When purchasing an investment property, a condo can be an attractive choice, especially for first-time investors. They generally cost less than single-family homes and can be easier to maintain.

Whether or not they’re a good investment, though, depends on a number of different factors.

Do condos appreciate in value?

In general, condos appreciate in value at a slower rate than single-family homes. The median sales price of a condo was up nearly 6% year-over-year in January 2024, according to the National Association of Realtors[1]. The median sale price of single-family homes was up 5% in the same timeframe.

Even though condos generally appreciate at a slower rate than single-family homes, they’re still likely to increase in value over time. Some of the factors that can impact appreciation include:

- Location

- Walkability

- Community amenities

- High population growth

- Demand for low-maintenance living situations

- How well the property is maintained

Advantages of investing in a condo

Investing in a condo can be a smart decision, especially in an expensive real estate market. Condos often cost less than single-family homes and you don’t have to worry about maintenance or repairs.

Here are some of the main advantages to buying a condo:

Costs less than a single-family home

One of the main draws of owning a condo is price. According to the National Association of Realtors, the median sales price of a condo was $339,400 in January 2024, while the median price of a single-family home was $383,500.

With home inventory at a record-low level and prices continuing to surge, more investors may see condos as an appealing, cost-effective option.

Offers a variety of amenities

For those interested in communal living, condos offer attractive amenities. Many condo communities include grilling areas, gyms, pools, and other common areas. These attractive amenities can make it easier to find renters for a condo or guests for an Airbnb.

Doesn’t require external maintenance and repairs

Condo fees are relatively low given that you aren’t responsible for all of the maintenance and repairs.

With a single-family home, you’re responsible for maintaining the roof, patio, gutters, paint, and every other part of your house. But with condos, you pay your regular fee and the homeowners association takes care of the external upkeep — including snow removal, yard work, and other exterior maintenance. This can make things easier for a beginning investor.

Appreciates in value while providing cash flow

A condo can provide cash flow, whether you rent it out or use it for Airbnb. While receiving this cash flow, the condo also appreciates in value over time, increasing your equity.

Drawbacks to investing in a condo

While convenient and cheaper than single-family homes, condos come with their share of drawbacks too. HOA fees and rental restrictions are just a few disadvantages you might be leery of as an investor and condo owner.

Here are some of the main drawbacks to buying a condo:

Association fees

Depending on the location, condo association fees can be high — from a few hundred dollars a month to a thousand dollars (or even more). Additionally, hefty monthly condo fees increase your payment, cutting into your overall return on investment.

Tip: Learn as much as you can about the condo’s HOA before you buy rental property there. Ask to see the HOA’s finances and see if it has sufficient cash reserves. If the HOA doesn’t have an adequate reserve fund, it might have to increase dues or impose special assessments to cover certain renovations or replenish that empty reserve — both of which cost you money.

Rental restrictions

Not every condo community allows you to rent out the condo. Or, you might be able to rent it out to long-term renters, but not be able to use it for short-term rentals like Airbnb. If you plan on renting out your unit, be sure to understand the limitations.

Association restrictions

In addition to rental restrictions, there might be other restrictions in a condo community. Your homeowner's association might limit the types of modifications you can make to the unit or the number of pets you can own.

For some investors, these restrictions can be a deal breaker.

