If you’re looking for a fast and convenient way to borrow up to $50,000 (or more), an online personal loan can be a good choice — whether you’re consolidating debt, paying for an emergency, or funding a major expense.

But some online lenders offer other types of loans, which can have triple-digit APRs and ultra-short repayment terms. They might help you get by until your next payday, or trap you in a cycle of high-cost debt.

This article provides tips on how to choose the best online loans and how to avoid predatory lenders.

Compare personal loan rates

Best online personal loans

Advertiser Disclosure

We receive compensation from the companies below if you purchase a product. Amount of compensation does not impact the ranking or placement of a particular product. Not all available financial products and offers from all financial institutions have been reviewed by this website. This content is not provided by Credible or any of the Providers on the Credible website. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by Credible.

LightStream: Best overall

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. We collected thousands of data points on dozens of lenders for personal loans, mortgages, and student loans. Specific criteria vary by loan type, but generally include interest rates, loan terms, eligibility requirements, transparency, funding times, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Advertiser Disclosure

We receive compensation from the companies below if you purchase a product. Amount of compensation does not impact the ranking or placement of a particular product. Not all available financial products and offers from all financial institutions have been reviewed by this website. This content is not provided by Credible or any of the Providers on the Credible website. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by Credible.

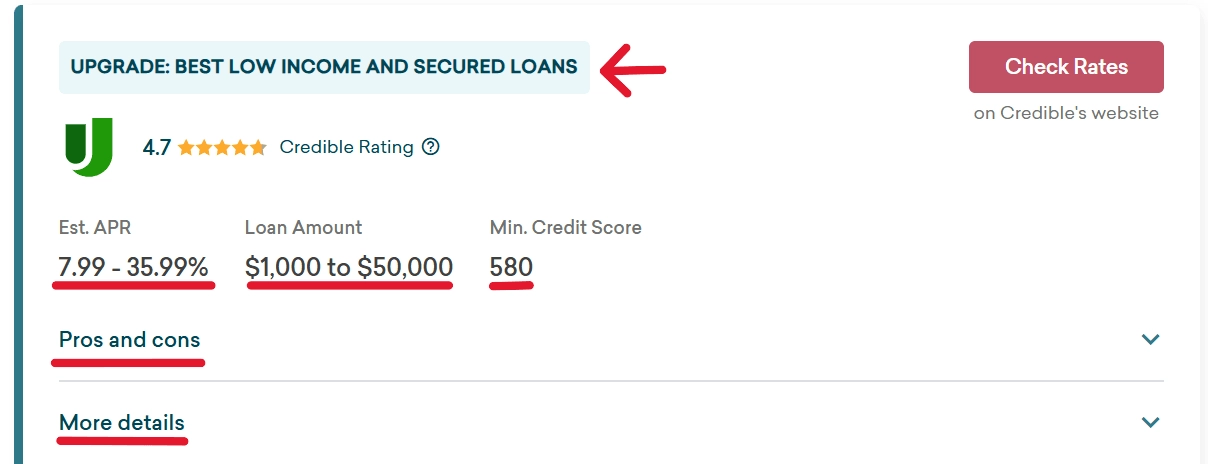

Upgrade: Best low income and secured loans

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. We collected thousands of data points on dozens of lenders for personal loans, mortgages, and student loans. Specific criteria vary by loan type, but generally include interest rates, loan terms, eligibility requirements, transparency, funding times, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Est. APR

7.74 - 35.99%

Loan Amount

$1,000 to $50,000

Min. Credit Score

580

Advertiser Disclosure

We receive compensation from the companies below if you purchase a product. Amount of compensation does not impact the ranking or placement of a particular product. Not all available financial products and offers from all financial institutions have been reviewed by this website. This content is not provided by Credible or any of the Providers on the Credible website. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by Credible.

SoFi: Best online bank loans

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. We collected thousands of data points on dozens of lenders for personal loans, mortgages, and student loans. Specific criteria vary by loan type, but generally include interest rates, loan terms, eligibility requirements, transparency, funding times, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Advertiser Disclosure

We receive compensation from the companies below if you purchase a product. Amount of compensation does not impact the ranking or placement of a particular product. Not all available financial products and offers from all financial institutions have been reviewed by this website. This content is not provided by Credible or any of the Providers on the Credible website. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by Credible.

Universal Credit: Best Fast Loans for Fair Credit

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. We collected thousands of data points on dozens of lenders for personal loans, mortgages, and student loans. Specific criteria vary by loan type, but generally include interest rates, loan terms, eligibility requirements, transparency, funding times, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Est. APR

11.69 - 35.99%

Loan Amount

$1,000 to $50,000

Min. Credit Score

580

Advertiser Disclosure

We receive compensation from the companies below if you purchase a product. Amount of compensation does not impact the ranking or placement of a particular product. Not all available financial products and offers from all financial institutions have been reviewed by this website. This content is not provided by Credible or any of the Providers on the Credible website. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by Credible.

