A $1,000,000 mortgage could be your ticket to a Midwestern mansion — or a Bay Area bungalow. Whatever type of home you’re after, a substantial income and top-notch credit can help you get the jumbo mortgage you need.

In addition to your down payment, you’ll need money to cover the loan origination fee, home appraisal, and other closing costs. But here, we’ll focus on the monthly payment you can expect — potentially $5,995.51 to $7,337.65 under different scenarios — as well as how much a $1,000,000 mortgage might cost in the long run.

If you’re applying for a $1,000,000 mortgage, we'll help you determine how much that loan will cost you each month with interest.

Monthly payments for a $1,000,000 mortgage

Monthly mortgage payments are based on how much you borrow, what interest rate you can get, and how long your repayment term is.

Your payment will include principal, interest, and other costs like property taxes and homeowners insurance.

Here’s what monthly payments for a $1,000,000 fixed-rate mortgage might look like for you:

Where to get a $1,000,000 mortgage

You can get a home loan from many types of mortgage lenders, including retail lenders, portfolio lenders, and credit unions.

Expert tip:

“During underwriting, stay in touch with your loan officer. You can help the process go smoothly by responding promptly to questions or requests for more information.” — Reina Marszalek, Senior Editor, Mortgages

What to consider before applying for a $1,000,000 mortgage

A $1,000,000 mortgage is considered a jumbo loan, and these loans are a bit different from the smaller conforming loans you more often read about. Qualifications can vary a lot from one lender to the next, but here’s what you’ll typically need:

- A down payment of at least 10% (and possibly as much as 20%)

- A credit score of at least 680

- A debt-to-income ratio (DTI) no higher than 43%

Total interest paid on a $1,000,000 mortgage

You’ll always pay more in interest with a longer loan term, and a $1,000,000 jumbo loan is no exception. For instance, a 30-year jumbo mortgage will give you a $5,995.51 monthly payment, but you’ll pay $1,158,381.89 in total interest, assuming a fixed rate of 6%.

A 15-year mortgage at the same interest rate will cost you $518,942.29 in interest, but the monthly payment will be higher — $8,438.57.

Cutting your mortgage term in half could save you $639,439.60 in interest. However, sticking with a 30-year term gives you an extra $2,443.06 each month to put toward other goals and expenses.

See: How Much Does It Cost to Buy a Home?

Amortization schedule on a $1,000,000 mortgage

A mortgage amortization schedule plans out your payments for each month of your mortgage term.

Most of your monthly payment will go toward interest at the beginning of your loan term. But with each payment you make, a little more will go toward the principal, and a little less will go toward interest, until you own your home free and clear.

Here’s what that looks like for a 30-year, $1,000,000 mortgage with a 6% fixed rate:

Here’s the amortization schedule on a 15-year, $1,000,000 mortgage with a 6% fixed rate:

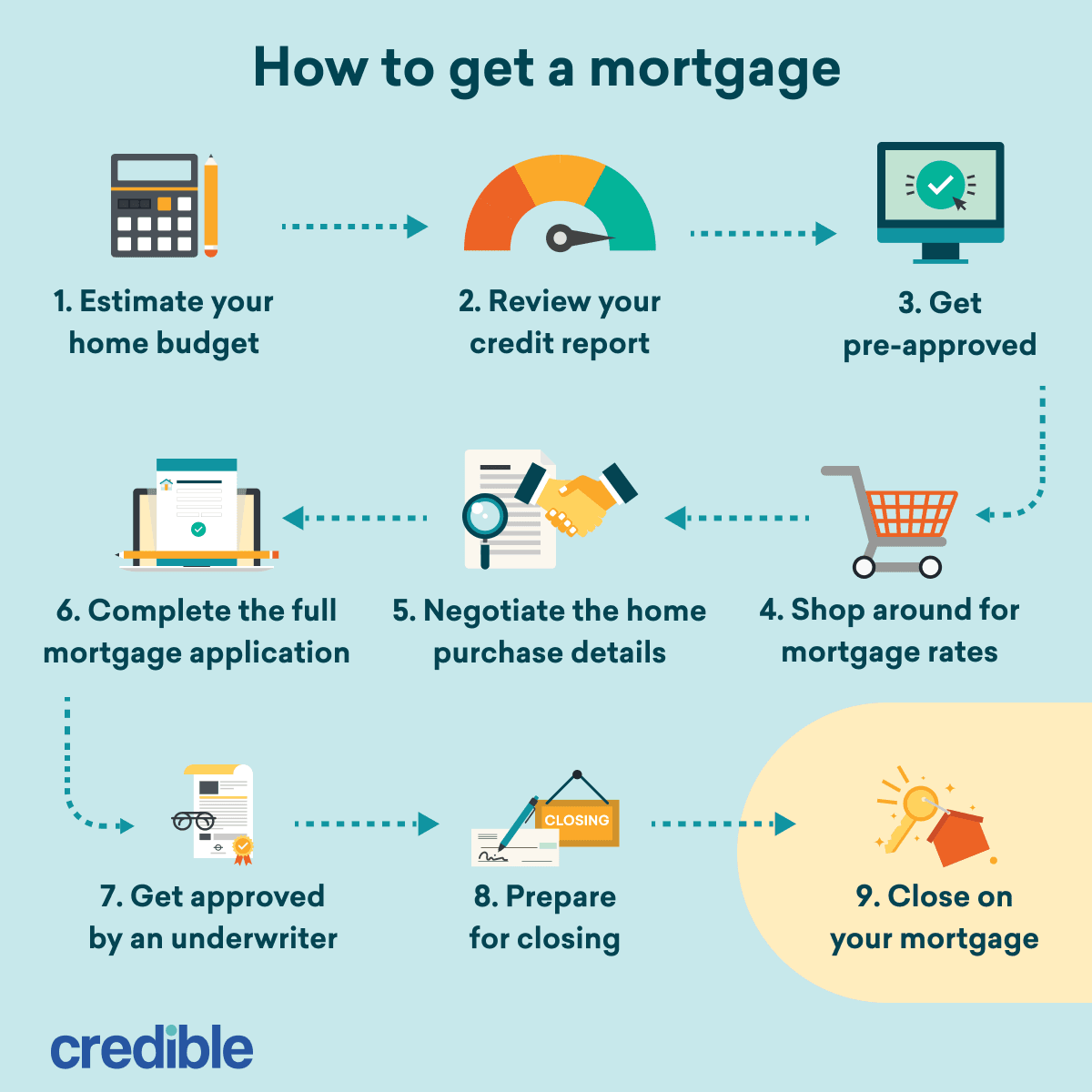

How to get a $1,000,000 mortgage

1. Calculate your homebuying budget

To figure out how much house you can afford, create a detailed account of your annual income and expenses. Then, factor in the new costs you’ll take on as a homeowner.

Besides your mortgage principal and interest, there will be property taxes, homeowners insurance, and home maintenance. Some properties also require homeowners association fees and special hazard insurance, such as flood insurance. Your utilities may be higher, too.

2. Review your credit report

Before you apply for a mortgage, check your credit report with each of the three major credit bureaus: Equifax, Experian, and TransUnion. Mistakes can happen due to identity theft, identically spelled names and similar Social Security numbers.

You don’t want to qualify for a smaller loan because someone else’s car payment ended up on your credit profile, or get rejected because your score is lower than you thought. If you find any mistakes, dispute the error with the reporting agency.

3. Get pre-approved

By giving lenders some basic information about your finances, they’ll be able to tell you if you’re likely to qualify for a full mortgage — and estimate how much you can borrow.

The mortgage pre-approval process also helps you learn which lender offers the lowest fees and APR.

Tip:

Getting a pre-approval letter from a lender will strengthen your purchase offer too. It shows sellers that you’re more likely to close the deal.

4. Shop around for mortgage rates

When you’re taking out a jumbo loan, a small difference in your interest rate can mean a difference of tens of thousands of dollars over the life of your mortgage. It’s worth your time and effort to shop around for the best mortgage rate.

But don’t stop there: Fees can add up, too. When comparing lenders, see what they charge in origination fees, application fees, discount points, and more.

5. Negotiate home purchase details

Don’t let the fact that you’re making a major purchase dissuade you from trying to save money any way you can. In a buyer’s market, you may be able to offer less than the asking price — or negotiate seller concessions, such as help paying for closing costs or repairs.

If that’s not possible, negotiating for your desired move-in date might help you save money by avoiding overlapping payments on your current place and new home.

Find Out: How to Know If You Should Buy a House

6. Complete the full mortgage application

Once you’ve found a home you want to buy and a seller has accepted your offer, it’s time to apply for a mortgage. You’ll provide extensive details about your income sources and your legally binding financial obligations, including debt payments and child support.

The lender wants to see that your income is stable and that your DTI is not too high to afford the mortgage you’re applying for.

7. Get approved by an underwriter

A mortgage underwriter will review your mortgage application, along with supporting documents you must supply, such as bank statements, pay stubs, and tax returns. The faster you provide this additional information, the sooner your mortgage can close.

The lender will also send an appraiser out to evaluate the condition and value of the home you want to buy. If all goes well, it will appraise for the purchase price or higher.

8. Prepare for closing

At this stage, you may have to comply with some last-minute underwriting requests. You’ll also want to schedule time to review and sign your closing paperwork and make sure you understand how to transfer the money for your down payment and closing costs.

9. Close on your mortgage

To complete your homebuying journey, you’ll sign dozens of papers in front of a notary. This process traditionally took place in an office, but now you may be able to do it in your home with a mobile notary or remote online notarization.

You’ll need to provide your ID and possibly your fingerprint. Soon after that, you’ll get the keys — and the real excitement of moving into your new home can finally begin!

Frequently asked questions

What is the down payment for a $1,000,000 loan?

If you’re taking out a jumbo loan, the down payment requirement could be as low as 10% and up to 20% of the loan amount. For a $1,000,000 mortgage, this could be between $100,000 and $200,000.

What salary do I need to afford a $1,000,000 mortgage?

One guideline suggests borrowers can afford a house roughly two to three times their annual salary. For a $1,000,000 home, this would be a salary of about $200,000 to $333,000 a year. You can also get a more detailed look by comparing your monthly income and housing expenses. Experts suggest you spend no more than 28% of your monthly gross income on housing costs. If you multiply your monthly income by 0.28, you can find your ideal monthly payment and use that to shop around for the right mortgage. For example, a $250,000 salary divided by 12 months would give you a pre-tax income of about $20,833 per month; 28% of that would be $5,833.24.