Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

College can be expensive — the average cost of college can range from $25,890 to $52,500, depending on the type of school you attend. The good news is there are several ways to pay for it, including financial aid.

Keep in mind that you’ll have to meet certain requirements to be eligible for financial aid, such as having financial need and being enrolled in a degree-seeking program.

Here’s what you should know about qualifying for financial aid:

- Financial aid eligibility requirements

- Types of financial aid

- Beware: You could lose your financial aid

- Need-based vs. non-need-based aid

- How to apply for financial aid

- Consider a private student loan to fill any gaps

Financial aid eligibility requirements

To qualify for federal financial aid, you need to meet the following requirements:

- Citizenship: You must be a citizen or eligible noncitizen of the U.S. with a valid Social Security number (if you’re from the Republic of the Marshall Islands, Federated States of Micronesia, or the Republic of Palau, this requirement is waived). Both independent and dependent students are eligible for aid.

- Education: You must have a high school diploma, a General Education Development certificate, or you must have completed a homeschooling curriculum.

- Enrollment: You need to enroll in an eligible program as a student seeking a degree or certificate.

- Academics: You must maintain satisfactory academic progress, meaning you’re fulfilling the minimum requirements needed to advance toward graduation.

- Finances: To be eligible for federal financial aid, you can’t owe a refund on federal student grants or be in default on a federal student loan.

Types of financial aid

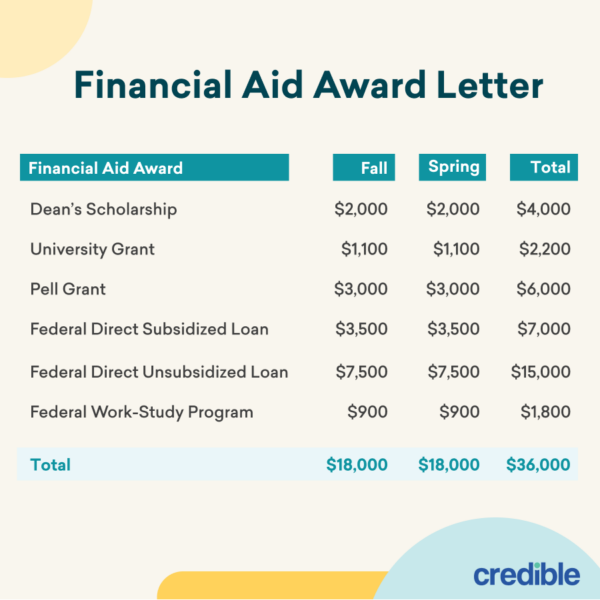

When a school accepts you as a student, you’ll receive a financial aid award letter. The letter will contain your financial aid package and will cover your tuition, fees, and even your housing.

The financial aid letter typically includes the following forms of aid:

- Federal and state grants: You might be eligible for some state or federal grants. Grants are a form of gift aid, meaning they don’t typically have to be repaid. Grants are usually based on financial need.

- Institutional aid: The school itself might also offer you grants or scholarships. Scholarships, like grants, don’t have to be repaid. But scholarships are usually based on merit, such as your academic or athletic performance.

- Work-study programs: Some schools offer a work-study program. With this option, you work a part-time job related to your field and use your earnings to pay for a portion of your educational expenses.

- Federal student loans: To pay the remaining balance of your tuition, the financial aid letter will list what kinds of federal student loans you can borrow. You could qualify for subsidized loans — where the government covers the interest charges that accrue while you’re in school and during your grace period — and unsubsidized loans.

Here’s an example of what a financial aid award letter might look like:

Other financial aid options

While the financial aid letter is helpful, it’s not fully comprehensive. You can find other financial aid options on your own. For example, you could qualify for college scholarships or grants offered by nonprofit organizations or companies.

After you’ve exhausted your scholarship, grant, and federal student loan options, private student loans could help fill any financial gaps left over. If you decide to take out a private loan, be sure to consider as many lenders as possible to find the right loan for your needs.

Credible makes this easy — you can compare your prequalified rates from multiple lenders in two minutes.

