A mortgage comes with many costs, both upfront and over time. Your repayment term, interest rate, closing costs, and other factors determine how much you’ll pay over the life of the loan. For a $350,000, these costs can add up, especially if you have a higher interest rate. If you have a 30-year mortgage, a 6% interest rate would give you a $2,098.43 monthly payment while an 8% interest rate would make your payment $2,568.18.

However, your interest rate isn’t the only factor you should consider. If you’re weighing a loan of this size, use this guide to understand both the monthly and long-term costs you can expect as a borrower.

Monthly payments for a $350,000 mortgage

Monthly mortgage payments contain principal and interest. In some cases, they might include other costs as well.

Here’s what typically makes up a mortgage payment:

- Principal: This money is applied straight to your loan balance.

- Interest: This is the cost of borrowing money. How much you’ll pay is indicated by your interest rate.

- Escrow costs: If you opt to use an escrow account (or your lender requires it), you’ll also have your property taxes, mortgage insurance, and homeowners insurance rolled into your monthly mortgage payment, too.

On a $350,000, 30-year mortgage with a 6% annual percentage rate (APR), you can expect a monthly payment of $2,098.43, not including taxes and interest (these vary by location and property, so they can’t be calculated without more detail).

The payment would jump to $2,953.50 for a 15-year loan. Use our mortgage payment calculator and the table below to see what your home will cost you every month.

Here’s a quick look at what the monthly principal and interest payment would be for a $350,000 mortgage with varying interest rates:

6.00% | ||

6.25% | ||

6.50% | ||

6.75% | ||

7.00% | ||

7.25% | ||

7.50% | ||

7.75% | ||

8.00% |

Where to get a $350,000 mortgage

You can get a $350,000 conventional mortgage from most banks, credit unions, and mortgage lenders. Rates and terms vary by lender, so you should get quotes from multiple lenders to be sure you’re getting the best deal.

To do this, you can contact each lender individually, fill out an application, and wait for a quote.

Expert tip:

“If you’re working with a real estate agent or loan officer, they can help you along the way. An agent can help you find the right home and negotiate a deal; a loan officer will be your main contact through closing.” — Valerie Morris, Editor, Mortgages

What to consider before applying for a $350,000 mortgage

Before taking out a $350,000 mortgage loan, you should consider how it fits into your overall budget and financial goals. Take into account the housing market where you plan to buy, too. If there are more buyers than there are homes for sale, shopping for a home can be competitive and sale prices can increase. In March 2025, the median sale price for a home was $383,750, a 3% increase from a year earlier, according to data compiled from Redfin.

In addition to home prices in your market, you’ll also need to budget for upfront costs, origination fees and long-term interest expenses.

Make sure you understand these fully before you apply for a mortgage of this size.

Total interest paid on a $350,000 mortgage

You’ll pay more in interest the longer your loan term is. Common mortgage terms are 10, 15, 20, or 30 years, but you may find some lenders that offer different repayment options.

For example:

On a 30-year, $350,000 loan with a 6% APR, your total interest cost would be $405,433.66. If you took out a 15-year loan at those same terms, your interest would total $181,629.80.

Because your rate can influence the total cost of your loan, it’s important to compare lender options.

Amortization schedule on a $350,000 mortgage

An amortization schedule breaks down your payments, interest costs, and principal balance for every year of the loan.

Here’s an example of what one might look like for a $350,000, 30-year mortgage loan with a 6% APR:

Here’s what an amortization schedule might look like for a 15-year, $350,000 mortgage with a 6% APR:

