CONTENT

TABLE OF CONTENTS

View All

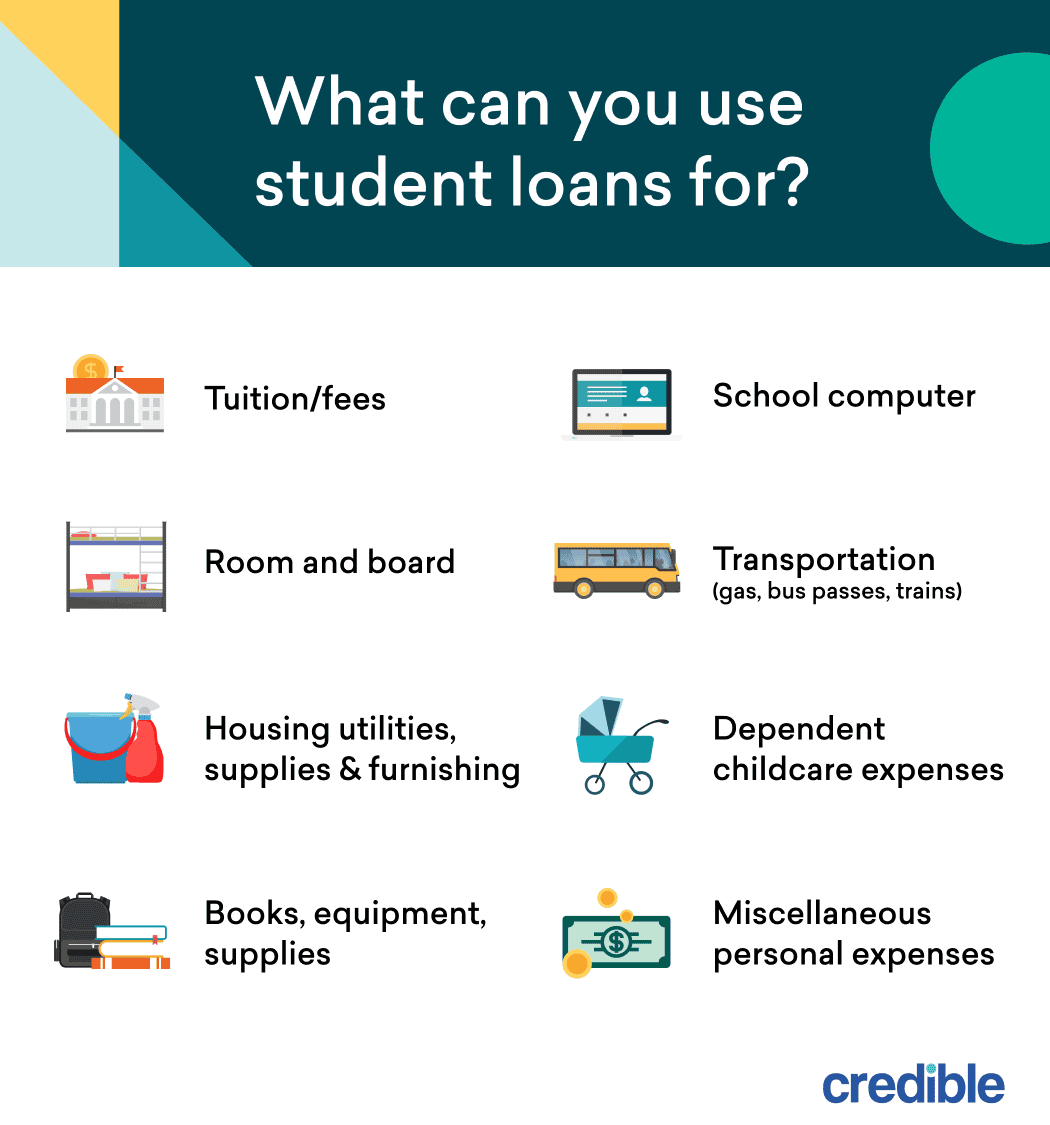

Paying for higher education can be a major financial burden — but student loans can lighten that burden. Student loans can make it more manageable to cover the costs of college, but you can only use them for certain expenses.

Can you use student loans for anything?

You can’t use student loans for just any expense, like you can with a personal loan. Student loans are designed to cover certain costs of attending college. It’s OK to use student loans for a few types of expenses, but a handful of expenses can’t be covered with student loan funds:

What student loans can be used for

The following expenses are approved by the U.S. Department of Education (and most private lenders follow suit):

If you’re not sure whether or not an expense would be approved, you can contact your loan servicer or lender.

Check Out: Your Student Loan Servicer Changed: What Now?

What student loans can’t be used for

Along with limitations on what expenses are covered by student loans, limitations also exist within some of the approved expense categories.

