Every year, Nelnet loans make it possible for students to realize their educational dreams and graduate from college. But your relationship with Nelnet doesn’t end there.

As with all important relationships, it pays to understand as much about your student loan servicer as possible. If your servicer is Nelnet, here’s what you need to know.

What is Nelnet?

Nelnet is a student loan servicer based in Lincoln, Nebraska, whose mission is to make educational dreams possible. While lenders provide the money for a student loan, servicers such as Nelnet handle the payment arrangements, allowing students to pursue their academic goals.

Nelnet currently helps more than 5 million borrowers as they repay their student loans.

As a student loan servicer, it’s Nelnet’s responsibility to ensure that its customers are able to successfully pay off their student loans. That means if you can’t afford your monthly payment, you can work with Nelnet to figure out an income repayment plan that can accommodate your budget.

Suppose Nelnet is servicing your federal student loans. In that case, they can also help you sign up for federal benefits such as deferment, forbearance, or income-driven repayment plans, or provide access to private loans through a partnership with the company U-Fi.

How Nelnet can help you with your student loans

One of the biggest benefits of having Nelnet as your student loan servicer is convenience — Nelnet has a number of different repayment plans to suit various needs, along with other borrower benefits.

Nelnet repayment plans

Nelnet offers borrowers several types of repayment plans:

- The Standard Repayment Plan spreads payments equally over your payment term.

- With the Extended Graduate Repayment Plan, the payments increase over time, making it a good option for those who expect to make more money in future years, since they will be able to pay more as their salary increases over the years.

- Extended Repayment Plans give you more time to pay off the loans by letting you increase the repayment term on your loans

- Income-Sensitive Repayment Plans can be used with Federal Family Education Loans (FFELP), allowing you to adjust the minimum payment to accommodate your income for up to five years.

- Income-Driven Repayment Plans let you adjust your minimum payments based on your income, ensuring that you never have to pay more than you can afford.

Remember, though, that extending your payments over a longer period of time will result in paying more over the life of the loan.

Suppose you’re interested in a repayment plan that extends your loan term. In that case, you’ll need to weigh the benefit of potentially having more disposable income now versus paying a greater amount in interest over the life of the loan.

If you can afford to pay off your Nelnet loans faster, you may want to do so.

Advertiser Disclosure

We receive compensation from the companies below if you purchase a product. Amount of compensation does not impact the ranking or placement of a particular product. Not all available financial products and offers from all financial institutions have been reviewed by this website. This content is not provided by Credible or any of the Providers on the Credible website. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by Credible.

Nelnet Bank: Best for Competitive Rates

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

Min. Credit Score

Mid to high 600’s FICO

Fixed APR

-

Variable APR

-

Loan Amount

$1,000 to $500,000

Term

5, 10, 15

Expert Insights

Nelnet Bank stands out among private student loan lenders for offering low starting rates and high loan limits across undergraduate, graduate, and health professional programs. You can qualify for a Nelnet Bank student loan with mid-600s credit or apply with a cosigner to improve your chances of approval and secure a better rate.

Choose how to pay and other Nelnet benefits

With Nelnet, you can choose how you’d like to make your monthly payments, from a variety of options, and also benefit from other perks such as:

- Autopay: You can have your payment automatically debited from your account, which ensures that you’ll never forget to pay the bill. Another benefit of using the auto debit option is that many lenders will give you a lower interest rate just for paying automatically

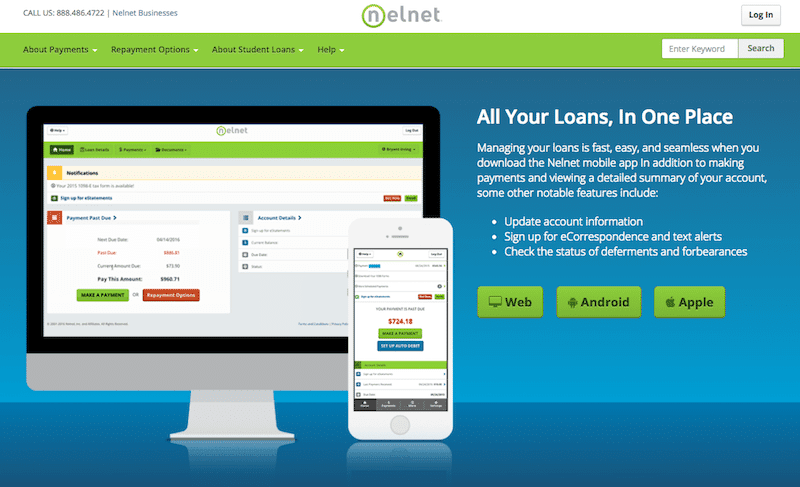

- Multiple payment options: Nelnet gives you the option to pay your bills online, via mail, telephone, or mobile app

- Online bill payment via your bank: Your bank’s online bill payment service is another option, but there’s a caveat: some bill payment services charge a fee; if your bank charges a fee, it’s better to use one of the free options for paying your student loans

- Text reminders: If you’re afraid that you’ll forget to make your payment, but don’t want to sign up for the autopay option, you can get some digital help by signing up for text alerts that will remind you of your upcoming due date

- Adjusting payment due dates: It is possible to have multiple Nelnet loans that have different due dates. Remembering when each one is due can be a challenge. To make things easier, you can contact Nelnet and ask them to adjust the dates so that you can pay the various loans at the same time

- Bundling similar loans: Individual loans can also be lumped together in groups if they have certain qualities in common. For example, loans with the same interest rate may be grouped together

- Designate money for each type of loan: Nelnet account numbers start with the letters E, D, or J. Loans that start with E are owned by the Department of Education, while loans that start with D or J are owned by other lenders. If you pay online, you can submit a single payment and designate how much money should go toward each account

How are my loan payments allocated?

