Credible takeaways

- Refinancing can help you pay off $300K in student loans faster if you qualify for a lower interest rate or choose a shorter repayment term.

- If you have federal student loans, switching to an income-driven repayment plan can help make your payments more manageable, and you can qualify for loan forgiveness if you meet the requirements.

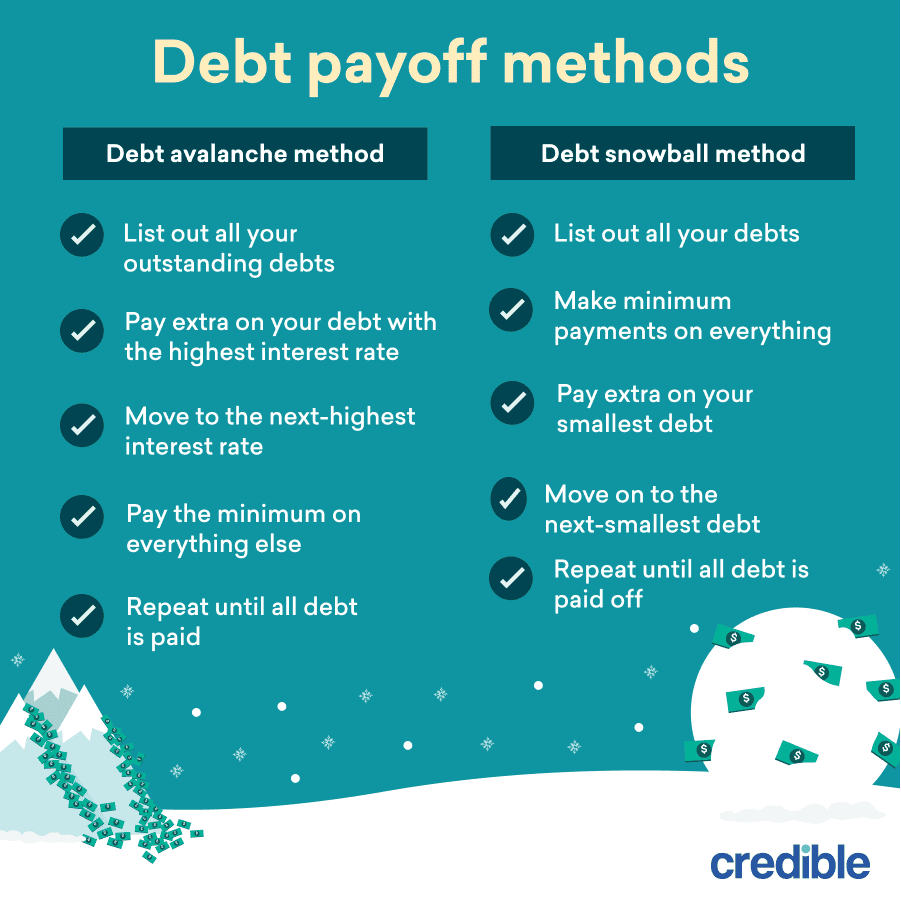

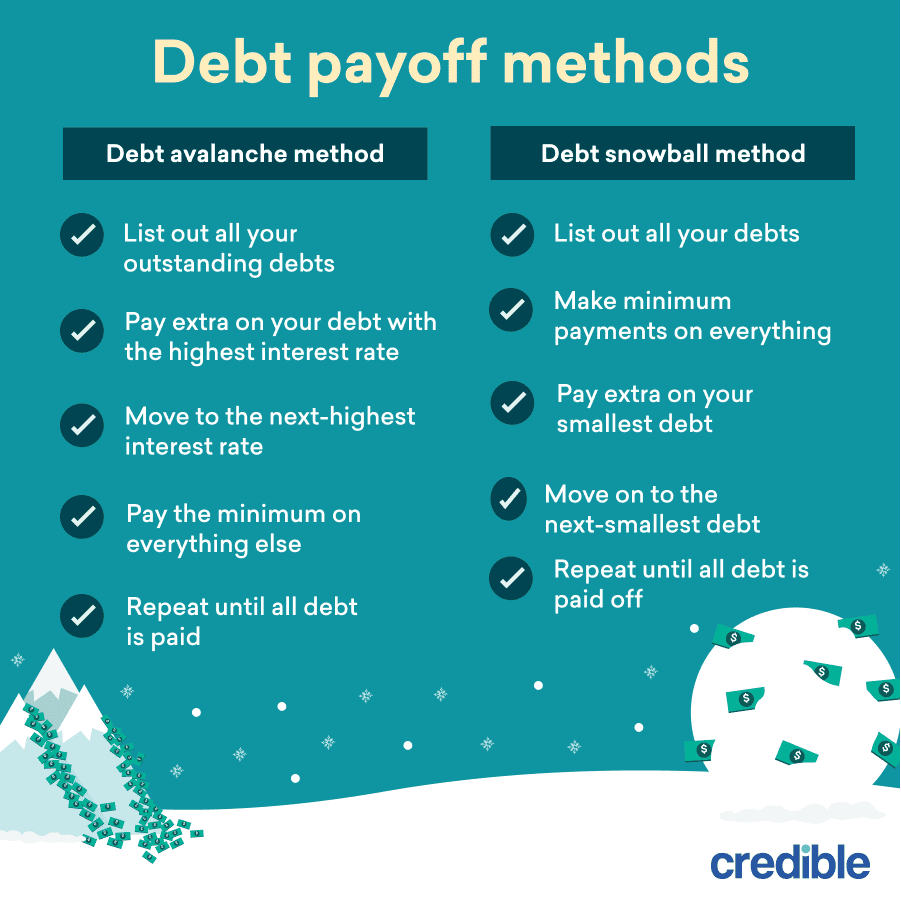

- Repayment strategies like the debt avalanche or debt snowball can help you stay focused on tackling your debt and create small wins along the way.

As of March 2024, only 2% of borrowers owed $200,000 or more in federal student loans, though this group holds 18% of the outstanding federal student loan debt, according to the College Board. The cost of college continues to rise, and if you're taking out loans for a medical degree or law school, for example, student loans can add up quickly.

While paying down a high balance can be overwhelming and time-consuming, several strategies can help make the process easier.

1. Refinance your student loans

Student loan refinancing is the process of paying off your old student loans with a new loan. Depending on your credit, you might get a lower interest rate through refinancing — this could save you money on interest and potentially help you pay off your loan faster.

Or you could opt to extend your repayment term through refinancing to reduce your monthly payments and lessen the strain on your budget. Remember that choosing a longer term means paying more interest over time.

“Before refinancing federal student loans, I recommend making sure you won't need income-driven repayment or loan forgiveness now or in the future. Refinancing makes your loans private, and you'll lose access to those federal benefits for good.”

— Renee Fleck, Student Loans Editor, Credible

If you refinance your student loans, consider as many lenders as possible. This way, you can find the right loan for your situation.

Here are Credible's partners that offer refinancing for student loan balances of $300,000:

Advertiser DisclosureOverview

Brazos offers refinancing loans to Texas residents who have a bachelor’s degree or higher from an eligible school. There are no origination or application fees, and interest rates could be lower than what you find with other private lenders.

