A $400,000 mortgage comes with a variety of costs in addition to your monthly payment. These costs may be significant, so it’s important to weigh them carefully before applying for the loan. A large portion of your monthly payment depends on rate and term; a 30-year mortgage could come with a monthly payment that ranges from $2,398.20 to $2,796.86, depending on your interest rate.

Knowing what to expect will ensure you can comfortably afford the mortgage — both now and over the long haul. Let's learn more about how much a $400,000 mortgage will cost you throughout the life of the loan.

Monthly payments for a $400,000 mortgage

On a $400,000 mortgage with an interest rate of 7%, your monthly payment would be $2,661 for a 30-year loan and $3,595 for a 15-year one. This isn’t too far from what the average homeowner with a mortgage pays each month. According to Redfin, the median mortgage payment hit an all-time high of $2,807 in March 2025 — a 5.3% increase over last year.

Keep in mind

Monthly mortgage payments don’t just go toward lowering your loan balance, but also cover several other expenses, too — like taxes and insurance, for example.

Here’s a look at what generally goes into a mortgage payment:

- Principal: This portion of your payment goes straight toward reducing your balance. It’s typically a very small share of your payment at the start of your loan.

- Interest: This covers the cost of borrowing your loan. It’s usually the largest share of your payment for the first few years of your loan.

- Escrow costs: Most lenders require an escrow account to stow away cash for property taxes and homeowners insurance. You’ll pay money into this account each month as part of your mortgage payment.

Here’s a quick look at what the monthly principal and interest payment would be for a $400,000 mortgage with varying rates:

Annual percentage rate (APR) | ||

|---|---|---|

6.00% | ||

6.25% | ||

6.50% | ||

6.75% | ||

7.00% | ||

7.25% | ||

7.50% |

Where to get a $400,000 mortgage

Shopping around for your mortgage is critical if you want to get the lowest interest rate. To do this, you’ll need to apply with several mortgage lenders directly.

Once you have a few loan estimates in hand, you can compare the costs of each lender one by one. Make sure to look at the APR, origination fee, mortgage points, and the total cash you’ll need to bring to closing.

From there, you can choose the best offer, proceed with the lender’s full application, and provide any financial documentation they might require.

Expert tip

“Not only can a pre-approval letter give you a good idea of what you may be able to borrow from a lender, but it can also give sellers more confidence in your offers.” — Reina Marszalek, Senior Editor, Mortgages

What to consider before applying for a $400,000 mortgage

Before you take out a $400,000 mortgage, you’ll need to understand the total costs of the loan.

You should know what your closing costs and monthly payment will be, how much you’ll need for a down payment, and the total interest you’ll pay over time.

Total interest paid on a $400,000 mortgage

The total interest you’ll pay will depend on both your APR and the length of your loan. Longer loan terms and higher APRs will result in more interest costs in the long run.

On a 15-year, $400,000 mortgage loan with a 6% interest rate, for example, you’d pay $207,577 in total interest by the end of your loan term.

On a 30-year loan with the same details, your interest costs would jump to $463,353 — a shocking $255,776 more.

Check Out: How To Buy a House: Step-by-Step Guide

Amortization schedule on a $400,000 mortgage

An amortization schedule, which breaks down the principal and interest payments for a loan, can help you understand the long-term costs of your mortgage.

As you’ll see below, the bulk of your payments will go toward interest costs initially. Over time, more of your payments go toward your loan balance, and you’ll start reducing that principal at a faster rate.

Here’s what an amortization schedule looks like for a 30-year, $400,000 mortgage with an APR of 6%:

Here’s what an amortization schedule looks like for a 15-year, $400,000 mortgage with an APR of 6%:

