Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Content provided by Credible. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

This article first appeared on the Credible blog.

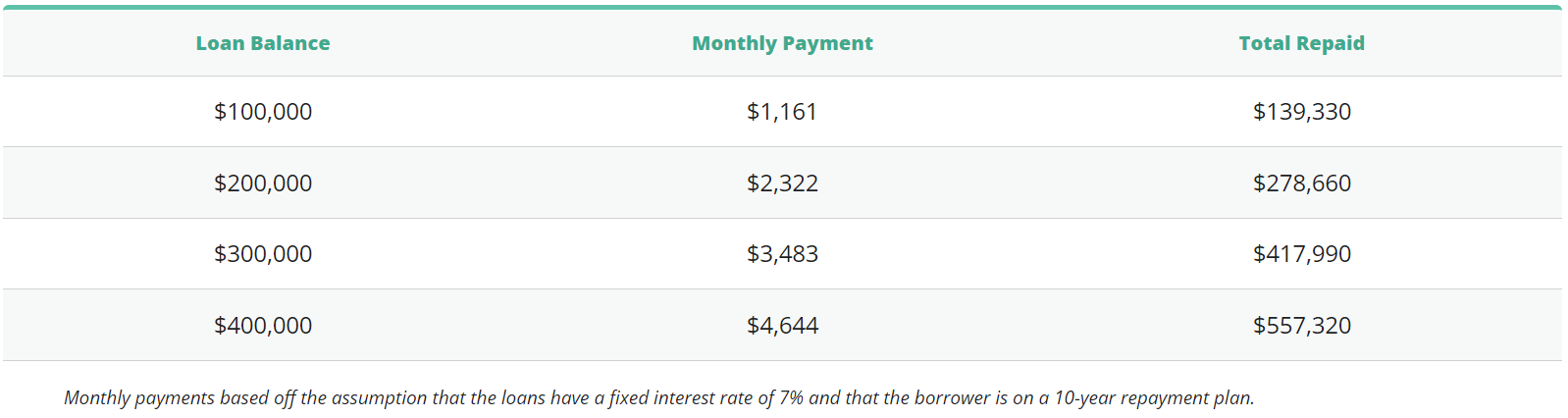

Paying off $100,000 in student loan debt (or more) could be a major struggle. Under the standard 10-year repayment plan, your minimum monthly payment might be quite daunting. Assuming a 7% interest rate, you’re looking at payments of over $1,000 per month.

But don’t worry — there are several potential ways to make your student loans more manageable, including refinancing. With Credible, you can easily compare student loan refinance rates from multiple lenders in just minutes.

1. Refinance your student loans

Best for:

- Borrowers with high interest rates

- Borrowers with high monthly payments

- Borrowers who want to combine multiple loans

How long will it take to pay off $100k: If you refinance your student loans, you’ll likely have a few different repayment terms to choose from — which will affect how long paying off your loan will take.

For example, if you refinance with one of Credible’s partner lenders, you’ll have a term ranging from five to 20 years, depending on the lender.

Keep in mind that a shorter repayment term will come with a higher monthly payment, while a longer repayment term could reduce your payment but would mean paying more in interest over time.

Student loan refinancing is a great method for saving money on your student loans. If you have $100,000 in student loans — or more — you probably have a mix of federal loans and private loans. With refinancing, you can combine all of your loans into one new loan with a single payment.

You might qualify for a lower interest rate on your new student loan, which could save you money over the life of your loan. Or if you choose to extend your repayment term, you could reduce your payment — lessening the strain on your monthly budget.

Keep in mind: If you refinance federal student loans, you’ll lose your federal benefits and protections, including access to income-driven repayment plans and student loan forgiveness programs. If your federal student loans already have a decent interest rate and you’re able to manage multiple federal loans each month, it might be a good idea refinance only your private student loans.

You can use Credible’s student loan refinancing calculator to see how much you can save by refinancing your student loans.

2. Add a creditworthy cosigner

Best for:

- Borrowers with fair or average credit

- Borrowers who can qualify for a lower interest rate with a cosigner

How long will it take to pay off $100k: Your payoff period with a cosigner will depend on the loan terms you choose at signup.

