Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

If you’re looking for a student loan to help pay for the cost of college, federal student loans often offer the lowest interest rates.

Those with excellent credit, however, might be able to find lower rates with private student loans. Your financial information, including your credit history, can help you qualify for low-interest student loans.

If you’ve already used up your federal student loans, here’s how to find low interest student loans from private lenders:

- Have good credit

- Focus on debt to income

- Get a cosigner

- Choose a shorter repayment term

- Look for discounts

- Compare lenders

1. Have good credit

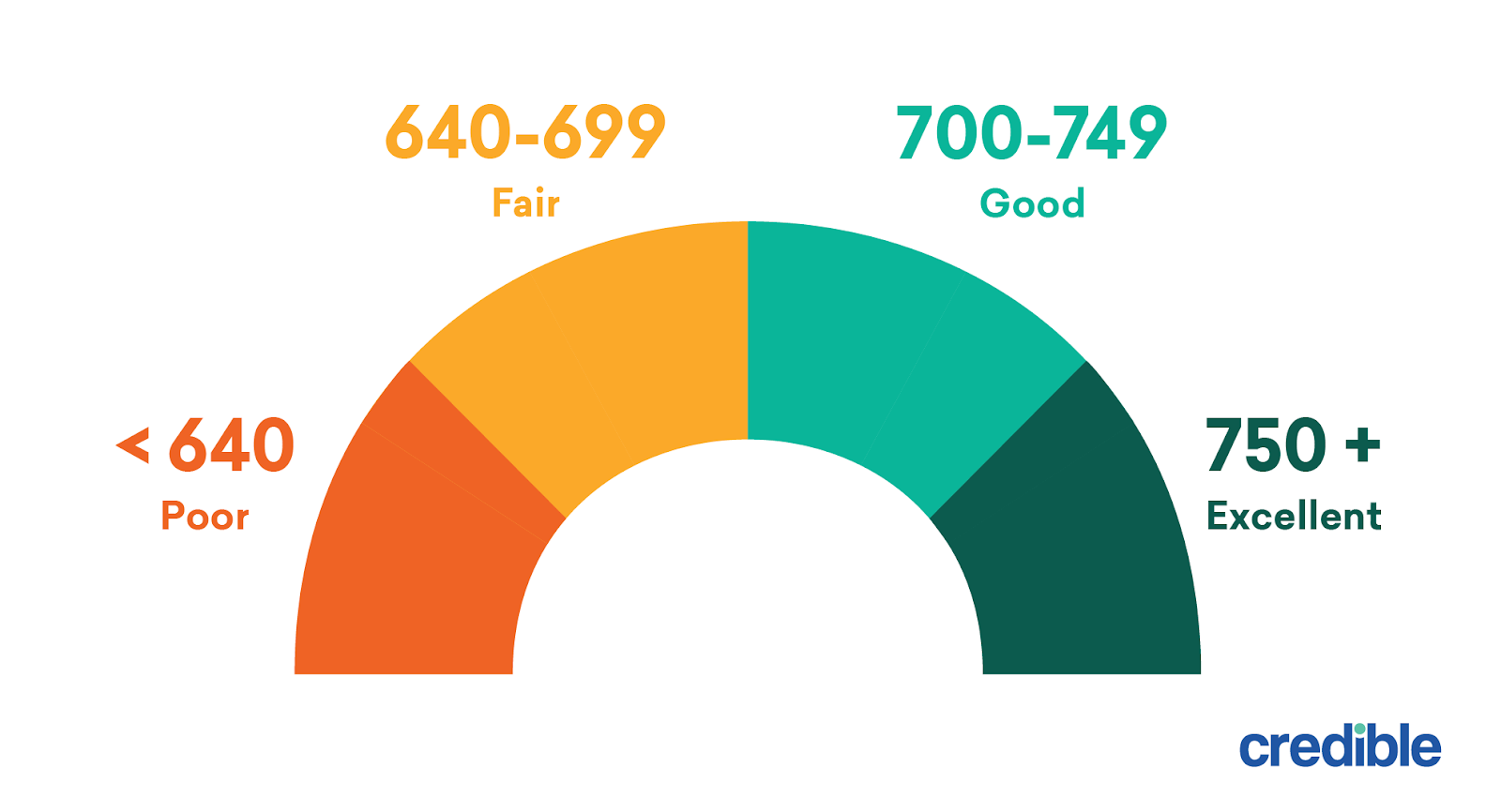

Most students turn to federal student loans first, since they provide added protections and benefits that private lenders can’t match. But if you’ve maxed out your federal loans and still need more funding, you might consider private student loans, too. There are several factors that impact the interest rate you’re eventually offered, but one of the biggest elements is your credit. A good credit score can be the difference between getting approved for a private loan at all.

