The monthly payment isn’t the only cost you’ll want to think about when taking out a mortgage. To gauge the real cost of your loan, you’ll need to think about interest, too — or how much it costs to borrow the money over time. If you borrow $250,000 with a 30-year repayment term, you could have a monthly payment ranging from $1,498.88 to $1,834.41.

Monthly payments for a $250,000 mortgage

Your monthly payment will depend on your interest rate and loan term — or how long your loan lasts.

On a $250,000 fixed-rate mortgage with an annual percentage rate (APR) of 7%, you’d pay $1,663.26 per month for a 30-year term or $2,247.07 for a 15-year one.

These estimates only include principal and interest. Other costs that are typically lumped into your monthly payment, including taxes and insurance, vary widely and are not included here.

Use our PITI (principal, interest, taxes & insurance) mortgage calculator to determine the full cost of your loan.

Annual percentage rate (APR) | ||

|---|---|---|

6.00% | ||

6.25% | ||

6.50% | ||

6.75% | ||

7.00% | ||

7.25% | ||

7.50% | ||

7.75% | ||

8.00% |

Check out: 20- vs 30-Year Mortgage: Is an Unusual Option Right for You?

Where to get a $250,000 mortgage

If you qualify, you can get a $250,000 mortgage from any mortgage lender, bank, or credit union. Rates and terms vary by loan servicer, though, so you’ll need to shop around to get the best deal.

Traditionally, this would mean reaching out to each lender individually to get a quote, which can be time-consuming and tedious.

What to consider before applying for a $250,000 mortgage

Before taking out a $250,000 mortgage, you’ll want to be well aware of the costs it will come with. These costs include interest, your down payment, and sometimes insurance and other fees.

Expert Tip:

“Make sure you budget for closing costs, which typically clock in somewhere between 2% and 5% of the total loan amount. If you take out a $250,000 loan, that would cost $5,000 to $12,500.” — Reina Marszalek, Senior Editor, Mortgages

Total interest paid on a $250,000 mortgage

The total amount of interest you’ll pay on a $250,000 mortgage will vary based on your interest rate and loan term. High interest rates and long terms will result in the most interest over time, while shorter terms and low interest rates will save you on interest and let you pay off your home loan sooner.

Example: On a 15-year, $250,000 mortgage with 6% APR, you’d end up paying $129,735.57 in total interest over the life of your loan.

However, if you chose a 30-year mortgage at the same rate, your interest costs would jump significantly, and you’d pay $289,595.47 by the end of your loan term.

Amortization schedule on a $250,000 mortgage

An amortization schedule spells out the annual principal and interest costs for each year of a home loan and can be a good way to gauge the long-term costs of financing your house.

As the examples below show, your monthly mortgage payments go mostly toward interest at the beginning of your loan and more toward principal further into your term.

Here’s what an amortization schedule for a 30-year, $250,000 loan looks like, assuming a 6% APR:

Here’s what an amortization schedule for a 15-year, $250,000 loan looks like, assuming a 6% APR:

