Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Content provided by Credible. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

This article first appeared on the Credible blog.

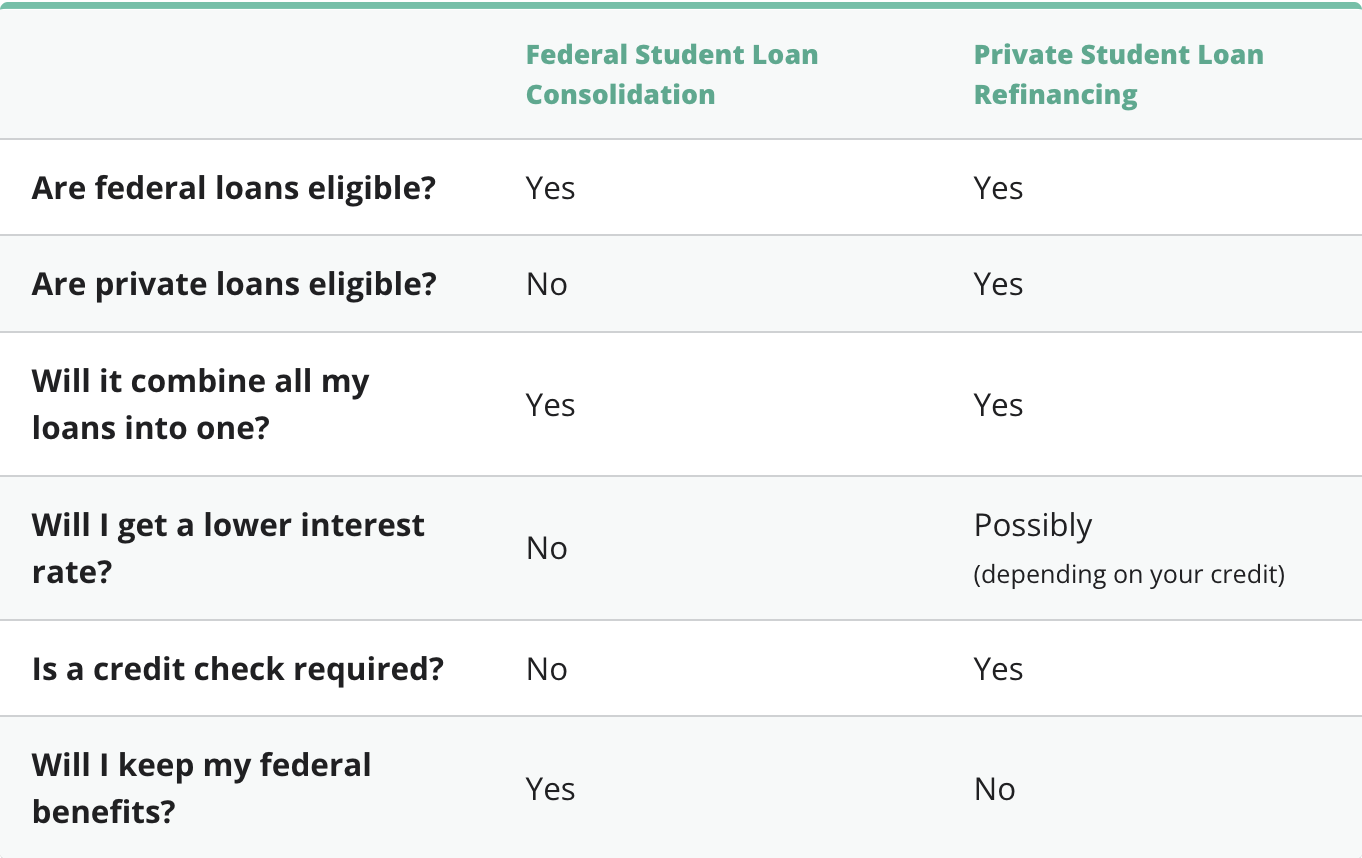

Student loan consolidation comes in two forms: private and federal. Although both private and federal consolidation allow you to combine all your loans into one, student loan consolidation is for only federal loans, and “private consolidation”, known as student loan refinancing, can combine both federal and private loans.

To help you decide which is best for you, here’s a breakdown of the similarities and differences between student loan consolidation and refinancing and the pros and cons of each.

Visit Credible to compare student loan refinance rates from various lenders in minutes.

Consolidation vs. refinancing

There are differences between consolidation and refinancing.

Student loan consolidation

Student loan consolidation, known as a federal Direct Consolidation Loan, can be used to simplify your payments, especially if you have multiple loans or servicers. The interest rate on a Direct Consolidation Loan is the weighted average of the rates on your existing loans, so you generally won’t save any money with federal consolidation.

Advantages of student loan consolidation

- Allows you to consolidate your federal student loans so you have just one monthly payment

- Able to keep federal benefits like income-driven repayment and Public Service Loan Forgiveness

- No credit check required

- You can pick the servicer that will service the new loan (from a list of potential servicers)

Keep in mind that private student loans don’t qualify for federal consolidation and consolidation won’t lower your interest rate, so your total repayment costs may increase if you stretch your payments out over a longer period of time.

Find out if refinancing is right for you. Checking rates with Credible takes two minutes and won’t impact your credit score.

Student loan refinancing

Just like with consolidation, student loan refinancing can help you combine multiple loans into one. It also allows you to combine both private student loans and federal into one. You might even be able to lower your interest rate, saving you money in the long run.

Advantages of student loan refinancing

- Allows you to consolidate federal student loans as well as private student loans so you have just one monthly payment

- May be able to lower your interest rate which could save you money

- May have the opportunity to lower your monthly payments by choosing a longer term (but if you choose to do so, you might end up paying more in interest over the life of your loan)

- If you use a cosigner to initially get a lower interest rate, you might have the opportunity to release them from the loan after a set amount of on-time payments

Keep in mind, though, that if you refinance your federal loans, you’ll lose benefits like income-driven repayment and Public Service Loan Forgiveness.

Which is right for you?

Now that you understand the differences between federal consolidation and refinancing, deciding which option is best for your loans is the next step.

Both can be helpful in combining your loans into a single simplified payment, making your life easier. If your goal is to maintain federal benefits like an income-driven repayment plan, federal consolidation is probably your best bet. But if you’re looking to save money on your student loans overall, refinancing may be the right move.

Comparing rates is free, doesn’t affect your credit score, and your personal information is not shared with Credible’s partner lenders unless you see an option you like.

About the author: Jamie Young is an authority on personal finance. Her work has been featured by Time, Business Insider, Huffington Post, Forbes, CBS News, and more.