Credible takeaways

- The best college degrees for you align with your interests, strengths, and career goals.

- Some of the highest-paying college degrees include engineering, computer science, and mathematics.

- Consider the earning potential, job stability, and career direction a specific degree offers.

College is expensive, but it's often an investment worth making since bachelor's degrees generally lead to higher salaries and more job prospects than a high school diploma alone.

In fact, college grads with a bachelor's degree reported median weekly earnings of $1,747 in the third quarter of 2025, according to the U.S. Bureau of Labor Statistics. That's 78% more than the $980 in median weekly earnings reported by employees with just a high school diploma.

The impact of a degree on your salary and job prospects can vary by field of study. However, experts caution that higher pay shouldn't be the only consideration in choosing a major.

Here’s what you should think about as you research the best college degrees for you.

Current private student loan rates

What makes a degree “worth it”?

Calculating the return on investment for different majors can be one of the best ways to tell which degrees are worth the cost.

Factors that influence ROI include:

- The cost of your degree

- Your field of study

- Potential earnings throughout your career.

There’s no single method for calculating ROI, but one option is to subtract the total cost of your degree from predicted earnings over a specific time. Then compare that number to the median earnings for people with only a high school diploma. For example:

- You complete an accounting program at a public university in Washington state that costs $31,920 per year.

- You get hired as a CPA and earn the median annual salary of $81,680.

- Your earnings outlook over 20 years is $81,680 x 20 years or $1,634,000

- Subtract $127,680 for four years of tuition at $31,920 to get $1,506,000

- Calculate 20 years of earnings for those with a high school diploma only. With an average of $980 weekly, that's $50,960 per year or $1,019,000

- The difference is $487,000 so this is your ROI on your accounting degree.

Keep in mind, how you use your degree, the strength of the academic program you attend, and your geographic location can also shape your career outcome and earning potential.

“Key indicators to me for whether a program is worth pursuing is whether students are actually getting internships or work experience in the field before graduation, and whether they’re finding employment in the field,” says Jessica Chermak, co-founder of Virtual College Counselors.

Other factors can influence whether a degree is worth it

While earning potential and long-term job stability are important, there are more factors to consider.

“There’s no such thing as the perfect major,” says Beth Hendler-Grunt, president of Next Great Step, a career counseling service. “There’s a tremendous amount of worry and stress and fear about picking the right thing, but it’s what is perfect for you.”

Typically, that means finding a major that aligns with your interests, strengths, and career goals.

Chermak recommends that her students explore careers by searching job requirements and preferred qualifications on LinkedIn and examining key phrases in the listed responsibilities.

“What they’ll find is that, for most jobs that don’t require a specific kind of license, the company doesn’t care what kind of degree you have,” Chermak says. “They care that you have a degree.”

It's also worth noting that while some degrees, such as engineering, can directly lead to higher-paying jobs, the value of other degrees, including those in the humanities, can be harder to quantify. That's especially true if a college grad works in a different field, such as an English major who develops transferable skills to put on their resume.