However, some borrowers may find that Brazos has relatively strict eligibility requirements. Borrowers must have a minimum income of $60,000 and a credit score of 720 or higher. If you can’t meet those minimums alone, you can add a cosigner that can be released after 24 on-time consecutive payments.

pros

- Five loan terms available

- Competitive rates

- Cosigner release

- No origination or application fees

- Autopay discount of 0.25 percentage points

cons

- Only available to Texas residents

- High minimum credit and income requirements

- Bachelor’s degree required

Loan terms

5, 7, 10, 15, or 20 years

Loan amounts

$10,000 minimum, up to $150,000 for bachelor degrees and $400,000 for graduate, medical, law, or other professional degrees

Cosigner release

Yes, after 24 on-time payments

Eligibility

Borrower must be a Texas resident and a U.S. citizen or permanent resident who has a bachelor’s degree or higher

Overview

The Rhode Island Student Loan Authority (RISLA) is a nonprofit lender offering student loan refinancing to borrowers across the U.S. You can refinance even if you didn't complete your degree, as long as you have at least $7,500 in student loan debt.

What makes RISLA unique is the flexibility it offers borrowers. If you're facing financial difficulties, RISLA provides income-based repayment options to help manage your payments. For added relief, you can access up to 24 months of forbearance, which is more than many lenders offer. If you return to graduate school, you can defer your payments for up to three years, giving you time to focus on your studies without worrying about loan payments.

pros

- Offers income-based repayment

- Generous payment relief options

- You can refinance without a degree

- Get a rate discount when you enroll in autopay

cons

- Fewer repayment terms to choose from

- Does not offer variable rates

Loan amounts

$7,500 minimum up to of $250,000, depending on degree

Cosigner release

After 24 months of on-time, consecutive payments (not available to residents of Colorado, Connecticut, Maine, Nevada, and Washington, D.C.)

Eligibility

Borrower or cosigner must meet credit requirements. Student must be a U.S. citizen or permanent resident and have used original student loans to attend an eligible degree-granting institution.

