Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

College can be an expensive investment: The average cost of college for an in-state student at a public college is $25,890 per year and the price goes up to $41,950 for an out-of-state school.

With this kind of cost, you might find yourself unable to afford your college expenses. Maybe you can’t get financial aid or student loans by the beginning of the semester — or maybe you’ve even run out of funds mid-semester.

The good news is that there are a few options that might help you get the funds you need to continue your education.

Here’s what to do if you can’t afford college:

- Fill out the FAFSA

- Apply for grants and scholarships

- Accept federal student loans

- Speak with your financial aid office

- Apply for private student loans

1. Fill out the FAFSA

If you need money to cover your college expenses, filling out the Free Application for Federal Student Aid (FAFSA) is a good place to start. Your school will use your FAFSA results to determine what federal financial aid you qualify for based on your:

- Estimated Family Contribution (how much your family is expected to contribute toward your education)

- Year in school

- Enrollment status

- Whether you’re an independent or dependent student

- Cost of attendance

Also keep in mind that many kinds of aid are given on a first-come, first-served basis, so it’s a good idea to submit the FAFSA as early as possible — especially if you have high financial need.

Even if you don’t think you’re eligible for federal aid, be sure to complete the FAFSA. There’s always a chance that you might qualify for financial aid you didn’t know about.

Learn More: When You Should Apply for a Student Loan

2. Apply for grants and scholarships

College grants and scholarships can be a great way to pay for school since you don’t have to pay them back, unlike student loans. This essentially makes them free money for covering college expenses.

There’s no limit to how many grants and scholarships you can get, so be sure to apply for as many as you can. Some might even be available year-round or on a repeat basis.

For example, you might find scholarships through:

- Credit unions

- Businesses

- Nonprofit organizations

- Associations for areas you’re engaged in (such as sports or arts)

Your school might also offer scholarships based on your FAFSA results. Additionally, you can use sites like Fastweb or Scholarships.com to search for scholarships on a wide scale.

Check Out: Taking Out Student Loans Without a Cosigner

3. Accept federal student loans

If you need to borrow money for school, federal student loans are typically the best place to start. This is mainly because they offer federal benefits and protections, such as access to income-driven repayment plans and student loan forgiveness programs.

Here are the types of federal student loans that might be available to you:

- Direct Subsidized Loans: Undergraduate students with financial need could be eligible for these loans. The government covers the interest on subsidized loans while you’re in school, which lowers your overall cost of repayment.

- Direct Unsubsidized Loans: These loans are available to both undergraduate and graduate students, regardless of financial need. Unlike with subsidized loans, you’re responsible for all of the interest that accrues on unsubsidized loans.

- Direct PLUS Loans: There are two types of Direct PLUS Loan: Grad PLUS Loans for students attending grad school and Parent PLUS Loans for parents who want to pay for their child’s education. The interest rates on PLUS Loans are typically higher compared to other types of federal student loans — depending on your credit, PLUS Loan rates might even be higher than what you’d get on a private student loan. Keep in mind that PLUS Loans also require a credit check.

| Loan type | Who qualifies? | Interest rates | Loan limits |

|---|---|---|---|

| Direct Subsidized Loans | Undergrad students with financial need | 5.50% | $3,500 to $5,500 per year |

| Direct Unsubsidized Loans | Undergrad, graduate, and professional students | Undergrad: 5.50% Graduate and professional: 7.05% | Dependent undergrad: $5,500 to $7,500 per year ($31,000 total limit) Independent undergrad: $9,500 to $12,500 per school year ($57,500 total limit) Graduate and professional: $20,500 per year ($138,500 total limit) |

| Direct PLUS Loans | Parents, graduate students, and professional students | 8.05% | Cost of attendance minus any other financial aid received |

Just keep in mind that private student loans don’t come with federal student loan benefits and protections.