Current rates for fixed-rate private student loans start at 3.74%+ for those with excellent credit. If you have a low credit score, you could pay multiple times that. If you don’t know your credit score, you can often get access for free through your bank, credit card issuer, or a third-party credit monitoring service.

Learn More: Compare Credit Score Ranges

2. Focus on your existing debt

In addition to looking at your credit, lenders also consider your existing debt by reviewing your debt-to-income (DTI) ratio. This number represents the percentage of your monthly income that goes toward your monthly debt payments.

The lower your DTI, the more appealing you are to lenders. A high debt load compared to your income is a red flag to lenders, indicating that you might not be able to repay your new loan. Typically, lenders look for a DTI of 50% or lower — but the lower you can get it, the better.

If you’re able to pay off credit card balances or other loans before applying for your student loans, it should lower the minimum monthly payments on your credit report and improve your DTI. Alternately, you could raise your income to improve your DTI. Both actions could help you get approved for student loans or qualify for lower rates.

3. Get a cosigner

If you have bad credit or no credit, it could take more time than you have to establish a good credit score. In that case, you might add a cosigner to your loan application. Cosigners agree to share responsibility for your loan, and must make payments if you can’t afford to. By adding a well-qualified cosigner, you could get approved for a loan or qualify for better rates than you would have alone.

A cosigner is often a family member or trusted friend who has good credit and a stable income. Many students look to their parents to cosign — in fact, over 90% of private student loans have a cosigner.

What is a cosigner release?

Some private lenders allow you to release a cosigner from your student loan if you meet specific requirements. Doing so means you’ll be solely responsible for the debt, and your loan will no longer appear on your cosigner’s credit report.

Typically, a borrower must meet certain eligibility requirements to prove to the lender that they’re financially stable, such as:

- On-time payments: Many private student loan lenders require a certain amount of consecutive, on-time monthly payments to qualify for cosigner release. This can be as few as 12 on-time payments up to three years’ worth or more.

- Income and credit score requirements: Lenders usually require borrowers to meet minimum credit and income standards before removing a cosigner. This may consist of undergoing a credit check and submitting pay stubs or tax returns to verify your earnings.

- Submit a cosigner release application: You can typically find a cosigner release application on the lender’s website, though some lenders may offer the option to submit a paper form. Follow the instructions provided and include all necessary documents to make sure your application is complete.

Using a cosigner could get you a lower interest rate, and relatives may be more willing to help you out if they know they can later be released from the loan. Here are Credible’s partner lenders that offer cosigner release:

| Lender | Fixed rates from (APR) | Variable rates from (APR) | Min. credit score | Cosigner release offered |

|---|---|---|---|---|

| 3.79%+10 | 5.99%+10 | Does not disclose | After 12 months |

|

||||

| 4.24%+1 | 5.99%+ | Does not disclose | After 36 months |

|

||||

| 4.24%+ | 5.44%+ | Does not disclose | After 36 months |

|

||||

| 4.8%+8 | 7.75%+8 | 670 | After 48 months |

|

||||

| 5.75%+ | N/A | 670 | After 48 months |

|

||||

| 4.150%9 - 15.49%9 | 5.37%9 - 15.70%9 | Does not disclose | After 12 months |

|

||||

your credit score. 100% free! Compare Now |

||||

Lowest APRs reflect autopay, loyalty, and interest-only repayment discounts where available | Read our full methodology | 10Ascent Disclosures | 1Citizens Disclosures | 2,3College Ave Disclosures | 11Custom Choice Disclosures | 7EDvestinU Disclosures | 8INvestEd Disclosures | 9Sallie Mae Disclosures |

||||

4. Choose a shorter repayment term

If you’re able to afford a higher monthly payment, a shorter repayment term could save you money in a few ways:

- Get a lower interest rate: Longer term loans are typically considered riskier by lenders, so lengthy repayment timelines often come with higher interest rates. With a shorter repayment term, you may get a lower rate and pay less over the life of your loan.

