If you’re looking to save money on a home loan, you might be intrigued by the low initial rates on an adjustable-rate mortgage (ARM). But while rates on ARMs start low, they can also rise over the life of the loan.

Interest rate caps protect you against a runaway rate increase, and it’s important to understand how they work if you’re shopping for adjustable-rate mortgages.

What is an interest rate cap?

An interest rate cap limits how much your interest rate can rise on an adjustable-rate mortgage. With an ARM, the interest rate starts at a low, fixed rate and then goes up or down periodically.

For example: On a 5/1 ARM, the interest rate remains fixed for the first five years of the loan. After the fixed period ends, the interest rate can go up or down once a year for the rest of the loan term.

And when the rate changes, your monthly mortgage payment changes, too. Interest rate caps can protect borrowers from the shock of a larger mortgage payment because they keep rates from increasing above a certain limit.

How ARM interest rate caps are structured

An adjustable-rate mortgage usually has a cap structure, which shows how much the interest rate can increase at different points in the home loan term.

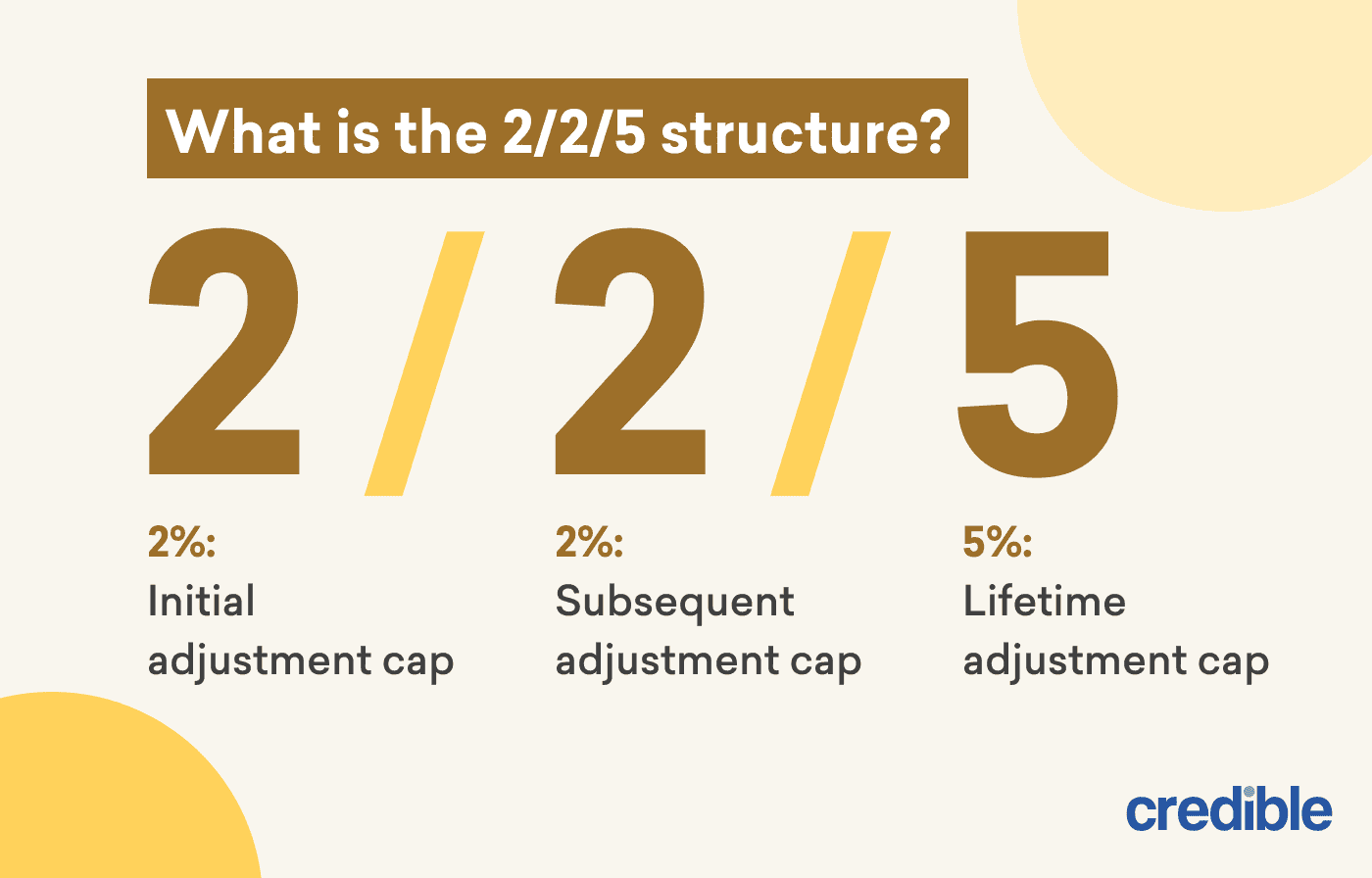

The lender sets adjustable-rate mortgage caps. They’re typically presented in a series of three numbers — such as 2/2/5 — that represent each cap: initial cap, periodic cap, and lifetime cap.

