Under normal circumstances, if you asked your lender, “How long does it take to refinance a house?” the answer would likely be 30 to 45 days. But you’re not necessarily out of luck if you need to refinance quickly to lock in a low rate or draw equity from your home.

How long it takes to refinance

The average time to refinance a house is 30 to 45 days, depending on your circumstances. The actual time frame to refinance could run anywhere from 15 to 60 days or more, however.

You could face delays, depending on the economic climate, which could make it take longer. Other factors that determine how long to refinance a house include the complexity of your financial situation and the documentation required.

Find out: How Soon You Can Refinance: Typical Waiting Periods By Home Loan

How to refinance a mortgage

Don’t let the number of steps involved in refinancing your mortgage intimidate you — the lender does most of the work. But here are the steps needed to refinance your mortgage.

1. Know how much equity you have

Your home equity is the value of your home minus your loan balance. Here’s a quick way to find out how much equity you have in your home:

- Use your mortgage balance: First, take your total mortgage balance.

- Know the value of your home: Next, use a recent appraisal or compare similar homes in your area to get the value.

- Calculate equity: Now, subtract your loan balance from your estimated home value and you have your total equity. Use a loan-to-value (LTV) calculator to make this easy.

Learn More: When to Refinance a Mortgage: Is Now The Best Time?

2. Check rates

Even small differences in interest rates can add up to thousands of dollars in savings since home loans are for such high amounts. So, it’s a good idea to compare rates from multiple lenders first.

3. Research lenders and their products

Rates only tell part of the story. You should also investigate the types of loans lenders offer, their terms, and their fees. Credible provides transparency into lender fees that other comparison sites don’t.

Common fees associated with refinancing your home include:

- Appraisal fee

- Credit report fee

- Loan origination fee

- Title search and insurance fee

- Underwriting fee

- Discount points

See: Best Mortgage Refinance Companies

4. Gather all documentation

Your lender must verify your income, assets, liabilities, credit, and home value. So, be prepared to submit the following documents:

- The most recent mortgage statement

- Two most recent pay stubs

- Most recent two years’ worth of W-2 and/or 1099 statements

- Government benefit award letters

- Most recent two years’ tax returns

- Bank and investment account statements

- Proof of homeowners insurance

- Divorce decree, if paying or receiving alimony and/or child support

5. Apply for your refinance

Depending on your lender’s capabilities and your preferences, you can apply online or using a paper application. Either way, the application asks for detailed information about the borrowers and their income, expenses, assets, liabilities, and current mortgage obligations.

