Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Credible Operations, Inc. NMLS# 1681276, “Credible.” Not available in all states. www.nmlsconsumeraccess.org.

This article first appeared on the Credible blog.

Getting pre-approved is a key step in the homebuying process. Once you’re pre-approved by a lender, you’ll receive a mortgage pre-approval letter, which shows how much you’re qualified to borrow. It also demonstrates to the seller that you’re a serious buyer.

Ready to get pre-approved? It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

What is a mortgage pre-approval?

A mortgage pre-approval is a letter from a mortgage lender or broker that details how much money a lender is able to lend to you, based on certain assumptions about your creditworthiness and credit history.

For example, a lender or broker might say that, based on your current credit score and income, the pre-approval letter supports a mortgage up to $250,000 in value.

In the pre-approval letter, you’ll see an estimate of your mortgage loan amount, interest rate, and what your monthly payment would be, based on the assumptions made regarding your creditworthiness and credit history.

To decide whether or not to issue a mortgage pre-approval, lenders or brokers typically assess the following information:

- Assets: How much you have in assets, including cash in your checking or savings account, stocks and bonds, and real estate

- Income: Whether your income is sufficient to cover the cost of your mortgage — typically, they’re looking to see that you have a debt-to-income ratio (DTI) below 50%, but ideally, your DTI is 43% or below

- Credit history: Credit check to review your credit report (the lowest interest rates are reserved for those with excellent credit)

How to get pre-approved for a mortgage

With some preparation and homework, the mortgage pre-approval process can be a breeze. To get pre-approved, you’ll want to take these five easy steps.

- Budget for a down payment

- Gather the information you’ll need

- Comparison shop with multiple lenders

- Limit your debt and stay current on your bills

- Submit your loan application

1. Budget for a down payment

The more money you can put down, the lower the interest rate and monthly payments will be. If you put down less than 20% of the home’s purchase price, you’ll have to pay for private mortgage insurance (PMI) on top of the cost of the home loan.

The type of mortgage you apply for will affect how much of a down payment you’ll need. For example, for most mortgages, you’ll need to put down 3% to 20%. But if you qualify for a Federal Housing Administration (FHA) loan, you can put down just 3.5%.

2. Gather the information you’ll need

Depending on where you get your pre-approval letter, traditional lenders require you to upload your documents upfront.

But if you choose to get an instant streamlined pre-approval letter online with Credible, the process is much quicker. To receive your letter, you’ll just need to have your information on hand so you can enter it into the signup form.

Here’s some of the information you should have ready:

- Proof of income: Such as pay stubs or W-2 forms

- Federal income tax returns: Your tax returns for the past two years

- Bank and investment account statements: Bank and investment account statements that show your current balances and contributions

- Driver’s license or passport: Some form of identification

- Debt statements: Any outstanding debt statements that show your remaining balance and monthly payment, like student loans

3. Comparison shop with multiple lenders

It’s a good idea to compare offers from several different lenders to ensure you get the lowest mortgage rates. If you choose to get a mortgage pre-approval from a bank, you typically have to go into a bank branch. It also requires a hard credit inquiry (which can affect your credit score).

4. Limit your debt and stay current on your bills

Your pre-approval is dependent on several factors, such as your:

- Credit score: Before getting pre-approved, keep your credit score healthy by making all of your payments on time and keeping your credit card and loan balances low. Keep up these habits throughout the mortgage process.

- Debt: You may also want to pay off debts, if possible, to lower your debt-to-income ratio. A high DTI ratio reduces how much you can borrow on a mortgage, which influences your pre-approval letter.

- Income: Lenders also check your income by looking over your pay stubs, tax returns, and W-2 forms. Try not to change employers or alter your income before getting a pre-approval and during the mortgage process.

- Down payment: If you can afford to put down a large down payment, it shrinks the amount you need to borrow and reduces risk for the lender. This may improve your chances of qualifying for a mortgage and getting good loan terms.

- Employment history: Lenders might not check your employment history during the pre-approval process. Just keep in mind they will eventually call your employer to ask about your employment history and inquire about the likelihood of continued employment.

5. Submit your loan application

Once the offer on your house is accepted, you can apply for a home loan. With Credible, you can easily complete the whole process online.

Getting pre-approved for a mortgage can make you a more desirable buyer, and can give you an idea of how much you can really afford to spend on a home, depending on your financial situation.

By following the above steps, you can navigate through the process smoothly and be on your way to buying your dream home.

Need a home loan? Credible makes getting a mortgage easy. It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter.

Getting pre-approved with Credible vs. traditional lenders

Depending on the lender, the pre-approval may be valid for approximately 30 days. After that, your credit score could change, which would affect your mortgage pre-approval.

If the homebuying process takes several months, you’ll likely need to get several pre-approvals which can take a lot of time. But with Credible, you’re able to sign back into your dashboard and generate a new prequalification letter to present to your realtor in seconds.

Credible’s process allows you to make changes to your down payment, amount of loan, and property address without having to put your information in each time. This way, you can easily create a new pre-approval letter for multiple scenarios should you need it.

