Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Content provided by Credible. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

This article first appeared on the Credible blog.

As the name suggests, direct deposit loans are loans that are directly deposited into your bank account.

However, while loan companies often market direct deposit payday loans as a fast way to get cash in an emergency, the interest rates on these loans can be sky-high. You may find better interest rates and quick funding by comparison shopping for a personal loan instead. Personal loan funds can typically be directly deposited into your bank account.

Credible makes it easy to see your prequalified personal loan rates in minutes. It’s 100% free to compare your rates.

Here’s what you should know about direct deposit loans (and less expensive alternatives).

What are direct deposit loans?

Direct deposit loans are payday loans that are quickly deposited into your bank account. You might be able to get a direct deposit loan online or from a storefront lender, often without a credit check.

Requirements for direct deposit loans vary from lender to lender, but in general, you’ll need to:

- Be 18 years or older

- Have a bank account

- Have pay stubs that show a recurring source of income

- Live in a state where payday loans are legal

Keep in mind: While fast funding through direct deposit might sound appealing, these small loans are notoriously expensive. Depending on the lender, you might end up paying 400% APR or more on a direct deposit loan.

10 alternatives to direct deposit loans for quick cash

There are other options to quickly borrow cash besides direct deposit loans. For example, you might qualify for a personal loan with better terms.

If you’re approved, you could get your loan funds as soon as the same or next business day, depending on the lender.

Here are Credible’s partner lenders that offer fast loan funding:

Avant

If you have less-than-perfect credit, Avant might be a good choice. If you’re approved, you could have your loan funded as soon as the next business day.

Axos Bank

Axos Bank offers personal loans ranging from $10,000 to $50,000. With Axos Bank, you could have your funds deposited by the next business day after loan approval.

Best Egg

Best Egg offers loans for a wide variety of uses, including debt consolidation, major purchases, credit card refinancing, and more.

You can borrow $2,000 to $50,000 through Best Egg and could get your funds within one to three business days after successful verification.

Discover

Discover could be a good option if you’re looking for longer repayment terms — you could have up to seven years to repay a Discover loan.

You’ll likely get a decision on your application on the same day you apply and might have your loan funded as soon as the next business day if you’re approved.

LendingPoint

LendingPoint specializes in working with borrowers who have near-prime credit, which could make it a good choice if you have a credit score in the upper 500s to 600s.

If you’re approved, your loan could be funded as soon as the next business day.

LightStream

LightStream might be a good option if you’re looking to borrow a large loan amount — personal loans from LightStream range from $5,000 to $100,000.

Plus, if you’re approved, you could have your loan funded as soon as the same business day.

OneMain Financial

If you prefer taking out a personal loan in person, OneMain Financial could be a good choice — it has about 1,400 branch locations in 44 states.

Loans approved in person at a branch office could be funded on the spot with a check, while online loans will generally be funded within one to two business days by direct deposit.

Prosper

With Prosper, you can borrow $2,000 to $50,000 with a repayment term of two to five years. If you’re approved, you could have your loan funded in as little as one business day.

Universal Credit

Universal Credit is another lender that could have your loan funded in as little as one business day, once approved. You can borrow $1,000 to $20,000 with a repayment term of three or five years.

Upgrade

Upgrade offers personal loans ranging from $1,000 to $50,000. If you’re approved, you could have your loan funds within a day of clearing the necessary verifications.

Upstart

Upstart considers education and job history in addition to credit score, which means that you might qualify for a loan even if you have limited credit history.

With Credible, you can easily compare rates from these lenders in minutes, and it won’t affect your credit.

What are the pros and cons of direct deposit loans?

If you’re considering a direct deposit loan, here are some points to keep in mind:

Pros

- Could get approved even with bad credit: In many cases, you only need to be 18 or older and have a job to get a direct deposit loan. This means you could get approved even if you have bad credit.

- Easy application: Applying for a direct deposit loan online might take just a few minutes.

- Fast loan funding: Depending on the lender, you could have your money as soon as the next business day — or even instantly.

Cons

- High rates and fees: It’s not uncommon for direct deposit loans to have APRs of 400% or higher.

- Can borrow only a small amount: Direct deposit loan amounts are generally only a few hundred dollars — typically $500 or less. If you need to borrow more (such as for a car repair or major purchase), this might not be enough.

- Payment could be taken from your account: Unless you opt for a direct deposit installment loan, you’ll typically give the lender a post-dated check or provide authorization for them to debit the funds from your bank account. If the due date rolls around and you don’t have the cash, this could put you in a financial bind.

