When you have a mortgage, you might decide to refinance the loan or pay it off early to save money. However, doing so may incur a prepayment penalty, which is a feature you should be aware of when comparing home loans.

What is a prepayment penalty?

A prepayment penalty is a fee some mortgage lenders charge when you pay off all or part of your loan before the term ends. It’s an incentive for a borrower to pay off the mortgage over the full term so the lender earns interest.

Prepayment penalties normally won’t apply when you make a few extra payments here and there. Instead, prepayment penalties typically kick in when you pay off the entire loan early. For example, you refinancing your mortgage, selling the home, or using a lump sum to pay off the loan.

Discover: Early Mortgage Payoff Calculator

Your conventional mortgage might be subject to a prepayment penalty depending on the loan’s origination date, but only within the first three years, and only if all of these conditions are met:

- The loan has a fixed rate.

- The loan is a “qualified mortgage.” This is a type of mortgage that a lender considers you qualified to repay. Nearly all lenders can issue a qualified mortgage.

- The loan is not a subprime mortgage. Subprime mortgages are high-risk home loans generally offered to borrowers with lower credit scores. They carry interest rates that exceed market-value rates for well-qualified borrowers.

Good to know:

VA, FHA, and USDA loans don’t allow lenders to charge a prepayment penalty.

Types of prepayment penalties

There are two types of prepayment penalties — soft prepayment penalties and hard prepayment penalties. Here’s a quick breakdown of the two:

- Soft prepay penalty: This applies to refinances only. You can sell your home or otherwise pay off the mortgage early without incurring a penalty.

- Hard prepay penalty: This applies to prepayment by any means.

The type of prepayment penalty you’ll pay may depend on the type of mortgage you get and your lender’s practices.

Limits on prepayment penalties

On fixed-rate qualified mortgages, lenders can include a prepayment penalty clause during the first three years, with limits on the size of the fee. But they must also offer an alternative loan that does not include prepayment penalty fees such as an FHA loan or ARM.

How a prepayment penalty works

You’ll know whether your loan has a prepayment penalty clause by looking at your monthly statement or payment coupons. If your loan is an older ARM, your rate adjustment notices should also indicate the loan is subject to a prepayment penalty.

In the event your loan is subject to a prepayment penalty, any action on your part that results in full repayment can trigger the penalty. Say, for example, you refinance your mortgage. The refinance is a new first mortgage that replaces your current loan by repaying it in full. That repayment could trigger the penalty.

The same is true if you sell your home. Since mortgages must be repaid in full if you decide to sell your home, that could trigger a prepayment penalty depending on the terms of your loan.

Tip:

Be sure to check your loan documents before paying off the mortgage to determine whether a prepayment penalty applies.

How much are prepayment penalties?

Prepayment penalties vary with each lender, but here are some typical formulas for determining this fee:

- Percentage of the outstanding loan balance: You may be required to pay a small percentage, such as 2%, of the remaining loan balance when paying off the loan within the first two or three years of the loan term. For example, if you owe $200,000 and the penalty fee is 2%, you pay a $4,000 prepayment penalty. Your lender may limit your prepayment penalty to a certain dollar amount, though.

- Interest for a certain number of months: Some lenders base the penalty fee on the amount of interest you would have paid had you kept the loan longer. For example, you might be required to pay six months’ worth of interest if you refinance.

- Flat fee: You might be required to pay a fixed amount, such as $2,000, to pay off the loan before the term ends.

- Sliding scale: This model is based on the length of the loan term. For example, if you pay off the mortgage within the first year, then you owe 2% of the outstanding balance; the penalty fee drops to 1% of the balance if you pay off the loan within the first two years.

Prepayment penalty example

Prepayment penalties sound complicated, but they’re actually pretty straightforward.

For example, if your loan imposes a soft prepayment penalty, you’d incur the penalty only if you were to refinance within the first three years. That’s because a refinance pays off your original mortgage.

A hard prepayment penalty works the same way but isn’t limited to refinances. For example, if you were to sell your home within the first three years of purchasing it, the closing agent that handles the fund disbursements would pay off your loan balance from the proceeds of the sale. This would trigger a hard prepayment penalty. The same result would apply if you make extra payments to pay off the loan early.

Why lenders charge prepayment penalties

You might think all mortgage lenders want their money back ASAP. But when lenders issue mortgage loans, they expect to earn interest over the entire loan term, typically between 15 and 30 years. When borrowers pay back their mortgages before the term ends, they lose out on all of that interest.

Prepayment penalties help lenders because they discourage borrowers from paying off their mortgages quickly. They also help lenders recoup some of the money they would have received through interest.

How to avoid prepayment penalties

The best way to avoid prepayment penalties is to take out a loan that doesn’t carry any. Lenders can’t charge these fees on:

- Single-family FHA loans

- VA loans

- USDA loans

- Any adjustable-rate mortgage (ARM)

- Any mortgage with a high interest rate

They can also choose not to charge this fee on conventional loans, so it makes sense to take out a loan from a lender that doesn’t impose the penalty.

Another way to avoid prepayment penalties is by holding off on refinancing or selling your home until the prepayment penalty period — usually three years — has passed. Or, if your loan’s penalty is a percentage of the principal balance, you can reduce the penalty by paying down the principal balance up to whatever amount the loan allows.

Check for a prepayment penalty

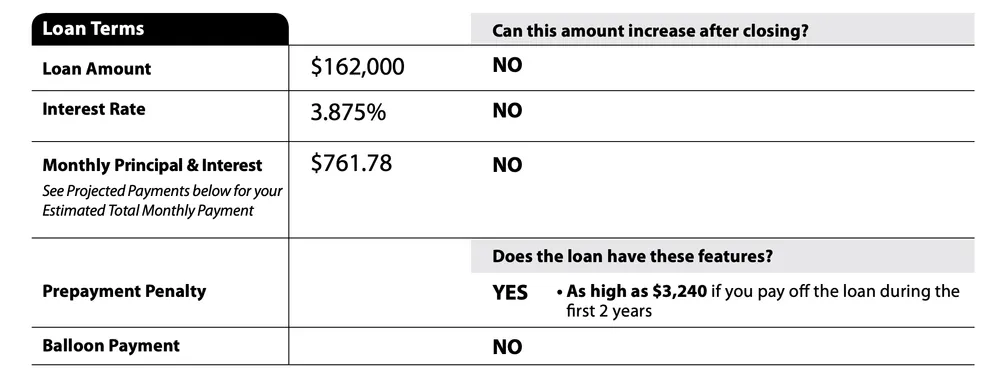

When you apply for a mortgage, the lender must give you a loan estimate within three days. This standardized document includes details about the loan, including the costs involved and whether any loan terms can change.

When you get the loan estimate, look at page 1 under the section “Loan Terms” / “Prepayment Penalty.” In the space under the question “Does the loan have this feature?” the document will say “yes” or “no.” If it says “yes,” then your loan has a prepayment penalty.

The loan estimate will also specify the amount of the penalty and when it may apply.

That’s why it’s important to compare offers from multiple lenders to find the best terms for a loan.

Daria Uhlig contributed to the reporting for this article.