Overview

Earnest student loan refinancing offers flexibility and accessibility, with loans available to borrowers with credit scores as low as 665. Borrowers can customize their repayment terms by setting their exact monthly payment or choosing a specific loan term, down to the number of months. If you opt for higher monthly payments you may qualify for Earnest's most competitive rates.

For borrowers facing financial challenges, Earnest offers a skip-a-payment option. After six months of on-time payments, you can skip one payment every 12 months without penalty. Keep in mind, though, that the skipped principal and interest charges will be distributed across your remaining payments, slightly increasing your monthly payment.

pros

- Low minimum credit score requirement

- Flexible options for structuring your loan payments

- Option to skip a payment every six months

- No origination or late payment fees

cons

- Cosigners are not accepted

- Loans aren’t available to Nevada residents

Minimum income

No minimum income requirement, but borrower must be employed, have a written job offer that starts within six months, or demonstrate consistent income.

Loan amounts

$5,000* minimum, up to $550,000

*Minimum loan amount for California residents is $10,000, and $10,001 for New Mexico residents.

Eligibility

Must be a U.S. citizen, permanent resident, DACA recipient, asylee, or hold an H-1B visa with a U.S. citizen cosigner. Must have debt from a Title IV-accredited school and be current on rent or mortgage payments. Loans must also be in good standing. California residents must refinance at least $10,000, and New Mexico residents must refinance at least $10,001.

$5,000 up to the full balance

Overview

Undergraduate and graduate students can refinance their student loans with SoFi® if they meet eligibility requirements. You can prequalify for a loan in two minutes without affecting your credit score, and the lender offers both fixed and variable rates. Plus, SoFi offers unique benefits to its members, including access to networking events and financial advisers.

SoFi requires a minimum loan balance of $5,000 to refinance. You can add a cosigner to your application, and remove them after 24 consecutive on-time payments. You can find out your potential rate through prequalification, but the lender doesn't disclose its minimum credit score or income requirements.

pros

- Doesn’t require loan prepayment, origination, application, or late payment fees

- Borrowers can get complimentary financial planning advice, referral bonuses, and discounts

- Offers a wide range of repayment plans

cons

- Must have at least $5,000 in loans to refinance

- Unclear credit and income requirements

- No cosigner release available

Loan terms

5, 7, 10, 15, or 20 years

Loan amounts

$5,000 up to full outstanding balance

Eligibility

Must be a U.S. citizen or permanent resident. Must have made 6 on-time payments in the past 6 months, with no record of default, delinquency, bankruptcy, or foreclosure in the last five years. Employment is required, or you must have a job offer starting within 90 days. Must also have attended a Title IV-eligible school.

Overview

LendKey is a marketplace that connects borrowers with more than 300 community banks and credit unions to find the best student loan refinancing options. Unlike most lenders, LendKey allows you to refinance your student loans while you're still in school, as long as you've earned at least an associate degree.

One of LendKey's biggest advantages is that it can help you compare multiple loan offers in one place. However, specific loan terms and eligibility requirements will vary by lender. Basic eligibility criteria include a minimum credit score of 680 and at least $5,000 in outstanding debt to refinance.

pros

- You can refinance with just an associate degree

- Can earn a $200 bonus for referring friends and family

- Lower your rate by a quarter of a percentage point with autopay

- No fees for applications or loan origination

cons

- Some lenders may require membership in a credit union or local bank

- Loan terms and qualifications vary by lender

Cosigner release

Varies based on lender's terms

Eligibility

Must be a U.S. citizen or permanent resident and have already graduated with at least an associate degree from one of LendKey lenders’ eligible institutions.

$10,000 up to total refinance amount

Overview

ELFI offers student loan refinancing to borrowers who graduated with a bachelor's degree or higher. Borrowers can even refinance their parents' PLUS loans in their own name. Plus, each ELFI borrower gets paired with a student loan adviser to help them through the refinancing process.

While borrowers can add a cosigner to their application, they can't release that cosigner later on. ELFI also doesn't offer rate discounts, but borrowers can apply for a forbearance of up to 12 months if they're experiencing financial hardship.

pros

- Doesn’t charge application or origination fees

- Borrowers are assigned to a student loan adviser

- Student borrowers can refinance parent PLUS loans in their name

- Clear credit and income requirements

- Offers financial hardship forbearance of up to 12 months

cons

- Doesn’t offer any discounts

- Need at least a bachelor’s degree to refinance

- Doesn’t offer cosigner release

- Charges fees for late and returned payments

Loan terms

5, 7, 10, 15, or 20 years for student loan refinancing; 5, 7, or 10 years for parent loan refinancing

Loan amounts

Minimum of $10,000 with no set maximum.

Eligibility

Must be a U.S. citizen or permanent resident with a bachelor’s degree or higher. Must have at least $10,000 in student loans to refinance and a minimum credit history of 36 months.

Overview

EdvestinU offers student loan refinancing through Granite Edvance Corporation, a New Hampshire-based nonprofit. The lender stands out with competitive interest rates and flexible repayment terms for borrowers with strong credit.

Although the lender doesn't disclose the minimum credit score to quality, borrowers and cosigners must have an annual income of $30,000 for loans less than $100,000 or $50,000 for larger amounts. Unlike many lenders, EdvestinU lets you refinance without a degree or while still enrolled in school.

pros

- You can refinance without a degree or while enrolled in school

- Autopay rate discount available

cons

- Requires a higher minimum loan balance than some lenders

- Cosigner release requires 2 years of on-time payments

Minimum income

For loan balances below $100,000, the income requirement is $30,000; over $100,000, the income requirement is $50,000.

Eligibility

U.S. citizens or permanent residents who are at least 18 years old and reside in the U.S.

Overview

INvestEd is a nonprofit based in Indiana that offers student loan refinancing to borrowers nationwide. It offers competitive rates and a discount for setting up autopay. INvestEd also allows cosigners to be released after 12 on-time payments, which is sooner than some other student loan refinancing lenders.

However, the most you can refinance through INvestEd is $250,000, less than what other lenders may allow. It also has strict credit and income requirements to qualify, or you'll need an eligible cosigner. INvestEd clearly defines its credit requirements before you apply.

pros

- Refinancing available even for non-degree holders

- Offers a one-quarter percentage point rate discount for autopay

- Deferment available while in school, military service or under financial hardship

- Will release cosigners after as few as 12 payments

cons

- Relatively low maximum refinance amount compared with some competitors

- No refinancing available for international students

- Parent loans cannot be refinanced in student’s name

Eligibility

U.S. citizens or permanent residents are eligible. Borrowers must meet minimum requirements including a FICO score of 670 or higher, annual income of $36,000, a debt-to-income ratio below 40% to 50%, a year of continuous employment, and no defaults or serious collection activities in recent years.

Overview

Citizens student loan refinancing is available to qualified borrowers who want to refinance at least $10,000.

Borrowers who earned undergraduate degrees can refinance as much as $300,000 in student loans. Those who borrowed for graduate or professional degrees can refinance from $500,000 to $750,000. Citizens refinancing loans are available with fixed or variable rates. Repayment terms are flexible, ranging from five to 20 years.

Medical residents can refinance student loans and only pay $100 per month for up to four years while completing residency or fellowship.

pros

- Range of repayment options between 5 and 20 years

- Offers prequalification with no impact on credit score

- Offers rate discounts for existing customers and autopay

cons

- Cosigners not eligible for release until after 36 payments are made

- Refinancing unavailable until you make 12 payments on your loans if you earned an associate degree or no degree at all

- Minimum loan amounts are higher than some other lenders

Loan terms

5, 7, 10, 15, or 20 years

Loan amounts

$10,000 minimum, with a maximum of $300,000 for bachelor’s degree or below; $500,000 for graduate degrees; and $750,000 for professional degrees

Eligibility

Must refinance at least $10,000 in student loans and be a U.S. citizen, permanent resident, or resident alien with a valid U.S. Social Security number. Must have earned at least a bachelor's degree to qualify.

$10,000 up to the total amount

Overview

Massachusetts Educational Financing Authority (MEFA) is a student refinancing lender offering a wide range of options, including to borrowers who didn't finish school. Though the lender doesn't offer variable-rate options, its fixed-rate loans have competitive rates.

MEFA's mission is to provide affordable student loans, and it doesn't charge any fees. You must have at least $10,000 in student loans to refinance, and you must have made a minimum of six consecutive on-time payments over the last six months. Borrowers who are unable to qualify on their own can add a cosigner to their application.

pros

- You can refinance without having graduated

- Doesn’t charge fee

- Can prequalify to check your rate

cons

- Can’t release a cosigner

- Doesn’t have any discounts

- Can’t refinance parent student loans

- Doesn’t offer variable-rate loans

Loan amounts

$10,000 up to your total debt

Eligibility

Must be a U.S. citizen or permanent resident who is the primary borrower on education debt used to attend an eligible college or university. Must have made six on-time loan payments over the most recent six months. Must have no history of default or delinquency on education debt for the past 12 months and no history of bankruptcy or foreclosure in the past five years.

Overview

Brazos offers refinancing loans to Texas residents who have a bachelor’s degree or higher from an eligible school. There are no origination or application fees, and interest rates could be lower than what you find with other private lenders.

However, some borrowers may find that Brazos has relatively strict eligibility requirements. Borrowers must have a minimum income of $60,000 and a credit score of 720 or higher. If you can’t meet those minimums alone, you can add a cosigner that can be released after 24 on-time consecutive payments.

pros

- Five loan terms available

- Competitive rates

- Cosigner release

- No origination or application fees

- Autopay discount of 0.25 percentage points

cons

- Only available to Texas residents

- High minimum credit and income requirements

- Bachelor’s degree required

Loan terms

5, 7, 10, 15, or 20 years

Loan amounts

$10,000 minimum, up to $150,000 for bachelor degrees and $400,000 for graduate, medical, law, or other professional degrees

Cosigner release

Yes, after 24 on-time payments

Eligibility

Borrower must be a Texas resident and a U.S. citizen or permanent resident who has a bachelor’s degree or higher

Overview

The Rhode Island Student Loan Authority (RISLA) is a nonprofit lender offering student loan refinancing to borrowers across the U.S. You can refinance even if you didn't complete your degree, as long as you have at least $7,500 in student loan debt.

What makes RISLA unique is the flexibility it offers borrowers. If you're facing financial difficulties, RISLA provides income-based repayment options to help manage your payments. For added relief, you can access up to 24 months of forbearance, which is more than many lenders offer. If you return to graduate school, you can defer your payments for up to three years, giving you time to focus on your studies without worrying about loan payments.

pros

- Offers income-based repayment

- Generous payment relief options

- You can refinance without a degree

- Get a rate discount when you enroll in autopay

cons

- Fewer repayment terms to choose from

- Does not offer variable rates

Loan amounts

$7,500 minimum up to of $250,000, depending on degree

Cosigner release

After 24 months of on-time, consecutive payments (not available to residents of Colorado, Connecticut, Maine, Nevada, and Washington, D.C.)

Eligibility

Borrower or cosigner must meet credit requirements. Student must be a U.S. citizen or permanent resident and have used original student loans to attend an eligible degree-granting institution.

Overview

Earnest student loan refinancing offers flexibility and accessibility, with loans available to borrowers with credit scores as low as 665. Borrowers can customize their repayment terms by setting their exact monthly payment or choosing a specific loan term, down to the number of months. If you opt for higher monthly payments you may qualify for Earnest's most competitive rates.

For borrowers facing financial challenges, Earnest offers a skip-a-payment option. After six months of on-time payments, you can skip one payment every 12 months without penalty. Keep in mind, though, that the skipped principal and interest charges will be distributed across your remaining payments, slightly increasing your monthly payment.

pros

- Low minimum credit score requirement

- Flexible options for structuring your loan payments

- Option to skip a payment every six months

- No origination or late payment fees

cons

- Cosigners are not accepted

- Loans aren’t available to Nevada residents

Minimum income

No minimum income requirement, but borrower must be employed, have a written job offer that starts within six months, or demonstrate consistent income.

Loan amounts

$5,000* minimum, up to $550,000

*Minimum loan amount for California residents is $10,000, and $10,001 for New Mexico residents.

Eligibility

Must be a U.S. citizen, permanent resident, DACA recipient, asylee, or hold an H-1B visa with a U.S. citizen cosigner. Must have debt from a Title IV-accredited school and be current on rent or mortgage payments. Loans must also be in good standing. California residents must refinance at least $10,000, and New Mexico residents must refinance at least $10,001.

Loan Amounts

$5,000 up to the full balance1

Overview

Undergraduate and graduate students can refinance their student loans with SoFi® if they meet eligibility requirements. You can prequalify for a loan in two minutes without affecting your credit score, and the lender offers both fixed and variable rates. Plus, SoFi offers unique benefits to its members, including access to networking events and financial advisers.

SoFi requires a minimum loan balance of $5,000 to refinance. You can add a cosigner to your application, and remove them after 24 consecutive on-time payments. You can find out your potential rate through prequalification, but the lender doesn't disclose its minimum credit score or income requirements.

pros

- Doesn’t require loan prepayment, origination, application, or late payment fees

- Borrowers can get complimentary financial planning advice, referral bonuses, and discounts

- Offers a wide range of repayment plans

cons

- Must have at least $5,000 in loans to refinance

- Unclear credit and income requirements

- No cosigner release available

Loan terms

5, 7, 10, 15, or 20 years

Loan amounts

$5,000 up to full outstanding balance

Eligibility

Must be a U.S. citizen or permanent resident. Must have made 6 on-time payments in the past 6 months, with no record of default, delinquency, bankruptcy, or foreclosure in the last five years. Employment is required, or you must have a job offer starting within 90 days. Must also have attended a Title IV-eligible school.

Overview

LendKey is a marketplace that connects borrowers with more than 300 community banks and credit unions to find the best student loan refinancing options. Unlike most lenders, LendKey allows you to refinance your student loans while you're still in school, as long as you've earned at least an associate degree.

One of LendKey's biggest advantages is that it can help you compare multiple loan offers in one place. However, specific loan terms and eligibility requirements will vary by lender. Basic eligibility criteria include a minimum credit score of 680 and at least $5,000 in outstanding debt to refinance.

pros

- You can refinance with just an associate degree

- Can earn a $200 bonus for referring friends and family

- Lower your rate by a quarter of a percentage point with autopay

- No fees for applications or loan origination

cons

- Some lenders may require membership in a credit union or local bank

- Loan terms and qualifications vary by lender

Cosigner release

Varies based on lender's terms

Eligibility

Must be a U.S. citizen or permanent resident and have already graduated with at least an associate degree from one of LendKey lenders’ eligible institutions.

Loan Amounts

$10,000 up to total refinance amount

Overview

ELFI offers student loan refinancing to borrowers who graduated with a bachelor's degree or higher. Borrowers can even refinance their parents' PLUS loans in their own name. Plus, each ELFI borrower gets paired with a student loan adviser to help them through the refinancing process.

While borrowers can add a cosigner to their application, they can't release that cosigner later on. ELFI also doesn't offer rate discounts, but borrowers can apply for a forbearance of up to 12 months if they're experiencing financial hardship.

pros

- Doesn’t charge application or origination fees

- Borrowers are assigned to a student loan adviser

- Student borrowers can refinance parent PLUS loans in their name

- Clear credit and income requirements

- Offers financial hardship forbearance of up to 12 months

cons

- Doesn’t offer any discounts

- Need at least a bachelor’s degree to refinance

- Doesn’t offer cosigner release

- Charges fees for late and returned payments

Loan terms

5, 7, 10, 15, or 20 years for student loan refinancing; 5, 7, or 10 years for parent loan refinancing

Loan amounts

Minimum of $10,000 with no set maximum.

Eligibility

Must be a U.S. citizen or permanent resident with a bachelor’s degree or higher. Must have at least $10,000 in student loans to refinance and a minimum credit history of 36 months.

Overview

EdvestinU offers student loan refinancing through Granite Edvance Corporation, a New Hampshire-based nonprofit. The lender stands out with competitive interest rates and flexible repayment terms for borrowers with strong credit.

Although the lender doesn't disclose the minimum credit score to quality, borrowers and cosigners must have an annual income of $30,000 for loans less than $100,000 or $50,000 for larger amounts. Unlike many lenders, EdvestinU lets you refinance without a degree or while still enrolled in school.

pros

- You can refinance without a degree or while enrolled in school

- Autopay rate discount available

cons

- Requires a higher minimum loan balance than some lenders

- Cosigner release requires 2 years of on-time payments

Minimum income

For loan balances below $100,000, the income requirement is $30,000; over $100,000, the income requirement is $50,000.

Eligibility

U.S. citizens or permanent residents who are at least 18 years old and reside in the U.S.

Overview

INvestEd is a nonprofit based in Indiana that offers student loan refinancing to borrowers nationwide. It offers competitive rates and a discount for setting up autopay. INvestEd also allows cosigners to be released after 12 on-time payments, which is sooner than some other student loan refinancing lenders.

However, the most you can refinance through INvestEd is $250,000, less than what other lenders may allow. It also has strict credit and income requirements to qualify, or you'll need an eligible cosigner. INvestEd clearly defines its credit requirements before you apply.

pros

- Refinancing available even for non-degree holders

- Offers a one-quarter percentage point rate discount for autopay

- Deferment available while in school, military service or under financial hardship

- Will release cosigners after as few as 12 payments

cons

- Relatively low maximum refinance amount compared with some competitors

- No refinancing available for international students

- Parent loans cannot be refinanced in student’s name

Eligibility

U.S. citizens or permanent residents are eligible. Borrowers must meet minimum requirements including a FICO score of 670 or higher, annual income of $36,000, a debt-to-income ratio below 40% to 50%, a year of continuous employment, and no defaults or serious collection activities in recent years.

Overview

Citizens student loan refinancing is available to qualified borrowers who want to refinance at least $10,000.

Borrowers who earned undergraduate degrees can refinance as much as $300,000 in student loans. Those who borrowed for graduate or professional degrees can refinance from $500,000 to $750,000. Citizens refinancing loans are available with fixed or variable rates. Repayment terms are flexible, ranging from five to 20 years.

