Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Online schools come with benefits like a flexible schedule and potentially lower costs (and the option to go to school in your pajamas).

If you’re considering a school like this, you might be wondering if you can pay for it with online college student loans. The good news is that yes, you can use both federal and private student loans to cover the cost of attending online college.

Here’s how to get student loans for online college:

- Check your school’s accreditation status for federal loans

- Fill out the FAFSA

- Apply for scholarships and grants

- Take out federal student loans

- Compare rates on private student loans

1. Check your school’s accreditation status for federal loans

If you’re considering federal vs. private student loans, it’s usually a good idea to start with federal student loans.

This is because they come with several borrower protections and benefits, including deferment and forbearance options, income-driven repayment, and student loan forgiveness programs.

You can check the Database of Accredited Postsecondary Institutions and Programs to see if your school is accredited.

Top accredited schools with fully online degrees

As of 2021, here are 10 of the top accredited online colleges that offer bachelor’s degrees, according to Accredited Schools Online.

Keep in mind that these rankings are based on a variety of factors, including academic quality, affordability, reputation, and program offerings.

Learn More: How to Take Out a Student Loan

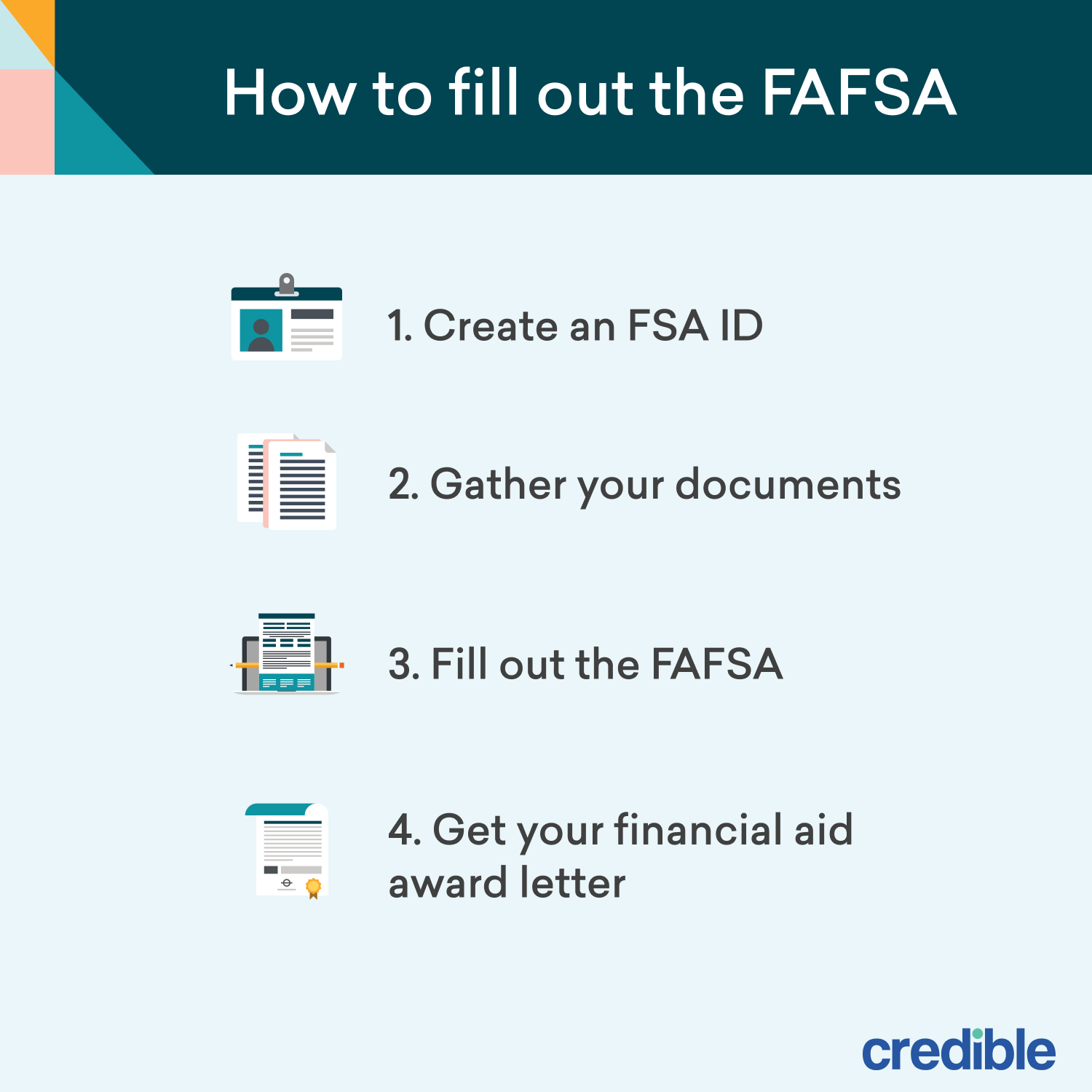

2. Fill out the FAFSA

Your first step in finding student loans for online colleges should be to complete the Free Application for Federal Student Aid (FAFSA). The FAFSA helps determine your eligibility for federal student aid, including federal student loans and grants.

If you’re ready to complete the FAFSA, follow these four steps:

- Create an FSA ID. To fill out the FAFSA online, you’ll need to create a Federal Student Aid (FSA) ID with a username and password at StudentAid.Gov. If you’re a dependent student, one of your parents will also need to create an FSA ID so they can can sign your application. Keep in mind that you’ll need your Social Security number to register an FSA ID.

