More Americans are turning to small personal loans, amounting to $2,500 or less, to stay afloat.

A recent Credible analysis found that paying bills or rent is the top loan purpose for loans of $2,500 and less. To learn more about this financial strategy, we surveyed Americans about their small loan use and found that many have turned to this type of loan, especially in the last few years.

Recent borrowing trends

1 in 5 Americans took out a small personal loan in the last 12 months

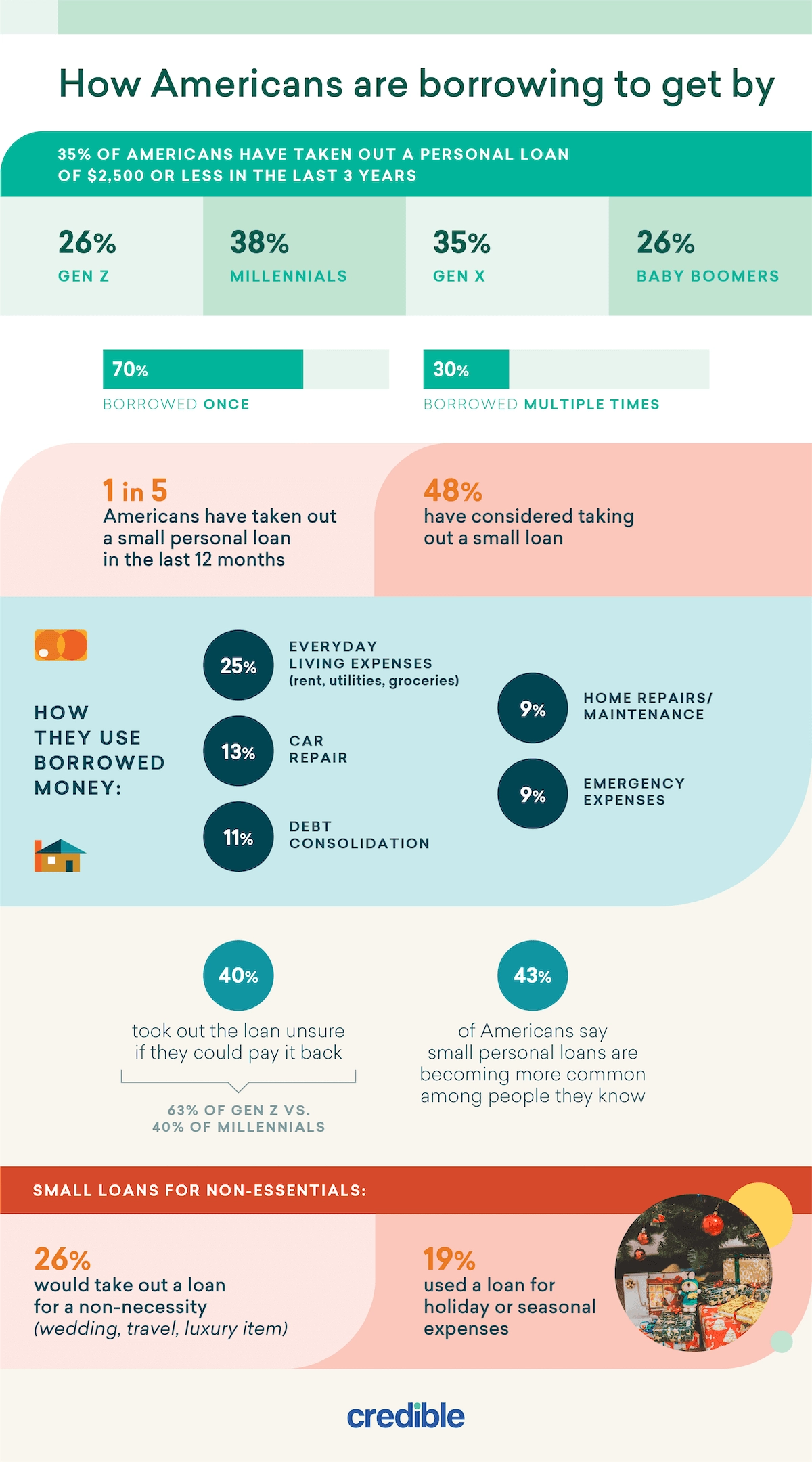

More than 1 in 3 Americans have taken out a personal loan of $2,500 or less in the last three years. Notably, 1 in 5 Americans took out a personal loan in just the last year. As for who is taking out these loans, Millennials top the list (38%), followed by Gen X (35%), Gen Z (26%), and Baby Boomers (26%). Among those who haven’t taken out a small loan in the last 3 years, 48% have considered it.