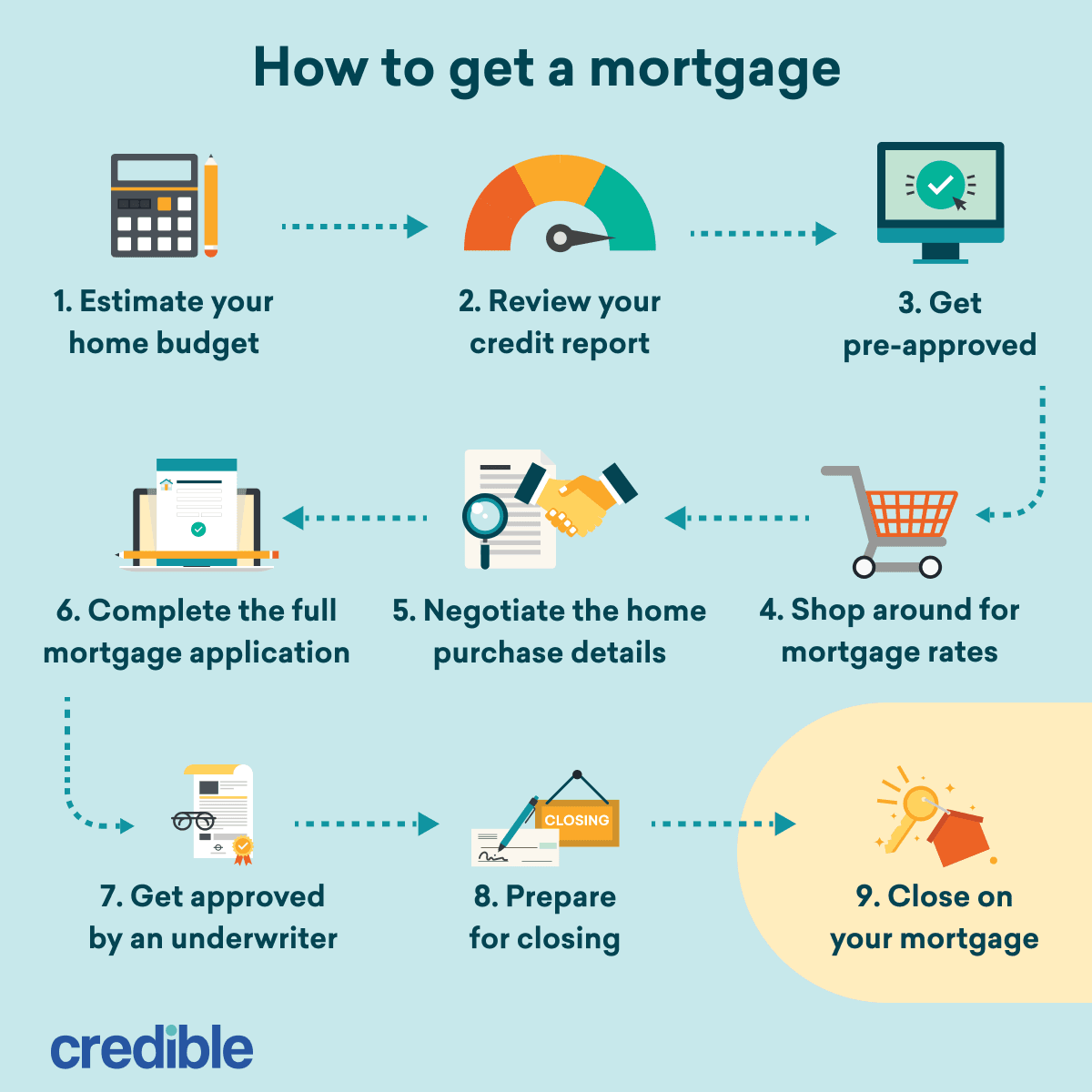

How to get a $350,000 mortgage

When filling out your mortgage application, you’ll want to have some financial details on hand, including your income, estimated credit score, homebuying budget, and documentation of your assets and savings.

Follow these steps to apply for a mortgage

- Estimate your homebuying budget: Before starting your home search, take a look at your income, monthly debts, and household expenses. You’ll need to determine what you can afford both for a down payment and your monthly mortgage payment.

- Review your credit report: Pull your credit report and look for any overdue accounts, late payments, or accounts in collections. These could all hurt your mortgage application. You’ll also want to look at your credit score. The higher your score, the better the interest rate you’ll qualify for.

- Get pre-approved: A pre-approval will give you a good idea of what you’ll be eligible to borrow and what price range you should be shopping in. It also helps show sellers that you have financing lined up.

- Shop around for mortgage rates: The lenders that pre-approved you will give you loan estimates. Look at the interest rate on each loan estimate, as well as the closing costs, fees, and total cash to close, too. Make sure you compare APRs, which account for the interest rate and additional fees.

- Negotiate the purchase details: Use your pre-approval letters to make any offers you submit more attractive. Once a seller accepts, you’re one step closer to owning a home.

- Complete the full application: Fill out the full application for the mortgage lender you’ve chosen. You’ll likely need to submit recent financial documents, including W-2s, pay stubs, tax returns, bank account statements, and more. Your loan officer will direct you on what paperwork to submit.

- Get approved by an underwriter: Your lender’s underwriter will verify all your information and ensure you can afford the monthly payments for the loan. Once approved, you’ll be scheduled for a closing appointment.

- Prepare for closing: While you await your closing date, you’ll need to secure a homeowners insurance policy. You should also review your final closing disclosure form to understand how much cash to bring to closing.

- Close on your mortgage: Attend your closing appointment, pay your closing costs and down payment, and sign the final paperwork. Once the funds have been transferred, you’ll be a bona fide homeowner.

Monthly payments by mortgage amount

Mortgage calculators

FAQ

Can I afford a $350,000 mortgage with a $100,000 salary?

Open

What is the down payment for a $350,000 home?

Open

What credit score do I need to qualify for a $350,000 mortgage?

Open