Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Content provided by Credible. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own. Requesting prequalified rates on Credible is free and doesn’t affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.

This article first appeared on the Credible blog.

If you have medical bills, a major home renovation, or another large expense, a personal loan could be an option to cover the cost.

Borrowing a substantial amount of money — such as a $40,000 personal loan — is a big decision, so it’s important to do your homework and consider as many lenders as you can to find the right loan for you.

Here’s what you should know before taking out a $40,000 personal loan. If you’re considering a personal loan, Credible can help. With Credible, you can easily compare personal loan rates from multiple lenders in minutes.

Where to get a $40,000 personal loan

When you’re looking for a personal loan, you have a few options. You may be able to find loans from:

- Online lenders

- Banks

- Credit unions

Online lenders

If you need to take out a large personal loan, an online lender could be a good option. In many cases, you can apply online in just a few minutes and might receive a decision right away, depending on the lender.

The time to fund for an online personal loan is typically five business days after approval — though some lenders will fund your loan as soon as the next business day.

Credible is partnered with seven online lenders that offer $40,000 personal loans:

- Happy Money personal loans are specifically designed for consolidating credit card debt and range from $5,000 up to $40,000.

- LendingClub offers personal loans ranging from $1,000 to $40,000. It’s also one of the few lenders that provides cosigned personal loans, which could make LendingClub a good choice if you have less-than-perfect credit.

- LightStream could be a good option if you need fast loan funding. If you’re approved, you might get your money as soon as the same business day.

- Prosper offers personal loans ranging from $2,000 to $50,000. Keep in mind that a Prosper loan has to be funded by its investors, which might extend the loan funding time.

- SoFi personal loans are available for up to $100,000, which could make it a good choice for home improvement or debt consolidation loans. If you take out a loan with SoFi, you’ll also enjoy additional benefits, such as unemployment protection.

- Upgrade has less stringent credit requirements than other lenders and so might be a good option if you’re looking for personal loans for bad credit. With Upgrade, you can borrow up to $50,000.

- Upstart could be another good choice if you have less-than-stellar credit or a thin credit history. With Upstart, you can borrow a $1,000 personal loan up to a $50,000 personal loan.

Banks

Banks often offer loyalty rate discounts on personal loans if you already have a checking or savings account with them. You might qualify for another discount if you sign up for autopay on your personal loan.

Keep in mind: Some banks like Chase and Bank of America don’t offer personal loans, but many do. For example, Citibank offers personal loans up to $50,000 (though you’ll have to apply in person at a branch to borrow more than $30,000). TD Bank and Wells Fargo could also be options for a $40,000 personal loan.

Credit unions

Because credit unions are nonprofit organizations, they often offer lower rates than banks. While credit union loans typically have lower personal loan limits, there are some that offer higher loan amounts.

Here are a few credit unions that offer $40,000 personal loans. Note that none are Credible partners.

- Alliant Credit Union offers personal loans from $1,000 up to $50,000.

- Consumers Credit Union personal loans go up to $40,000.

- First Tech Federal Credit Union personal loans are available for up to $50,000.

- Navy Federal Credit Union personal loans range from as little as $250 all the way up to $50,000.

Keep in mind: You’ll need to be a member of the credit union to take out a personal loan with them. Qualifying for membership might require living in a certain area, working in a specific field, or joining an organization.

Checking your prequalified personal loan interest rates is easy when you use Credible. It’s 100% free and seeing your rates won’t affect your credit.

What to consider when comparing $40,000 loans

Before taking out a personal loan, be sure to consider the following factors to find the right loan for your needs:

1. Interest rates

The interest rate is how much you’ll pay in interest each year, expressed as a percentage. The higher the rate, the more you’ll pay in interest over time — adding to the loan’s cost.

Most personal loans have fixed interest rates, which stay the same for the entire length of your repayment term. There are also some personal loans available with variable rates, which can fluctuate over time.

Keep in mind: You’ll generally need good to excellent credit to qualify for best interest rates. If you have poor credit and can wait to take out a loan, it might be a good idea to work on building credit before you apply.

It’s also a good idea to consider how much a loan will cost you over time. You can estimate how much you’ll pay for a loan using a personal loan calculator.