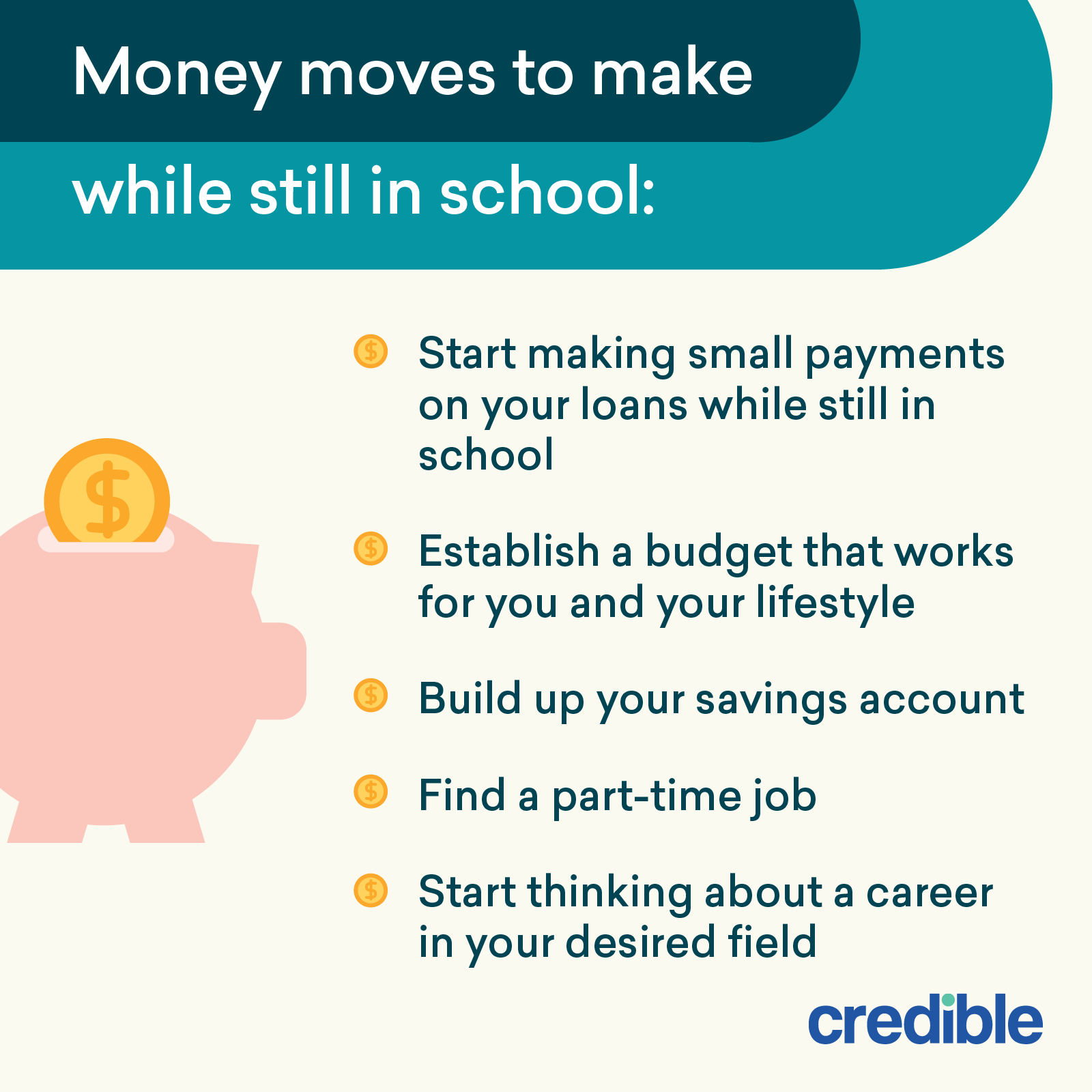

No matter which type of student loan you decide to take out, it’s important to think about how much that loan will cost you in the future. This way, you can prepare for any added expenses.

You can find out how much you’ll owe over the life of your federal or private student loans using our student loan calculator below.

Enter your loan information to calculate how much you could pay

With a $ loan, you will pay $ monthly and a total of $ in interest over the life of your loan. You will pay a total of $ over the life of the loan, assuming you're making full payments while in school.

Need a student loan?

Compare rates without affecting your credit score. 100% free!

Checking rates won’t affect your credit score.

See: How to Cover Tuition Costs With the Post-9/11 GI Bill

Learn More: How Long Does It Take to Get a Student Loan?

4. Speak with your financial aid office

If you can’t afford your college costs, it’s a good idea to visit your school’s financial aid office to see what resources might be available to you. A financial aid counselor can help you understand your options as well as how to apply for them.

For example, they might be able to walk you through applying for work-study or other alternatives to help you pay for on-campus or off-campus housing, textbooks, and more.

Check Out: Emergency Loans: How to Get a Personal Loan Fast

5. Apply for private student loans

If you’ve exhausted your scholarship, grant, and federal student loan options, private student loans could help fill any remaining financial gaps.

