Your mortgage size depends on the home’s price and the down payment you’re making. If you buy a home priced at $255,000, for example, and put down a 20% down payment ($51,000), you’ll need a mortgage worth $204,000.

You’ll then pay off that balance by making monthly payments for the rest of your loan term — which can be 30 years for many homebuyers. Learn more about what factors impact your monthly payment and how to budget for a $200,000 mortgage.

Monthly payments for a $200,000 mortgage

Your monthly mortgage payment consists of principal and interest. In some cases, your lender might include other recurring costs as well.

Here’s what typically makes up a mortgage payment:

- Principal: Principal is money that goes directly toward whittling down your balance.

- Interest: This is what you pay to borrow the money. The amount you’ll pay is reflected in your interest rate.

- Escrow costs: If you use an escrow account (or your lender requires it), you’ll also have your property taxes, mortgage insurance, and homeowners insurance rolled into your monthly mortgage payment.

On a $200,000, 30-year mortgage with a 6% fixed interest rate, your monthly payment would come out to $1,199 — not including taxes or insurance.

Your total monthly payment can vary greatly depending on your insurance policy, loan type, down payment size, and other factors. Use our mortgage calculator to determine the monthly payment on your potential home loan. In addition, if your down payment is less than 20%, many mortgage lenders will require you to pay private mortgage insurance (PMI), which is added to your monthly payment.

Here’s a more detailed look at what the total monthly payment (principal and interest) would look like for a $200,000 mortgage with different interest rates:

Check Out: 20- vs. 30-Year Mortgage: Is an Unusual Option Right for You?

Where to get a $200,000 mortgage

To buy a home, you can research financing from a variety of lenders, such as banks, online lenders, or mortgage brokers. If you want a specific type of loan, such as a VA or FHA loan, find lenders that offer the mortgage you’re applying for. Research your potential lenders and narrow down your list to three or four, then fill out applications for each one. If approved, you’ll receive loan estimates from each lender detailing the expected terms of the loan, including closing costs, interest rates, and annual percentage rates (APRs). You can use the loan estimates to compare offers more directly and determine which one is best for you.

Note:

The interest rate describes the cost to borrow money, but it’s not the total cost of the loan. APR can give you a more complete idea of the overall charges because it accounts for additional lender fees, such as for underwriting.

What to consider before applying for a $200,000 mortgage

When taking out any mortgage, it’s important to analyze your upfront costs (closing costs, down payment, etc.) as well as how much you’ll be paying to borrow the money over time. In addition, consider whether you’re in a competitive housing market. The housing inventory has been lagging for some time but is starting to show signs of improvement. In March 2025, housing inventory was up 28.5% for the 17th straight month, according to data from REALTOR.com. If you’re shopping for a home in a tougher housing market, however, you might have to be prepared to budget for a higher offer.

Total interest paid on a $200,000 mortgage

The longer your mortgage term, the more you’ll pay in interest over the life of the loan.

For example, on a 30-year $200,000 mortgage with a 6% fixed rate, you’ll end up paying $231,676 in interest over the full term.

Expert tip:

“On a 15-year mortgage with the same balance and rate, you’d pay just $103,788 — saving you $127,888 in interest charges. But keep in mind, your monthly payment would be higher with the 15-year mortgage.” — Reina Marszalek, Senior Editor, Mortgages

Amortization schedule on a $200,000 mortgage

A mortgage amortization schedule ensures that your home loan will be paid in full when you make your last scheduled payment.

When you first start paying off your loan, most of your payment goes toward interest. But as years pass, more of your payment is applied to the principal balance.

Here’s the mortgage amortization schedule on a 30-year, $200,000 mortgage with a 6% fixed rate:

Here’s the mortgage amortization schedule on a 15-year, $200,000 mortgage with a 6% fixed rate:

You can use a mortgage payment calculator to compare different loan terms and interest rates and see how they influence your payment amount.