Gen Z: Born between 1997 and 2012

Millennials: Born between 1981 and 1996

Gen X: Born between 1965 and 1980

Baby Boomers: Born between 1946 and 1964

Among those who have borrowed in the past three years, 70% borrowed once, while 30% borrowed multiple times. When it comes to how Americans are using the borrowed money, paying for everyday living expenses (rent, utilities, groceries) tops the list, followed by car repairs and debt consolidation.

Nearly half (48%) took out the loan, uncertain they could pay it back, a concern most common among Gen Z (63%) compared to Millennials (40%).

Small personal loans appear to be becoming a normalized part of financial life. Nearly half of Americans (43%) say these loans are increasingly common among people they know.

Editor insight: “Small loans are becoming an increasingly common way to cover the gap between rising housing and food costs and stagnant wages. At Credible, we’ve seen interest in small loans increase significantly, whether it’s someone seeking a personal loan to pay bills or rent or searching for BNPL and cash apps to cover food and other essentials.”

— Meredith Mangan, Senior Loans Editor, Credible

In fact, 26% say they would consider taking out a loan for a non-essential purchase, like a wedding, vacation, or luxury item. Additionally, 19% report using a loan to cover holiday or seasonal expenses.

The future of borrowing

1 in 7 Americans plan to take out a small loan in 2026

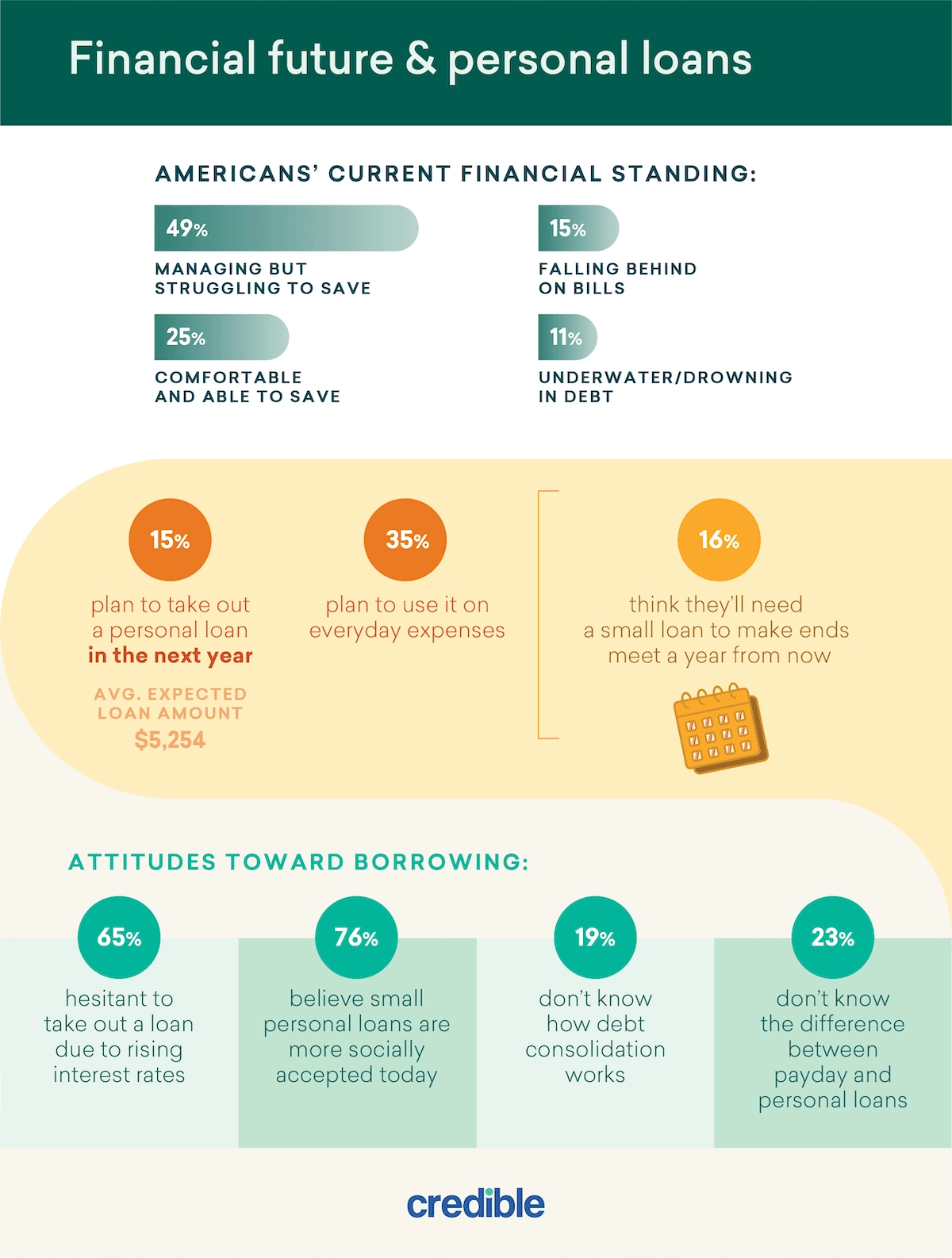