While private student loans don’t offer the protections of federal student loans, they do offer some benefits of their own, such as:

- Higher loan amounts: Depending on the lender, you might be able to borrow up to your school’s cost of attendance.

- No application deadlines: You can apply for a private student loan at any time, which could be helpful if you run out of funds during the semester or miss the FAFSA deadline.

- Potentially lower rates than federal student loans: Depending on your credit, you might qualify for a lower interest rate on a private student loan compared to a federal loan.

- Could cover non-traditional schooling: You might be able to use private student loans for non-traditional programs, such as trade school, online college, or summer school.

If you’re considering a private student loan, here are several important points to keep in mind:

| Eligibility |

|

| How to apply | Apply directly with a private lender |

| Loan amounts | Up to your school’s cost of attendance (depending on the lender) |

| Interest rates | Fixed rates from (APR):

3.74%+

Variable rates from (APR): 5.13%+ (Private lenders on Credible) |

| Repayment terms | 5 to 20 years (with Credible partner lenders) |

If you’re struggling to get approved, consider applying with a cosigner to improve your chances and possibly even get a better interest rate. Most private student loans are cosigned — so if you need a cosigner, you’re not alone!

Before you take out a private student loan, be sure to consider as many lenders as possible to find the right loan for you. Credible makes this easy — you can compare your prequalified rates from our partner lenders in the table below in two minutes.

| Lender | Fixed Rates From (APR) | Variable Rates From (APR) | Loan Terms (Years) |

|---|---|---|---|

| 3.79%+10 | 5.99%+10 | 5, 7, 10, 12, 15, 20 (depending on loan type) |

|

|||

| 4.24%+1 | 5.99%+ | 5, 10, 15 |

|

|||

|

3.99%+2,3

| 5.59%+2,3 | 5, 8, 10, 15 |

|

|||

| 4.24%+ | 5.44%+ | 7, 10, 15 |

|

|||

| 4.8%+8 | 7.75%+8 | 5, 10, 15 |

|

|||

| 5.75%+ | N/A | 10, 15 |

|

|||

| 4.150%9 - 15.49%9 | 5.37%9 - 15.70%9 | 10 to 20 |

|

|||

your credit score. 100% free! |

|||

Lowest APRs reflect autopay, loyalty, and interest-only repayment discounts where available | Read our full methodology | 10Ascent Disclosures | 1Citizens Disclosures | 2,3College Ave Disclosures | 11Custom Choice Disclosures | 7EDvestinU Disclosures | 8INvestEd Disclosures | 9Sallie Mae Disclosures |

|||

Learn More:

- How to Get Student Loans, Grants, and More for Adult Learners

- What to Do If You’re Denied a Student Loan With a Cosigner

What happens if I can’t pay my college tuition?

If you can’t pay your college tuition, your school account could be placed on hold. This means you might not be able to attend classes, receive financial aid, or have your diploma issued until your account is brought up to date.

If you’ve exhausted your federal financial aid options, a private student loan could help you cover your tuition costs. You could even use a private student loan for past-due tuition.

Just remember to consider as many lenders as you can before taking out a private loan. This way, you can find a loan that works for you. This is easy with Credible — you can compare your prequalified rates from multiple lenders in two minutes.

See Your Rates

Checking rates will not affect your credit

Check Out: How to Get a Student Loan With No Credit Check

Can you pay for college if you have no income or savings?

Yes, there are several options available that could help low-income students pay for a degree, even if they have no money saved for college. After you fill out the FAFSA, your school will calculate your Expected Family Contribution.

They’ll then use this number to determine what federal aid as well as school-based aid you’re eligible for, such as scholarships and grants.

Having this much aid available might even help lower your overall costs. In 2019, students whose families earned less than $50,000 per year paid $11,280 less per year to attend a public four-year school compared to students whose families earned over $150,000 per year, according to the CollegeBoard.

Learn More:

Private student loans can be taken out at any point during the school year

If you’re unsure how to pay for college, don’t worry — there are several options available that might help you cover your costs. Be sure to speak with your school’s financial aid office to see what resources you might qualify for.

If you decide to get a private student loan, remember to consider as many lenders as you can to find a loan that suits your needs. Credible makes this easy — you can compare your prequalified rates from multiple lenders after filling out a single form.

See Your Rates

Checking rates will not affect your credit

Keep Reading: Fixed- or Variable-Rate Student Loan: Which Is Right for You?