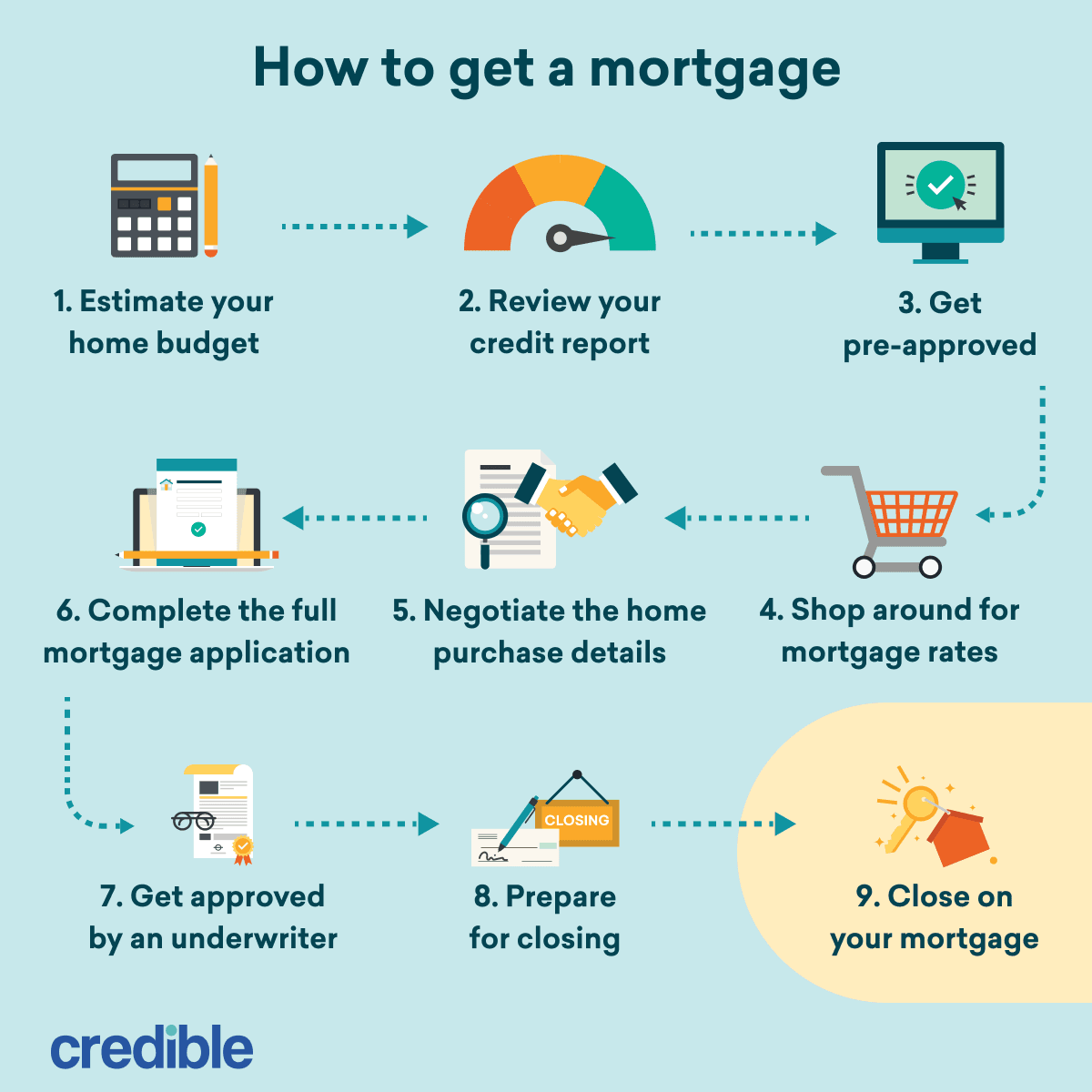

How to get a $200,000 mortgage

When you shop for a mortgage, make sure you know what to expect. Here’s how to break the process down into small, manageable steps.

Here are the steps to follow to get a mortgage:

- Estimate your home budget: Calculate your monthly debts, expenses, and take-home pay. Then, determine what you can afford each month and consider how much of a down payment you can afford.

- Check your credit: Pull your credit report, and see where you stand. You’ll get the best interest rates with a good or excellent credit score. But if it’s not quite there, you still have options. Many lenders will approve you for a conventional loan with a score as low as 620, but you might not be eligible for the best interest rates. If you have a lower score, lots of debt, or late payments, you might want to spend time improving your credit before applying for a loan.

- Get pre-approved: Next, you’ll need to request pre-approval with one or more lenders. You can do this by contacting each lender separately.

- Compare mortgage rates: Next, determine which loan is the best one for you. You should compare the origination fees, interest rate, and mortgage APR, which reflects the loan’s interest costs and fees. You can also talk to lenders about paying mortgage points, which could lower your interest rate (for a fee).

- Negotiate your home purchase: Use your pre-approval letter to make an offer on a house and negotiate the purchase details. If you’re working with a real estate agent, they can help guide you through the process.

- Complete your mortgage application: After the seller has accepted your offer, fill out your lender’s full application. This requires more detailed information than your pre-approval did. Be prepared to provide documents like tax returns, W-2s, and bank statements.

- Wait for full approval: Your loan will move into underwriting, which means your application is evaluated, your income is verified, and all the numbers are crunched. The lender will also request a home appraisal to ensure it’s worth the money you’re looking to borrow for it.

- Prep for closing: Once you get your closing date, you’ll need to arrange for homeowners insurance because your lender will likely require it. You should also take some time to review your closing disclosures to make sure you understand the final costs and terms of your loan.

- Close on your loan: Finally, you’ll attend your closing appointment, sign your paperwork, and pay your closing costs. Once all is said and done, you’ll get the keys to your new home.

Remember that you’re not alone in the homebuying process. Your real estate agent can guide you in your home search and negotiations, and a loan officer can help with mortgage-related tasks.

FAQ

How much is the down payment for a $200,000 mortgage?

Open

Can I afford a $200,000 mortgage with a $70,000 salary?

Open

How much are closing costs on a $200,000 house?

Open