Many Americans remain caught between managing day-to-day expenses and striving for financial stability. Nearly half (49%) say they’re managing but struggling to save, while 1 in 4 feel comfortable and able to save. However, 15% report falling behind on bills, and 11% say they’re underwater or drowning in debt.

Looking ahead, borrowing remains part of many Americans’ financial plans.

How Americans plan to use small loans in 2026

- 1 in 7 Americans (15%) plan to take out a personal loan in the next year

- Average expected loan amount is $5,354

- 35% plan to use it for everyday expenses

- 16% believe they’ll need a small loan just to make ends meet next year

When it comes to attitudes toward borrowing, nearly two in three (65%) say they’re hesitant to take out a loan because of rising interest rates, yet 76% believe small personal loans are more socially accepted today than in the past.

Note

Interest rates aren’t actually rising — in fact, the Federal Reserve cut rates twice this year — but rates may appear to be rising if you’re having a hard time qualifying for credit.

Despite the growing prevalence of borrowing, financial literacy gaps persist as 19% of Americans say they don’t know how debt consolidation works, and nearly 1 in 4 (23%) aren’t sure of the difference between payday and personal loans.

Editor insight: “Now more than ever, it’s important to understand how borrowing works and how much it costs, especially if you don’t have good credit. When you know how to borrow wisely, it can help you save money, which can help you limit borrowing in the future. In turn, this can help you plan for long-term goals like buying a home or funding a child’s college tuition.”

