Credible takeaways

- Debt settlement can help you settle your debt for less than owe.

- Debt that's written off could be considered taxable income.

- Other ways to pay off your debt include a debt consolidation loan or using a debt pay off strategy.

- Beware of debt settlement companies — check reviews through the Better Business Bureau and Consumer Financial Protection Bureau before choosing a company.

Debt settlement is when you negotiate with a creditor to settle your debt, often for less than what you owe. If the creditor accepts the settlement, you’ll typically have to make a lump-sum payment to resolve the debt.

In some situations, settlement could be a helpful option to take control of your debt — such as if you are behind on payments or have a high balance that will be difficult to repay. However, there are other payoff strategies that might better suit your needs. In any case, it’s important to weigh the pros and cons of debt settlement so you can make the right choice for your situation.

Debt settlement pros and cons

While debt settlement can be a good choice in some cases, it isn’t right for everyone. Here are some pros and cons to consider while weighing your options:

Pros

- Might be able to settle for less than what you owe: A creditor could agree to a settlement that’s less than what you owe. They might also be willing to waive fees or interest charges.

- Pay off debt sooner: Settling a debt lets you pay off your balance all at once rather than spending months or years making payments — meaning you can quickly lessen the strain on your budget.

- Stop calls from collection agencies: If you successfully settle a debt, the calls from collection agencies should stop. Just keep in mind that it could take several months for the paperwork to be resolved before the calls will cease.

- Could help you avoid bankruptcy: Negotiating a settlement might provide you with the financial breathing room you need to avoid bankruptcy.

Learn More: Debt Consolidation vs. Bankruptcy

Cons

- Creditors might not be willing to negotiate: There’s no guarantee that a creditor will accept a settlement offer.

- Fees are likely: For-profit debt settlement companies typically charge fees for their services — usually 20% to 25% of the final settlement amount.

- Could hurt your credit: Resolving a debt for less than what you actually owe could have a negative impact on your credit. Additionally, many debt settlement companies will encourage you to stop making payments while they attempt to negotiate with your creditor, which will further damage your credit.

- Debt written off might be taxable: If a creditor agrees to settle, the difference between what you owe and what you pay might be taxed as income.

Debt settlement alternatives

Debt settlement can be a valuable option for taking control of debt — however, it also comes with several risks that aren’t always worth it for every situation.

The good news is that there are several other strategies that could help you pay off your debt more easily. If debt settlement doesn’t seem right for you, here are some alternatives to consider:

Use a balance transfer credit card

With a balance transfer credit card, you can move a credit card balance from one card to another. Some balance transfer cards have a 0% APR introductory offer, which means you could avoid interest charges if you pay off your card before the introductory period ends.

If your credit isn't good enough to qualify for a new card with a 0% APR balance transfer offer, scour existing cards for balance transfer offers.

Related: Personal Loan vs. 0% APR Credit Card

Keep in mind

If you can’t repay your balance before a 0% APR period ends, you could get stuck with some hefty interest charges. Also note that you’ll likely have to pay a fee to transfer your balance — typically 3% to 5% of the amount you want to transfer.

Apply for a debt consolidation loan

A debt consolidation loan is a type of personal loan that you can use to pay off multiple debts. This will leave you with just one loan and payment to manage. But you can also use a personal loan to refinance a single credit card or other debt at a lower interest rate or to get a more manageable monthly payment.

Depending on your credit, you might get a lower interest rate on a personal loan than what you’re currently paying, which could save you money on interest and potentially help you pay off your loan faster.

Or you might opt to extend your repayment term to reduce your monthly payments and lessen the strain on your budget — even if the interest rate isn't less than your current one. Just keep in mind that you’ll pay more interest over time with a longer term.

If you decide to take out a personal loan to consolidate debt, be sure to consider multiple lenders to find the right loan for your situation. An easy way to do this is to compare prequalified rates from multiple lenders using a loan marketplace (you can do this using the table below).