- Paying interest for a shorter period of time: With a shorter term, you’ll pay off your loan sooner and be out of debt faster. That means fewer months (or years) of interest charges, saving you money.

Learn More: APR vs. Interest Rate: What’s the Difference?

5. Look for discounts

Some student lenders are willing to give you a discount for meeting certain criteria or requirements. For example, nearly all lenders give you a 0.25% discount when you enroll in automatic payments.

Some lenders might have other unique discount programs to further lower your rate, such as loyalty rewards or good-grade discounts. Take advantage of every discount you can. Even if it doesn’t sound like much, it can really add up.

See what your estimated monthly payment will be using our student loan calculator below.

Enter your loan information to calculate how much you could pay

With a $ loan, you will pay $ monthly and a total of $ in interest over the life of your loan. You will pay a total of $ over the life of the loan, assuming you're making full payments while in school.

Need a student loan?

Compare rates without affecting your credit score. 100% free!

Checking rates won’t affect your credit score.

Read More: Student Loan Interest Rates

6. Compare lenders

Federal student loan rates are set annually by the government, but private lenders set their own rates for student loans. Shopping around will help you find the right loan for your situation.

Credible helps you save time shopping around by letting you compare offers from multiple lenders by filling out just one simple form. The lenders in the table below are Credible’s approved partner lenders.

| Lender | Fixed rates from (APR) | Variable rates from (APR) |

|---|---|---|

| 3.79%+10 | 5.99%+10 |

| 4.24%+1 | 5.99%+ |

|

3.99%+2,3

| 5.59%+2,3 |

| 4.24%+ | 5.44%+ |

| 4.8%+8 | 7.75%+8 |

| 5.75%+ | N/A |

| 4.150%9 - 15.49%9 | 5.37%9 - 15.70%9 |

your credit score. 100% free! Compare Now |

||

Lowest APRs reflect autopay, loyalty, and interest-only repayment discounts where available | Read our full methodology | 10Ascent Disclosures | 1Citizens Disclosures | 2,3College Ave Disclosures | 11Custom Choice Disclosures | 7EDvestinU Disclosures | 8INvestEd Disclosures | 9Sallie Mae Disclosures |

||

Check out: 8 Best Small Student Loans

What is a decent student loan interest rate?

Average student loan interest rates vary depending on the type of student loan you borrow.

- Federal student loan interest rates are fixed rates set by Congress. Your federal student loan interest rate is determined by the type of federal loan you borrow, your dependency status, and your year in school.

- Private student loan interest rates can be either fixed or variable, and depend on your credit score, repayment term, and other factors. You’re more likely to get a lower interest rate with a higher credit score.

Here’s how current federal interest rates compare to private interest rates for borrowers who took out a private loan through Credible in September 2023:

| Borrower type | Loan | Loan type | APR |

|---|---|---|---|

| Undergraduate students |

| Federal | Fixed rate: 5.50% |

| Graduate or professional students | Direct Unsubsidized Loan | Federal | Fixed rate: 7.05% |

| Direct PLUS Loan | Federal | Fixed rate: 8.05% |

| Borrowers with credit scores of 720 or higher | 5-year loan | Private | Variable rate: 6.04% average |

| Borrowers with credit scores of 720 or higher | 10-year loan | Private | Fixed rate: 7.14% average |

You can use our loan score tool below to see how competitive your student loan is. Just enter your APR, credit score, monthly payment, and remaining balance to see how your loan compares.

Low interest student loans for parents

Parents looking to take on student loans to help finance their student’s education might consider Parent PLUS Loans first, but that isn’t your only loan option. Parents with good credit scores might be able to find cheaper loans through private lenders than what’s offered in the PLUS program.

Parents might also be able to save on existing PLUS loans by refinancing to a new loan with a lower interest rate. Be sure to note the 4.228% origination fee on Parent PLUS loans, which can significantly increase the loan’s APR.

Learn More: Parent PLUS Loans vs. Private Student Loans

See Your Rates

Checking rates will not affect your credit

Keep Reading: How to Take Out a Student Loan