Best college degrees for high-paying jobs

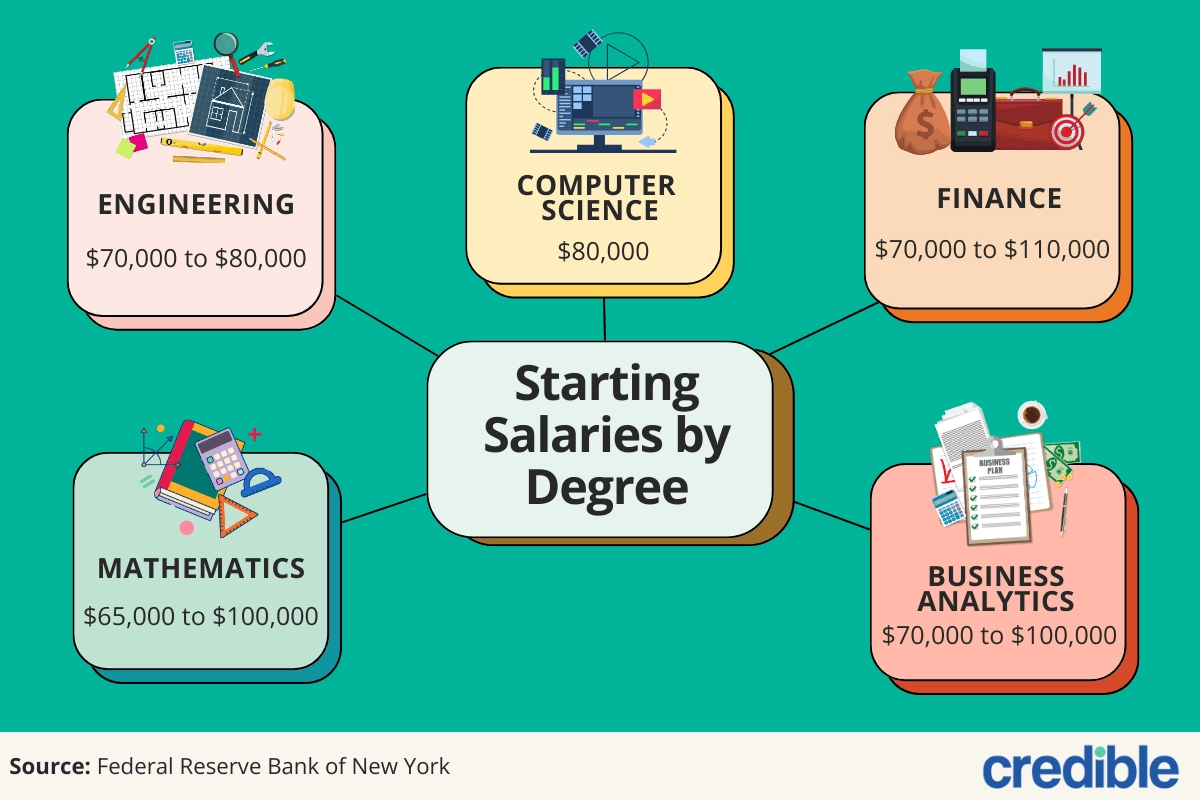

Some career-focused majors offer a more direct path to a higher-paying job. Here are some of the top college degrees for income, according to the Federal Reserve Bank of New York.

- Engineering: $70,000 to $80,000 starting salary. Mid-career salaries range from $100,000 to $125,000 or higher, depending on your specialty

- Computer science: $80,000 median early-career wage and $115,000 mid-career

- Mathematics: $65,000 to $100,000

- Finance and Economics: $70,000 to $110,000 median mid-career

- Business analytics: $70,000 to $100,000

Degrees with the best job growth outlook

It's also worth considering the best majors for job placement, including degrees that provide access to industries where job demand is expected to grow.

According to the U.S, Bureau of Labor Statistics, renewable energy, technology, healthcare, and financial services are some of the fastest-growing industries. Hendler-Grunt also predicts strong growth in the healthcare and technology industries, with demand expected to rise in the fields of nursing, public health, physical therapy, cybersecurity, cloud computing, and data analytics.

Hendler-Grunt warns that career roles are likely to change with artificial intelligence, so students should keep in mind that many future jobs haven’t even been invented yet. Still, 21st-century soft skills are more important than ever.

“Hiring managers want you to understand how to use AI and also to have well-developed human skills like critical thinking, problem solving, and strong communication,” she says.

Affordable college degrees with strong ROI

College degrees that lead to the best paying jobs are likely to have the best ROI. However, if you want to maximize your returns, your best approach is to attend the most affordable school possible.

For many students, in-state public universities can be the least expensive option. The average cost of college for in-state students at a four-year public university is $11,950, while private non-profit four-year colleges averaged $45,000 for the 2025-26 academic year, according to the College Board.

However, many students don’t pay the published price. In 2024-25, the average tuition discount at private colleges was 56%, with grants and other aid cutting the cost of attendance by more than half, according to the National Association of College and University Business Offices. For some, grants and scholarships from a private college can make it less expensive than a public university.

In other cases, attending a private college may be worth some extra cost. However, not all degrees warrant paying for a costlier school.

“I would hesitate to go into a teaching degree at a college that costs you $90,000 even if your family has the money,” Chermak says.

How to pay for the best college degrees

No matter what degree you decide on, here are some of the best ways to pay for college.

- Grants: Grants don't need to be repaid, and can come from the federal or state government, your school, or private organizations. Federal grants include Pell Grants, capped at $7,395 (2025-2026); TEACH Grants for students enrolled in eligible programs, and the Federal Supplemental Educational Opportunity Grant (FSEOG) for students with exceptional financial need.

- Scholarships: These also don’t need to be repaid and can come from colleges, state education agencies, or private companies or nonprofits. State education agencies often offer scholarships for residents, such as Florida’s Bright Futures Scholarship, Georgia’s Hope Scholarship, and California’s Middle Class Scholarship.

- Work-study: Available to eligible students who complete the FAFSA, work-study is a need-based program that allows you to take a part-time on or off-campus job, often related to your major. The amount you can earn is typically between $ 2,000 and $ 4,000.

- Part-time and summer work: Working part-time while in school and full-time in the summer helps pay college bills. About 45% of full-time college students were either employed or looking for work, while about 82% of part-time students were doing so, according to the latest data released by the U.S. Bureau of Labor Statistics in April 2025.

- College savings: College savings plans, such as 529 plans or Coverdell accounts, can be used to pay for qualifying education expenses. Family savings can help too.

- Federal student loans: The Department of Education offers several types of federal student loans to help pay for college.

- Private student loans: If you’ve maxed out your federal student loan limit, private loans can cover the gap, but it’s best to borrow as little as possible.

Always start your search for aid by filling out the FAFSA to determine your eligibility for federal, state, and institutional aid.

Editor insight: “Federal student loans offer affordable fixed interest rates, forgiveness options, and more borrower protections than private student loans. I recommend maxing out federal student loans before considering any private student debt.”

— Christy Bieber, Student Loans Editor, Credible

FAQ

What are the highest-paying college degrees?

Open

Which degrees are most in demand?

Open

What’s the best degree for job stability?

Open

Which degrees offer the best value for tuition cost?

Open

Are certain degrees easier to repay student loans with?

Open