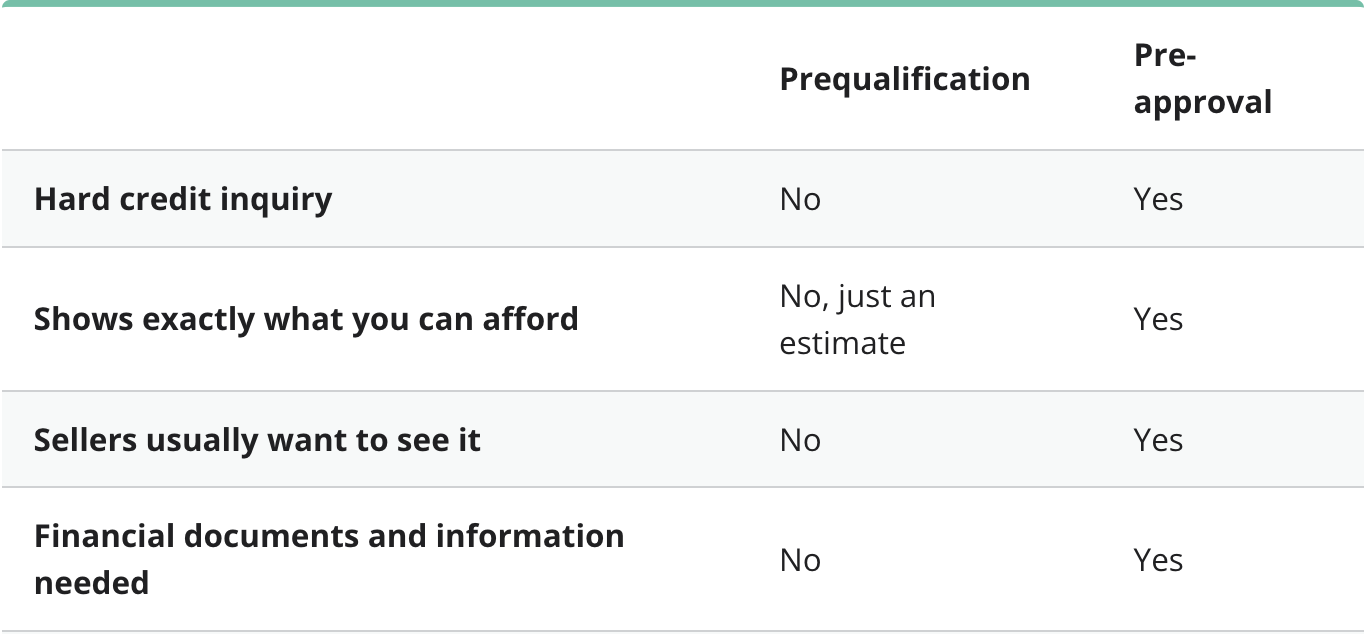

Mortgage prequalification vs. pre-approval

Prequalification is usually better for buyers who have not yet started looking at properties. But if you’re serious about buying, you should probably work on getting pre-approved.

Generally, getting prequalified for a mortgage is less involved than a “full” mortgage pre-approval. Here’s a comparison of the two:

Pre-approval vs. approval

Pre-approval and approval are two different stages of the homebuying process. When a lender runs a pre-approval, they’ll check your credit, assets, income, and employment status. But the pre-approval isn’t a binding agreement, so it doesn’t guarantee you a mortgage.

Approval comes after you’ve found a home and submitted a mortgage application. The lender checks your financial situation again and orders an appraisal to verify the value of the home you’re buying. If you pass these underwriting steps, the lender will approve your home loan and move you to the closing table.

Why should I get pre-approved?

There are several ways a pre-approval can help you during the homebuying process. Because a pre-approval letter tells you how much you can borrow, it can help guide your budget. You can tailor your search to homes within that price range.

A pre-approval letter also shows sellers you’re a serious borrower. When you submit a purchase offer and include a pre-approval letter, the seller knows a lender has verified your information. There are fewer chances you’ll run into problems getting the loan, which can help you stand out in a competitive housing market.

Plus, the pre-approval process may help you uncover potential issues before you get to the underwriting stage later on. For instance, you might find an error on your credit report. It’s better to deal with these issues upfront.

What does a mortgage pre-approval letter say?

A mortgage pre-approval letter shows you how much a lender is willing to let you borrow. It’ll typically include the following information:

- Purchase price

- Loan amount

- Loan type

- Down payment

- Expiration date

- Interest rate

Credible’s streamlined pre-approval letter is similar — you’ll see the purchase price, loan amount, and expiration of the pre-approval based on the information you provided them. You can see an example of this below.

A full copy of the pre-approval letter will also list the steps you’ll need to take should you find a home and want to move forward with Credible.

What are the benefits of having a mortgage pre-approval?

Qualifying for a mortgage pre-approval has several benefits:

- You’ll know how much home you can afford. Having a pre-approval can give you a solid idea of how much home you can really afford, especially as a first-time homebuyer. That can help you narrow down your home search, so you don’t stretch your budget too far.

- It makes you more desirable. If you’re considering putting an offer on a house, having a mortgage pre-approval is essential. Otherwise, you risk being overlooked because home sellers won’t see you as a serious buyer and will choose someone else.

- Agents will be more willing to work with you. Many real estate agents won’t work with buyers who don’t have pre-approval letters, putting you at a huge disadvantage.

When should I get pre-approved for a mortgage?

The best time to get pre-approved for a mortgage is when you’re just starting the homebuying process. Typically, this will be before you start looking for a house or while you’re starting to shop around.

Basically, when you’re serious about buying a home, it’s a good idea to get pre-approved.

How long does a mortgage pre-approval last?

Depending on the lender, your pre-approval might only be valid for about 30 days — though it’s usually valid for at least 90 days. If it’s taking you longer to find the house you wish to buy, you might need to request multiple pre-approval letters over that time.

Will getting pre-approved by multiple lenders hurt my credit score?

If you decide to get a mortgage pre-approval from a bank, it will require a hard credit inquiry and that can affect your credit score.

However, if you use Credible to secure an instant streamlined pre-approval letter, they use a soft credit check which won’t affect your score. Plus, you can get pre-approved in just three minutes.

About the author: Kat Tretina is a freelance writer who covers everything from student loans to personal loans to mortgages. Her work has appeared in publications like the Huffington Post, Money Magazine, MarketWatch, Business Insider, and more.