Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Paying off a $150,000 student loan balance can be a major challenge. Under a standard 10-year plan, your payments could end up being very high and difficult to manage. If you had a 7% interest rate under this plan, you’d be paying almost $2,000 or more each month.

| Loan Balance | Monthly Payment | Total Repaid |

|---|---|---|

| $150,000 | $1,742 | $208,995 |

| $250,000 | $2,903 | $348,325 |

| $350,000 | $4,064 | $487,655 |

| $450,000 | $5,225 | $626,985 |

The good news is there are several strategies that could help you more easily manage your student loan debt.

Here’s how to pay off $150,000 in student loans:

- Refinance your student loans

- Add a creditworthy cosigner

- Pay off the loan with the highest interest rate first

- See if you’re eligible for an income-driven repayment plan

- Consider student loan forgiveness

1. Refinance your student loans

Best for:

Keep in mind that it’s usually a good idea to choose the shortest repayment term you can afford to save as much as possible on interest. However, if you need a smaller monthly payment, extending your repayment term might be the better option for your budget — though remember that you’ll pay more in interest if you pick a longer term.

Student loan refinancing lets you take out a new loan to pay off your existing loans — leaving you with just one loan and payment to manage. Depending on your credit, you might qualify for a lower interest rate through refinancing, which could help you save money and even pay off your loan faster.

Or you could choose to extend your repayment term to reduce your monthly payments, though this means you’ll pay more in interest over time.

Ultimately, your refinancing savings will mainly depend on the rate you qualify for and the loan term you pick.

For example, if you were able to reduce your interest rate from 7% to 4% on a $150,000 student loan with a 10-year term, you could save $223 per month and $26,754 over the life of the loan.

You’ll also no longer qualify for the suspension of federal payments and interest accrual under the CARES Act due to the COVID-19 pandemic.

You can use our calculator below to see how much you can save by refinancing your student loans.

Step 1. Enter your loan balance

Step 2. Enter current loan information

Step 3. Enter your new loan information to start calculating your savings

If you refinance your student loan at % interest rate, you can save will pay an additional $ monthly and pay off your loan by . The total cost of the new loan will be $.

Does refinancing make sense for you?

Compare offers from top refinancing lenders to determine your actual savings.

Checking rates won’t affect your credit score.

Learn More: How to Pay Off $100,000+ in Student Loans

2. Add a creditworthy cosigner

Best for:

You’ll typically need a good to excellent credit score to qualify for refinancing. While some lenders offer student loan refinancing with bad credit, these loans tend to come with higher interest rates compared to good credit loans.

However, refinancing with a cosigner could improve your chances of getting approved. Even if you don’t need a cosigner to qualify, having one might get you a lower interest rate than you’d get on your own.

If you decide to refinance your student loans — with or without a cosigner — be sure to consider as many student loan refinance companies as possible. This way, you can find the right loan for you. Credible makes this easy — you can compare your prequalified rates from our partner lenders in the table below in two minutes.

| Lender | Fixed rates from (APR) | Variable rates from (APR) | Min. credit score |

|---|---|---|---|

| 3.99%+ | 5.33%+ | 720 |

|

|||

| 6.49%+1 | 7.03%+1 | Does not disclose |

|

|||

| 6.99%+2 | 6.99%+2 | Does not disclose |

|

|||

| 6.0%+5 | 8.06%+5 | 700 | |

|

|||

| 5.48%+3 | 5.28%+3 | 680 |

|

|||

| 6.15%+4 | 8.5%+4 | 670 |

|

|||

| 6.94%+ 7 | N/A | 670 |

|

|||

| 5.24%+ | 5.54%+ | 700 |

|

|||

| 6.2%+ | N/A | 670 |

|

|||

| 6.34%+ | N/A | 680 | |

|

|||

| Ready to see how much you can save? |

|||

All APRs reflect autopay and loyalty discounts where available | 1Citizens Disclosures | 2College Ave Disclosures | 5EDvestinU Disclosures | 3 ELFI Disclosures | 4INvestEd Disclosures | 7ISL Education Lending Disclosures | 8Nelnet Bank Disclosures |

|||

Check Out: How to Find Your Student Loan Balance

3. Pay off the loan with the highest interest rate first

Best for:

How long this method will take will depend on your repayment term and how many additional payments you can afford to make.

Tackling your debt by focusing on the loan with the highest interest rate first can help you save the most money on overall interest charges. As you repay this loan, continue making minimum payments on your other loans while putting extra money toward the highest-interest loan.

Once this loan is paid off, you’ll move on to the loan with the next-highest interest rate — continuing until all of your loans are repaid. This is commonly known as the debt avalanche method.

If you’re more motivated by small wins, you might consider the debt snowball method instead.

If you’re wondering how long it’ll take to pay off your student loans, enter your current loan information into the calculator below to find out. Use the slider to see how increasing your payments can change the payoff date.

Learn More: What Is the Average Time It Takes to Repay Student Loans?

4. See if you’re eligible for an income-driven repayment plan

Best for:

Depending on which IDR plan you choose, you could have any remaining balance forgiven after 20 to 25 years.