Medical residents can refinance student loans and only pay $100 per month for up to four years while completing residency or fellowship.

pros

- Range of repayment options between 5 and 20 years

- Offers prequalification with no impact on credit score

- Offers rate discounts for existing customers and autopay

cons

- Cosigners not eligible for release until after 36 payments are made

- Refinancing unavailable until you make 12 payments on your loans if you earned an associate degree or no degree at all

- Minimum loan amounts are higher than some other lenders

Loan terms

5, 7, 10, 15, or 20 years

Loan amounts

$10,000 minimum, with a maximum of $300,000 for bachelor’s degree or below; $500,000 for graduate degrees; and $750,000 for professional degrees

Eligibility

Must refinance at least $10,000 in student loans and be a U.S. citizen, permanent resident, or resident alien with a valid U.S. Social Security number. Must have earned at least a bachelor's degree to qualify.

Loan Amounts

$10,000 up to the total amount

Overview

Massachusetts Educational Financing Authority (MEFA) is a student refinancing lender offering a wide range of options, including to borrowers who didn't finish school. Though the lender doesn't offer variable-rate options, its fixed-rate loans have competitive rates.

MEFA's mission is to provide affordable student loans, and it doesn't charge any fees. You must have at least $10,000 in student loans to refinance, and you must have made a minimum of six consecutive on-time payments over the last six months. Borrowers who are unable to qualify on their own can add a cosigner to their application.

pros

- You can refinance without having graduated

- Doesn’t charge fee

- Can prequalify to check your rate

cons

- Can’t release a cosigner

- Doesn’t have any discounts

- Can’t refinance parent student loans

- Doesn’t offer variable-rate loans

Loan amounts

$10,000 up to your total debt

Eligibility

Must be a U.S. citizen or permanent resident who is the primary borrower on education debt used to attend an eligible college or university. Must have made six on-time loan payments over the most recent six months. Must have no history of default or delinquency on education debt for the past 12 months and no history of bankruptcy or foreclosure in the past five years.

2. Consider using a cosigner when refinancing

You'll typically need good credit to qualify for refinancing — a good credit score is a FICO score of 670 or higher. Several lenders offer refinancing for bad credit, but these loans usually have higher interest rates than good credit loans.

If you're struggling to get approved, consider applying with a cosigner who has strong credit. Around 80% of student loan refinancing applications with a cosigner were approved in 2024, according to Credible marketplace data. Even if you don't need a cosigner to qualify, having one could get you a lower interest rate than you'd get on your own.

Tip:

A cosigner can be anyone with good credit — such as a parent, other relative, or trusted friend — who is willing to share responsibility for the refinanced loan. Keep in mind that this means they’ll be on the hook if you can’t make your payments.

Learn More: Best Student Refinance Companies

3. Explore income-driven repayment plans

If you have federal student loans, you might consider signing up for an income-driven repayment (IDR) plan. On an IDR plan, your payments will be based on your income — 5% to 20% of your discretionary income, depending on the plan. Additionally, you could have any remaining balance forgiven after 10 to 25 years, depending on the plan.

Here's how the four main IDR plans compare to a few other federal repayment plan options:

| | | | Eligible for loan forgiveness? |

|---|

| Any borrower with Direct or FFEL loans | Amount when payments are spread equally over 10 years (usually $50 min.) | | |

| Any borrower with Direct or FFEL loans | Depends on loan amount (payments start low; increase every 2 years) | | |

| Any borrower with more than $30,000 in Direct or FFEL Loans | Fixed: Spread evenly over up to 25 yearsGraduated: Depends on loan amount (start low; increase every 2 years) | | |

| Borrowers with partial financial hardship (no Parent PLUS loans) | Loans after July 1, 2014: 10% of discretionary income (never more than 10-year plan)

Loans before July 1, 2014: 15% of discretionary income (never more than 10-year plan) | Loans after July 1, 2014: 20 yearsLoans before July 1, 2014: 25 years | |

| Must have partial financial hardshipMust have borrowed on or after Oct. 1, 2007 | 10% of discretionary income (never more than 10-year plan) | | |

Saving on a Valuable Education | Any borrower (no Parent PLUS loans) | 5% of discretionary income (undergrad loans only); Weighted average between 5% and 10% of discretionary income (undergrad and grad loans) | As soon as 10 years for original loans of $12,000 or less | |

| Any borrower (Parent PLUS loans must be consolidated) | 20% of discretionary income (or income-adjusted payment on 12-year plan) | | |

Check Out: PAYE vs. SAVE

4. Pursue loan forgiveness for federal student loans

Several student loan forgiveness programs are available if you have federal student loans. Most of these require you to work in a certain field and make qualifying payments for a specific period of time.