Let’s look at transportation as an example. If you already own a car when you start college, you can use student loan funds to cover the costs of vehicle maintenance and gas. But you can’t use student loan funds to buy a car. Similarly, food you purchase at a grocery store may fall under the approved expense of room and board (such as housing), but dining out at a restaurant may not.

The following personal expenses are ineligible for federal student loans and are likely also ineligible with many private lenders:

- Travel

- Clothing

- Video games

- Business expenses

- Down payment for a house

- Expensive meals and drinks

Consequences of misusing student loans

Many college students tend to live on tight budgets, and it may be tempting to use student loan funds to cover other expenses not directly related to attending college. Be careful here, though: Using student loan funds on unapproved expenses can violate your student loan agreement.

When you sign a student loan agreement, you agree to only use the loan funds disbursed to you to pay for college education expenses. If you use these loan funds inappropriately, the Department of Education or your private lender could cancel the loan agreement and demand immediate repayment of the loan.

Check Out: The Complete List of Student Loan Forgiveness Programs

Student loan uses FAQs

Here are answers to some commonly asked questions about how you can use student loan funds.

What happens to unused Pell Grant money?

Federal Pell Grants aren’t loans, so they don’t need to be repaid (except in certain circumstances). This means you can keep any amount of Pell Grant money you don’t use. For 2022-23, the maximum Federal Pell Grant award is $6,895. Filling out the FAFSA can help you qualify for grants and scholarships.

What happens if I don’t use all my financial aid money?

When you take out a student loan, the lender (whether federal or private) pays the school directly first. The school then applies the loan or grant funds toward tuition, fees, and room and board (for students living on campus).

Your school will disburse any remaining funds directly to you, and you can use the leftover money to pay for your educational expenses.

Good to know

If you receive a student loan refund and don’t use all the remaining funds for education expenses, you can apply them toward repaying your student loan balance.

Can I use student loans for car payments?

No, you can’t use student loan funds to make car loan payments. Transportation expenses to get to and from school are an approved expense, but you can’t use the loan money to buy a car. You can, however, use student loan funds to pay for gas and vehicle maintenance.

Is it illegal to misuse student loans?

Yes, when you take out student loans, you sign a loan agreement stating you’ll use the funds for education expenses. If you misuse federal student loans, you risk the Department of Education canceling the loan agreement and demanding immediate loan repayment. How private lenders handle this situation can vary.

Can I use student loan money for living expenses?

Yes, you can use student loan money for some living expenses. For example, an approved living expense is room and board. That category can include food purchased at the grocery store.

Can I use student loans to pay for health insurance?

In some cases, you can use student loans to help pay for health insurance. Many schools require that students have healthcare coverage in order to enroll. Often, colleges and universities offer an on-campus healthcare plan that you can enroll in if you don’t have outside health insurance. If you sign up for on-campus health care, the cost of that care will be added to your cost of attendance, which can be covered by student loans.

The companies in the table below are Credible’s approved partner lenders.

The rates that appear are from companies from which Credible receives compensation. This compensation does not impact how or where products appear within the table. The rates and information shown do not include all financial service providers or all of the displayed lenders' available services and product offerings.

Lender

Fixed (APR)

Loan Amounts

Min. Credit Score

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

2.69% - 15.26%

$2,001 to $400,000

Does not disclose

Overview

While Ascent provides traditional student loans for undergraduate, graduate, and medical programs, it also stands out with some options that are uncommon among private student loan lenders. For example, its Outcomes-Based Loan, which doesn't require established credit or a cosigner, is available to juniors and seniors. When assessing your application, Ascent considers factors including your school, major, and GPA to determine if you're eligible.

Ascent also offers its Progressive Repayment plan to qualified borrowers. It allows you to begin with smaller payments at the start of the repayment term and then gradually pay more each month over time. If you borrow with a cosigner, they can be released after you make as few as 12 monthly payments. However, cosigners on loans for international students do not qualify.

pros

- Doesn’t charge application fees or origination fees

- Offers discounts of 0.50 to 1 percentage points when making automatic payments

- Can get a 1% cash-back reward after you graduate

- Grace periods from 9 to 36 months

cons

- May find lower interest rates with some competitors

- International students don’t have option to release cosigners

Interest rates

Fixed or variable

Minimum credit score

Does not disclose

Minimum income

$30,000 for most loans

Loan terms

5, 7, 10, 12, 15, or 20 years

Loan amounts

$2,001 minimum up to your school’s annual cost of attendance; lifetime limits of $200,000 for undergrads and $400,000 for graduates

Cosigner release

12 months

Eligibility

Must be a U.S. citizen or DACA student enrolled at least half time at an eligible institution. International students with a qualified cosigner may also qualify. Applicants who can’t meet financial, credit, or other requirements may qualify with a cosigner.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

2.84% - 17.99%

$1,000 up to 100% of the school-certified cost of attendance

Does not disclose

Overview

College Ave offers student loans for almost every type of degree program, with a range of repayment options, including a unique 8-year repayment term. Additionally, you can get extended grace periods of as long as 36 months on graduate, dental, and medical student loans.