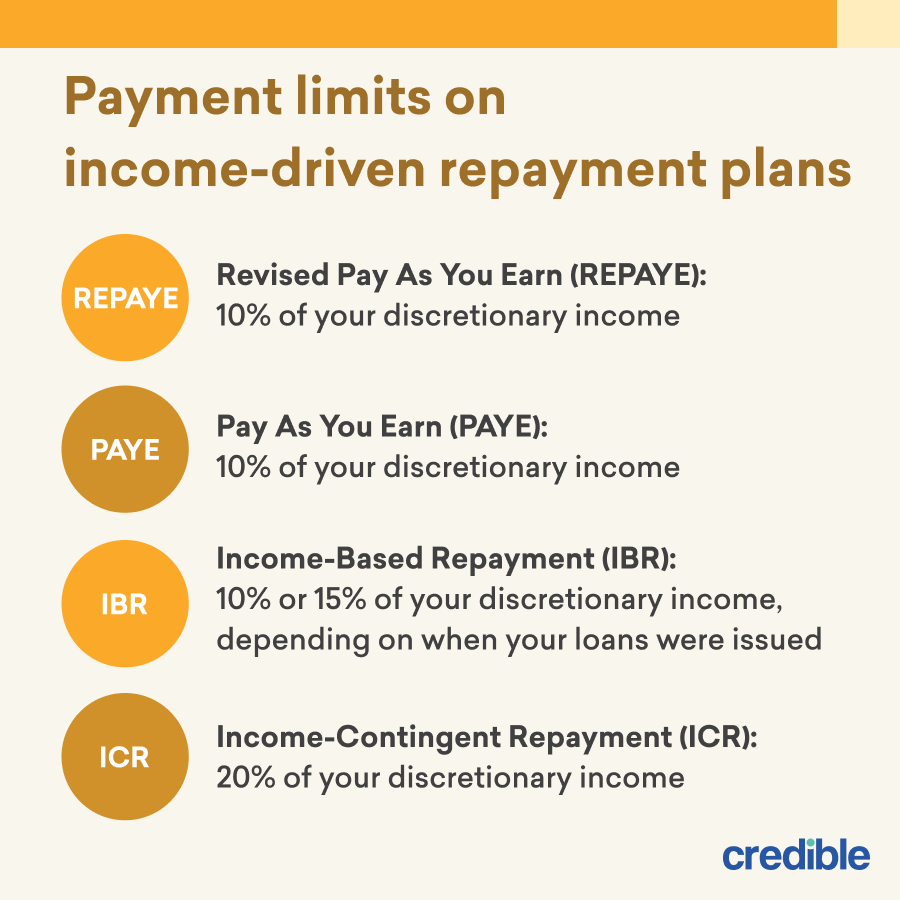

IDR plans are a benefit that almost any federal student loan borrower can take advantage of. Under these plans, your payments are calculated as a percentage of your discretionary income. There are four IDR plans to choose from:

- Pay As You Earn (PAYE): This plan is available to borrowers who can demonstrate financial hardship. Under the PAYE plan, your payments are capped at 10% of your discretionary income and can’t be higher than what you’d pay on the standard repayment plan. Any remaining balance could be forgiven after 20 years of payments.

- Revised Pay As You Earn (REPAYE): This plan is available for almost any federal student loan besides Parent PLUS Loans. Under this plan, payments are generally limited to 10% of your discretionary income — though unlike other IDR plans, there’s no cap on how high they can be. Any remaining balance could be forgiven after 20 to 25 years, depending on whether you took out your loans for undergraduate or graduate studies.

- Income-Based Repayment (IBR): Like the PAYE plan, IBR requires borrowers to demonstrate financial hardship. Payments are capped at 10% of your discretionary income if you borrowed after July 1, 2014, or 15% of your discretionary income if you borrowed before this date. You could have any remaining balance forgiven after 20 or 25 years, depending on when you took out your loans.

- Income-Contingent Repayment (ICR): Any borrower can qualify for the ICR plan — including Parent PLUS Loan borrowers who have consolidated their loans. Under ICR, your payments are either 20% of your discretionary income or what you’d pay on a 12-year repayment term, adjusted to your income — whichever is less. Any remaining balance could be forgiven after 25 years.

Check Out: PAYE vs. REPAYE: Which Repayment Plan Is Right for You?

5. Consider student loan forgiveness

Best for:

For example, if you work for an eligible government or nonprofit organization, you might be able to apply for Public Service Loan Forgiveness after 10 years of qualifying payments.

Or if you’re a teacher, you might be eligible to have a portion of your loans discharged after five years through the Teacher Loan Forgiveness Program after teaching for five consecutive years.

There are several student loan forgiveness programs available for federal student loans. Many of these require that you work in certain professions, such as programs for:

Additionally, you could qualify to have your federal student loan balance discharged after making payments for 20 to 25 years on an IDR plan.

If you decide to refinance your student loans, remember to consider as many lenders as you can to find a loan that suits your needs. This is easy with Credible — you can compare your prequalified rates from multiple lenders in just two minutes.

Keep Reading: