We want this to be a “win-win” situation and only want to get paid if we bring you value in the form of finding a personal finance option that works for you, not by selling your data to multiple lenders. Generally, our lenders pay us at the time of receiving your loan application and incorporate the cost of our services as part of the final interest rate on your loan, or in your loan amount. Although we are paid at the time of your application transmission, you only pay this cost if your loan closes. This fee is non-refundable to lenders after they receive your application. This is common practice in mortgage transactions where lenders pay brokers for performing certain services in connection with your loan. If you would prefer to minimize your rate, you may opt to buy "points" to decrease your rate. If you choose to buy points, you would pay this amount to your lender and your final interest rate on your loan or your loan amount would reflect the combined fees of points you purchased and the fee your lender paid us upon receipt of your application.

We want this to be a “win-win” situation and only want to get paid if we bring you value in the form of finding a personal finance option that works for you, not by selling your data to multiple lenders. Generally, our lenders pay us at the time of receiving your loan application and incorporate the cost of our services as part of the final interest rate on your loan, or in your loan amount. Although we are paid at the time of your application transmission, you only pay this cost if your loan closes. This fee is non-refundable to lenders after they receive your application. This is common practice in mortgage transactions where lenders pay brokers for performing certain services in connection with your loan. If you would prefer to minimize your rate, you may opt to buy "points" to decrease your rate. If you choose to buy points, you would pay this amount to your lender and your final interest rate on your loan or your loan amount would reflect the combined fees of points you purchased and the fee your lender paid us upon receipt of your application.

CURRENT REFINANCE RATES

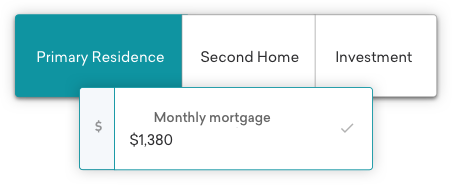

Check 20-year fixed refinance rates. Then personalize them.

Your refinance rate depends on your credit score and other details. So once you check today’s rates, get a personalized refinance quote just for you.

HOW IT WORKS

Let us do the heavy lifting for you 👋

WEEKLY TRENDS AND INSIGHTS

National refinance interest rate trends

On February 26, 2026, the national average 30-year fixed refinance rate decreased NaN basis points to %. The current average 15-year fixed refinance rate decreased NaN basis points to %.

For context, the national average 30-year fixed refinance rate was NaN basis points higher a week ago and NaN basis points higher a year ago. The 15-year fixed refinance rate was NaN basis points higher a week ago and NaN basis points higher a year ago.

If you're looking to purchase or refinance a home, Credible is here to help. We can help you quickly compare lenders and check prequalified rates for free, without hurting your credit score.

Get your personalized refinance quote today

Checking rates won’t affect your credit score

Compare

Refinance rates by loan term

Home refinance rates rise and fall on a daily basis with changing economic conditions, central bank policy decisions, and investor sentiment. The table below shows recent trends in home refinance rates.

| Product | Interest rate | APR | ||||

|---|---|---|---|---|---|---|

General Information and Rate Disclosures: The listings that appear on this page are from companies that pay Credible compensation. This table does not include all companies or all available products. Displayed information is valid as of Mar 02, 2026 and assumes a customer with a 750 credit score borrowing a conventional loan for a single-family, primary residence, at or near zero discount points, and a 80% loan-to-home-value ratio. For products indicated as a jumbo (e.g. 30-year fixed jumbo rate), displayed information follows the same assumptions as a conventional loan but set at loan above the conforming limit. Here is an example of your payment based on a $400,000 loan amount, for each advertised loan term:

*Payments do not include amounts for taxes and insurance premiums, your actual payment obligation will be greater. The IP address of the customer accessing this page has been used to determine which U.S state should be used for pricing. In states where Credible does not have a license to operate, we are providing information about rates available in a nearby state. If you are viewing this page from an IP address in one of the states where Credible is not licensed, the rates displayed above are for consumers located in the neighbouring state shown below: IP state without license - Assumed location Missouri - Kansas Hawaii - California Rates, payments, and all information displayed are for informational purposes only and are subject to change without notice. This is not a credit decision or commitment to lend. Mortgage rates and terms you may qualify for depend on your individual financial circumstances. Payment Disclosures: All monthly payment amounts above assume on time monthly payments each month for the full duration of the loan term (e.g. 360 monthly payments for a 30 year loan). Displayed monthly payment amounts do not include amounts for property taxes and hazard insurance. Your actual monthly payment obligation will be higher. Amounts for borrower-paid mortgage insurance premiums are included in the monthly payment if (1) the loan amount is below the “conforming thresholds” set by Fannie Mae and Freddie Mac, and (2) the loan-to-home-value ratio is greater than 80%; mortgage insurance premiums are excluded from the monthly payment if either the loan amount is above the conforming thresholds or the loan-to-home-value ratio is less than or equal to 80%. Your actual payment obligation may be higher. “Conforming thresholds” depend on the county where the property is located. Fees Disclosures: The fee amounts shown above include estimates of loan costs and closing costs you may pay in connection with a mortgage transaction with the assumptions above. This includes fees the lender charges, including points and underwriting fees, and third party services the lender does not let you shop for such as a flood certification fee. It does not include title charges, recording costs, prepaids, initial escrow deposit, and other fees. ARM Disclosures: Variable rate products, such as ARMs, have interest rates that can change over the life of the loan. Changes in the interest rate will cause required payment amounts to change.” The displayed rate and payment will be in effect for the number of years in the product’s description (e.g. 5/1 ARM means the initial rate and payment are in effect for 5 years, 7/1 means they are in effect for 7 years, etc.), after which the rate and monthly payment will change every 12 months. Last updated on Mar 02, 2026. These rates are based on the assumptions shown here. Actual rates may vary. | ||||||

REFINANCE TOOLS

Mortgage refinance calculators

Use our mortgage refinance calculators to determine if you can save money on interest, pay off your loan sooner, or turn your home’s equity into cash.

Financial education

Need more info about refinancing a mortgage?

How to refinance your mortgage step-by-step

Refinancing your mortgage can help you get a lower interest rate or lower monthly payment, depending on your goals.

7 min read

Learn moreWhen does it make sense to refinance your mortgage?

If you can shave at least 0.75% off your interest rate and plan to stay in your home for the long haul, consider refinancing your mortgage.

6 min read

Learn moreHow to get the best mortgage refinance rates

To score a great refinance rate on your mortgage, work on building your credit score, get multiple quotes, and consider shortening the term.

6 min read

Learn moreThe true cost of refinancing your home mortgage

Refinancing isn’t free — you’ll have to pay closing costs — but there are ways you can pay less for your new loan.

5 min read

Learn moreThe information in this section is provided for general education purposes only to allow you to shop for the best loan more effectively and does not necessarily reflect Credible services. For homebuyers, we will not display rates, loan options, take a mortgage application, or negotiate loan terms. We will provide advertisements of lenders you can select from based on a description of factors our lenders work with best.

The information in this section is provided for general education purposes only to allow you to shop for the best loan more effectively and does not necessarily reflect Credible services. For homebuyers, we will not display rates, loan options, take a mortgage application, or negotiate loan terms. We will provide advertisements of lenders you can select from based on a description of factors our lenders work with best.

Mortgage Refinance FAQs

Still have questions?

We’re here to help!

Michael Schmidt - NMLS ID 717293

Monday - Thursday

9am - 9pm ET

Friday

9am - 5pm ET

Saturday

10am - 6pm ET

Sunday

Closed

Jenni is a personal finance editor and writer. Her favorite topics are investing, mortgages, real estate, budgeting, and entrepreneurship. She also hosts the Mama’s Money Map podcast, which helps stay-at-home moms earn more, spend less, and invest the rest. She has written articles for Business Insider, Fintech Nexus News, FinanceBuzz, The Ways to Wealth, and more.

Jenni is a personal finance editor and writer. Her favorite topics are investing, mortgages, real estate, budgeting, and entrepreneurship. She also hosts the Mama’s Money Map podcast, which helps stay-at-home moms earn more, spend less, and invest the rest. She has written articles for Business Insider, Fintech Nexus News, FinanceBuzz, The Ways to Wealth, and more.

Reina Marszalek is Credible's senior mortgage editor and is an experienced multimedia content creator. She previously served as a managing editor at Policy Genius, where she covered the insurance and home verticals.

Reina Marszalek is Credible's senior mortgage editor and is an experienced multimedia content creator. She previously served as a managing editor at Policy Genius, where she covered the insurance and home verticals.

Mike Schmidt is Credible's senior manager of mortgage operations and is a licensed mortgage loan originator in 50 states. Mike has spent 18 years in the industry, working at various financial institutions. He has expertise in all mortgage products, including conventional, FHA, and VA loans.

Mike Schmidt is Credible's senior manager of mortgage operations and is a licensed mortgage loan originator in 50 states. Mike has spent 18 years in the industry, working at various financial institutions. He has expertise in all mortgage products, including conventional, FHA, and VA loans.

Get your personalized refinance quote today

Checking rates won’t affect your credit score