If you have federal loans and work for a nonprofit or government organization, you might be eligible for Public Service Loan Forgiveness (PSLF). Under this program, you'll need to make qualifying payments for 10 years to have your loans forgiven.

Some occupations that might qualify for a forgiveness program include:

- Dentists

- Doctors

- Lawyers

- Nurses

- Pharmacists

- Teachers

Keep in mind:

Unfortunately, private student loan forgiveness doesn’t exist. However, there are other options that could help you manage your private loans more easily — such as refinancing.

5. Utilize the debt avalanche or debt snowball method

If you have multiple loans and don't qualify for forgiveness or refinancing, here are a couple of strategies that could help:

Debt avalanche method

With the debt avalanche method, you’ll concentrate on paying off the loan with the highest interest rate first while making minimum payments on your other loans.

After you pay off the highest-interest loan, move on to the loan with the next-highest rate. You’ll continue with this until all of your loans are paid off.

Good to know: While the debt avalanche method can be a good option to save money on interest, it can also take a while to see any results.

If you’re more motivated by small wins, you might consider the debt snowball method instead.

Debt snowball method

With the debt snowball method, you’ll focus on paying off your next-smallest loan first while making the minimum payments on your other loans.

After this loan is paid off, move on to the next smallest loan — and continue until all of your loans are paid off.

Tip:

The debt snowball method generally offers quicker results. But if you’d rather save more money on interest and don’t mind waiting to see your savings, the debt avalanche might be a better fit.

If you’re thinking about filing for bankruptcy, be sure to consult with a lawyer so you can make the best decision for your financial situation.

Are student loans forgiven after 20 years?

This depends on the type of student loans you have.

- If you have federal student loans, you could have your loans forgiven after 10 to 25 years if you sign up for an IDR plan. Or you might be able to have them partially or fully discharged even sooner if you qualify for PSLF or another federal forgiveness program.

- If you have private student loans, you won’t be eligible for federal forgiveness programs. But you might be able to save money on interest and even possibly shorten your repayment time through refinancing.

Tip:

Bankruptcy will severely damage your credit and make it hard to access new loans in the future. Because of this, it’s best to treat bankruptcy as a last resort after all other repayment strategies have been exhausted.

Do children inherit student debt?

This depends on your loan type:

- Federal students are discharged upon the death of the borrower. If you have parent PLUS loans, they’ll be discharged upon the death of either the parent or the student who benefited from the loan.

- Private student loans are often discharged like federal loans — however, this is up to the discretion of the lender. If your lender doesn’t offer a death discharge, then your loans will be considered part of your estate and will be paid off by your assets.

Keep Reading: How Often Can You Refinance Student Loans?

FAQ

How long does it take to pay off $300k student loans?

Open

This will depend on the type of student loans you have and the repayment terms you choose.

- Federal student loans: It will generally take 10 to 25 years to pay off federal loans, depending on the repayment plan. You could also opt to consolidate your loans into a Direct Consolidation Loan — this will let you extend your term up to 30 years.

- Private student loans: These loans usually come with repayment terms ranging from 5 to 20 years, depending on the lender.

Can I file for bankruptcy to eliminate my student loan debt?

Open

Yes, you can file bankruptcy for student loan debt. But remember that having your student loans discharged could be quite difficult. To have your loans discharged, you’ll have to prove to the court that repaying them would cause an undue hardship on you and your dependents.

If the court decides in your favor, your loans might be:

- Fully discharged

- Partially discharged with you responsible for the remainder of the balance

- Adjusted with different terms to make repayment easier (such as a lower interest rate)

Can I use student loan forgiveness to help pay off $300K in student loans?

Open

If you have federal student loans, you can have your remaining student loan debt forgiven after making payments under an income-driven repayment plan when your repayment term is complete. You might also qualify for federal student loan forgiveness programs like Public Service Loan Forgiveness or Teacher Loan Forgiveness if you meet the eligibility requirements.

Should I refinance to pay off $300,000 in student loans?

Open

Refinancing could make sense if you have private student loans and are able to qualify for a lower interest rate and better terms. If you have federal student loans, it's generally not a good idea to refinance them since you'll forfeit federal benefits and protections like access to income-driven repayment plans and loan forgiveness.

Meet the expert:

Dori Zinn

Dori Zinn is a personal finance journalist with over 10 years of experience. Her work has been featured by Huffington Post, Wirecutter, Bankrate, and CBS News.