If you have a credit score of 800 or higher, you’ve achieved one of the highest scores possible. Credit scores stretch from 300 to 850, and the average American’s FICO score in 2025 is 717.

Generally, a high credit score shows you’ve managed debt responsibly in the past — and it comes with benefits. Aside from bragging rights, an exceptional credit score makes you an attractive borrower for mortgage lenders and puts the best interest rates within your reach. Even the difference between a 6% and a 6.1% interest rate can mean saving thousands over your loan’s term.

How good is an 800 credit score?

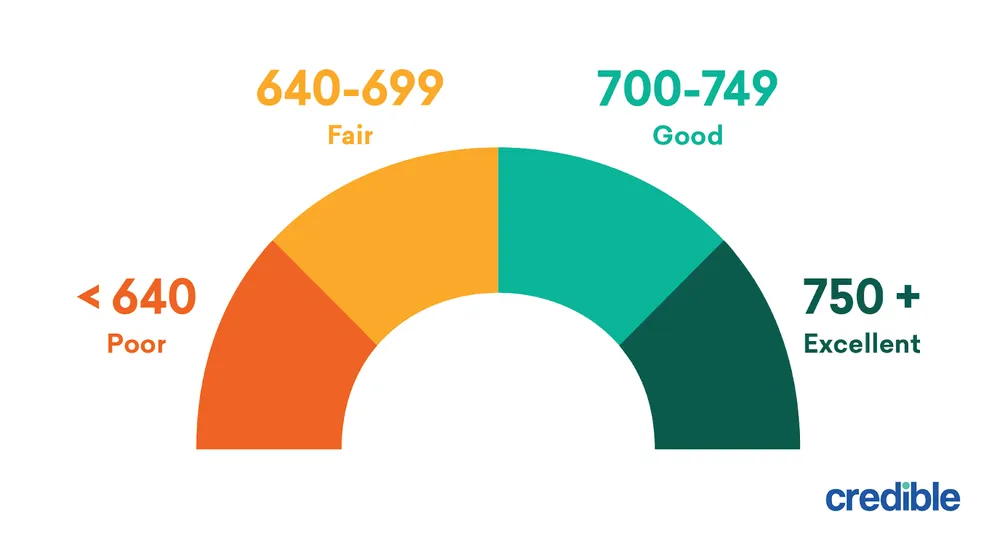

Lenders tend to evaluate credit scores in ranges, and a credit score between 800 and 850 falls in the “excellent” range. People who achieve such a high credit score have generally shown they pay back borrowed money on time and don’t miss payments.

Here are a few advantages to having an 800+ credit score:

- You have a better chance of getting approved for a home loan.

- You may qualify for a low mortgage rate.

- You have more power to negotiate your interest rate and closing costs.

Learn More: What Is a Mortgage Rate and How Do They Work?

Expert tip:

“Small improvements can help, even if you’re far from an 850 credit score. If you can raise your credit score by a few points, it might put you in the next credit score range and make you eligible for a better rate.” — Valerie Morris, Editor, Mortgages

Average mortgage rates for an 800 credit score

Your credit score plays a big part in whether you’ll qualify for a mortgage and receive a good interest rate.

The annual percentage rate (APR) is an excellent metric to check when you compare mortgage offers because it accounts for both the interest rate and lender fees. The APR reflects the total cost of borrowing instead of describing interest rates alone. Qualifying for a lower APR can help you save thousands of dollars over the life of the loan.

For example:

A high credit score might net you an APR of 6.233% on a 30-year, $200,000 mortgage with a monthly payment of $1,229 (not including insurance or taxes).

On the other hand, a borrower with a 620 credit score might receive an APR of 6.592% and pay $1,276 per month. That $47 difference in monthly payments adds up to nearly $17,000 over the life of the loan. Use a mortgage calculator to dive deeper into the numbers and understand your unique situation.

Tip:

You can also use a mortgage calculator to test different options, such as a larger down payment, shorter loan term, or even small differences in interest rates. This can give you an idea of all your options.

Learn More: APR vs. Interest Rate: Understanding the Difference

Other factors behind your mortgage rate

While having a good credit score can help you get a low mortgage rate, it isn’t the only factor driving your offer. Lenders also examine broader economic trends and other areas of your financial profile when determining rates. Some examples include:

|

While some of these factors are out of your control, you can work on other areas to boost your chances of getting a low mortgage rate, regardless of your credit score. Here are some factors you can control:

- Down payment: Putting down at least 20% can help you avoid private mortgage insurance. Because the lender is taking on less risk, you’ll likely get a break on the interest rate, too.

- Loan size: Getting a particularly big mortgage might mean paying a higher interest rate. If possible, look for homes that are cheaper or increase your down payment so the loan size shrinks.

- Loan term: Generally, shorter loan terms have lower interest rates because the lender is extending risk for a shorter period of time. Compare interest rates and monthly payment amounts on different loan terms — such as 15, 20, and 30 years — to see what you can afford.

- Debt-to-income ratio (DTI): Your DTI compares how much of your monthly income goes toward paying debt. A lower DTI — around 43% or less — may help you qualify for a low mortgage rate.