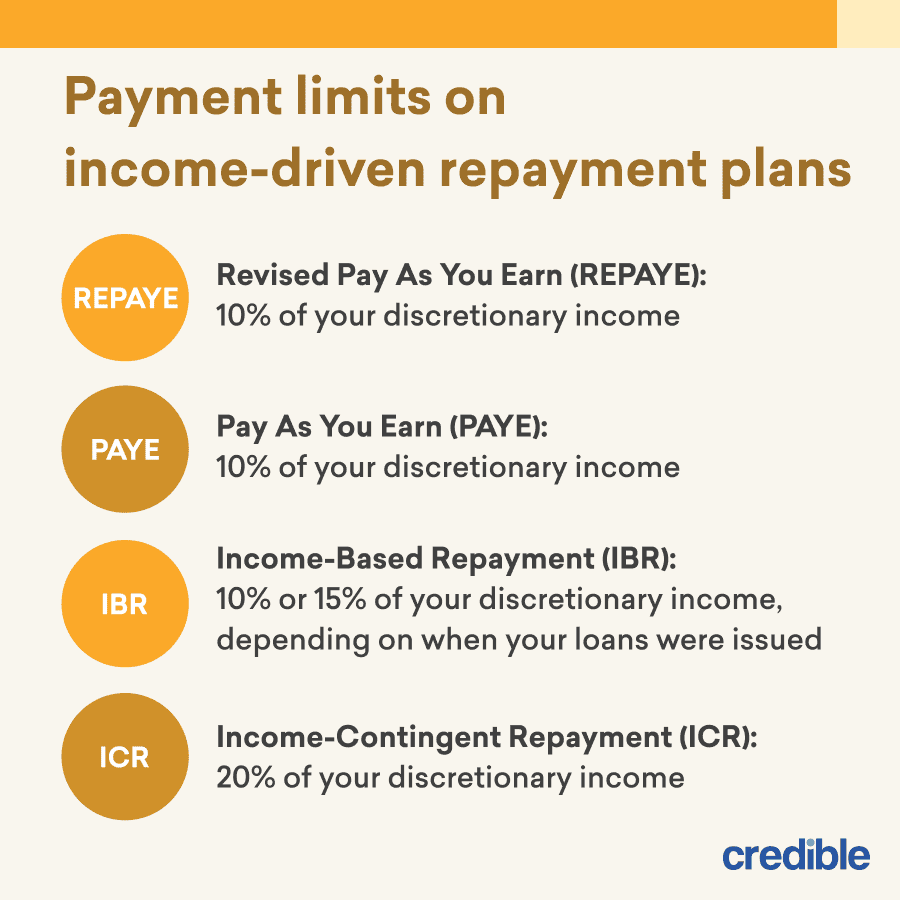

The U.S. Department of Education offers four IDR plans:

- Revised Pay As You Earn (REPAYE): REPAYE is available to almost all federal student loan borrowers. With REPAYE, your payments are capped at 10% of your discretionary income, and your remaining balance is forgiven after 20 or 25 years, depending on whether you have undergraduate or grad school debt.

- Pay As You Earn (PAYE): You have to demonstrate a partial financial hardship to qualify for PAYE, meaning your payment would be lower on PAYE than on the 10-year Standard Repayment Plan. With PAYE, your payments are capped at 10% of your discretionary income, and any remaining balance is forgiven after 20 years.

- Income-Based Repayment (IBR): Like the PAYE Plan, you must demonstrate a partial financial hardship to qualify for Income-Based Repayment. This plan limits your payments to 10% or 15% of your discretionary income, depending on when your loans were issued. If you took out your loans before July 1, 2014, they’ll be forgiven after 25 years on IBR. Loans taken out after that date will be forgiven after 20 years.

- Income-Contingent Repayment (ICR): The ICR Plan is available to student or parent borrowers and limits payments to 20% of your discretionary income. On ICR, any remaining balance is forgiven after 25 years.

Check out loan repayment assistance programs

Depending on where you live, you might qualify for a state loan repayment assistance program. These programs sometimes offer assistance for private student loans if you meet the requirements.

For example: You might qualify for a state loan repayment assistance program if you live in California, Florida, or Texas.