Best Egg: Best for secured loans

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. We collected thousands of data points on dozens of lenders for personal loans, mortgages, and student loans. Specific criteria vary by loan type, but generally include interest rates, loan terms, eligibility requirements, transparency, funding times, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Est. APR

6.99 - 35.99%

Loan Amount

$2,000 to $50,000

Min. Credit Score

600

Advertiser Disclosure

We receive compensation from the companies below if you purchase a product. Amount of compensation does not impact the ranking or placement of a particular product. Not all available financial products and offers from all financial institutions have been reviewed by this website. This content is not provided by Credible or any of the Providers on the Credible website. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by Credible.

Splash: Low Rates for Good Credit

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. We collected thousands of data points on dozens of lenders for personal loans, mortgages, and student loans. Specific criteria vary by loan type, but generally include interest rates, loan terms, eligibility requirements, transparency, funding times, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Est. APR

-

Loan Amount

$3,000 to $50,000

Min. Credit Score

680

Advertiser Disclosure

We receive compensation from the companies below if you purchase a product. Amount of compensation does not impact the ranking or placement of a particular product. Not all available financial products and offers from all financial institutions have been reviewed by this website. This content is not provided by Credible or any of the Providers on the Credible website. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by Credible.

BHG Financial: Best large debt consolidation loans

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. We collected thousands of data points on dozens of lenders for personal loans, mortgages, and student loans. Specific criteria vary by loan type, but generally include interest rates, loan terms, eligibility requirements, transparency, funding times, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Est. APR

-

Loan Amount

$20,000 to $250,000

Min. Credit Score

640

Advertiser Disclosure

We receive compensation from the companies below if you purchase a product. Amount of compensation does not impact the ranking or placement of a particular product. Not all available financial products and offers from all financial institutions have been reviewed by this website. This content is not provided by Credible or any of the Providers on the Credible website. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by Credible.

OneMain Financial: Best large loans for bad credit

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. We collected thousands of data points on dozens of lenders for personal loans, mortgages, and student loans. Specific criteria vary by loan type, but generally include interest rates, loan terms, eligibility requirements, transparency, funding times, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Est. APR

18.00 - 35.99%

Loan Amount

$1,500 to $20,000

Min. Credit Score

N/A

Advertiser Disclosure

We receive compensation from the companies below if you purchase a product. Amount of compensation does not impact the ranking or placement of a particular product. Not all available financial products and offers from all financial institutions have been reviewed by this website. This content is not provided by Credible or any of the Providers on the Credible website. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by Credible.

Upstart: Best for easy prequalification

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. We collected thousands of data points on dozens of lenders for personal loans, mortgages, and student loans. Specific criteria vary by loan type, but generally include interest rates, loan terms, eligibility requirements, transparency, funding times, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Est. APR

6.60 - 35.99%

Loan Amount

$1,000 to $75,000

Min. Credit Score

620

Advertiser Disclosure

We receive compensation from the companies below if you purchase a product. Amount of compensation does not impact the ranking or placement of a particular product. Not all available financial products and offers from all financial institutions have been reviewed by this website. This content is not provided by Credible or any of the Providers on the Credible website. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by Credible.

LendingClub: Best rates for most credit scores

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. We collected thousands of data points on dozens of lenders for personal loans, mortgages, and student loans. Specific criteria vary by loan type, but generally include interest rates, loan terms, eligibility requirements, transparency, funding times, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Est. APR

6.53 - 35.99%

Loan Amount

$1,000 to $60,000

Min. Credit Score

600

Advertiser Disclosure

We receive compensation from the companies below if you purchase a product. Amount of compensation does not impact the ranking or placement of a particular product. Not all available financial products and offers from all financial institutions have been reviewed by this website. This content is not provided by Credible or any of the Providers on the Credible website. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by Credible.

Prosper: Best P2P lending platform

Credible lender ratings are evaluated by our editorial team with the help of our loan operations team. We collected thousands of data points on dozens of lenders for personal loans, mortgages, and student loans. Specific criteria vary by loan type, but generally include interest rates, loan terms, eligibility requirements, transparency, funding times, repayment options, fees, discounts, customer service, cosigner options, and more.

Read our full methodology.

Est. APR

8.99 - 35.99%

Loan Amount

$2,000 to $50,000

Min. Credit Score

660

What is an online loan?

An online loan is any type of loan you can get online, but in most cases, it refers to a personal loan from an online lender. Financial technology companies (sometimes called "fintech lenders") offer an entirely online experience, while some bank and credit union loans may be processed partially online. For instance, you may have to visit a branch location in person to fill out the application or sign the loan agreement.

Whether you get a loan online or in person, it generally won’t affect your eligibility.

Here are a few common features of online personal loans:

- Fast funding: Online personal loans are typically processed quickly thanks to automation and AI underwriting. Funds are available within a few days in most cases, although some lenders offer same-day funding.

