Credible takeaways

- You can apply for federal student loans as soon as the FAFSA opens.

- Federal aid is awarded on a first-come, first-served basis, so it's best to apply early.

- You can apply for private student loans anytime, but it can take a few weeks or more for the funds to be disbursed.

Federal and private student loans have different application deadlines, and knowing when to apply for each is an important part of your financial planning for college. No matter which type of loan you're applying for, it's best to do it as soon as you can. This helps ensure you don't miss important deadlines, giving you ample time to handle potential hiccups during the application, approval, and disbursement process.

Here's when to apply for both federal and private student loans, and some tips for borrowing wisely.

Current private student loan rates

When to apply for federal student loans

For most borrowers, it's best to apply for federal student loans as early as possible in the college planning process. This starts with completing the Free Application for Federal Student Aid (FAFSA). This application allows you to access federal and state financial aid, and your college or university could also use it to award school-specific scholarships and grants.

You should plan to submit your FAFSA as soon as you can after it's released for the upcoming school year. This will keep you from missing critical deadlines and potentially help you qualify for more financial aid that doesn't need to be repaid. Certain types of aid have limited funding and are offered to students on a first-come, first-served basis. The earlier you complete your FAFSA, the better your chances of securing that kind of aid before it's gone.

See Also: How To Take Out a Student Loan

Federal student aid deadlines

The FAFSA has traditionally become available on October 1 each year. However, in 2025, it became available about a week prior.

Some states and schools require students to apply before the federal deadline. Florida, for example, has a May 15, 2026, deadline for state financial aid programs for the 2026-27 school year, more than a year before the last federal deadline.

Federal student aid timeline

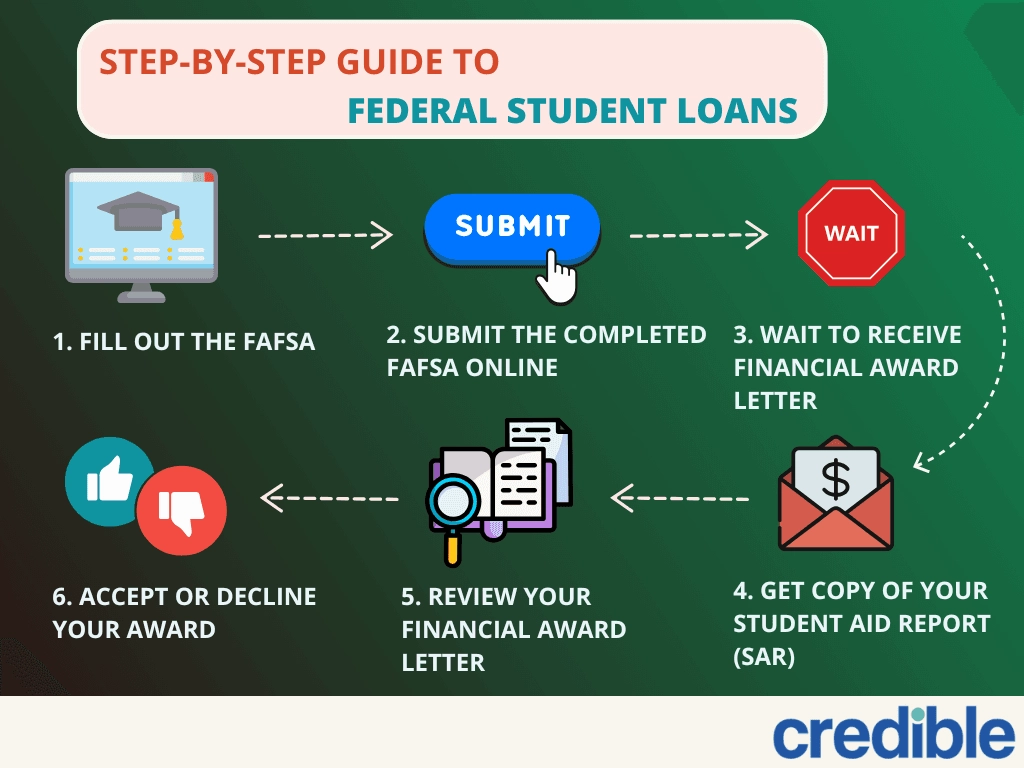

Here are the steps you’ll follow to apply for federal aid:

Editor insight: “I suggest contacting your school's financial aid office to confirm its internal FAFSA deadline, as meeting it could help you qualify for school-based aid. To avoid missing out on state-based aid, check the FAFSA state deadlines published each year on the Federal Student Aid website.”

— Renee Fleck, Student Loans Editor, Credible

When to apply for private student loans

If you need more funding beyond federal loans, you can apply for a private student loan anytime. But even though the timing is more flexible than federal loans, you should avoid waiting until the last minute.

“Timing matters because it helps ensure you have the funds you need in place before tuition and other bills are due,” explains Dr. Darla Bishop, author of “How To Afford College.”

“Applying early gives you extra time to sort out any issues that might come up with your application or lender,” she adds.

The good news is that many private lenders can approve your application in minutes, although any applications that require additional review may take up to two weeks for approval.

Private student loan timeline

- Application: While private student loans don't have specific deadlines, students whose college costs are likely to exceed the federal loan limits would be smart to apply for private loans long before their tuition is due. This gives students ample time to compare as many private loan options as possible to find the right loan for their needs.

- Certification: Typically, private lenders won't disburse loan funds until they've worked with your school to certify your enrollment status, cost of attendance, and other relevant details. While certification can be a quick process, it's smart to plan for delays. Depending on your school, the certification process generally takes 2 to 7 weeks. Contact your school's financial aid office for more information about certification time frames.

- Disbursement: Private lenders typically disburse student loans at the start of the semester, and the funds are usually sent to the school, which directly applies the loan proceeds to your tuition and fees. If there is any money left over, you'll generally receive that money from your school to use for other educational costs like living expenses and books.

“If you're considering private loans, starting early is important since they can take a little longer to process, and you don't want to feel rushed close to deadlines,” Bishop advises.

Good to know

A private student loan can take as long as a month to secure from application to disbursement.

How to plan your student loan application

To make sure you don't miss any important student loan application deadlines, here is a helpful timeline you can follow:

1. Create a checklist of required documents

Depending on the specific types of loans you apply for, you may need to provide several required documents. These may include:

- Your Social Security number

- Your parents' Social Security numbers if you're a dependent student

- Recent tax returns

- Records of child support payments received

- Current checking account, savings account, and cash balances

- Net worth of investments, businesses, and farms

2. Submit the FAFSA

Submitting the FAFSA as soon as possible will help ensure you meet all critical federal, state, and school deadlines and improve your chances of qualifying for first-come, first-served financial aid.

3. Coordinate with your school's financial aid office

After you submit the FAFSA, you'll need to wait for the financial aid award letters from the schools you've applied to. These letters will detail which federal student loans you're eligible for, as well as grants, scholarships, or other financial aid awards the school itself can offer you.

Once you receive your financial aid award letters, you can talk to the schools' financial aid offices to determine if there's a gap between your total award amounts and the cost of attendance. This can help you decide if you need to apply for a private loan to make up the difference.

4. Apply for private student loans

If you learn that your school costs will exceed your federal student aid and other financial awards, it's best to compare private student loan options as soon as possible. The earlier you can find the best private lender for your needs, the sooner you can apply for that loan. This will help ensure your loan funds are disbursed before your tuition due date.

FAQ

When does the FAFSA open each year?

Open

Can I apply for student loans after the semester starts?

Open

Do I need a cosigner for private student loans?

Open

What happens if I miss the FAFSA deadline?

Open

Can I apply for student loans before I’m accepted to college?

Open