Payments are first allocated towards loan groups or individual loans that are past due. After that, money goes across loan groups based on each group’s current monthly payment amount.

If you want to pay more towards a particular loan or group, you have to provide instructions to do so. If not, any extra money will simply be allocated across all of the loans and loan groups.

One way to pay the least amount of money over the course of your loan is to designate that extra money be paid to the loan group with the highest interest rate. Then, once those higher-interest-rate loans are paid off, you can designate that more money goes to the other loans.

The payment itself is allocated toward each loan or loan group in the following manner: First, it goes toward fees, then interest, and then the principal.

Whether you make more than the minimum payments or not, you should avoid late payments at all costs. Not only might late payments be reported to credit reporting agencies and cause a dip in your credit score, but you could also be charged late fees, which will just add to the amount of money you will have to pay for your loan.

Also, if you skip a payment or make less than the minimum payment, you could end up with multiple loans or loan groups being delinquent.

How to pay off your student loans faster

Here are some ways you can tackle your student loans faster.

- Make more than the minimum payments: Any amount of money that you can scrape together to apply to your student loan balances will make a difference.

- Use the debt avalanche method: If you have multiple student loans with different interest rates, the debt avalanche method can save you a fair bit of money. With this strategy, you pay the most on the loan with the highest interest rate and make minimum payments on the rest. Once the first student loan is paid off, you focus on the student loan with the next highest interest rate and apply the same strategy, making minimum payments on the rest

- Refinance your loans to a lower interest rate: The less money you’re paying on interest, the more money that goes to the principal balance, and the faster you’ll pay off the loan

- Apply tax refunds, bonuses, and other windfalls to your debt: Whenever you find yourself with a chunk of money, resist the urge to spend it and use the money to pay off your student loans instead

- Make a payment whenever you get a paycheck: Divide the amount of money you owe each month in two and pay that amount every two weeks. This is effective because, over the course of the year, you will make an extra loan payment.

Credible rating

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. The rating criteria for lenders encompass 78 data points spanning interest rates, loan terms, eligibility requirement transparency, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Credible rating

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. The rating criteria for lenders encompass 78 data points spanning interest rates, loan terms, eligibility requirement transparency, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Credible rating

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. The rating criteria for lenders encompass 78 data points spanning interest rates, loan terms, eligibility requirement transparency, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Nelnet loan forgiveness and other benefits

Here’s where we come to what every borrower really wants to know — is there a way for you to get out of paying for your student loan?

The answer is yes …sort of …

If you have a private loan, you may be out of luck, but if you have a federal student loan, you may have some options.

If you work in a public service field (such as government, law enforcement, or public education), you may be eligible for Nelnet student loan forgiveness.

There are dozens of loan forgiveness programs out there, targeted at different demographics and types of borrowers. Here are just some examples:

The Public Service Loan Forgiveness (PSLF) Program: Certain federal loans, including Direct Stafford Loans, Direct PLUS Loans, and Direct Consolidation Loans, forgive your remaining loan balance after you’ve made 120 qualifying payments while working full-time for certain employers. To qualify for Public Service Loan Forgiveness, you must complete and submit an Employment Certification form to the Department of Education.

The Stafford Loan Forgiveness Program for Teachers: This program forgives up to $17,500 in student loan principal and interest once teachers have taught full-time, typically at schools in low-income neighborhoods for five consecutive years.

Disability Discharge: If you become disabled and are no longer able to work, you may qualify for a disability discharge, which means you would not be obligated to finish paying off your student loan.

Servicemembers Civil Relief Act (SCRA): If you’re a member of the military, the SCRA limits interest on federal student loans taken out before military service to 6% or less. Some loans also allow members of the military to pay 0 % interest if they are currently serving in a hostile area.

The HEROES Act Waiver for Income-Driven Repayment Plan Certification for Service Members: Military members or their families can request an extension on the lower payments on an income-driven repayment plan if they are serving the country.

What if you can’t pay your student loans?

So what happens if you find that you can’t pay your loans? Nelnet wants to help you succeed, so you should contact them immediately if you’re having trouble making your payments.

If you have federal loans, you may be able to postpone your payments through deferment or forbearance options. But which is right for you?

- With a deferment, you get a temporary break from making payments. If you have subsidized loans, you won’t be charged interest during the break, but if you have unsubsidized loans, interest will still be accruing. You’d be surprised at the types of deferments that are available. You may be able to get a deferment for such reasons as economic hardship, military deployment, working in an internship, or even caring for a newborn or newly adopted child.

- With forbearance, you may be eligible to postpone payments — however, interest will accrue during that period. For that reason, it’s a good idea to continue to make payments on the interest if you can, even while you’re not making payments on the principal.

If you have a private loan, you should contact the lender, as they may have procedures in place to help you temporarily if you have trouble paying your bills.

How to contact Nelnet

As you work to pay down your student loans, you should think of Nelnet as your ally. Make sure you contact them immediately if you have a problem making a Nelnet student loan payment or even if you have a question about the loan repayment process.

You can call Nelnet 24 hours a day, seven days a week at 888-486-4722, fax them at 877-402-5816, contact them using an online form on their website, or send them mail at:

Nelnet

P.O. Box 82561

Lincoln, NE 68501-2561

While many people think of student loans as a necessary evil, it’s better to think of them as a tool that can help you achieve your educational goals. Nelnet can help you get through the repayment process as smoothly and effectively as possible.