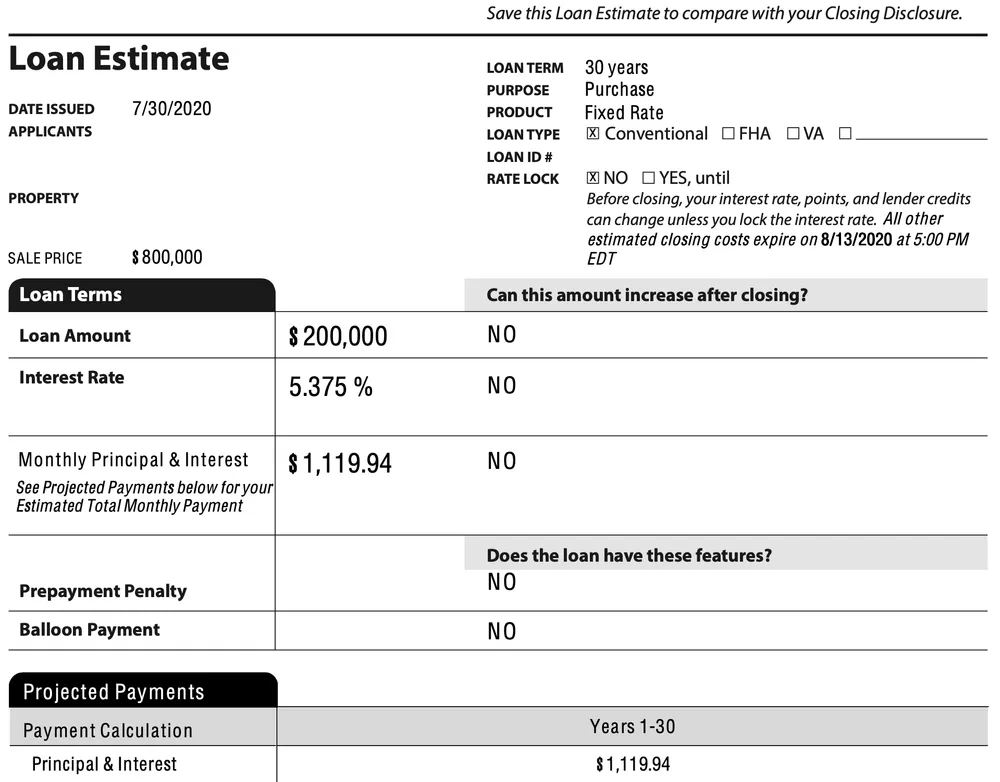

6. Receive a loan estimate

Your lender will provide your loan estimate within three business days after you submit your application. Among other information, the Loan Estimate discloses the interest rate, payment amount, and expected closing costs for your loan.

7. Have your home appraised

Not all refinance loans require an appraisal, but in many cases, the lender will order one. Expect the lender to have the appraisal report within about a week after the appraiser views your home.

8. Complete underwriting

After you submit your loan application and any documents your lender requests, the lender will work to verify your income, debt, assets, and credit to determine whether you qualify for the loan. If you qualify, they will also decide how much you’re qualified to borrow.

How long does underwriting take?

Underwriting can take anywhere from a couple of days to several weeks, but the average is a week or two. Your lender will issue your approval once underwriting is complete.

See: Manual Underwriting: Could It Help You Buy a Home?

9. Lock in your rate

You’ll want to lock in your interest rate before you close the loan. The rate lock guarantees that rate for a period, like 30, 45, or 60 days, and it provides details such as the loan terms, any points you’ll pay to get the offered rate, and an expiration date for the lock.

Learn More: Mortgage Rate Lock: How and When to Lock in Your Mortgage Rate

10. Sign documents and close on your loan

Your lender will send you a closing disclosure at least three days before your scheduled closing date. The disclosure details the fees associated with your loan, including closing costs. Then, you’ll sign the disclosure and other loan documents on closing day.

Keep Reading: No Closing Cost Refinance: Will It Save You Money?

How to speed up the refinance process

Every situation is different, but there’s a lot you can do to avoid delays and even speed up the process:

- Use an online platform. They allow you to compare multiple refinancing options quickly and streamline your application and document submissions — which can help you save time.

- Pick a loan and stick with it. Starting from scratch with a new lender after you’ve already applied can add weeks to the time it takes you to close.

- Stay in close contact with your mortgage rep. Stay in communication with your rep and respond to requests for information and documentation right away. Keep copies of all your correspondence.

- Be prepared to explain credit blemishes. Write a letter detailing the circumstances around late payments, collections, and charge-offs, and the steps you took to resolve them. It’s also helpful to indicate how your current financial situation makes a recurrence of these problems unlikely.

- Avoid applying for new credit. Credit inquiries could lower your credit score slightly, and new debt will increase your debt-to-income ratio. Either situation could reduce your chances of qualifying for your refinance loan.

- Write a letter explaining any gaps in employment. Unexplained lapses in employment might cause the lender to question whether you have the stable income needed to make your payments on time.

- Make sure your home is up to regulation. Ensure that your home meets zoning requirements like proper shed and fence setbacks and downspout placement. Your home should also be compliant with local codes for safety equipment like smoke and carbon dioxide detectors and stairway handrails.

- Document improvements. Give the appraiser documentation of significant improvements you’ve made to your home, especially if they set it apart from similar homes in your neighborhood.