Keep in mind that lenders might not offer you longer repayment terms if you have poor credit.

The more you demonstrate to lenders that you’re not a risky borrower, the more comfortable they’ll likely feel about lending to you. Sometimes adding a cosigner can lower your interest rate if you choose to refinance your student loans, though they also take on responsibility for repayment if you don’t pay as agreed.

A cosigner doesn’t need to be a parent or relative either. To benefit your financial situation, a cosigner just needs to be creditworthy and willing to take you on as a cosigner.

Tip: Even if you don’t need a cosigner to qualify, having one might also get you a lower interest rate than you’d get on your own.

If you decide to refinance — whether with or without a cosigner — be sure to consider as many lenders as possible to find the right loan for you. Credible makes this easy — you can compare your prequalified rates from partner lenders in minutes.

3. Pay off the loan with the highest interest rate first

Best for:

- Borrowers who can afford to make additional payments

- Borrowers who want to get out of debt quickly

How long will it take to pay off $100k: If you have multiple student loans and can make extra payments, paying off your debt first with the highest interest rate first could save you money while shortening your repayment period.

How long it will take to pay off your debt will depend on your repayment term and many additional payments you can afford to make.

You’ll save the most money in interest over the life of your loans if you focus on paying the loan with the highest interest rate first. You should continue to make minimum payments on all your loans, but make bigger payments toward the highest-interest loan.

Then, when that loan is paid off, you can put that money toward the next-highest-interest-rate loan — and so on until all your loans are paid off. This is commonly known as the debt avalanche, a twist on the popular debt snowball method to pay off debt.

Keep in mind: While the debt avalanche method will save you money in interest charges over time, it can take longer to see the results. If you’re motivated by small wins, the debt snowball method could be another option.

4. See if you’re eligible for an income-driven repayment plan

Best for:

- Borrowers with high federal student loan payments

- Borrowers with relatively low incomes compared to their minimum federal loan payments

How long will it take to pay off $100k: If you sign up for an IDR plan, your payment will be based on your monthly income. This could significantly lower your monthly payment but will also extend your payback period.

However, if you keep up with your payments on an IDR plan, you could have the remainder of your balance forgiven after 20 to 25 years — depending on the plan you choose.

Income-driven repayment (IDR) plans are another option that many federal borrowers can take advantage of.

In general, an IDR plan could be a good choice if you’re struggling to make your student loan payments.

There are four IDR plans to choose from:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

5. If you’re eligible, map out steps to student loan forgiveness

Best for:

- Borrowers who work for an eligible government or nonprofit organization

- Borrowers with high payments for federal student loans relative to income

How long will it take to pay off $100k: The time it will take to have your loans discharged under a student loan forgiveness program will depend on the program itself. For example, if you’re eligible for Teacher Loan Forgiveness, you could have a portion of their loans discharged after five years. Or if you pursue forgiveness under an IDR plan, you could have your loans forgiven after 20 to 25 years, depending on the plan.

There are several student loan forgiveness programs available for federal student loans. Many of these programs are geared toward borrowers who work in certain professions — such as teachers, doctors, and lawyers.

If you work full time for the government or in any public service job, for example, you might be eligible for Public Service Loan Forgiveness (PSLF). To apply for PSLF, you’ll have to make 120 qualifying payments over 10 years, after you could have your remaining student loan balance forgiven.

Keep in mind: Unfortunately, private student loan forgiveness isn’t available. However, there are other options that could help you more easily pay off private student loans and potentially save money along the way, such as private student loan consolidation.

If you decide to refinance your student loans, remember to shop around and compare as many lenders as you can. This way, you can find a loan that fits your needs.

This is easy with Credible — you can compare your prequalified rates from multiple lenders in two minutes.

About the author: Eric Rosenberg is an expert on personal finance. His work has been featured at Business Insider, Investopedia, The Balance, The Huffington Post, MSN Money, Yahoo Finance, Mint.com and more.