See Your Rates

Checking rates will not affect your credit

Beware: You could lose your financial aid

While you may have qualified for financial aid in the past, you’re not guaranteed to get the same amount, or the same type of aid, in the following years. Federal aid requirements can change from year to year, and other circumstances can affect your eligibility.

Here are a few reasons you could lose financial aid:

- Your family’s income increased: If your family’s income increased after getting a raise or a new job, you might no longer qualify for federal or state grants or subsidized loans.

- You defaulted on your loans: If you previously took out federal loans and defaulted on them, you’ll need to get out of student loan default before you can borrow any more.

- Your grades went down or you didn’t complete enough credits: If your grades slipped, you failed a class, or you didn’t complete enough credits, you might not satisfy the academic progress requirement and lose your federal aid eligibility.

- You were arrested for a drug offense: If you’re arrested for a drug offense and convicted, you’re ineligible for federal aid until your sentence is served.

Need-based vs. non-need-based aid

Federal financial aid falls into two categories — need-based and non-need-based aid. Here’s how they work:

Need-based aid

This kind of aid is given based on financial need. Generally, the higher your need, the more aid you’re likely to qualify for.

There are a few main types of need-based aid, including:

- Pell Grants: These grants are awarded to undergraduate students with exceptional financial need.

- Direct Subsidized Loans: These loans are available to undergraduate students with financial need. The government will cover any interest that accrues on these loans while you’re in school.

- Work-Study: This program provides part-time jobs to undergraduate, graduate, and professional students with financial need.

Non-need-based aid

Unlike need-based aid, non-need-based aid isn’t given based on your financial need. Instead, your school will subtract your need-based aid from your cost of attendance to see how much non-need-based aid you’re eligible for.

Here are some of the main kinds of non-need-based aid:

- Direct Unsubsidized Loans: These loans are available to undergraduate, graduate, and professional students regardless of financial need. Unlike with subsidized loans, you’re responsible for all of the interest that accrues on unsubsidized loans.

- Direct PLUS Loans: There are two kinds of Direct PLUS Loan — Grad PLUS Loans for students who want to pay for grad school and Parent PLUS Loans for parents who want to pay for their child’s education. These loans usually come with higher interest rates compared to other federal loans. They also require a credit check.

- TEACH Grants: To qualify for a Teacher Education Assistance for College and Higher Education (TEACH) Grant, you must be enrolled in an eligible program and agree to teach full time in a high-need field for at least four years. If you don’t meet the requirements of your service obligation, your grant will be converted into a Direct Unsubsidized Loan that you’ll have to repay.

Also see: FAFSA for Graduate School: What You Should Know

How to apply for financial aid

If you’re ready to apply for financial aid, follow these four steps:

- Create an FSA ID. To start, you’ll need to create a Federal Student Aid (FSA) ID, which includes setting up a username and password that will give you access to Department of Education websites — including the FAFSA.

- Gather your documents. When you complete the FAFSA, you’ll have to provide both personal and financial information. If you’re a dependent student, you’ll also need this information from your parents. Some of the documentation you’ll need includes your Social Security number, your driver’s license number (if you have one), federal tax returns, and any information regarding your financial assets (such as bank statements).

- Fill out the FAFSA. Once you’ve gathered your information, you can fill out the FAFSA at StudentAid.gov. As you go through the form, you’ll provide your personal information, financial information, and the list of schools you’d like to receive your FAFSA results. Be sure to include all of the schools you’re applying to.

- Get your financial aid award letter. After you submit the FAFSA, your school will send you a financial aid award letter detailing what federal student loans and other financial aid you qualify for. You can then choose which aid you’d like to accept.

Also keep in mind that some aid is given on a first-come, first-served basis — so it’s a good idea to submit the FAFSA as early as possible, especially if you have high financial need.

Consider a private student loan to fill any gaps

Once you’ve used all of your available federal aid, a private student loan could help fill any financial gaps left over. If you decide to take out a private student loan to cover more of your college expenses, remember to consider as many lenders as you can to find the right loan for your situation.

This is easy with Credible — you can compare your prequalified rates from multiple lenders in two minutes after filling out just a single form.

See Your Rates

Checking rates will not affect your credit