Credible takeaways

- Refinancing can help you pay off $300K in student loans faster if you qualify for a lower interest rate or choose a shorter repayment term.

- If you have federal student loans, switching to an income-driven repayment plan can help make your payments more manageable, and you can qualify for loan forgiveness if you meet the requirements.

- Repayment strategies like the debt avalanche or debt snowball can help you stay focused on tackling your debt and create small wins along the way.

As of March 2024, only 2% of borrowers owed $200,000 or more in federal student loans, though this group holds 18% of the outstanding federal student loan debt, according to the College Board. The cost of college continues to rise, and if you're taking out loans for a medical degree or law school, for example, student loans can add up quickly.

While paying down a high balance can be overwhelming and time-consuming, several strategies can help make the process easier.

1. Refinance your student loans

Student loan refinancing is the process of paying off your old student loans with a new loan. Depending on your credit, you might get a lower interest rate through refinancing — this could save you money on interest and potentially help you pay off your loan faster.

Or you could opt to extend your repayment term through refinancing to reduce your monthly payments and lessen the strain on your budget. However, remember that choosing a longer term means paying more interest over time. You can use a student loan refinance calculator to estimate what your new monthly payments and potential savings could look like after refinancing.

If you decide to refinance your student loans, prequalify with as many lenders as possible before applying to see which lender offers you the best rates and terms.

Expert insight: “Before refinancing federal student loans, I recommend making sure you won't need income-driven repayment or loan forgiveness now or in the future. Refinancing makes your loans private, and you'll lose access to those federal benefits for good.”

— Renee Fleck, Student Loans Editor, Credible

2. Consider using a cosigner when refinancing

You'll typically need good credit to qualify for refinancing — a good credit score is a FICO score of 670 or higher. Several lenders offer refinancing for bad credit, but these loans usually have higher interest rates than good credit loans.

If you're struggling to get approved, consider applying with a cosigner who has strong credit. Around 80% of student loan refinancing applications with a cosigner were approved in 2024, according to Credible marketplace data. Even if you don't need a cosigner to qualify, having one could get you a lower interest rate than you'd get on your own.

Tip

A cosigner can be anyone with good credit — such as a parent, other relative, or trusted friend — who is willing to share responsibility for the refinanced loan. Keep in mind that this means they’ll be on the hook if you can’t make your payments.

Learn More: Best Student Refinance Companies

3. Explore income-driven repayment plans

If you have federal student loans, an income-driven repayment (IDR) plan could help you lower your monthly payments and eliminate a portion of your loan balance. IDR plans adjust your monthly payments based on your income and family size. They also forgive any remaining loan balance at the end of your IDR plan’s repayment period.

Here's how the four main IDR plans compare to a few other federal repayment plan options:

Under new legislation, IDR plans are being phased out for new borrowers starting in July 2026, but you can still enroll in one before then. Here are some key rules and dates current borrowers should be aware of:

- You can stay on an IDR plan until they’re phased out completely on July 1, 2028.

- After that, you'll need to switch to the new Repayment Assistance Plan (RAP), Standard, Graduated, Extended, or revised Income-Based Repayment (IBR) Plan.

- If you don't choose a new plan by July 2028, eligible loans will automatically be transferred to RAP, which is set to replace IDR.

Learn More: Federal Student Loan Repayment Plan Options in 2025

4. Pursue loan forgiveness for federal student loans

Several student loan forgiveness programs are available if you have federal student loans. Most of these require you to work in a certain field and make qualifying payments for a specific period of time.

If you have federal loans and work for a nonprofit or government organization, you might be eligible for Public Service Loan Forgiveness (PSLF). Under this program, you'll need to make qualifying payments for 10 years to have your loans forgiven.

Some occupations that might qualify for a forgiveness program include:

- Dentists

- Doctors

- Lawyers

- Nurses

- Pharmacists

- Teachers

Keep in mind

Unfortunately, private student loan forgiveness doesn’t exist. However, there are other options that could help you manage your private loans more easily — such as refinancing.