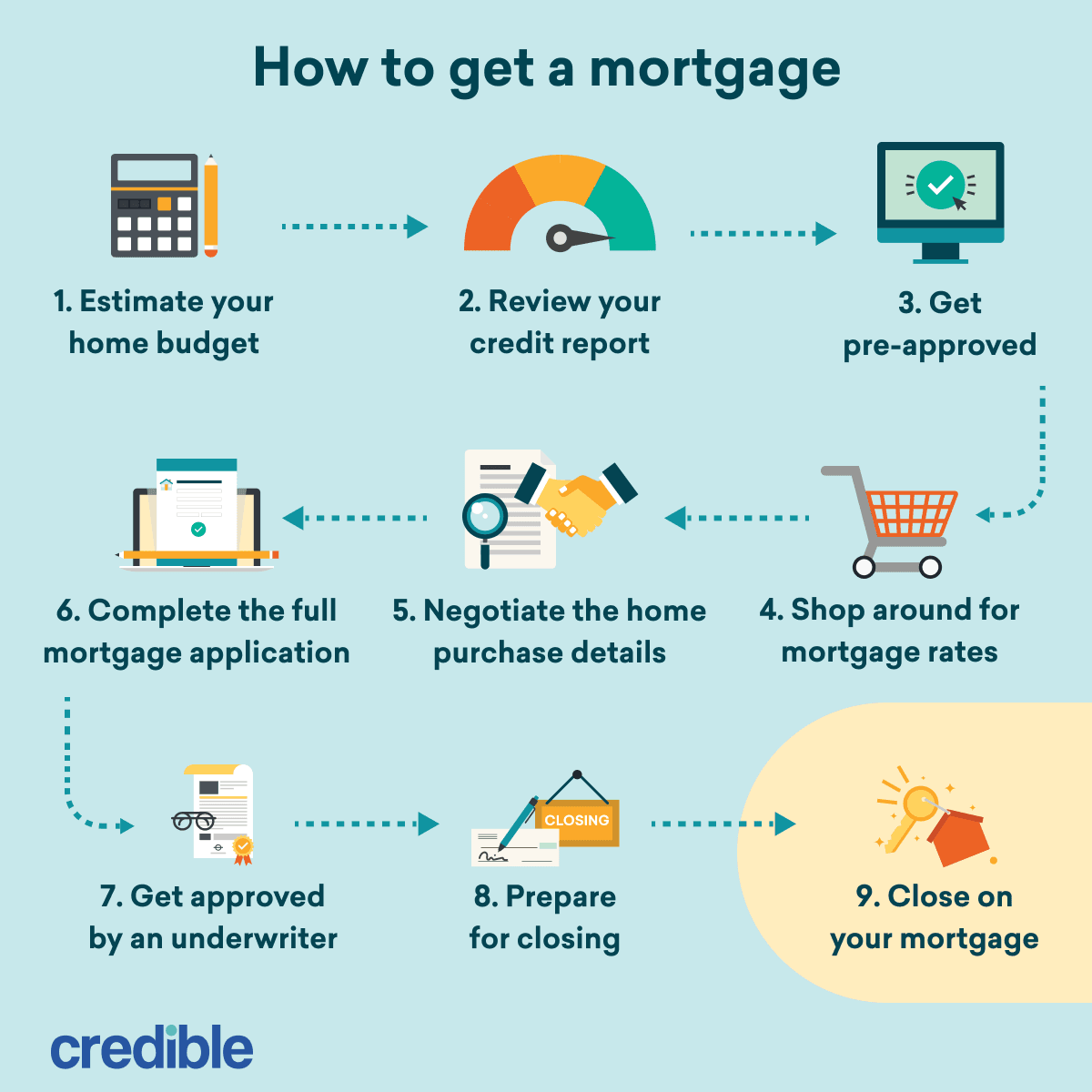

How to get a $400,000 mortgage

When filling out your mortgage application, you’ll want to have some financial details on hand, including your income, estimated credit score, homebuying budget, and info regarding your assets and savings.

Follow these simple steps to apply for a mortgage:

- Estimate your budget: First, determine how much home you can afford. Use a mortgage calculator to estimate your monthly payment for different loan amounts, and make sure you factor in insurance, taxes, homeowners association (HOA) dues, maintenance, and other costs. This can help guide you toward the right price range to shop in.

- Pull your credit report: Review your credit report early. Lenders will use your credit score and overall credit history when they consider your loan application, and this can determine which loans, interest rates, and amounts you qualify for. Request copies from the three credit bureaus or AnnualCreditReport.com to gauge where you stand. If you find any late payments, errors, or accounts in collections, work on settling those before you apply for a loan.

- Get pre-approved for your loan: Get pre-approved for a mortgage before beginning your home search. Lenders will review your credit history and financial documents and provide you with a letter that shows the likely loan terms and amount you could be approved for when you formally apply.

- Compare rates and loan offers: Once you’re pre-approved, you can compare those letters — and the loan estimates they come with — and choose the best lender for your home purchase. Be sure to look carefully at the numbers, including the interest rate, APR, closing costs, and any fees.

- Find a home and make an offer: When you’ve found that dream home, put in an offer and negotiate the details. If you’re working with a real estate agent, they can help ensure you submit a competitive offer. If the seller accepts, you can proceed with your chosen mortgage lender’s full application.

- Fill out your mortgage application: Complete your mortgage application, and submit any documentation the lender requires. Be prepared to provide recent tax returns, W-2s, and pay stubs.

- Wait for approval: Your loan application will be processed and underwritten. During underwriting, your lender will verify your financial information and make sure you can repay the loan.

- Get ready for closing: Once your loan nears approval, you’ll be scheduled for a closing date. To prepare, you’ll want to find a homeowners insurance policy, review your final closing disclosures, and arrange your payment, which is usually done via wire transfer or cashier’s check.

- Close on your loan: You’ll eventually attend your closing appointment, sign your paperwork, and pay your down payment and closing costs. Once you’re finished, you’ll get your keys and can move into the home.

FAQ

What down payment do I need for a $400,000 loan?

Open

Can I afford a $400,000 mortgage on a $100,000 salary?

Open