Credible takeaways

- Credit unions often require you to be a member to be able to borrow.

- If you qualify, a credit union can sometimes be a better option for private student loans than borrowing from a for-profit lender.

- While credit union student loans have benefits, you should still maximize federal student loans before turning to private loans.

- You can get these loans from local or national credit unions, such as Navy Federal Credit Union, if you qualify.

Credit union student loans can be an option for members seeking potentially lower rates and personalized service. There are roughly 4,370 federally insured credit unions serving about 144 million members in the United States, according to the latest data from the National Credit Union Administration. Credit unions offer various financial products, and while those products may differ from one institution to another, many offer student loans.

Current private student loan rates

How do credit union student loans work?

Credit unions are not-for-profit financial institutions that are owned by their members. You typically can't borrow from a credit union or open any financial accounts with one unless you meet its membership requirements and pay any membership fees the credit union charges.

Many credit unions offer student loans as one of the financial products available to members. These can include:

- Undergraduate loans

- Graduate loans

- Parent loans

- Medical and dental school loans

“Credit unions can be good places for student loans, as the rate may be a bit lower than their for-profit lending counterparts,” explains Jack Wang, a wealth adviser with Innovative Advisory Group specializing in college financial aid.

Since these are still loans, you must repay the amount you borrow — including student loan interest that accrues. Before you take on any debt from a credit union or other source, you should carefully consider the pros and cons to confirm you understand your payoff obligations.

Credit unions that offer student loans

While many credit unions are only available in local areas or tied to specific groups, some have broader membership options. To borrow, you'll need to join the credit union and meet its credit requirements. Here are a few examples of well-known credit unions that offer student loans:

- Navy Federal Credit Union offers 5- or 10-year student loans for eligible current students and graduates. Membership is open to service members in all branches of the military, veterans, and their family members.

- Y-12 Credit Union offers undergraduate, graduate, and parent student loans with 5-, 10-, or 15-year terms. The credit union serves communities across the southeastern United States. You can qualify through family, location, or by joining the Y-12 FCU Gives Foundation.

- United Federal Credit Union offers student loans for members who live, work, or attend school near a branch in Arkansas, Indiana, Michigan, Nevada, North Carolina, Pennsylvania, or Ohio. Loans are only available to students attending schools on the credit union's approved list.

Editor insight: “I recommend you start by researching credit unions in your area, or any that are affiliated with your school, as they may offer competitive student loan options. Once you've narrowed down the list, compare interest rates, repayment terms, and borrower benefits to determine which loan best fits your needs.”