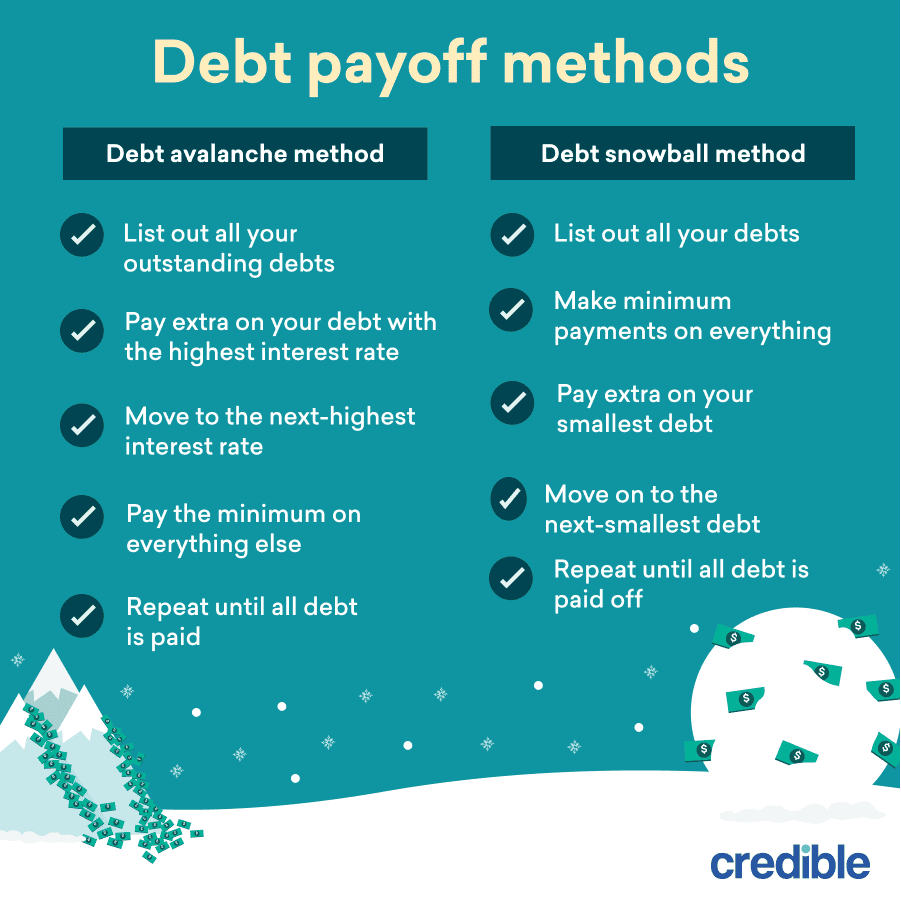

5. Utilize the debt avalanche or debt snowball method

If you have multiple loans and don't qualify for forgiveness or refinancing, here are a couple of strategies that could help:

Debt avalanche method

With the debt avalanche method, you’ll concentrate on paying off the loan with the highest interest rate first while making minimum payments on your other loans.

After you pay off the highest-interest loan, move on to the loan with the next-highest rate. You’ll continue with this until all of your loans are paid off.

Good to know

While the debt avalanche method can be a good option to save money on interest, it can also take a while to see any results.

If you’re more motivated by small wins, you might consider the debt snowball method instead.

Debt snowball method

With the debt snowball method, you’ll focus on paying off your next-smallest loan first while making the minimum payments on your other loans.

After this loan is paid off, move on to the next smallest loan — and continue until all of your loans are paid off.

Tip

The debt snowball method generally offers quicker results. But if you’d rather save more money on interest and don’t mind waiting to see your savings, the debt avalanche might be a better fit.

If you’re thinking about filing for bankruptcy, be sure to consult with a lawyer so you can make the best decision for your financial situation.

Are student loans forgiven after 20 years?

This depends on the type of student loans you have.

- If you have federal student loans, you could have your loans forgiven after 10 to 25 years if you sign up for an IDR plan. Or you might be able to have them partially or fully discharged even sooner if you qualify for PSLF or another federal forgiveness program.

- If you have private student loans, you won’t be eligible for federal forgiveness programs. But you might be able to save money on interest and even possibly shorten your repayment time through refinancing.

Tip

Bankruptcy will severely damage your credit and make it hard to access new loans in the future. Because of this, it’s best to treat bankruptcy as a last resort after all other repayment strategies have been exhausted.

Do children inherit student debt?

This depends on your loan type:

- Federal students are discharged upon the death of the borrower. If you have parent PLUS loans, they’ll be discharged upon the death of either the parent or the student who benefited from the loan.

- Private student loans are often discharged like federal loans — however, this is up to the discretion of the lender. If your lender doesn’t offer a death discharge, then your loans will be considered part of your estate and will be paid off by your assets.

Keep Reading: How Often Can You Refinance Student Loans?

FAQ

How long does it take to pay off $300k student loans?

Open

Can I file for bankruptcy to eliminate my student loan debt?

Open

Can I use student loan forgiveness to help pay off $300K in student loans?

Open

Should I refinance to pay off $300,000 in student loans?

Open