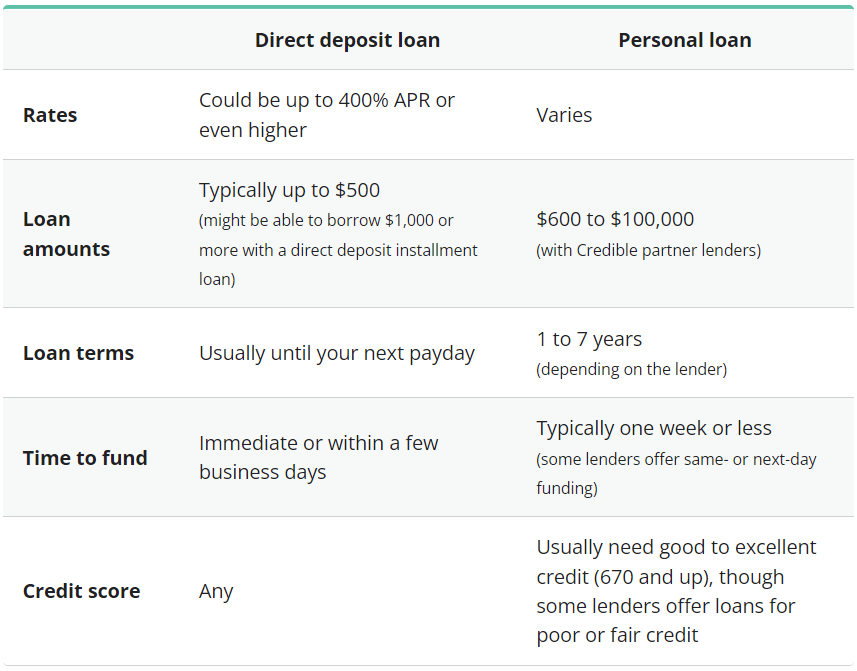

Online personal loans vs. direct deposit loans

Both online personal loans and direct deposit loans can come with fast loan funding. However, they each have different loan terms, amounts, and rates, as well as varying eligibility requirements.

Here’s a look at several important features of online personal loans vs. direct deposit loans:

If you’re looking for next- or same-day loans, be careful — while you can get cash from a direct deposit loan quickly, the high APR could land you in a deeper financial rut.

Here’s what you might expect to pay if you borrow $1,000 with a direct deposit loan vs. a personal loan:

- If you take out a $1,000 direct deposit loan with a 150% interest rate and one-year term, you’d pay a whopping $982 in interest.

- If you take out a $1,000 personal loan with a 5% interest rate and one-year term, you’d pay just $164 in interest.

No matter which type of loan you choose, it’s a good idea to consider how much a loan will cost you over time. You can estimate how much you’ll pay for a loan using a personal loan calculator.

How to get an online personal loan

If you’re ready to take out a personal loan, follow these four steps:

- Shop around and compare lenders. Be sure to compare as many lenders as possible to find the right loan for you. Compare not only rates but also repayment terms and any fees charged by the lender.

- Choose your loan option. After comparing lenders, pick the loan option that best suits your needs.

- Fill out the application. You’ll need to complete a full application and submit any required documentation, such as tax returns or pay stubs.

- Get your funds. If you’re approved, the lender will have you sign for the loan so they can send you the funds. The time to fund for a personal loan is typically a week or less — though some lenders might fund your loan as soon as the same or next business day.

Tip: While you’ll generally need good to excellent credit to qualify for a personal loan, there are some lenders that offer personal loans for bad credit. However, these typically come with higher interest rates compared to the rates given to borrowers with good credit. If you’re struggling to get approved for a personal loan, another option is applying with a cosigner. Not all lenders allow cosigners on personal loans, but some do.

Even if you don’t need a cosigner to qualify, having one could get a lower rate than you’d get on your own.

Other alternatives to a direct deposit loan

There are also other options besides personal loans if you need quick cash. Here are a few alternatives to consider:

- Pawn shop loans: These types of loans are available from pawn shops and are secured by a valuable item that you own, such as jewelry or machinery. However, pawn shop loans can also come with extremely high rates and fees. Plus, if you can’t repay the loan, the pawn shop can sell your item.

- Cash advance apps: Apps like Earnin and MoneyLion offer members small, interest-free cash advances. Keep in mind that this type of cash advance might be limited to a few hundred dollars or less.

- Credit cards: A credit card could be a simple way to cover small, recurring expenses. Some credit cards even come with 0% APR introductory offers, which means you won’t have to pay interest if you repay your balance by the time this period ends. However, if you can’t repay the card in time, you could be stuck with some hefty interest charges.

- Loans from friends or family: If you have friends or family willing to lend you the money you need, you might be able to avoid interest charges. However, be sure to stick to the repayment terms you agree upon to avoid any damage to your relationships.

If you decide to take out a personal loan, remember to consider as many lenders as you can to find the right loan for your needs. Credible makes this easy — you can compare your prequalified rates from multiple lenders in two minutes.

About the author: Taylor Medine is a Credible authority on personal finance. Her work has been featured by Bankrate, USA Today, Business Insider, Credit Karma, and more.