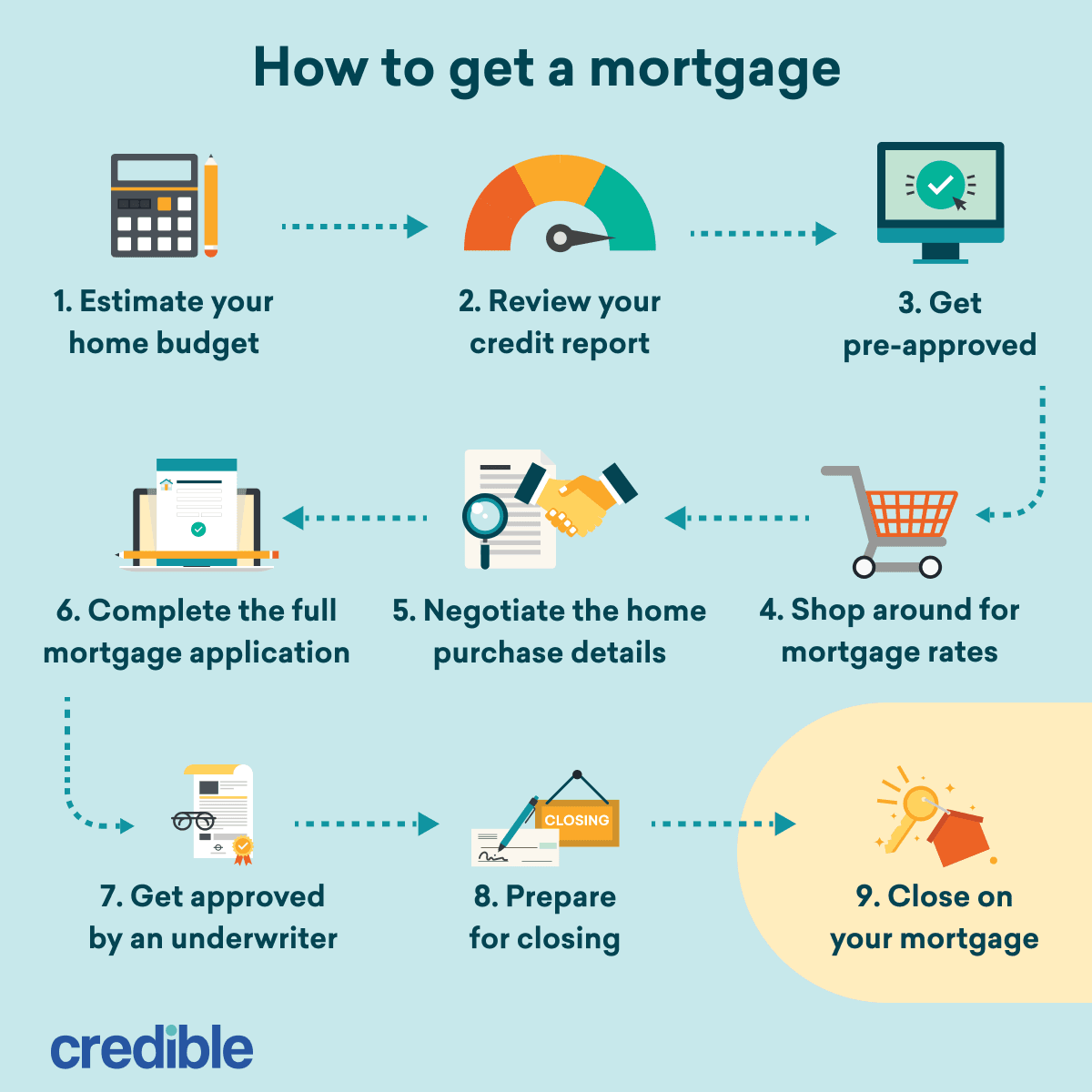

How to get a $250,000 mortgage

If you’ve weighed both the upfront and long-term costs of a $250,000 mortgage and are comfortable moving forward, it’s time to start the mortgage process.

Here are the steps to follow to get a mortgage:

- Estimate your home budget: Add up your monthly household income, as well as your debts, bills, and other regular costs, and see how much you can comfortably afford. You can use a mortgage calculator to gauge the monthly payment for a particular home price but don’t forget to factor in other housing costs too, like maintenance and homeowners association (HOA) dues.

- Review your credit report: Your credit will play a factor in what mortgage rate you qualify for, so review your credit report to see where you stand. If your report shows lots of debt or your score is low, you might want to improve your credit before applying for the loan.

- Get pre-approved: A mortgage pre-approval can show you how much you might be able to borrow, and it can help you set the price range you should start shopping in. Pre-approvals also give sellers more confidence in your offers.

- Shop around for mortgage rates: Mortgage rates vary widely, so it’s incredibly important you shop around for your loan. Once you get quotes from several lenders, be sure to compare the APR, origination fees, and closing costs. You can also look into buying mortgage points, which could lower your interest rate (for a fee).

- Negotiate the home purchase details: You’ll then start the search for your dream home. Once you find a property you like, you’ll put in an offer and negotiate the details. If the seller accepts, you’ll move forward with your chosen mortgage lender.

- Complete the full mortgage application: It’s now time to fill out your lender’s full mortgage application and provide any required financial documentation. This usually includes tax returns, W-2s, bank statements, and recent pay stubs.

- Get approved by an underwriter: Your loan will next move into underwriting, which is when your lender verifies your information and makes sure you have the financial capabilities to repay the loan. This is the last big hurdle before closing on your loan.

- Prepare for closing: You’ll eventually be assigned a closing date, which is when you’ll finalize the transaction and take ownership of the home. Before this date rolls around, make sure you’ve secured a home insurance policy. Your lender will require it before approving the loan.

- Close on your mortgage: The last step is attending your closing appointment and signing the final paperwork. You’ll also pay your closing costs and down payment, and receive the keys to your new home.

Monthly payments for different mortgage amounts

Mortgage calculators

FAQ

How much income do I need to afford a $250,000 mortgage?

Open

Can I afford a $250,000 mortgage on a $70,000 salary?

Open

What is the down payment for a $250,000 mortgage?

Open