Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Content provided by Credible. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own. Requesting prequalified rates on Credible is free and doesn’t affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.

This article first appeared on the Credible blog.

If you’re wondering how to get a $10,000 loan, it’s a good idea to research the loan options that could be available to you from different lenders. A low interest personal loan can help with emergency expenses or other big ticket expenses you might need some extra cash for.

When deciding on the best personal loan for your situation, you should consider how much need, the monthly payment you can afford, and the interest rate. Credible makes it easy to compare personal loan rates from multiple lenders. It’s free and seeing your rates won’t affect your credit.

Where to get a $10,000 personal loan

Here are some lending institutions that offer personal loans and the limits on what they will lend:

Online lenders

You can look for a loan from online lenders anytime. Whether you’re looking for a $1,000 loan or a $100,000 loan, you ‘re usually able to find what you need online.

If you’re looking for a fair credit personal loan, and you have options. But remember that interest rates for borrowers with better credit can be significantly lower than those with poor credit.

Also, if you’ve been turned down by traditional lending institutions, you might have better luck getting approved by online lenders, who sometimes use alternative methods of evaluating borrower risk. For one, online lenders will typically want to see proof of income and length of employment.

Another perk of an online lender is that you could get your money sooner. The money might even be available to you within 24 hours or less of approval.

You can compare prequalified rates from all Credible’s partner lenders by filling out just one form (instead of one form for each). Plus, although some lenders charge prepayment penalties for paying your loan off early, none of Credible’s partner lenders do.

Banks and credit unions

Banks and credit unions also offer personal loans, along with checking, savings and other secured and unsecured loans. A personal loan may also be available through a line of credit, which can be revolving.

The limits vary from institution to institution, but banks and credit unions are often willing to accommodate you. Wells Fargo, for example, says it will lend from $3,000 to $100,000. Most banks do not include a prepayment penalty, although there might be an origination fee.

The interest rates are usually fixed and are often some of the lowest available, with a specific payment over the life of the loan. Another plus is that your personal bank might offer loyalty or relationship discounts if you already have an account with them.

What to consider when comparing loans

If you’re considering multiple $10,000 personal loan options, here’s what you should research before making a decision:

1. Interest rates

The interest rate is the main thing to consider when borrowing money. This is how much you’ll pay in interest charges each year when you take out a loan, expressed as a percentage. Typically, the shorter the loan term, the lower the interest rate offered by most lenders.

You should also decide if a fixed or variable rate loan is best for your situation. Not all personal loan lenders offer both, but some do.

2. Fees

The next thing to look out for is fees. Origination fees, for one, are taken out of your loan proceeds before you even see them. To help you understand the impact of any additional fees and expenses over the life of your loan, lenders are required to factor them into another calculation called the annual percentage rate, or APR.

Also, comb the fine print and ask your lender about any prepayment penalties, which are charged at the end of your loan if you decide to pay it off early. Prepayment penalties aren’t factored into your actual APR because you might not have to pay them. Credible’s partner lenders, for example, don’t charge prepayment penalties.

3. Repayment term

Your repayment term is the amount of time you have to pay back the money you’ve borrowed. The cost to repay the loan depends not only on the loan amount you borrow and at what interest rate, but on how long you take to repay your loan.

Keep in mind: The longer your repayment term, the more interest you’ll pay over the life of your loan; the shorter your repayment term, the lower the interest rate offered by most lenders.

4. Monthly payment and total cost

Another consideration should be your monthly payment. You should make sure a personal loan will fit into your budget. If it seems that the monthly payment will eat up too much of your paycheck, you can look at loans with longer repayment terms.

If you stretch your payments out over seven years instead of five, you’ll make 84 payments instead of 60, so each payment will be smaller. Just remember that the longer the repayment term, the higher the interest rate and total repayment costs will be.

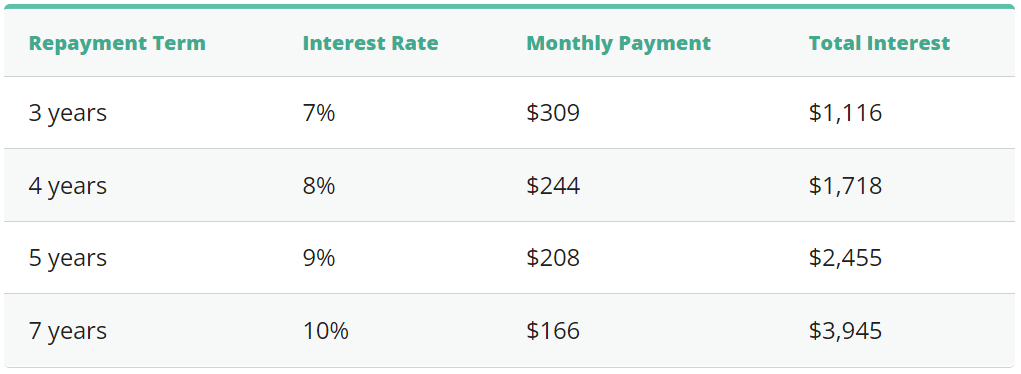

Cost to repay a $10k loan

The table below shows the relationship between your repayment term, interest rate, monthly payment, and total interest charges. The interest rates in the table are hypothetical and for illustration purposes only.

A good rule of thumb, if you’re seeking to minimize total repayment costs, is to select a loan with the biggest monthly payment and the shortest repayment term you can afford. A personal loan calculator can help you understand how much a loan will cost you each month. And, with Credible, you can easily see your prequalified personal loan rates from multiple lenders.

Requesting prequalified rates on Credible is free and doesn’t affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.

About the author: Jamie Young is an authority on personal finance, covering everything from student loans to personal loans, and general finance. Her work has appeared on some of the best-known media outlets including Time, CBS News, Huffington Post, Business Insider, AOL, MSN, and more.