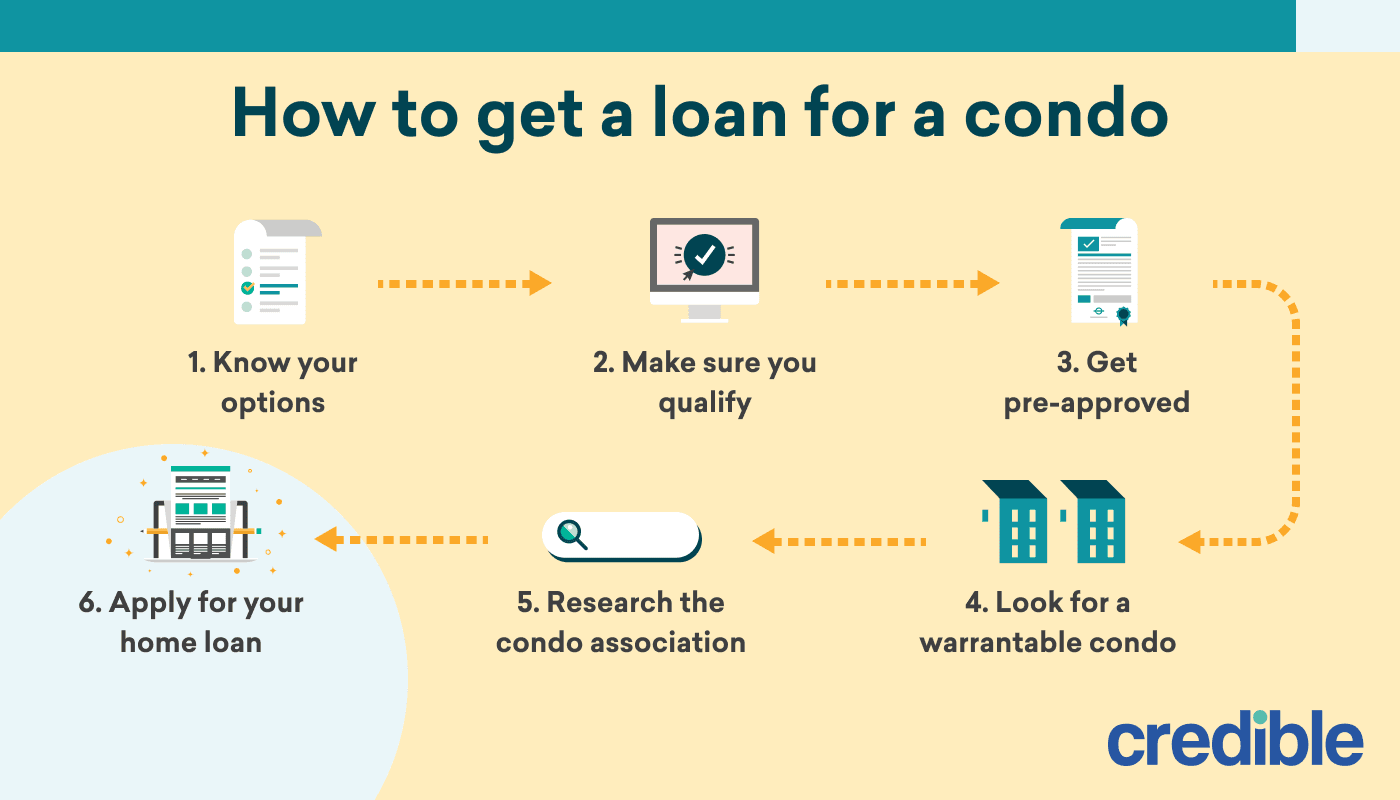

Difficulty in obtaining financing for a condo

It can be harder to get financing for a condo. Condo mortgage rates tend to be higher than rates for single-family homes, and the lender might have other conditions, like expecting a certain amount of the units in a community to be owner-occupied (i.e., there are more owners than renters) before offering you pre-approval.

Good to know:

When getting a mortgage for a condo, you might need to show a high level of financial health and provide a larger down payment. You might also need to be prepared with additional documentation about the condo community.[

Should you invest in a condo?

Before investing in a condo, carefully think about your situation and money goals, and weigh the pros and cons.

If you want to start investing in condos, make sure that you’re choosing a location that’s likely to provide a good rate of appreciation.

Consider how much time you want to spend on maintenance and repairs too. As long as you can keep up with the fees and the restrictions don’t prevent you from renting the unit, investing in a condo can be a savvy financial move.

How to figure out your ROI

When determining your ROI, you need to take into account costs associated with the condo, as well as the financing costs. Our mortgage calculator and loan-to-value calculator can help you nail down your projected ROI.

Let’s say you buy a condo for $250,000 and put 20% down. You finance $200,000 at 6.5% for 30 years. That works out to $1,375.22 a month (not including taxes or fees), or $16,502.64 annually.

Tip:

You can also try for an FHA-approved condo, which requires a smaller down payment.

Now, say you rent the condo for $1,700 per month. This gives you a monthly profit of over $300. Over the course of a year, that’s nearly $3,900 in profit.

To come up with your ROI, take that profit and divide it by the amount you’re paying annually for your mortgage (in this case, $16,502.64) plus your $50,000 down payment. The ROI would be close to 6% per year ($3,900 divided by $66,502).

However, you also have to factor in expenses that can reduce the ROI, such as:

- Condo fees

- Insurance

- Vacancies

- Repairs and maintenance

- Advertising costs

Remember:

You can also factor in the appreciation. As the value of the condo goes up, your ROI increases over time.