Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Research by the LIMRA Secure Retirement Institute suggests that millennials who begin their careers with $30,000 in student debt could find themselves with less retirement savings compared to their debt-free peers — about $325,000, according to LIMRA.

So what do we make of this?

I had two thoughts when I read the findings. First, duh! Obviously, students with debt are going to be more likely to fall behind on saving compared to peers with no debt.

Second, but far more important, what can we do with these findings?

For those who are fortunate enough to have your parents or scholarships fund your college education, great. Be thankful for your brains or brawn that got you a scholarship or write mom and dad a heartfelt thank you card for keeping you out of debt. Really, go get a card and put a pen to it — no one does that anymore. They will love it!

If you have to foot the bill for your own education, don’t let this research get you down. You still have a few things working in your favor.

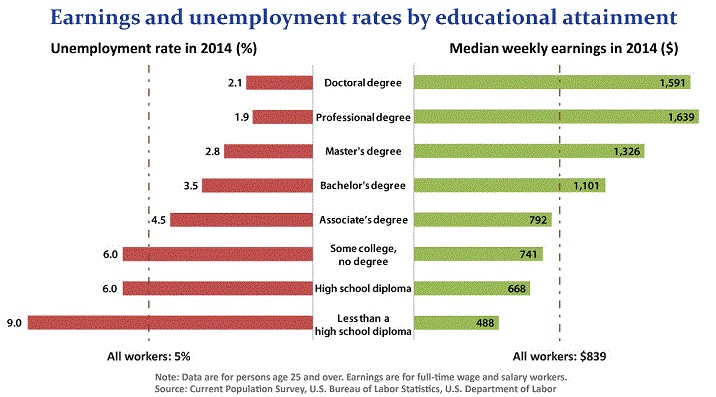

First, obtaining a college degree is still better than the alternative. Earnings for workers who hold a bachelor’s degree are far greater than for high school graduates. Those with an advanced degree also earn more, on average, than those with a bachelor’s.

All this to say that if you invest in your education, you should see higher income over your lifetime, which should translate into greater financial security for you and your family.

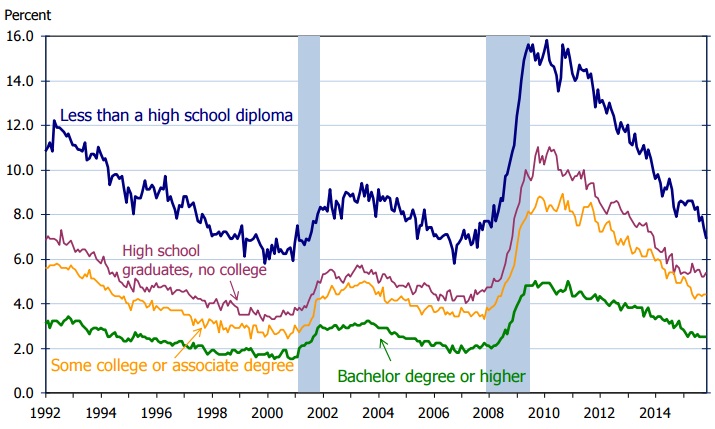

Also take note of employment prospects. Over the last few economic cycles, the less educated were much worse off than those with higher education.

Unemployment rates by educational attainment, 1992-2015

Source: Bureau of Labor Statistics, Current Population Survey, Dec. 4, 2015.

While some with higher education might have been underemployed during the most recent downturn, they were still employed!

The second point I take away from these finding is that we need to focus on what we can control.

Young parents who worry that their children will be riddled with debt after college should do something about it. Get educated on the types of college saving plans that are available, and start saving.

Just be sure to opt for the airline traveler’s emergency oxygen mask strategy. Before you make saving for your children’s college a priority, make sure that your retirement saving is on the right track. Your children will thank you when you don’t have to move in with them in your 70s.

If you already have student debt, take a moment to review your loans and determine whether you are optimizing your payment strategy. Depending on the type of loan(s), there are a multitude of repayment options.

If you are preparing to attend college, take a moment to truly understand the costs and benefits of the schools you have been accepted to. Cost should be a factor in your decision. While the chart above is promising for most, spending $250,000 on an undergraduate degree in theater may not deliver higher pay. Be honest with yourself and go to school with your eyes wide open.

At the end of day, higher education should still lead to upward mobility and greater financial success in life. While it may be more difficult for those of us who need to take on debt, it could easily turn out to be the best investment you make in your life.