About 90% of undergraduates applying with a cosigner are approved for additional student loans. However, you must complete at least half of your repayment term before you can remove a cosigner for your loan. Some lenders allow cosigners to be released much sooner, after as few as 1 to 2 years of payments.

pros

- Rate discount of one-quarter of a percentage point for using autopay

- Does not charge origination or application fees

- Grace periods between 9 and 36 months for graduate, MBA, law, dental, and medical school loans

cons

- Parent borrowers are required to pay at least the interest while the student is in school

- Cosigners not eligible for release until at least half the repayment term of the loan is completed

Interest rates

Fixed or variable

Minimum credit score

Does not disclose

Minimum income

Does not disclose

Loan terms

5, 8, 10, or 15 years for most borrowers (law, dental, medical, and other health profession students have up to 20 years)

Loan amounts

$1,000 minimum up to your school’s annual cost of attendance; lifetime limits depend on your degree and credit profile

Cosigner release

Available after more than half of the scheduled repayment period has elapsed and other requirements are met

Eligibility

Must be a U.S. citizen or permanent resident at an eligible institution. International students with a Social Security number and a qualified cosigner may also qualify. Applicants who can’t meet financial, credit, or other requirements may qualify with a cosigner.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

2.85% - 15.61%

$1,000 up to $225,000 (aggregate $225,000 limit)

Does not disclose

Overview

Custom Choice is a student loan lender that offers loans ranging from $1,000 to $225,000 per year. Undergraduates and grad students can borrow up to a lifetime limit of $225,000.

You can get a 0.25% autopay discount, a 0.25% on-time payment discount, plus a 2% principal reduction for graduating with at least a bachelor’s degree. You may apply with a cosigner if you can't qualify on your own, and you can release them after making 12 consecutive on-time principal and interest payments.

Custom Choice doesn't charge any fees whatsoever, even late fees. The lender also offers a forbearance program that lets you pause payments if you experience a natural disaster or unemployment.

pros

- Multiyear approval lets you secure funding for future school years

- You can reduce your rate by 0.5 percentage points with autopay and loyalty discounts

- Cosigner release available upon entering principal and interest repayment

- Offers parent student loans

cons

- No mobile app for managing student loans

- Does not offer refinancing options for existing student loans

Interest rates

Fixed or variable

Minimum credit score

Does not disclose

Minimum income

Does not disclose

Loan terms

5, 7, 10, 15, or 20 years

Loan amounts

$1,000 to $225,000 per year (lifetime limit of $225,000)

Cosigner release

After making 12 consecutive on-time principal and interest payments

Eligibility

Available to borrowers in all states except West Virginia. The student must be a U.S. citizen or permanent resident alien, and must be the legal age of majority at the time of application or at least 17 years of age if applying with a cosigner who meets the age of majority requirements in the cosigner's state of residence. Eligible noncitizens, such as international students and DACA residents, can also qualify by applying with a cosigner who’s a U.S. citizen or permanent resident.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

2.89% - 17.49%

$1,000 up to 100% of school-certified cost of attendance

Does not disclose

Overview

Sallie Mae offers the Smart Option Student Loan for undergraduate students and a suite of loans for graduate students. You can borrow up to your school-certified cost of attendance and apply just once annually to get the funds you need for the entire academic year. Plus, applying for a Smart Option Student Loan with a cosigner may help you get a better rate.

Through Sallie Mae, you can find a variety of loans designed for specific needs, including loans for MBA programs, law school, medical school, and health profession programs.

pros

- Can borrow up to school-certified cost of attendance

- No prepayment or origination fees

- Loans available to noncitizens with an eligible cosigner

- Cosigner release after 12 on-time payments

cons

- No parent loan options

- Does not offer student loan refinancing

- Loan terms not disclosed until after you apply

Interest rates

Fixed or variable

Minimum credit score

Does not disclose

Minimum income

Does not disclose

Loan terms

10 to 15 years for the Smart Option Student Loan; 15 years for law school, MBA, and graduate school loans; 20 years for medical school loans

Loan amounts

$1,000 up to school-certified cost of attendance. Student must be listed as the borrower, and a parent may cosign.

Cosigner release

After you graduate, make 12 one-time principal and interest payments, and meet certain credit requirements

Eligibility

Must be a U.S. citizen or permanent resident enrolled in an eligible program. Noncitizens residing and attending school in the U.S. may qualify by applying with a creditworthy cosigner, who must be a U.S. citizen or permanent resident, and providing an unexpired government-issued photo ID.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

2.99% - 12.85%

$1,000 up to cost of attendance

680

Overview

ELFI a division of Tennessee-based SouthEast Bank, offers private student loans and refinancing for undergraduates, graduates, and parents. Borrowers can take out loans starting at $1,000, with options up to the full cost of attendance at their school.

ELFI student loans are available to students nationwide who are enrolled in a bachelor's degree program or higher. Borrowers can choose from multiple repayment terms and benefit from competitive interest rates and support from a dedicated Student Loan Advisor. However, ELFI doesn't offer cosigner release or rate discounts, which may limit flexibility for some borrowers.

pros

- Receive support from a dedicated Student Loan Advisor

- Transparent credit and income requirements

- Doesn't require full-time enrollment

- Flexible repayment terms

cons

- Must be enrolled in a bachelor’s degree program or higher

- Cosigners can’t be released from the loan

- No autopay rate discounts available

Interest rates

Fixed or variable

Minimum credit score

680

Minimum income

$35,000

Loan terms

5, 7, 10, or 15 years

Loan amounts

$1,000 - Cost of attendance

Cosigner release

A cosigner may not be taken off a loan, but the borrower can apply for a new loan without their cosigner.

Eligibility

All 50 states as well as Washington DC and Puerto Rico.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

3.24% - 13.37%

$1,000 up to 100% of the school-certified cost of attendance

640

Overview

Citizens Bank offers private student loans for undergraduate and graduate students, as well as parents. With its multiyear approval option, you can apply for a loan once, and as long as you qualify, you won't need to reapply each year. This means you can secure loans for future academic years without multiple hard credit checks.

Citizens borrowers can also take advantage of interest rate discounts. If you or your cosigner has an account with Citizens Bank, you can reduce your rate by 0.25 percentage points. Another 0.25 percentage points can be shaved off by enrolling in automatic payments, giving you the chance to lower your rate by up to 0.5 percentage points.

pros

- Multiyear approval lets you secure funding for future school years

- You can reduce your rate by 0.5 percentage points with autopay and loyalty discounts

- International students can apply with a qualified cosigner

- Cosigner release available after starting full principal and interest repayment

cons

- Fewer repayment terms to choose from than some other lenders

- Parents can’t defer payments while student is in school

- Must be enrolled at least half-time in a degree-granting program

Interest rates

Fixed or variable

Minimum credit score

640

Minimum income

Does not disclose

Loan terms

5, 10, or 15 years for student loans; 5 or 10 years for parent loans

Loan amounts

Minimum $1,000, up to 100% of the school-certified cost of attendance

Cosigner release

After starting full principal and interest repayment

Eligibility

Must be a U.S. citizen or permanent resident enrolled at least half-time in a degree-granting program at an eligible institution. International students can apply with a cosigner who’s a U.S. citizen or permanent resident.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

3.29% - 8.89%

$1,500 up to school’s certified cost of attendance less aid

670

Overview

Massachusetts Educational Financing Authority (MEFA) offers student loans to borrowers with good credit. However, you won't be able to see your potential rate before applying.

The lender doesn't charge any fees and its rates are competitive, though MEFA only offers two repayment terms. You can add a cosigner to your loan if you're unable to qualify, but only one repayment plan allows you to release your cosigner.

pros

- Doesn’t charge any fees

- Low maximum rate compared with some lenders

- Can borrow up to the school-certified cost of attendance

cons

- No discounts for borrowers

- Limited repayment terms

- No prequalification available

Interest rates

Fixed

Minimum credit score

Does not disclose

Minimum income

Does not disclose

Loan terms

10 or 15 years

Loan amounts

$1,500 minimum up to school-certified cost of attendance

Cosigner release

48 months

Eligibility

Must be a U.S. citizen or permanent resident, enrolled at least half time at a degree-granting, nonprofit institution, and must maintain satisfactory academic progress. Must have no history of default on an education loan and no history of bankruptcy or foreclosure in the past 60 months. Applicants who can’t meet the minimum credit and income requirements may apply with a cosigner.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

- 1

$1,000 to $100,000

Does not disclose

Overview

SoFi offers fixed- and variable-rate student loans to help undergraduate, graduate, and professional students and parents of students finance their education. These loans can cover up to the total cost of attendance, with a minimum loan of $1,000. Students must be enrolled at least half-time in a degree-seeking or graduate-certificate program at an eligible school and a U.S. citizen, permanent resident, or non-permanent resident alien.

SoFi has multiple repayment plans, allowing students to pick terms that best fit their financial situations, with cosigner release after 12 months of consecutive on-time payments. Borrowers have the option to reduce rates by 0.25% when enrolling in automatic payments. They can also qualify for a 0.125% interest rate discount on subsequent loans with SoFi's Continuing Scholar Discount. Plus, a $250 cash bonus with a 3.0 GPA or higher for full-year loans or $100 cash back for single-semester loans.

pros

- Top customer service ratings

- Valuable member benefits

- No fees

- Cosigner release after 12 months of on-time payments

cons

- No disclosed credit or income requirements

- Shorter repayment terms than some lenders

Interest rates

Variable or fixed

Minimum credit score

Does not disclose

Minimum income

Does not disclose

Loan terms

5, 7, 10, or 15 years

Loan amounts

$1,000 minimum up to your school’s annual cost of attendance

Cosigner release

After 12 months

Eligibility

Must be a U.S. citizen or DACA student enrolled at least half-time at an eligible institution. International students with a qualified cosigner may also qualify. Applicants who can’t meet financial, credit, or other requirements may be eligible with a cosigner.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

-

$1,000 to $500,000

Mid to high 600’s FICO

Overview

Nelnet Bank (Member FDIC) provides private student loans at competitive rates for undergraduate, graduate, and health professional degrees. You'll need a FICO credit score in the mid to high 600s to qualify. Borrowers with bad credit can apply with a cosigner, which may help them qualify and could reduce their interest rate.

Cosigners on Nelnet student loans can be released after 24 consecutive on-time payments (see disclaimer). You can also get a 0.25% interest rate reduction when you sign up for automatic payments (see disclaimer). There are no loan origination or application fees, but Nelnet does charge fees for late payments of insufficient funds.

pros

- Rates are competitive for borrowers or cosigners with strong credit

- Rate discount of 0.25 percentage points for autopay

- Cosigners can be released after 24 on-time payments

- Offers deferment and payment assistance programs

cons

- Charges fees for late payment and insufficient funds

- Doesn’t guarantee deferment and forbearance options

Interest rates

Fixed or variable

Minimum credit score

Mid-to-high 600s

Minimum income

Does not disclose

Loan terms

5,10,15* (IO, Deferred, Immediate)

Loan amounts

$1,000 to $125,000 for undergraduate, $1,000 to $175,000 for graduate, $1,000 to $500,000 for graduate health professions

Cosigner release

After 24 months

Eligibility

All states and US Territories

*Loan Terms Details

See disclaimer

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

4.34% - 8.43%

$1,001 up to 100% of school certified cost of attendance

670

Overview

INvested is an Indiana company that offers affordable student loans exclusively to state residents. Loans are available to Indiana students and parents who can meet income and credit requirements, or who have an eligible cosigner. Borrowers can borrow as little as $1,001 or as much as the school-certified cost of attendance minus other aid.

INvested provides detailed information on eligibility so borrowers can quickly determine whether to apply for a loan — however, there’s no option to prequalify with a soft credit check. Cosigner release is also available after just 12 on-time payments, considerably shorter than many other lenders.

pros

- Low minimum borrowing limits

- Autopay discount of 0.25 percentage points

- Short cosigner release requirements

- Transparent qualification requirements

cons

- Loans are available only to Indiana residents

- No prequalification option to view your rates

- No loan options for international students

Interest rates

Fixed or variable

Minimum credit score

670

Minimum income

Does not disclose

Loan terms

5, 10, or 15 years

Loan amounts

$1,001 minimum, up to the school certified cost of attendance

Cosigner release

12 months

Eligibility

Loans are available to Indiana residents only. Borrowers must have a FICO score of 670 or higher, a 30% maximum debt-to-income ratio or minimum monthly income of $3,333, continuous employment over two years, and no major collections or defaults in recent years. Borrowers who do not meet income or credit requirements can apply with a cosigner.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

Fixed (APR)

2.69% - 15.26%

Loan Amounts

$2,001 to $400,000

Min. Credit Score

Does not disclose

Overview

While Ascent provides traditional student loans for undergraduate, graduate, and medical programs, it also stands out with some options that are uncommon among private student loan lenders. For example, its Outcomes-Based Loan, which doesn't require established credit or a cosigner, is available to juniors and seniors. When assessing your application, Ascent considers factors including your school, major, and GPA to determine if you're eligible.

Ascent also offers its Progressive Repayment plan to qualified borrowers. It allows you to begin with smaller payments at the start of the repayment term and then gradually pay more each month over time. If you borrow with a cosigner, they can be released after you make as few as 12 monthly payments. However, cosigners on loans for international students do not qualify.

pros

- Doesn’t charge application fees or origination fees

- Offers discounts of 0.50 to 1 percentage points when making automatic payments

- Can get a 1% cash-back reward after you graduate

- Grace periods from 9 to 36 months

cons

- May find lower interest rates with some competitors

- International students don’t have option to release cosigners

Interest rates

Fixed or variable

Minimum credit score

Does not disclose

Minimum income

$30,000 for most loans

Loan terms

5, 7, 10, 12, 15, or 20 years

Loan amounts

$2,001 minimum up to your school’s annual cost of attendance; lifetime limits of $200,000 for undergrads and $400,000 for graduates

Cosigner release

12 months

Eligibility

Must be a U.S. citizen or DACA student enrolled at least half time at an eligible institution. International students with a qualified cosigner may also qualify. Applicants who can’t meet financial, credit, or other requirements may qualify with a cosigner.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

Fixed (APR)

2.84% - 17.99%

Loan Amounts

$1,000 up to 100% of the school-certified cost of attendance

Min. Credit Score

Does not disclose

Overview

College Ave offers student loans for almost every type of degree program, with a range of repayment options, including a unique 8-year repayment term. Additionally, you can get extended grace periods of as long as 36 months on graduate, dental, and medical student loans.

About 90% of undergraduates applying with a cosigner are approved for additional student loans. However, you must complete at least half of your repayment term before you can remove a cosigner for your loan. Some lenders allow cosigners to be released much sooner, after as few as 1 to 2 years of payments.

pros

- Rate discount of one-quarter of a percentage point for using autopay

- Does not charge origination or application fees

- Grace periods between 9 and 36 months for graduate, MBA, law, dental, and medical school loans

cons

- Parent borrowers are required to pay at least the interest while the student is in school

- Cosigners not eligible for release until at least half the repayment term of the loan is completed

Interest rates

Fixed or variable

Minimum credit score

Does not disclose

Minimum income

Does not disclose

Loan terms

5, 8, 10, or 15 years for most borrowers (law, dental, medical, and other health profession students have up to 20 years)

Loan amounts

$1,000 minimum up to your school’s annual cost of attendance; lifetime limits depend on your degree and credit profile

Cosigner release

Available after more than half of the scheduled repayment period has elapsed and other requirements are met

Eligibility

Must be a U.S. citizen or permanent resident at an eligible institution. International students with a Social Security number and a qualified cosigner may also qualify. Applicants who can’t meet financial, credit, or other requirements may qualify with a cosigner.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

Fixed (APR)

2.85% - 15.61%

Loan Amounts

$1,000 up to $225,000 (aggregate $225,000 limit)

Min. Credit Score

Does not disclose

Overview

Custom Choice is a student loan lender that offers loans ranging from $1,000 to $225,000 per year. Undergraduates and grad students can borrow up to a lifetime limit of $225,000.

You can get a 0.25% autopay discount, a 0.25% on-time payment discount, plus a 2% principal reduction for graduating with at least a bachelor’s degree. You may apply with a cosigner if you can't qualify on your own, and you can release them after making 12 consecutive on-time principal and interest payments.

Custom Choice doesn't charge any fees whatsoever, even late fees. The lender also offers a forbearance program that lets you pause payments if you experience a natural disaster or unemployment.

pros

- Multiyear approval lets you secure funding for future school years

- You can reduce your rate by 0.5 percentage points with autopay and loyalty discounts

- Cosigner release available upon entering principal and interest repayment

- Offers parent student loans

cons

- No mobile app for managing student loans

- Does not offer refinancing options for existing student loans

Interest rates

Fixed or variable

Minimum credit score

Does not disclose

Minimum income

Does not disclose

Loan terms

5, 7, 10, 15, or 20 years

Loan amounts

$1,000 to $225,000 per year (lifetime limit of $225,000)

Cosigner release

After making 12 consecutive on-time principal and interest payments

Eligibility

Available to borrowers in all states except West Virginia. The student must be a U.S. citizen or permanent resident alien, and must be the legal age of majority at the time of application or at least 17 years of age if applying with a cosigner who meets the age of majority requirements in the cosigner's state of residence. Eligible noncitizens, such as international students and DACA residents, can also qualify by applying with a cosigner who’s a U.S. citizen or permanent resident.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

Fixed (APR)

2.89% - 17.49%

Loan Amounts

$1,000 up to 100% of school-certified cost of attendance

Min. Credit Score

Does not disclose

Overview

Sallie Mae offers the Smart Option Student Loan for undergraduate students and a suite of loans for graduate students. You can borrow up to your school-certified cost of attendance and apply just once annually to get the funds you need for the entire academic year. Plus, applying for a Smart Option Student Loan with a cosigner may help you get a better rate.

Through Sallie Mae, you can find a variety of loans designed for specific needs, including loans for MBA programs, law school, medical school, and health profession programs.

pros

- Can borrow up to school-certified cost of attendance

- No prepayment or origination fees

- Loans available to noncitizens with an eligible cosigner

- Cosigner release after 12 on-time payments

cons

- No parent loan options

- Does not offer student loan refinancing

- Loan terms not disclosed until after you apply

Interest rates

Fixed or variable

Minimum credit score

Does not disclose

Minimum income

Does not disclose

Loan terms

10 to 15 years for the Smart Option Student Loan; 15 years for law school, MBA, and graduate school loans; 20 years for medical school loans

Loan amounts

$1,000 up to school-certified cost of attendance. Student must be listed as the borrower, and a parent may cosign.

Cosigner release

After you graduate, make 12 one-time principal and interest payments, and meet certain credit requirements

Eligibility

Must be a U.S. citizen or permanent resident enrolled in an eligible program. Noncitizens residing and attending school in the U.S. may qualify by applying with a creditworthy cosigner, who must be a U.S. citizen or permanent resident, and providing an unexpired government-issued photo ID.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

Fixed (APR)

2.99% - 12.85%

Loan Amounts

$1,000 up to cost of attendance

Min. Credit Score

680

Overview

ELFI a division of Tennessee-based SouthEast Bank, offers private student loans and refinancing for undergraduates, graduates, and parents. Borrowers can take out loans starting at $1,000, with options up to the full cost of attendance at their school.

ELFI student loans are available to students nationwide who are enrolled in a bachelor's degree program or higher. Borrowers can choose from multiple repayment terms and benefit from competitive interest rates and support from a dedicated Student Loan Advisor. However, ELFI doesn't offer cosigner release or rate discounts, which may limit flexibility for some borrowers.

pros

- Receive support from a dedicated Student Loan Advisor

- Transparent credit and income requirements

- Doesn't require full-time enrollment

- Flexible repayment terms

cons

- Must be enrolled in a bachelor’s degree program or higher

- Cosigners can’t be released from the loan

- No autopay rate discounts available

Interest rates

Fixed or variable

Minimum credit score

680

Minimum income

$35,000

Loan terms

5, 7, 10, or 15 years

Loan amounts

$1,000 - Cost of attendance

Cosigner release

A cosigner may not be taken off a loan, but the borrower can apply for a new loan without their cosigner.

Eligibility

All 50 states as well as Washington DC and Puerto Rico.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

Fixed (APR)

3.24% - 13.37%

Loan Amounts

$1,000 up to 100% of the school-certified cost of attendance

Min. Credit Score

640

Overview

Citizens Bank offers private student loans for undergraduate and graduate students, as well as parents. With its multiyear approval option, you can apply for a loan once, and as long as you qualify, you won't need to reapply each year. This means you can secure loans for future academic years without multiple hard credit checks.

Citizens borrowers can also take advantage of interest rate discounts. If you or your cosigner has an account with Citizens Bank, you can reduce your rate by 0.25 percentage points. Another 0.25 percentage points can be shaved off by enrolling in automatic payments, giving you the chance to lower your rate by up to 0.5 percentage points.

pros

- Multiyear approval lets you secure funding for future school years

- You can reduce your rate by 0.5 percentage points with autopay and loyalty discounts

- International students can apply with a qualified cosigner

- Cosigner release available after starting full principal and interest repayment

cons

- Fewer repayment terms to choose from than some other lenders

- Parents can’t defer payments while student is in school

- Must be enrolled at least half-time in a degree-granting program

Interest rates

Fixed or variable

Minimum credit score

640

Minimum income

Does not disclose

Loan terms

5, 10, or 15 years for student loans; 5 or 10 years for parent loans

Loan amounts

Minimum $1,000, up to 100% of the school-certified cost of attendance

Cosigner release

After starting full principal and interest repayment

Eligibility

Must be a U.S. citizen or permanent resident enrolled at least half-time in a degree-granting program at an eligible institution. International students can apply with a cosigner who’s a U.S. citizen or permanent resident.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

Fixed (APR)

3.29% - 8.89%

Loan Amounts

$1,500 up to school’s certified cost of attendance less aid

Min. Credit Score

670

Overview

Massachusetts Educational Financing Authority (MEFA) offers student loans to borrowers with good credit. However, you won't be able to see your potential rate before applying.

The lender doesn't charge any fees and its rates are competitive, though MEFA only offers two repayment terms. You can add a cosigner to your loan if you're unable to qualify, but only one repayment plan allows you to release your cosigner.

pros

- Doesn’t charge any fees

- Low maximum rate compared with some lenders

- Can borrow up to the school-certified cost of attendance

cons

- No discounts for borrowers

- Limited repayment terms

- No prequalification available

Interest rates

Fixed

Minimum credit score

Does not disclose

Minimum income

Does not disclose

Loan terms

10 or 15 years

Loan amounts

$1,500 minimum up to school-certified cost of attendance

Cosigner release

48 months

Eligibility

Must be a U.S. citizen or permanent resident, enrolled at least half time at a degree-granting, nonprofit institution, and must maintain satisfactory academic progress. Must have no history of default on an education loan and no history of bankruptcy or foreclosure in the past 60 months. Applicants who can’t meet the minimum credit and income requirements may apply with a cosigner.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

Fixed (APR)

- 1

Loan Amounts

$1,000 to $100,0001

Min. Credit Score

Does not disclose1

Overview

SoFi offers fixed- and variable-rate student loans to help undergraduate, graduate, and professional students and parents of students finance their education. These loans can cover up to the total cost of attendance, with a minimum loan of $1,000. Students must be enrolled at least half-time in a degree-seeking or graduate-certificate program at an eligible school and a U.S. citizen, permanent resident, or non-permanent resident alien.

SoFi has multiple repayment plans, allowing students to pick terms that best fit their financial situations, with cosigner release after 12 months of consecutive on-time payments. Borrowers have the option to reduce rates by 0.25% when enrolling in automatic payments. They can also qualify for a 0.125% interest rate discount on subsequent loans with SoFi's Continuing Scholar Discount. Plus, a $250 cash bonus with a 3.0 GPA or higher for full-year loans or $100 cash back for single-semester loans.

pros

- Top customer service ratings

- Valuable member benefits

- No fees

- Cosigner release after 12 months of on-time payments

cons

- No disclosed credit or income requirements

- Shorter repayment terms than some lenders

Interest rates

Variable or fixed

Minimum credit score

Does not disclose

Minimum income

Does not disclose

Loan terms

5, 7, 10, or 15 years

Loan amounts

$1,000 minimum up to your school’s annual cost of attendance

Cosigner release

After 12 months

Eligibility

Must be a U.S. citizen or DACA student enrolled at least half-time at an eligible institution. International students with a qualified cosigner may also qualify. Applicants who can’t meet financial, credit, or other requirements may be eligible with a cosigner.

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

Fixed (APR)

-

Loan Amounts

$1,000 to $500,000

Min. Credit Score

Mid to high 600’s FICO

Overview

Nelnet Bank (Member FDIC) provides private student loans at competitive rates for undergraduate, graduate, and health professional degrees. You'll need a FICO credit score in the mid to high 600s to qualify. Borrowers with bad credit can apply with a cosigner, which may help them qualify and could reduce their interest rate.

Cosigners on Nelnet student loans can be released after 24 consecutive on-time payments (see disclaimer). You can also get a 0.25% interest rate reduction when you sign up for automatic payments (see disclaimer). There are no loan origination or application fees, but Nelnet does charge fees for late payments of insufficient funds.

pros

- Rates are competitive for borrowers or cosigners with strong credit

- Rate discount of 0.25 percentage points for autopay

- Cosigners can be released after 24 on-time payments

- Offers deferment and payment assistance programs

cons

- Charges fees for late payment and insufficient funds

- Doesn’t guarantee deferment and forbearance options

Interest rates

Fixed or variable

Minimum credit score

Mid-to-high 600s

Minimum income

Does not disclose

Loan terms

5,10,15* (IO, Deferred, Immediate)

Loan amounts

$1,000 to $125,000 for undergraduate, $1,000 to $175,000 for graduate, $1,000 to $500,000 for graduate health professions

Cosigner release

After 24 months

Eligibility

All states and US Territories

*Loan Terms Details

See disclaimer

Credible rating

To determine the best student loan companies, Credible evaluated lenders based on several different categories, including: rates and fees, loan terms, eligibility, repayment options, and customer support. We assigned a score out of five stars to each lender based on our findings.

Read our full methodology.

Fixed (APR)

4.34% - 8.43%

Loan Amounts

$1,001 up to 100% of school certified cost of attendance

Min. Credit Score

670

Overview

INvested is an Indiana company that offers affordable student loans exclusively to state residents. Loans are available to Indiana students and parents who can meet income and credit requirements, or who have an eligible cosigner. Borrowers can borrow as little as $1,001 or as much as the school-certified cost of attendance minus other aid.

INvested provides detailed information on eligibility so borrowers can quickly determine whether to apply for a loan — however, there’s no option to prequalify with a soft credit check. Cosigner release is also available after just 12 on-time payments, considerably shorter than many other lenders.

pros

- Low minimum borrowing limits

- Autopay discount of 0.25 percentage points

- Short cosigner release requirements

- Transparent qualification requirements

cons

- Loans are available only to Indiana residents

- No prequalification option to view your rates

- No loan options for international students

Interest rates

Fixed or variable

Minimum credit score

670

Minimum income

Does not disclose

Loan terms

5, 10, or 15 years

Loan amounts

$1,001 minimum, up to the school certified cost of attendance

Cosigner release

12 months

Eligibility

Loans are available to Indiana residents only. Borrowers must have a FICO score of 670 or higher, a 30% maximum debt-to-income ratio or minimum monthly income of $3,333, continuous employment over two years, and no major collections or defaults in recent years. Borrowers who do not meet income or credit requirements can apply with a cosigner.

Jacqueline DeMarco has spent over seven years covering personal finance and is an expert on credit cards, budgeting, banking, student loans, and insurance. Her work has been featured at The Balance, Student Loan Hero, NerdWallet, and the New York Post.