— Meredith Mangan, Senior Loans Editor, Credible

Emotional and financial impacts

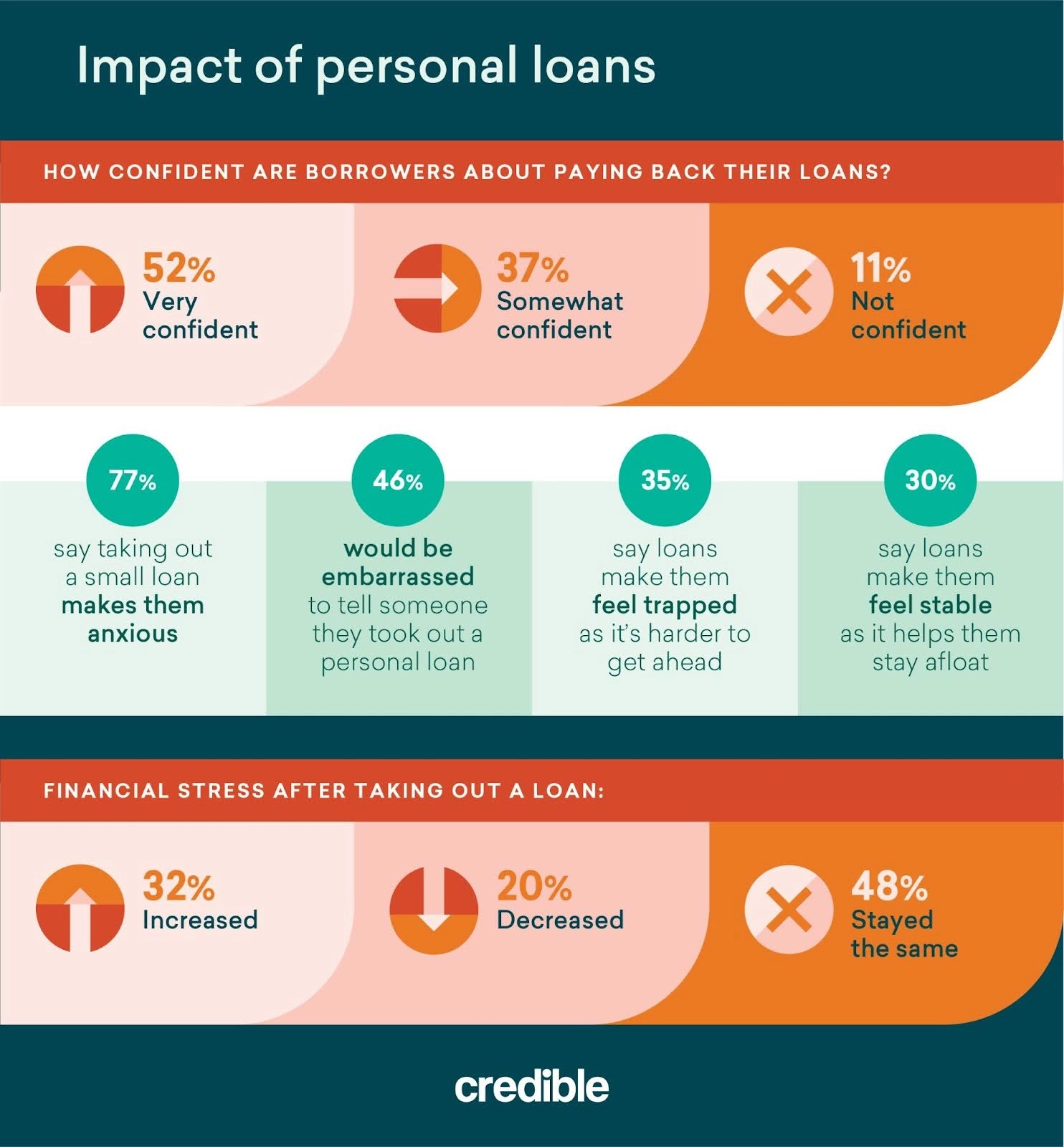

While small personal loans can provide short-term relief, they can also lead to lingering financial effects. More than half of borrowers (52%) say they feel very confident in their ability to pay back their loans, while another 37% are somewhat confident and 11% admit they’re not confident about repayment.

More than 3 in 4 Americans (77%) say taking out a small loan makes them feel anxious, and nearly half (46%) would be embarrassed to tell someone they borrowed money. For some, loans contribute to a sense of stagnation: 35% say borrowing makes them feel trapped because it’s harder to get ahead financially. Conversely, 30% view these loans as stabilizing, offering a way to stay afloat when finances are tight.

When asked how their financial stress changed after taking out a loan, nearly 1 in 3 (32%) say it increased, while 20% say it decreased and 48% say it stayed the same.

Methodology

In November 2025, Credible commissioned Digital Third Coast and Prolific to conduct a survey of 1,005 people from across the U.S. about their use of personal loans. Among respondents, 50% identified as male, 48% as female, and 2% non-binary. The median age of respondents was 39.

For media inquiries, contact [email protected].

Fair use

When using this data and research, please attribute it by linking to this study and citing Credible.