— Kelly Larsen, Student Loans Editor, Credible

Eligibility requirements for credit union loans

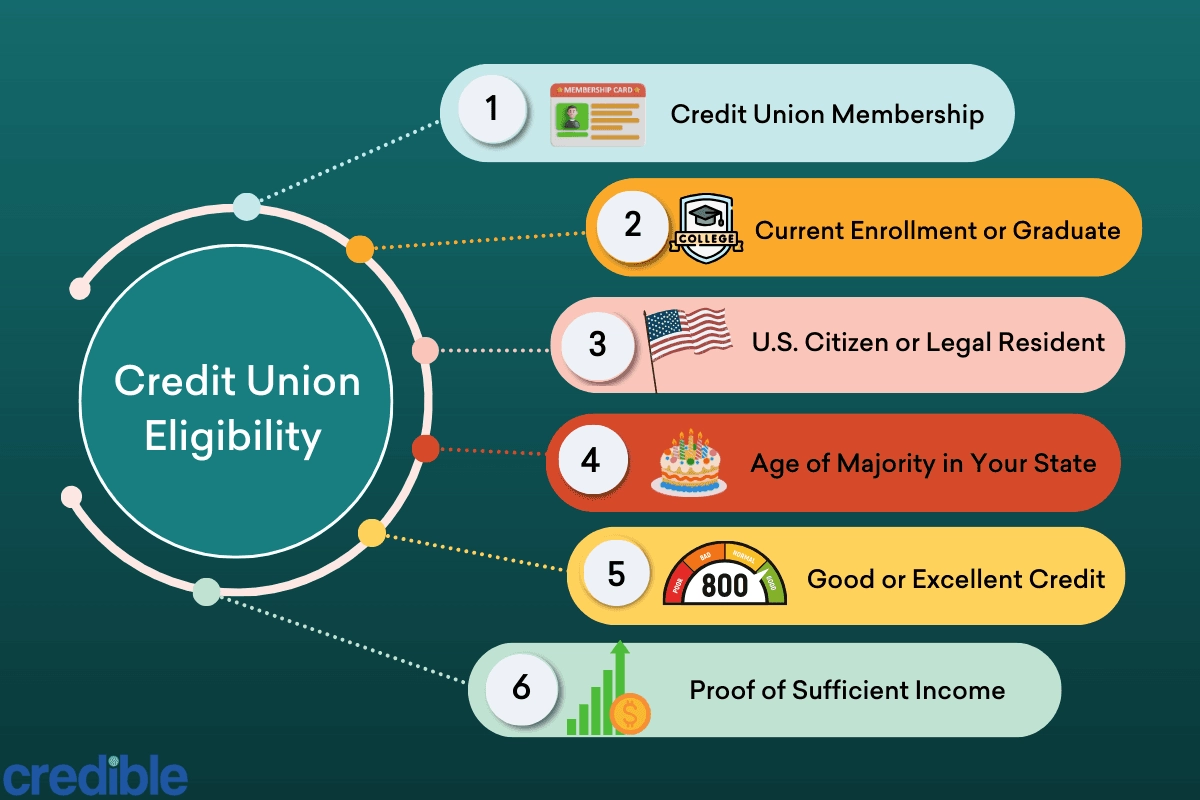

Eligibility requirements for credit union student loans vary based on the specific institution. To determine if you're eligible, you'll need to apply with that lender. However, there are some common traits most credit unions require, including:

- Credit union membership (or a plan to become a member after approval)

- Current enrollment in, or graduation from, an eligible school

- U.S. citizenship or legal resident status

- Age of majority in your state

- Good or excellent credit

- Proof of income sufficient to repay the loan

If you're applying for a student loan with a credit union and you don't meet some of these requirements — especially those related to credit or income — you may be able to apply with an eligible cosigner who does meet the credit union's standards.

How to get a student loan from a credit union

While the application process varies by credit union, you can generally expect to follow these steps to get a loan:

- Review eligibility requirements: Check a lender's published eligibility requirements before applying to find out if you can qualify. Some credit unions offer online prequalification, which allows you to see what rate you may qualify for without affecting your credit.

- Complete the application: If you've determined that you could qualify for a credit union loan, fill out the application online. You'll need to provide personal and financial details, including your Social Security number, enrollment status, and the loan amount you're requesting.

- Upload supporting documents: You typically must submit proof of income and identity, among other requirements, as part of your application.

- Consider adding a cosigner: Adding a cosigner to your application can help you get approved and even receive a lower rate. If you're an undergraduate student, you likely don't have an established credit history, so adding a trusted loved one to your loan application could help you get the funds you need. Navy Federal Credit Union states that 9 out of 10 of its student borrowers have a cosigner.

- Sign your loan agreement and receive loan funds: If your application is approved, you must sign your loan agreement. The credit union will then send a certification request to your school's financial aid office to verify your cost of attendance and other information. Once that's complete and approved, the credit union will send the loan funds directly to your school.

Pros and cons of credit union student loans

Pros

- Typically offer lower interest rates and fees than traditional banks

- Offer more personalized customer service

- May be easier to get approved if you're already a member

- In-person support available through local branches

Cons

- Require membership, which may limit eligibility

- Do not offer federal protections, like income-driven repayment or loan forgiveness

- Loans are still private, meaning interest starts accruing right away

Benefits of credit union student loans

There are many benefits to getting your student loan from a credit union. These institutions typically offer a choice of fixed- or variable-rate student loans, so you have the flexibility to decide what's best for you. Rates are often lower on these loans, and they generally have lower fees.

Because credit unions are member-owned and more focused on customer service, they usually offer a more personalized customer experience. Plus, it can be easier to get approved to borrow with a credit union if you're already a member and have a relationship with the financial institution. In addition, you can visit your local branch if you want in-person customer support.

While you can often get a better rate and other perks, it's still important to compare all your choices. “As always, it pays for borrowers to shop around,” Wang advises.

Drawback of using a credit union for student loans

There are also some disadvantages to using a credit union for student loans.

Credit unions have membership requirements that banks don't — and if you don't want to become a member or aren't eligible to do so, then you won't be able to borrow.

One of the biggest downsides is that credit union loans are still private student loans, meaning you won't have access to federal borrower benefits.

“There are advantages to federal student loans,” says Clifford Cornell, a certified financial planner (CFP) and associate financial adviser at Bone Fide Wealth. “For undergraduate loans specifically, they can be subsidized, meaning no interest will accrue during your education and even six months after graduation. Any private loan will not qualify for any sort of loan forgiveness either.”

Credit union student loans vs. federal and private loans

The lower your rate and the better your loan terms, the easier it'll be to pay off student loans. That's why it's important to understand the difference between credit union loans and those from federal and private lenders.

Student loans from credit unions and lenders like banks are all private loans. These loans are issued by private organizations, rather than the government. As a result, borrowers won't receive the benefits federal student loans offer, including access to loan forgiveness options and income-driven repayment plans, as well as the ability to change repayment plans as needed.

The biggest difference between credit unions and other private student loan lenders is the ownership of each institution. If borrowing from a member-owned institution is appealing to you, then a credit union student loan may be best for you. However, if you don't want to be required to be a member to borrow, then a loan from a bank or online lender will likely be a better fit for you.

If more individualized customer service is a priority, then you may want to take out a credit union student loan. If you don't care about having access to a local branch for customer service, then other lenders may be a better fit.

FAQ

Is it better to get a student loan from a credit union?

Open

Do credit unions offer better student loan rates than banks?

Open

Can anyone apply for a credit union student loan?

Open

How do credit union loans compare to federal student loans?

Open

Can I refinance student loans through a credit union?

Open

What are the main benefits of choosing a credit union for student loans?

Open