Here’s how these caps work:

Initial adjustment cap

The initial adjustment cap limits how much the mortgage rate can rise the first time it changes after the fixed-rate period expires.

Your lender sets this interest cap, but the Consumer Financial Protection Bureau says it usually falls between 2% and 5%.

For example, say you get a 5/1 ARM with an initial fixed rate of 3.5% and a cap structure of 2/2/5. Your interest rate could rise up to 5.5% in the sixth year of the loan term.

Subsequent adjustment cap

The subsequent adjustment cap limits how much the mortgage rate can rise in each adjustment period after the first one.

This cap is most commonly set at 2%, though it varies by lender and loan. Take a look at your 5/1 ARM with the 2/2/5 cap structure. Your rate increased to 5.5% in the sixth year, and in the seventh year, it can increase to no higher than 7.5%.

See More: 30 Mortgage Terms to Know: Ultimate Glossary for Homebuyers

Lifetime adjustment cap

The lifetime adjustment cap limits how much your mortgage rate can increase overall throughout the life of the loan.

The lifetime cap is most commonly 5%, though some lenders set a higher cap. In the example of a 5/1 ARM that starts at 3.5% and has a cap structure of 2/2/5, the interest rate can never go higher than 8.5%.

How to compare rate caps when choosing an ARM

When you’re shopping for an adjustable-rate mortgage, two lenders may offer the same initial interest rate but different rate caps. One may end up being more expensive, so it’s important to go over the interest cap and figure out how high the interest rate may increase.

Tip

Ask the lender to calculate the highest payment you’d have to make on the loan, and figure out if your budget can absorb that increased payment.

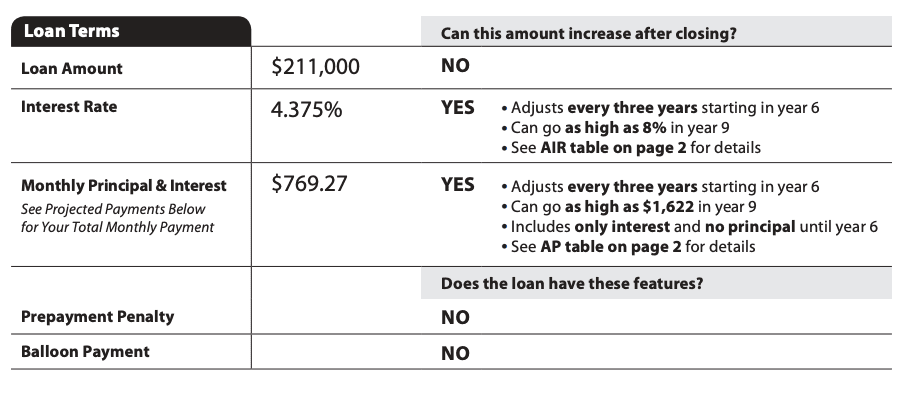

You can also check your loan estimate, a document the lender provides within three business days after you apply for a mortgage loan. Look at page 1 under “Loan Terms.”

Use our mortgage payment calculator to estimate your monthly payment including principal, interest, taxes, and insurance.

Next to the interest rate, the document will say whether the rate can increase after closing. It will also tell you how long the rate is fixed, how often the rate can increase, and how high it can stretch.

Is an ARM right for you?

When choosing a mortgage, you’ll need to decide between an adjustable and a fixed rate. Generally, adjustable-rate mortgages benefit homebuyers who plan to sell their house or refinance the mortgage before the fixed-rate period ends.

Tip

An ARM may also make sense if you can pay more toward the principal during the fixed-rate period.

A fixed-rate, on the other hand, might benefit someone who is planning to stay in the home long-term and prefers a predictable monthly mortgage payment. If your budget is already tight, then you might not be able to weather a rate increase.

Here are the pros and cons of an ARM you should consider:

When choosing between an ARM vs. a fixed-rate loan, ask yourself these questions:

- What’s happening with mortgage rates? Interest rates are always changing, but you can track their general trajectory over time. An adjustable-rate mortgage could make sense if mortgage rates have been rising. That’s because the difference between adjustable and fixed rates is more pronounced, so you might find a great deal on an ARM.

- Can I make extra payments during the fixed-rate period? When you have a mortgage with a low interest rate, more of your monthly payment goes toward paying down the principal. If you can make extra payments while your rate is low, then you could pay off more of your debt and save more money on interest in the long run.

- How long do I plan to live in the home? An ARM could be a good option if you’re planning to move before the fixed rate period ends. For instance, people who frequently relocate for work might benefit from an adjustable-rate mortgage. But there’s some risk involved here because you might not be able to sell the home when you plan to.