Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Content provided by Credible. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

This article was originally published on the Credible blog.

If you’re ready to pay off your student loans, it’s a good idea to get a payoff statement from your servicer or lender. This is a document that tells you the exact amount you’d need to pay off your student loans in full.

When do you need a payoff statement?

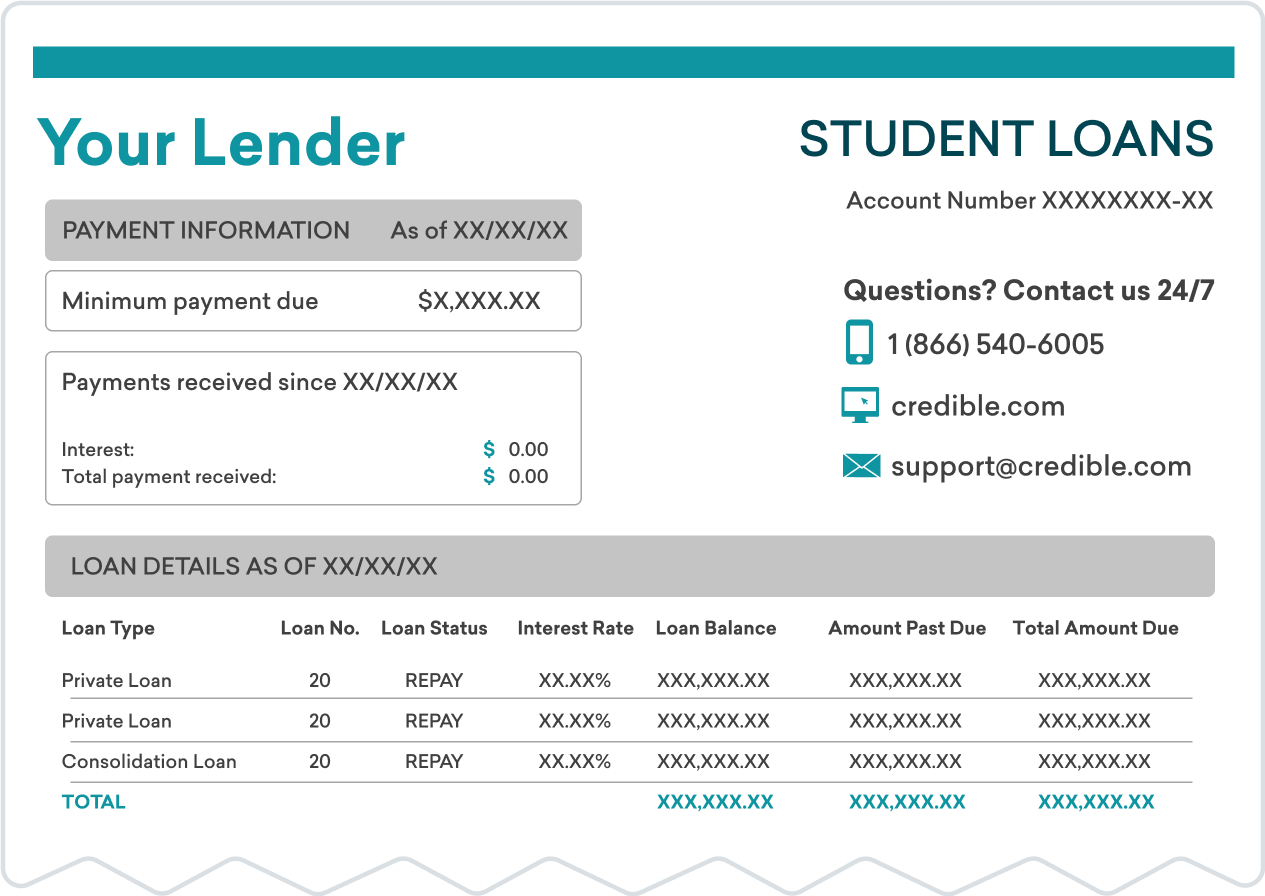

A payoff statement typically breaks down your total principal balance, any interest that has accrued since your last payment, and what you’d need to pay today to take care of your student loan balance for good.

In addition to paying off your student loans, there are some other financial situations where you might need a payoff statement:

- Buying a home: Your mortgage lender will likely want to review all aspects of your finances, including any student loan debt you owe. Your student loans are part of your total debt profile, so your lender will need a payoff statement to calculate your debt-to-income (DTI) ratio.

- Paying off your student loans: If you’re close to paying off your student loans, a payoff statement will tell you how much you owe to cover both the principal balance and any interest. This way, you won’t have any leftover interest to pay off the next month.

