While there was once a time when a $500,000 house would be considered luxurious, in many places in the U.S., a $500,000 house is now just the average price.

If half a million dollars is the sticker price for the home you have your eye on, you may be wondering if you can afford the monthly payment for a $500,000 mortgage. In this article, we’ll break down what’s included in a $500,000 mortgage payment and how it’s affected by the terms and interest rates of the loan.

Monthly payments for a $500,000 mortgage

Any mortgage payment breaks down into four elements:

- Principal: This portion pays down the amount you owe on your mortgage.

- Interest: The interest compensates the bank for lending you money. For the first few years, you may pay more in interest than principal in your monthly mortgage payment.

- Taxes: These are based on the assessed value of the property and are usually collected once a year.

- Insurance: Your lender will typically require you to carry homeowners insurance for as long as you have your mortgage.

These are often abbreviated to PITI (pronounced “pity”). The first two go directly to your lender. The last two are usually held in an escrow account and disbursed to the government and mortgage insurance company when they are due.

While the amount for insurance and taxes can vary, here’s what you can expect to pay for the principal and interest portion of a $500,000 mortgage payment:

Where to get a $500,000 mortgage

You can get a $500,000 mortgage from a bank, credit union, or mortgage broker. Each of these options has benefits and drawbacks, so it’s important to compare them to find the best rates and terms.

Beatrice de Jong, real estate broker associate at Beverly Hills Estates, explains that “since loan terms and interest rates can vary, it’s essential to ask each lender about the specific loan options they can offer you. Many lenders have special programs for first-time buyers that could be advantageous.”

The lowest APR isn’t the only factor to pay attention to when shopping for a mortgage loan. Down payment requirements, closing costs, and lender offers (such as discount points, lower fees, or closing credits) can make one lender more appealing than another.

Bear in mind that each lender is best suited to a particular demographic, so ask your loan officer if they help people in situations similar to your own (i.e., first-time homebuyers, real estate investors, luxury buyers, etc.). To start your search for a lender, ask your real estate agent or friends for a recommendation.

For example

Make sure you find a lender skilled in handling the type of mortgage you want. If you’re a veteran applying for a VA loan, check that your mortgage lender has experience with this loan type to help you with all the ins and outs.

What to consider before applying for a $500,000 mortgage

Before taking on a $500,000 mortgage, make sure to account for all the costs above and beyond the sticker price. You’ve likely considered the down payment needed for your loan, but don’t forget that closing costs can require you to bring quite a bit more to the closing table. De Jong notes that “Closing costs typically amount to around 5% of the home’s purchase price. These include the appraisal, home inspection fee, and more. You’ll also need to reserve money for incidentals, such as moving expenses and changing locks once you move in.”

In addition to the upfront costs, owning a home involves ongoing expenses you may not have had to worry about as a renter. For instance, ongoing maintenance — everything from changing the furnace filter to replacing the roof — can cost thousands of dollars each year. You’ll also be responsible for any repairs, upgrades, utilities, and homeowners association (HOA) dues if your community requires them.

Tip

Closing costs can equal about 2% to 5% of the loan amount and are often paid upfront unless your lender allows you to roll the costs into your loan. For a $500,000 mortgage, this could range from $10,000 to $25,000.

Amortization table on a $500,000 mortgage

An amortization schedule details how much principal and interest you will pay at any given interval over the life of your loan. The table below outlines the amortization schedule of a 30-year, $500,000 mortgage with a 6% fixed rate:

Here’s an amortization schedule for a $500,000 mortgage with a 15-year term and 6% interest rate:

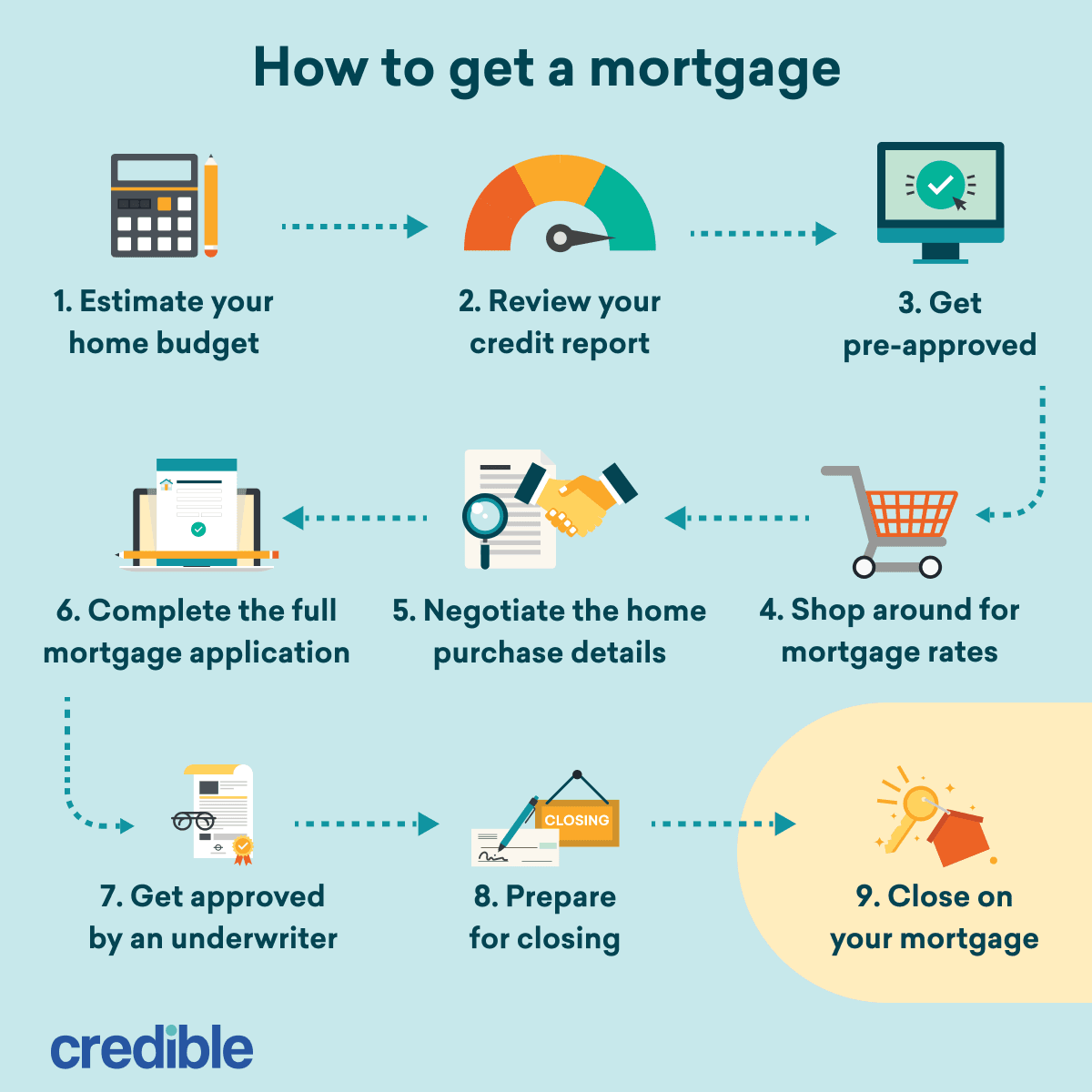

How to get a $500,000 mortgage

It may feel intimidating to ask a bank to loan you half a million dollars, but the process of getting approved for a $500,000 mortgage is the same as a $100,000 mortgage.

Here are the steps to get a mortgage

- Determine your budget: Before you start shopping for a home, figure out how much you can afford to spend. Use a mortgage calculator to compare different terms and interest rates to find a loan that fits your budget.

- Check your credit score: This will give you a good idea of whether you will have a strong loan application or if you need time to get your financial affairs in order before applying for a mortgage. De Jong recommends asking your lender how you can improve your buying power. “Lenders can review your credit score and suggest specific actions, like paying down certain debts, to raise your score and potentially secure a better interest rate. Even a slight improvement in your credit score could save you hundreds of dollars each month by reducing your interest rate.”

- Get pre-approved for your loan: You’ll need proof of your financial standing and assets, including pay stubs, bank statements, tax returns, and more. Gather as much as you can so that sending applications will be quick and easy. Experts recommend applying for pre-approval with at least three mortgage lenders. This gives you the chance to negotiate and find the best offer. If you apply with multiple lenders within a 45-day window, it only counts as one credit pull.

- Compare lender terms and rates: Ask each to beat your best offer; you may be surprised at how much better the offer can get. Use the Loan Estimate document to make an apples-to-apples comparison of each mortgage offer.

- Shop for a home: Once you find the home you want to buy, you can make an offer and negotiate the specifics. If you’re using a real estate agent, they can help with the details. If the seller accepts your offer, you can submit a full mortgage application with the mortgage lender you choose.

- Apply for a mortgage: Complete an application with your lender, and submit any additional paperwork the lender needs. This could include W-2s, tax returns, and pay stubs.

- Wait for approval: An underwriter will process your application and financial documents to make sure you can repay the loan.

- Prepare for closing: When your application is approved, your lender will schedule a closing date. Before that day, you’ll need to arrange a homeowners insurance policy and review your closing disclosure.

- Close on the loan: At your closing appointment, you’ll sign paperwork, as well as submit your down payment and closing costs.

FAQ

What is the average interest rate for a $500,000 mortgage?

Open

How does a 15-year vs. 30-year mortgage affect payments?

Open

Can I get a $500,000 mortgage with less than 20% down?

Open

What are additional costs to consider with a $500,000 mortgage?

Open

How do I calculate my $500,000 mortgage payment?

Open