Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

You can always pay off your federal or private student loans ahead of schedule by paying more than the minimum each month. And for some, paying off student loans early can be a smart decision that gives you more freedom and flexibility.

If you’re wondering how long it’ll take to pay off your student loans, a student loan calculator can help. Refinancing your student loans could help you pay them off sooner if you refinance into a shorter repayment term and/or lower interest rate. With Credible, you can easily compare student loan refinance rates from multiple lenders.

Here are three signs that paying off your student loans early makes sense (and two signs that you should wait):

1. If you have an emergency fund

Before considering making extra payments toward your loans, it’s a good idea to have an emergency fund. An emergency fund is money set aside in a bank account to cover sudden crises, such as an unexpected car repair, job loss, or illness.

Having an emergency fund ensures you won’t have to turn to credit cards when faced with a problem. But if you don’t have an emergency fund yet, you should consider holding off on making extra payments on your loans and put that cash toward your savings first.

Tip: Typically, you want to have three to six months worth of expenses in your emergency fund.

2. If you have lots of credit card debt

If you have credit card debt, paying off your balance should be the priority before turning to your student loans. While student loans can have high interest rates, credit card interest rates can be staggering. The average credit card interest rate was 16.44%, as of November 2021, according to Federal Reserve data.

With such high rates, you’ll probably save more money by paying off your credit card debt first than if you focused on your student loans.

3. If your student loans have high interest rates

If you have high student loan interest rates — federal student loans (from the federal government) can have rates as high as 8.5%, while private loans (from private lenders) can be even higher — a good deal of your monthly loan payment goes toward interest rather than principal, increasing how much you’ll pay over time. Paying off your private or federal loans early can help you save thousands over the length of your loan since you’ll be paying less interest.

If you do have high-interest debt, you can make your money work harder for you by refinancing your student loans. With a stable income and good credit score, you could qualify for a low interest rate, helping you save more and become debt-free faster. Plus, there’s no limit to how many times you can refinance and there are no fees to do so either.

Credible makes it easy to compare student loan refinance rates from multiple lenders.

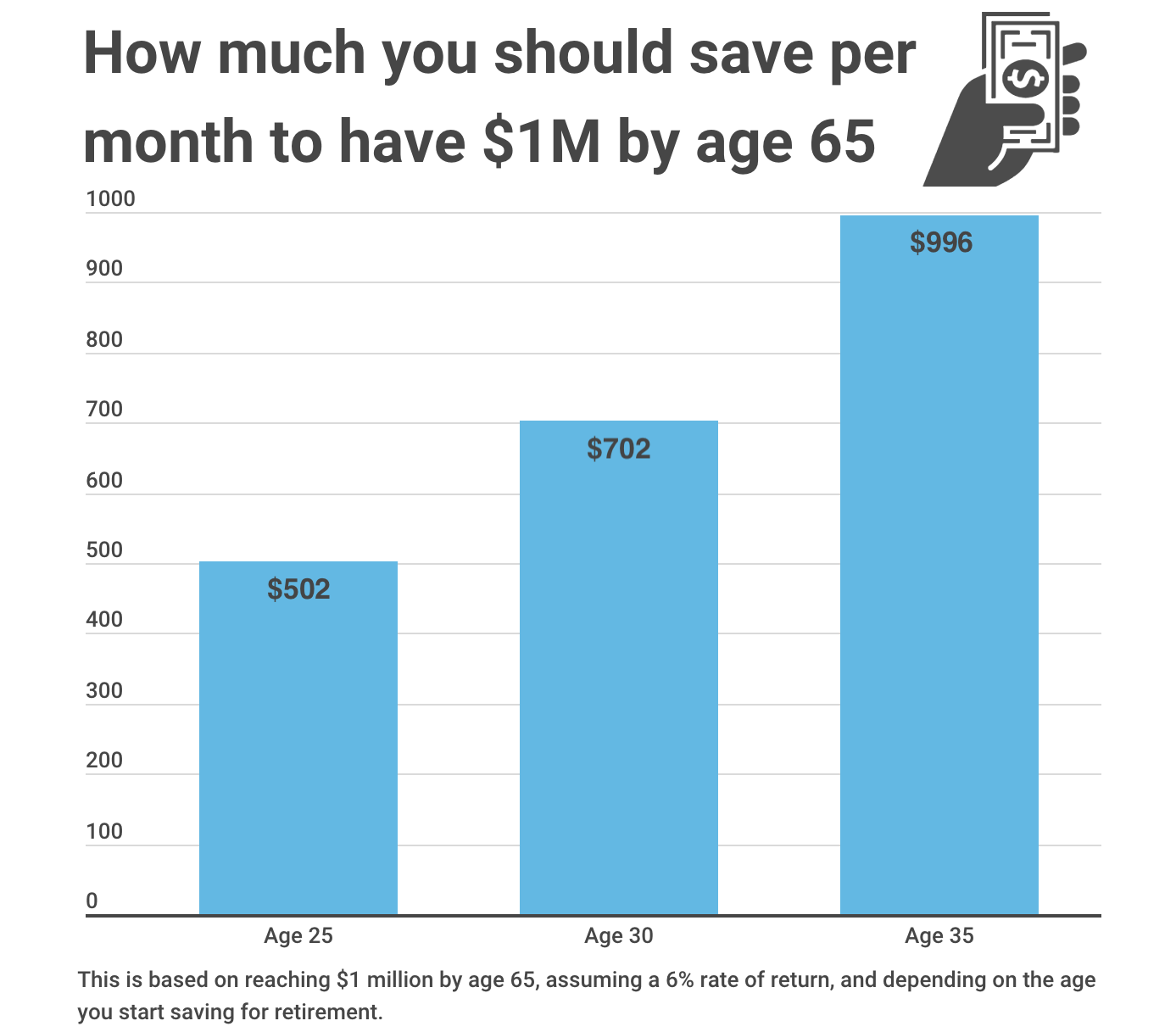

4. If you don’t contribute to your retirement and get the max employer match

When you have student loans, future goals like retirement may not seem that important. But it’s important to invest now, while you’re young. This gives your money time to grow so you can have a comfortable retirement.

Not all employers offer 401(k) matching, but many offer a match up to a certain amount or percentage. So at the minimum, it’s a good idea to contribute enough to employer-offered retirement plans to qualify for the full match before making extra payments on your debt.

5. If you’re already contributing to other life goals

When your finances are in good shape, deciding what best to do with extra money can be difficult. If you have student loan debt, you might think about paying it down aggressively. Just make sure you’re contributing to your long term goals, as well, or else paying student loans off early could set you too far back.

Here are some long term goals you should consider contributing to first:

- Saving for a house

- Investing

- Paying off higher interest debt first

Don’t let your student loans weigh you down

If your student loans weigh you down, cause you anxiety, or make you feel like you can’t pursue other goals while you have them, it might be worth tackling them early.

Getting rid of your debt can give you a sense of freedom and independence you wouldn’t otherwise have if you let the debt linger. It can also motivate you to work toward paying down your other debt, as well.

If you’re financially ready to start paying off your student loans early, refinancing your loans can be a smart way to save money and pay off your student loans faster. With Credible, you can fill out one, simple form and get prequalified rates from multiple lenders — all without affecting your credit score.

About the author: Jamie Young is an authority on personal finance. Her work has been featured by Time, Business Insider, Huffington Post, Forbes, CBS News, and more.