It’s a good idea to check whether your state offers such a program to help with private student loans.

Declaring bankruptcy may not dismiss your student loans

If you declare bankruptcy, you might be able to have some of your debts reduced or forgiven. But this should be a last resort, as it can impact your credit score for up to 10 years.

Even worse, bankruptcies typically exclude student loans unless you’re able to prove an undue hardship, which isn’t all that common.

The bankruptcy process can be expensive, too. You’ll likely have to pay a lawyer and court fees. The total cost could be thousands of dollars, depending on your specific circumstances and which type of bankruptcy you file for.

Disability and death discharge

If you as a student loan borrower were to become permanently disabled, you might be able to have your remaining student loan balance discharged.

And while we especially don’t want to think about this, if you were to pass away, your cosigner might be able to discharge the loan.

For private student loans, death and disability discharges are at the discretion of the lender. For example, College Ave and Sallie Mae both provide disability and death discharges.

How does student loan discharge affect a cosigner? If a student loan is discharged, it will likely be listed as “discharged” on the cosigner’s credit report.

Depending on the status of the loan before it was discharged, this might negatively affect their credit score. In this case, it might be a good idea for the cosigner to speak with a financial expert before moving forward with a discharge.

Private student loan forgiveness alternatives

Private student loan forgiveness isn’t an option, but that doesn’t mean you should ignore your student loans if you’re having trouble paying. Contacting your lender to see what your options are is a good first step to taking control of your loans.

Another alternative is refinancing your student loans. You might be able to lower your interest rate or monthly payment with refinancing.

Student loan forgiveness FAQs

Many borrowers wonder if the same programs and policies that impact federal student loans are also applicable to private student loans. Unfortunately, very few instances exist in which a private student loan holder will be eligible for the benefits or leniencies that federal student loan holders are offered.

Generally speaking, this discrepancy is due to the fact that private student loan payments, including applicable interest rates, fall under a contractual obligation that the loan providers have with the investors that own the loans.

Can private student loans be forgiven after 10 years?

No, private student loans can’t be forgiven after 10 years, even if you’ve kept up with your monthly repayments or are facing economic hardship.

This also applies to borrowers who are employed in the public service sector, such as working for a not-for-profit organization or within a branch of government. For a borrower’s loans to be eligible for forgiveness after 10 years under the Public Service Loan Forgiveness Program, they must:

- Have employment within a state, federal, local, or tribal department of the United States government, work for a not-for-profit organization, or be enlisted in the U.S. military

- Have Direct Loans or have consolidated their federal student loans into a single Direct Consolidation Loan

- Have made 120 qualifying repayments on the loan under an income-driven repayment plan

Remember that even borrowers who do meet these eligibility requirements are not always granted forgiveness. If you have federal student loans along with your private student loans and believe you might meet these requirements, check with your federal student loan servicer.

Are private student loans forgiven after 20 years?

Unfortunately, private student loans don’t ever go away. What you borrow is what you’ll have to pay back — along with interest and potential fees.

Only federal student loans are eligible for student loan forgiveness programs, such as Public Service Loan Forgiveness or forgiveness under an income-driven repayment plan. One such program is the Revised Pay As You Earn Repayment Plan (REPAYE) which forgives the outstanding balance on federal loans used for undergraduate studies after 20 years or after 25 years for federal loans used for graduate or professional study.

Additionally, the suspension of payments and interest accrual under the CARES Act due to the COVID-19 pandemic is available only for federal student loans.

Check Out: How Often Can You Refinance Student Loans?

How can I get out of paying private student loans?

Even if you default on your private student loans or claim bankruptcy, it’s unlikely that your loan holder will cancel your loan. If you’re in default, you’ll need to ask your lender if any options are available to repay your student loans with the funds you have.

Can private student loan lenders garnish wages?

Technically, private student loan lenders can’t independently garnish wages; only the federal government can seize your wages, tax refunds, or Social Security benefits to repay defaulted federal student loan debt.

However, private student loan lenders can sue borrowers for missed or defaulted payments, and if the court rules in favor of the company, they can then garnish the borrower’s wages or seize other assets. Private student loan collectors can sue you but can’t intercept your tax return.

Taylor Medine contributed to the reporting for this article.