Credible takeaways

- You can use federal financial aid to help cover both on-campus and off-campus housing costs.

- Your housing choice — on-campus, off-campus, or living with parents — can affect how much aid you receive.

- FAFSA-based aid doesn't guarantee full coverage, and your award might not cover all your college costs.

- To maximize your financial aid amount, submit the FAFSA as early as possible each year.

College costs involve far more than just tuition, and some of those other expenses can be substantial. Housing is one of the biggest expenses, with average on-campus room and board totaling $13,310 at public four-year colleges in 2024-25, according to the College Board.

Thankfully, you can get financial aid for housing through FAFSA, and you have a few other options to help with the costs, too.

Current student loan rates

How FAFSA covers housing costs

Financial aid covers your school's cost of attendance, which could include both on- and off-campus housing. But there are limits to how much aid you can receive, and your award might be enough to cover all your college expenses.

To apply, you'll need to submit the Free Application for Federal Student Aid (FAFSA). The Department of Education uses the FAFSA information to calculate your Student Aid Index (SAI), which is a number used by schools to determine how much aid you're eligible for each year.

After you submit the FAFSA, the school will send you a financial aid award letter. This letter will detail the financial aid you qualify for, including:

- Federal college grants

- Federal student loans

- School-specific awards, such as college scholarships

How much financial aid can I get?

Generally, the fewer assets you or your family have, the more financial aid you might be eligible for. This will also depend on whether you're an independent or a dependent student.

For example, if you're a dependent student and your parents used a 529 plan to save for your education, you might receive less financial aid. Or if you're an independent student with no assets, you might be eligible for more.

Editor insight: “I recommend submitting the FAFSA as early as possible, especially if you have high financial need. Some federal financial aid is awarded on a first-come, first-served basis, so applying early can increase your chances of receiving the full amount you're eligible for.”

— Richard Richtmyer, Senior Student Loans Editor, Credible

Average cost of housing on campus

The cost of college and living on campus varies widely depending on your school and area.

For example, for the 2025-26 school year, you'll pay as much as $13,660 for on-campus housing at Northern Michigan University (a public university) and as much as $15,136 at Carnegie Mellon University (a private university).

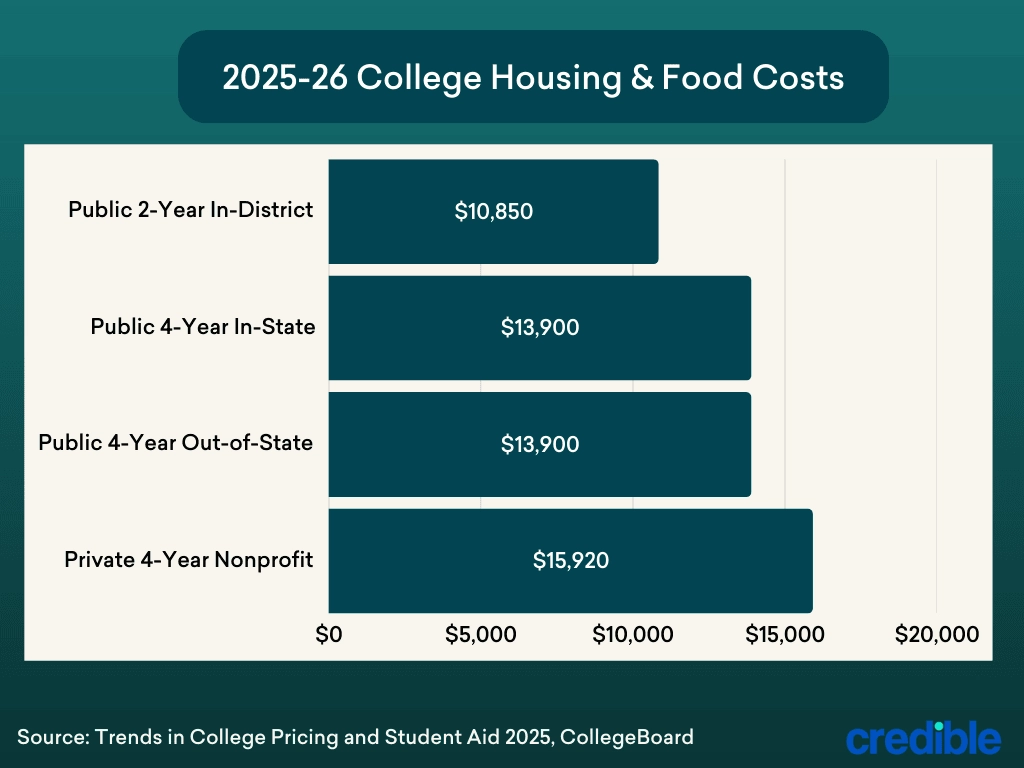

Here's a look at average room and board costs for full-time undergraduate students in 2025-26, based on the type of college you attend:

Every school publishes its own cost of attendance, estimating how much it will likely cost you to attend. This generally includes:

- Tuition and fees

- Room and board

- School supplies, such as college textbooks

- Transportation

Save money by living off campus

You have the option to live off campus, usually after completing your freshman year, which could be less expensive than on-campus housing, depending on the type of housing you choose and whether you'll have roommates, as well as the geographical location. If you decide to go this route, your school will use the financial aid you're awarded to first cover tuition and fees before releasing any leftover funds to you. Then, this leftover money can go towards paying for your off-campus rent.

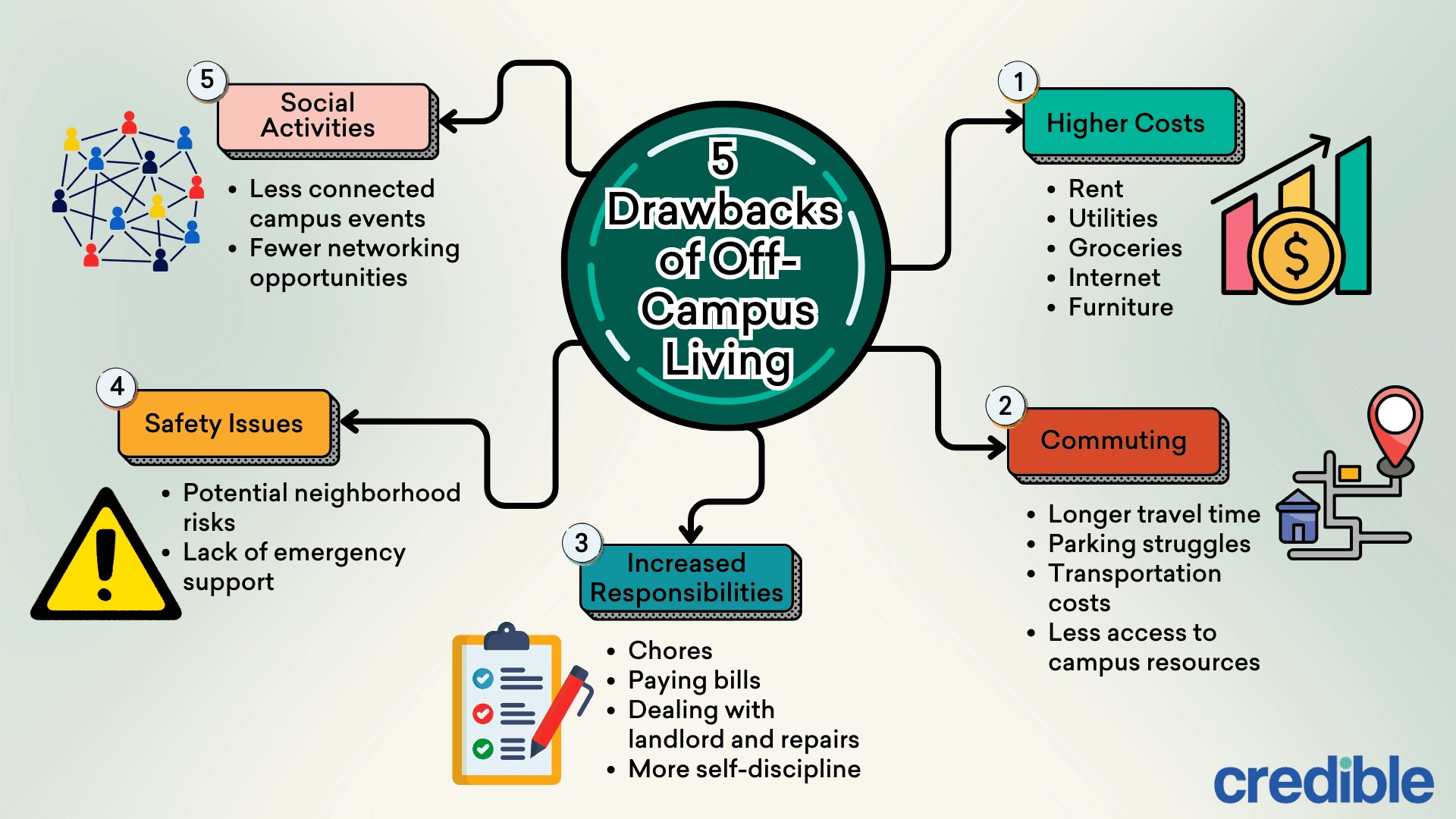

When you're deciding between on-campus versus off-campus housing, keep in mind, living off campus comes with its own drawbacks. These include:

- Higher costs: Rent, utilities, internet, and groceries can add up quickly. Plus, off-campus housing often requires you to furnish the place.

- Commuting: Now that you don't live on campus, getting to classes, the library, or events can take longer than walking from a dorm. And finding affordable and reliable parking near campus may be a hassle - and costly. You also aren't as close to dining halls, study lounges, or recreational facilities.

- Increased responsibilities: You're now responsible for cooking, cleaning, and maintaining your space, not to mention paying your bills on time. Plus, dealing with leases, repairs, or difficult landlords can be stressful.

- Safety issues: Safety can be a greater concern if you live off campus. On-campus housing often has security staff available to help keep you safe.

- Social activities: Living off campus can make it harder to participate spontaneously in campus events or late-night study sessions. You may miss out on the built-in social environment of dorm living.

Keep in mind

Some schools’ cost estimations are more detailed than others. For example, one school might publish different costs based on your living situation (such as on or off campus) while another won’t.

Check Out: When To Apply for Student Loans

How FAFSA affects your housing plans

When you fill out the FAFSA, you'll need to indicate your housing plan for each school you list: on-campus, off-campus, or with parents. This helps schools estimate your cost of attendance and determine your total financial aid package. The housing option you choose can impact how much aid you receive at the school you end up attending.

Use private student loans to fill the gaps

If you’ve exhausted your financial aid and federal student loan options, private student loans could help fill any gaps. You might be able to borrow more in private student loans than in federal student loans, typically up to the cost of attendance.

But remember to borrow only what you need to keep your future costs low — especially since these loans aren’t eligible for federal repayment assistance like loan forgiveness.

Keep in mind, unlike federal student loans that come with strict application deadlines, a big advantage of private student loans is that you can take them out at any point during the semester. It’s also a good idea to apply as soon as you know you need the loan funds.

FAQ

Is housing included in FAFSA?

Open

Can I use FAFSA money to pay rent?

Open

Will FAFSA pay for off-campus housing?

Open

Does FAFSA give me more money if I live off campus?

Open

What does FAFSA not cover?

Open