- Gather your documents. You’ll need your financial information, most recent tax return, and documentation regarding any assets to fill out the FAFSA. If you’re a dependent student, you’ll need this information from your parents as well. Keep in mind that if you filed a U.S. tax return, you’ll likely be able to transfer it directly to your FAFSA using the IRS Data Retrieval Tool, which is linked within the FAFSA itself.

- Fill out the FAFSA. Once you have your FSA ID and have gathered your information, you’re ready to complete the FAFSA at StudentAid.gov. As you fill out the form, you’ll provide your financial and tax information. You’ll also need to list at least one school that will receive your FAFSA information. When you’re done, sign and submit the form.

- Get your financial aid award letter. Once you’ve completed the FAFSA, your school’s financial aid office will send you a financial aid award letter. This letter will detail the federal student loans and grants you qualify for. You can then decide which aid you’d like to accept.

For the 2023-2024 academic year, the deadline is June 30, 2024. Some colleges and states also have their own FAFSA deadlines — double-check with your school’s financial aid office so you don’t miss any important dates.

Check Out: 5 Steps to Take If You Can’t Afford College

3. Apply for scholarships and grants

Unlike student loans, college scholarships and grants don’t have to be repaid — which makes them a great way to pay for college.

There’s also no limit to how many scholarships and grants you can get, so it’s a good idea to apply for as many as possible.

Some of the organizations that might offer scholarships and grants for online classes include:

- Nonprofit organizations

- Local and national businesses

- Professional associations in your field

You can use sites like Fastweb and Scholarships.com to easily search for scholarships that you might be eligible for. Also keep in mind that you might qualify for school-based scholarships, depending on your FAFSA results.

For example, you could consider getting a job or participating in the federal work-study program, which provides part-time employment to undergraduate and graduate students with financial need.

Learn More: How to Pay for College With No Money Saved

4. Take out federal student loans

After you fill out the FAFSA and receive your financial aid award letter, you can decide what federal financial aid and federal student loans to accept.

The government pays the interest on these loans while you’re in school, which can help keep your repayment costs lower.

If you aren’t eligible for subsidized loans or have met your limits, Direct Unsubsidized Loans are generally the next-best choice. While the government doesn’t cover any interest on these loans, they have lower rates compared to Direct PLUS Loans.

If you’re considering Direct Subsidized vs. Unsubsidized Loans, here are several important points to keep in mind:

| Direct Subsidized Loans | Direct Unsubsidized Loans | |

|---|---|---|

| Who qualifies? | Undergrad borrowers with financial need | Undergrad, graduate, and professional students (regardless of financial need) |

| Available to graduate or professional students? | No | Yes |

| Interest rates |

|

|

| Aggregate loan limits (for dependent students) |

|

|

| Aggregate loan limits (for independent students) |

|

|

| Interest covered by the Department of Education |

| None |

Check Out: Guide to Every Type of Student Loan Offered

5. Compare rates on private student loans

After you’ve exhausted your federal student loan options, private student loans could help fill in any funding gaps.

If you have excellent credit, you might even find lower interest rates with private student loans compared to federal PLUS Loans.

Some private lenders only offer loans to students enrolled at certain schools, which might not include the online colleges you’re considering.

If you decide to take out a private student loan, be sure to shop around and consider as many lenders as possible. This way, you can find the right loan for your needs.

Here are Credible’s partner lenders that offer private student loans for online college:

| Lender | Fixed Rates From (APR) | Variable Rates From (APR) | Loan amounts | Loan terms (years) |

|---|---|---|---|---|

| 3.79%+10 | 5.99%+10 | $2,001* to $400,000 | 5, 7, 10, 12, 15, 20 |

|

||||

| 4.24%+1 | 5.99%+ | $1,000 to $350,000 (depending on degree) | 5, 10, 15 |

|

||||

|

3.99%+2,3

| 5.59%+2,3 | $1,000 up to 100% of the school-certified cost of attendance | 5, 8, 10, 15, 20 |

|

||||

| 4.24%+ | 5.44%+ | $1,000 to $99,999 annually ($180,000 aggregate limit) | 7, 10, 15 |

|

||||

| 4.8%+8 | 7.75%+8 | $1,001 up to 100% of school certified cost of attendance | 5, 10, 15 |

|

||||

| 5.75%+ | N/A | $1,500 up to school’s certified cost of attendance less aid | 10, 15 |

|

||||

| 4.150%9 - 15.49%9 | 5.37%9 - 15.70%9 | $1,000 up to 100% of school-certified cost of attendance | 10 to 20 |

|

||||

your credit score. 100% free! |

||||

Only borrow what you need

If you’re attending an online school, you can save on common costs like room and board. This means you can likely pay for your education with fewer student loans than the average student.

This way, you’ll have lower loan balances to pay back in the future.

Find out how much you’ll owe over the life of your federal or private student loans using our student loan calculator below.

Enter your loan information to calculate how much you could pay

With a $ loan, you will pay $ monthly and a total of $ in interest over the life of your loan. You will pay a total of $ over the life of the loan, assuming you're making full payments while in school.

Need a student loan?

Compare rates without affecting your credit score. 100% free!

Checking rates won’t affect your credit score.

Keep Reading: How to Get a Student Loan With No Credit Check