Learn More: Best Debt Consolidation Loans

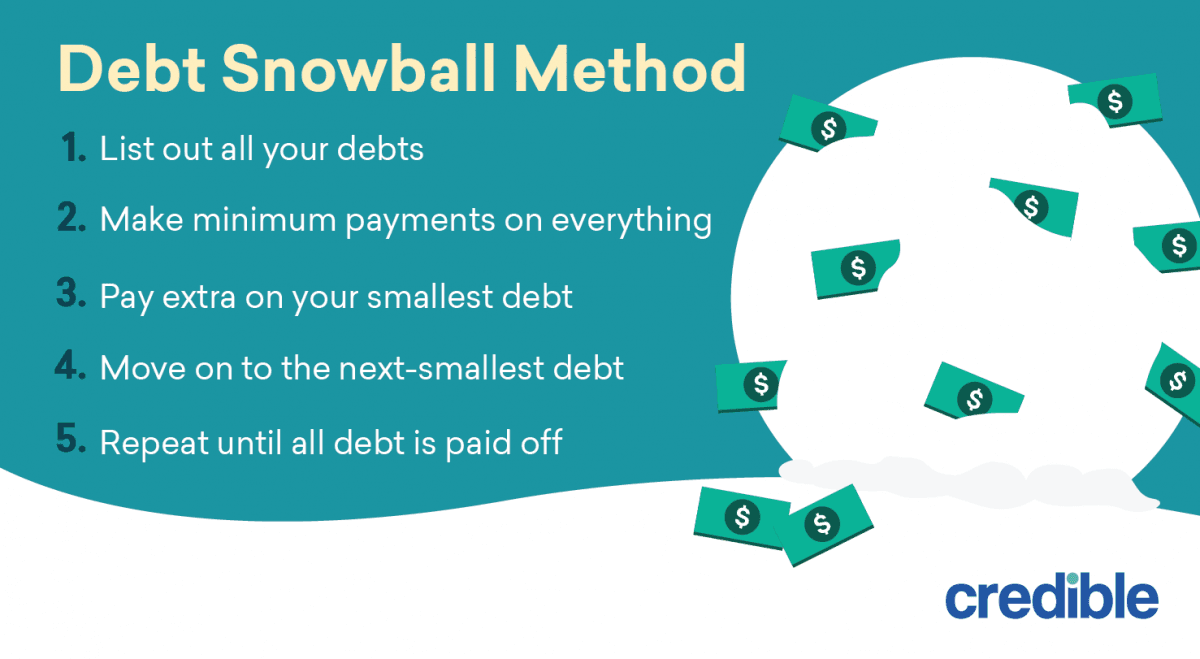

Use the debt snowball method

In some cases, you might just need a little motivation to pay off your debts. One payoff strategy that can offer this is the debt snowball method. With this method, you’ll focus on paying off your smallest debt first, getting an easy, initial win, and the confidence to pay off your larger debts next.

Here’s how it works:

Tip

The debt snowball method can be a helpful strategy if you’re motivated by small wins. However, if you would prefer to save money on interest and don’t mind waiting to see results, you might consider the debt avalanche method instead.

Use the debt avalanche method

Another payoff strategy is the debt avalanche method. With this method, you’ll focus on paying off debt with the highest interest rate first. This approach can save you the most in interest, but could also delay the confidence boost from paying off one of your accounts in full.

Here’s how it works:

Tip

The debt avalanche method can help you save money on interest — but it can also take a while to see any movement on your loan balances. If you’re motivated by small wins, the debt snowball method might be a better fit.

Consider a debt relief program

In addition to debt settlement, there are also other debt relief programs that might help you take control of your debt. One option to consider is a debt management plan, which is offered by many nonprofit credit counseling organizations — such as the National Foundation for Credit Counseling.

If you sign up for a debt management plan, your credit counselor will help set up a voluntary agreement between you and your creditors. You’ll then make monthly payments to the counseling agency, which will disburse the funds directly to your creditors. It typically takes three to five years to successfully complete a debt management plan.

Your creditors might be willing to reduce or waive fees or finance charges in return for your participating in a debt management plan.

Additionally, making on-time payments throughout the plan could help you begin to re-establish a positive payment history and rebuild your credit.

Learn More: How to Pay Off Debt Fast

Debt settlement next steps

If pursuing a debt settlement seems like the right option for you, here are some tips to keep in mind:

- Consider how much you can pay. Settling a debt typically requires making a lump-sum payment. Before starting any negotiations, run through your budget to see how much you can reasonably afford to pay.

- Decide if you want to work with a debt settlement company. You can negotiate with a creditor on your own — however, this can be quite intimidating. Just keep in mind that working with a for-profit debt settlement company will likely come with fees — usually 20% to 25% of the settlement amount. Additionally, these companies often ask borrowers to stop making payments while attempting to negotiate, which could damage your credit.

- Watch out for debt settlement scams. Unfortunately, there are plenty of scammers looking to take advantage of people who are trying to settle their debt. If you decide to work with a debt settlement company, make sure to do your research and verify that the company is trustworthy, such as by checking for customer reviews through the Better Business Bureau and Consumer Financial Protection Bureau.

- Consult with a tax professional. If you’re able to settle your debt for less than what you owed, consider speaking with a tax advisor to see how that settlement will affect your taxes owed for the year. This can help you avoid any unpleasant tax surprises.

Learn More: How To Negotiate Credit Card Debt

Disclosure: Some lending partners that participate in Credible’s comparison marketplace offer loans to borrowers with scores as low as 550. Borrowers with low scores will have fewer lending options than borrowers with higher credit scores.