2. Fees

Some lenders charge fees with personal loans, which could add to your overall loan cost. Here are a few common fees you might come across:

- Origination fees: Many lenders charge origination fees, which are a percentage of your loan amount.

- Late fees: If you miss a payment, you might be charged additional fees as a penalty.

- Prepayment fees: Some lenders will charge you a penalty if you pay off your loan early, though these fees are uncommon for personal loans.

Tip: Be sure to consider any lender fees as you shop around for a loan. Keep in mind that if you take out a loan with one of Credible’s partner lenders, you won’t have to worry about prepayment penalties.

3. Repayment terms

You’ll generally have one to seven years to repay a personal loan, depending on the lender. It’s usually a good idea to pick the shortest loan term you can afford to save on interest charges. Plus, you might get a better rate with a shorter loan term.

Keep in mind: Choosing a longer repayment term could get you a lower monthly payment, which might fit your needs better if you need less of a strain on your budget. Just remember that you’ll pay more in interest over time with a longer term.

4. Monthly payment

Before you agree to a loan’s terms, be sure that you can afford the monthly payments. If it’s too much for your budget, you might consider opting for a longer repayment term.

Keep in mind: While most personal loans are unsecured — meaning lenders can’t seize your property if you fall behind — missing loan payments could severely damage your credit. You could even end up in collections.

5. Total repayment costs

When you take out a loan, review the federal Truth in Lending Act (TILA) disclosure provided by your lender. By law, lenders are required to give you this form that discloses all the terms of your loan.

Pay special attention to these two numbers:

- The finance charge: This is the cost of your loan, including interest and fees, assuming you make all your payments on time.

- Total payments: This is the sum of all the payments you’ll make to pay off your loan, including the loan principal and finance charges.

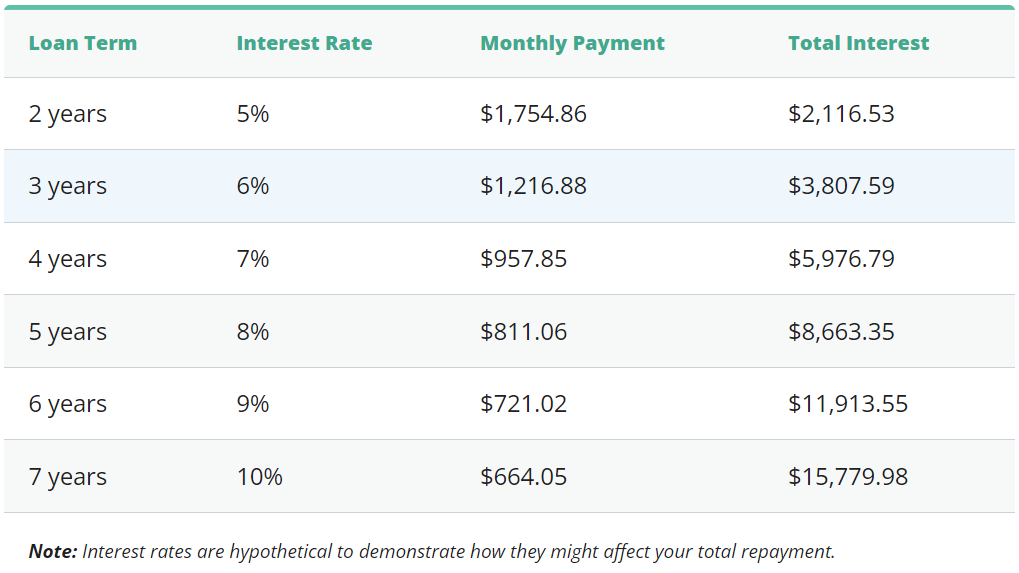

Cost to repay a $40k loan

The interest rate, monthly payment, and loan term will affect how much you’ll repay over the life of your loan. Here’s what payments on a $40,000 personal loan might look like with varying loan terms and interest rates:

If you’re ready to find your $40,000 personal loan, remember to consider as many lenders as you can to find the right loan for you. Credible makes this easy — you can compare your prequalified rates from multiple lenders in two minutes.

About the author: Kat Tretina is a freelance writer who covers everything from student loans to personal loans to mortgages. Her work has appeared in publications like the Huffington Post, Money Magazine, MarketWatch, Business Insider, and more.