- Refinancing your student loans: Your new lender might need a payoff statement to see exactly how much you’ll need to pay off your old student loans. Keep in mind that refinancing student loans could help you save money on interest charges in the long run and reduce your overall costs. If you decide to refinance, be sure to consider as many lenders as possible to find the right loan for you — you can compare your rates from Credible partner lenders in the table below in two minutes.

What information is included in a payoff statement?

A payoff statement has a lot of the same information as your regular monthly student loan statement. However, where your monthly statement gives you recent updates and information on the next payment due, a payoff statement provides totals for your entire loan balance.

You can also see how long it will take to pay your loans off.

Here’s some of the most important information you’ll find in a payoff statement:

- Principal balance: This is the amount you owe without including any new interest. The principal is based on your original borrowing amount plus any compounded interest.

- Accrued interest: Any interest that has accrued since your last payment will also need to be paid off — you’ll be able to see this exact amount in the payoff statement.

- Payoff amount: Your full payoff amount should equal your total principal balance plus any accrued interest. This is what you’d need to cover to pay off your student loan for good.

- Good-until date: Loan interest accrues on a regular basis, so a payoff statement won’t be accurate forever. Because of this, you’ll see a date showing how long the payoff amount will be valid. After this date, your payoff balances will change.

If you’re applying for another type of loan (such as a home loan), the lender might request to see your payoff statement. This way, they can verify exactly how much you owe on your student loans — and how that could affect your ability to pay on a new loan.

How to get a payoff statement

You can usually get a payoff statement by either visiting your lender’s website or calling them to request a copy. It’s also a good idea to keep a copy of your payoff statement in case you need to verify any of the information later.

Here’s how to find your payoff statement for federal student loans as well as from several private student loan lenders:

Federal student loans

You can get your payoff statement for federal student loans from your loan servicer, most likely from their website or by calling directly.

Advantage Education Loan

Call Advantage at 800-693-8220 to get a current payoff amount.

Ascent

Call Ascent at 877-216-0876 to get a current payoff amount.

Aspire Servicing Center

Call 800-243-7552 to request your payoff statement.

Brazos

Brazos student loans are serviced by American Education Services (AES), Firstmark, Navient, and Nelnet. You can check your most recent statement to verify which one services your loans.

You can call your specific servicer to get a current payoff amount:

- AES: 800-233-0557

- Firstmark: 888-538-7378

- Navient: 888-272-5543

- Nelnet: 888-486-4722

Citizens

Call Citizens at 866-259-3767 to get a current payoff amount.

College Ave

Call College Ave at 844-803-0736 to get a current payoff amount.

CommonBond

Call CommonBond at 800-975-7812 to request your current payoff amount.

Cornerstone Education Loan Services

Call 800-663-1662 to request your payoff statement.

Discover

Call Discover at 800-788-3368 to request your current payoff amount.

Educational Credit Management Corporation (ECMC)

Call ECMC at 855-810-4922 to request your current payoff amount.

EdvestinU

Call EdvestinU Ave at 855-887-5430 to get a current payoff amount.

ELFI

Call ELFI at 844-601-3534 to get a current payoff amount.

Firstmark Services

Call 888-538-7378 to request your payoff statement.

Higher Education Student Assistance Authority

Call 609-584-4480 to request your payoff statement.

INvestEd

Call INvestEd at 317-715-9007 to get a current payoff amount.

LendKey

Call LendKey at 888-966-9268 to request your current payoff amount.

Missouri Higher Education Loan Authority (MOHELA)

- Log in to your MOHELA account.

- Click on “Payoff Calculator” under the “Payment Assistance” menu.

- Choose a payoff method from the options listed.

- Select your payoff date for an accurate payoff statement.

- Select the loans you’d like to include and click the “calculate” button.

You can also call 888-866-4352 to request your payoff statement.

Oklahoma Student Loan Authority (OSLA)

Call 866-264-9762 to request your payoff statement.

Texas Higher Education Coordinating Board (THECB)

Call THECB at 800-242-3062 or 512-427-6340 to request your current payoff amount.

ZuntaFi

You can request your current payoff amount from ZuntaFi (previously known as Reunion Student Loan Finance Corporation) by calling 800-592-1270.

Requesting your payoff statement gets you one step closer to saving money

If you’re getting close to paying off your student loans forever, requesting your payoff statement could be a good idea.

A payoff statement can also help you compare your current interest rate to a lower interest rate you might get by refinancing. If you’re ready to refinance your student loans, you can check your rates through Credible, without affecting your credit.

About the author: Eric Rosenberg is a finance, travel, and technology writer in Ventura, California. His work has been featured at Business Insider, Investopedia, The Balance, The Huffington Post, MSN Money, Yahoo Finance, Mint.com, and many other fine outlets.