There’s a lot to like about condo living. Depending on where you live and the specific community, a condo could come with a cheaper mortgage, less maintenance, and plenty of top-notch amenities.

But there are some drawbacks to living in a condo community — beginning with the loan. Your lender will put the condo under extra scrutiny during the underwriting process to make sure it meets all sorts of requirements.

What is a condo?

A condo, or condominium, is a single unit within a multiple-unit property. Unit owners might have access to amenities such as a gym, pool, dog-walking area, business center, and other shared areas.

Unlike an apartment, a condo board, elected by the unit owners, usually manages the amenities, sets the budget, and sponsors events.

As a unit owner, you’ll pay a monthly condo fee to cover the property expenses set by the association.

Additionally, you might have to pitch in to cover special assessments, which are projects and repairs paid for by you and the other owners.

Pros and cons of buying a condo

There are several key differences between buying a condo and a single-family home. Familiarize yourself with some of the pros and cons before you start home shopping:

Pros

- They’re more affordable: Buying a condo is typically cheaper than buying a house. The median sales price of single-family homes was $388,700 in February 2024, while the median sales price of condominiums was $344,000, according to the National Association of Realtors.

- You’ll have access to shared amenities: Depending on the condo community, you might have access to great amenities and opportunities to socialize with your neighbors.

- They might have better security: Some condo associations hire security guards to patrol the grounds, which can mean a safer neighborhood.

Cons

- You’ll have to pay HOA fees: Condo fees can range from a couple of hundred dollars to more than a thousand dollars per month, but these vary with each association and might increase over time. These fees might pay for things like insurance, parking lots, security, and shared amenities. Before buying a condo, consider whether your budget can handle this extra expense.

- You’ll be subject to more restrictions: Each condo association sets its own covenants and restrictions, which are rules that members have to follow. These can range from simply annoying to outright restrictive, and breaking the rules might result in a hefty fine.

- They might be harder to sell: Life under a condo association isn’t for everyone, which might narrow the pool of buyers vying for your property.

Tips for buying a condo

A condo can be a great choice for the right buyer. Here are some tips to help ensure you’re happy with your purchase.

1. HOA fees

Homeowners association fees can be very reasonable, but in some buildings, they can cost as much as a mortgage payment.

Find out what the current HOA fees are for the unit you’re looking at before you even make an offer, so you’ll know whether they’re within your budget.

2. Special assessments

As the owner of a condo, you may be charged a special assessment by your HOA. These fees pay for major renovations and emergency repairs the association’s cash reserves don’t cover.

Whereas a relatively minor assessment of $1,000, for example, might not factor heavily into your decision to make an offer on a condo, a $10,000 or $20,000 assessment likely would. The listing agent should know about any current or impending assessments, but if not, you can ask them to find out.

3. FHA loan

If you plan on using an FHA loan to finance your condo purchase, make sure the development is on the FHA’s approved list.

Site condos — which are single-family detached units insured and maintained solely by the owner of the unit, similar to free-standing homes — may be exempt from this list if they meet the FHA’s Single-Unit Approval requirements.

4. Covenants, conditions, and restrictions

You’ll receive a copy of the declaration of covenants, conditions, and restrictions (CC&Rs) along with other documents before you close, but the earlier you can review them, the better.

The CC&Rs specify all the rules you have to follow when you own a condo in that development. If they turn out to be more restrictive than you’re comfortable with, it’s better to know before you’ve incurred costs like home inspection and appraisal fees.

5. Lifestyle

Living in a condo means you’ll have significantly less privacy compared to living in a free-standing home. Add to that restrictions imposed by the CC&Rs, and condo living can leave some feeling hemmed in. You’ll need to determine ahead of time if condo living is right for you.

On the other hand, condo living also provides a built-in community — and those rules, albeit restrictive at times, protect your property value and allow you to enjoy the amenities of the complex.

6. Amenities

The more amenities a condo development has, the higher the HOA fees are likely to be due to the required maintenance and upkeep. Think realistically about how much you’ll use them and whether having them on-site is worth the extra expense.

7. Rental restrictions

If you’re purchasing a condo as a second home or investment property, it’s vital to know in advance whether the condo development or the local zoning codes place any restrictions on rentals.

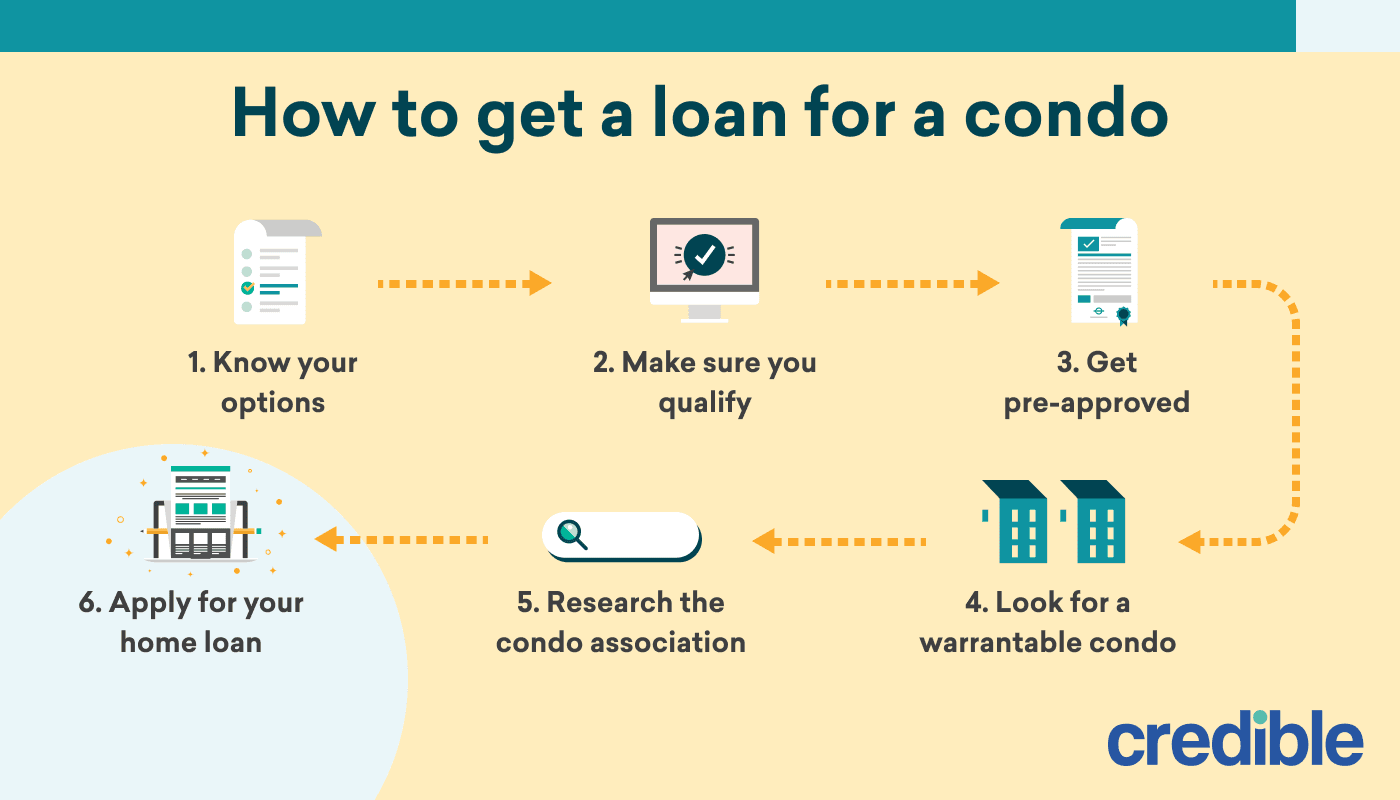

How to get a loan for a condo

Getting a mortgage for a condo is generally harder than getting a mortgage for a house.

A condo unit is part of a multi-unit development, so the borrower’s finances are intertwined with others — and lenders see this type of home as a riskier investment.

Your chosen condo will need to exhibit strong financial health if you want to qualify for a mortgage. Here are some tips for buying a condo:

1. Know your options

When you’re buying a condo, you have the same mortgage options as someone buying a single-family home. These include:

- Conventional loans

- FHA loans

- VA loans

Keep Reading: 10 Mistakes to Avoid as a First-Time Homebuyer

2. Make sure you qualify

Every loan program will have its own rules surrounding mortgages for condominiums.

If you’re looking to get an FHA loan — an attractive option for first-time homebuyers — then you’ll need to see if the condo is listed on the agency’s approved condominium list. The Department of Veterans Affairs publishes a similar list for VA loans.

If the condo appears on one of these lists, it will likely be approved for a conventional mortgage.

Learn More: FHA Approved Condos: How to Find One

3. Get pre-approved

The best way to determine whether the condo will meet program requirements is to ask a lender and get a mortgage pre-approval.

During this process, the lender will review your finances and let you know how much you can afford on a home loan. If you have a specific condo in mind, the lender might be able to tell whether it fits the requirements.

Also See: How Does the Mortgage Underwriting Process Work?

4. Look for a warrantable condo

A warrantable condo is one that fits the eligibility requirements set out by Fannie Mae and Freddie Mac.

These agencies, which purchase and insure most of America’s conventional loans, want to make sure the condo is in a financially sound community before they buy the loan.

Fannie Mae and Freddie Mac say that warrantable condos generally meet these requirements:

- No more than 15% of units are delinquent on condo association dues

- The association holds at least 10% of its annual budget in reserves

- A certain percentage of the units are owner-occupied

- The condo development has many individual owners — so no single entity owns more than a certain number of units

- The association carries appropriate insurance coverage

A non-warrantable condo does not meet these requirements, and it will be harder to qualify for a mortgage. In this case, you might consider buying a single-family home or paying for the condo with cash.

5. Research the condo association

Before buying a condo, you’ll want to research the association to make sure the unit is a good investment.

Ask the association for copies of its governing documents, which will give you all the details on its financial health.

Tip: If you spot low reserve funds or a history of litigation in the association’s governing documents, those are red flags. A real estate attorney can help you decipher these documents.

You’ll also want to see who’s in charge of maintaining the day-to-day operations. If it’s a property management company, you can research its reputation via the Better Business Bureau or through online reviews.

6. Apply for your home loan

If your condo meets eligibility requirements, then you can apply for a home loan. The lender will review your finances and send the condo association a list of questions.

For example, the lender will want to know how many units are in the community, who lives in them, and whether special assessments are coming down the line.

Are condos a good investment?

It might be hard to imagine selling a condo you haven’t even bought yet. But even if future gains aren’t a priority for you right now, it’s worth considering the investment value of any real estate you purchase.

Some factors that point to the condo being a good investment include:

- Location: A desirable location in a growing area, perhaps near transportation and within a respected school district, with easy access to conveniences and local attractions, can have a positive impact on your condo’s value.

- Vacation rental potential: Rental income from your condo can offset the cost of owning a vacation property, and it might even cover your expenses. To compare the investment potential of one condo to another, calculate their capitalization rates. There are online calculators to help with this. Essentially, you’ll take the net operating income and divide it by the condo’s sales price — the higher the cap rate, the better the investment potential.

- Cost vs. return: Short of finding a crystal ball, it’s impossible to know with certainty whether your condo will appreciate in value — or, if it does, by how much. But you can weigh the costs of owning a condo against the costs of owning another type of home, such as a townhouse, and determine which type is likely to generate the best return upon resale.

Is a condo right for you?

You’ll need to consider whether your lifestyle aligns with the condo’s rules and regulations.

For instance, if you have a pet, play musical instruments, and have plans to customize your home, then you’ll need to check whether the homeowners association will allow it.

But if you don’t mind following association rules, paying monthly dues, and living in close proximity to your neighbors, then owning a condo could be a good option for you.

When shopping around for mortgage lenders, you’ll want to consider factors like rates, fees, and loan products.

Daria Uhlig contributed to the reporting for this article.