- Upfront lump sum: The amount you borrow is typically deposited directly into your bank account. If you're using the loan for debt consolidation, some lenders send the funds directly to your creditors.

- Repaid in monthly installments: Unlike credit cards, which are a type of revolving credit, personal loans are typically paid back in scheduled monthly installments of equal size.

- Fixed interest rates: Most personal loans have fixed rates rather than variable rates, so your interest rate and the size of your monthly payments remain the same.

- Often unsecured: Unsecured loans don’t require collateral, which means you don't have to pledge an asset to secure the loan. Since there's no asset that needs to be evaluated, an unsecured personal loan can be funded more quickly than a secured loan.

- Prequalification widely available: Most personal loan lenders offer prequalification with a soft credit pull that doesn't affect your credit score. It’s not a loan offer, but it can give you an idea of the rate and terms you might qualify for if you apply.

- Credit check with application: Most personal loan lenders run a hard credit check when you apply, which could ding your score by up to 10 points for up to one year.

Learn More: How Do Personal Loans Work?

Important

Watch out for predatory loans online, especially if you have bad credit or need a small loan amount. If a lender offers loans with APRs above 36%, doesn't require any kind of credit check, and doesn’t report to the credit bureaus, those are red flags.

Average personal loan interest rates

Borrowers with excellent credit qualify for the best loan rates. But you can often get a lower rate by choosing a shorter repayment term. For instance, we can see that borrowers with the best credit actually paid higher rates, on average, for five-year loans compared to borrowers with very good credit who got three-year loans.

Types of online loans

Though we focus on online personal loans here, other types are also available. Here’s an overview of the different types of loans available online:

- Unsecured personal loans: No collateral is required; approval is based on creditworthiness, income, and current debt.

- Secured loans: These are backed by an asset like your car or a savings account.

- Payday loans: Available in some states, payday loans are small, short-term, high-fee loans that tend to have triple-digit APRs.

- Buy Now, Pay Later (BNPL): These short-term installment loans are often interest-free if paid off in 6 weeks.

- Cash advance apps: Similar to payday loans, these small loans (typically up to $500) are due within two weeks. You can avoid paying fees if you don’t need the money right away.

- Credit card / personal line of credit: Borrow what you need, when you need, up to your credit limit. However, interest rates for credit cards and personal lines of credit are typically variable rather than fixed, unlike personal loans.

Pros and cons of online loans

Pros

- Quick application process

- Fast approval

- Same-day or next-day funding

- No collateral required (in most cases)

- Prequalification has no credit impact

- Lump sum deposit into your account

- Rates are typically fixed, not variable

Cons

- Difficult to qualify with bad credit

- Hard credit pull during application

- Risk of predatory lending

- Few online lenders have in-person customer service

Check Out: Should I Get a Personal Loan?

How to compare online loans

It’s often easiest to compare online loans and lenders on a personal loan marketplace. You can see APR ranges, available loan amounts, credit score requirements, and more side by side, all in one place.

Here’s an example of a Credible lender card showing where to find estimated APRs, available loan amounts, minimum credit scores, and more:

You can also prequalify with multiple lenders at once on a loan marketplace to see which might have the best rate and terms. But not all marketplaces partner with all lenders, so it’s best to also shop individual lenders to get a fuller picture of the personal loans that may be available to you.

Compare APRs

The annual percentage rate (APR) measures the cost of borrowing money on an annualized basis. A personal loan's APR accounts for the interest rate and any upfront fees, such as origination fees. Note that lenders of short-term loans, like payday loans, often charge fees instead of interest, which can equate to triple-digit APRs. Most legitimate lenders charge APRs no higher than 36%.

Check approved loan purposes

Not all lenders approve all loan purposes. Before you apply, confirm that your lender of choice will allow you to use the money as intended. Some lenders allow a limited number of loan purposes, such as debt consolidation or credit card refinancing.

Check eligibility requirements

The main considerations are:

- Do you meet the lender's credit score and minimum income requirements?

- Do you live in a state or territory where the lender is licensed to loan money?

- Is there anything in your financial profile that could disqualify you, such as a bankruptcy?

Some lenders have more specific requirements than others. When in doubt, contact the lender to ask about your eligibility.

Confirm available loan amounts

Make sure the lender offers the amount of money you need to borrow. Personal loan amounts are often available between $1,000 and $50,000, but what you qualify for often depends on your income, credit score, and existing debt.

Check funding speed

Personal loans are typically funded within a few days of approval, but some lenders offer same-day or next-day funding. If you need money fast, choose a lender with fast approvals and same-day funding.

Consider repayment terms

Repayment terms typically range from 2 to 7 years, depending on the lender and loan purpose. The longer your loan’s term, the lower your monthly payment is, in most cases. Use a personal loan calculator to see how monthly payments can vary based on repayment terms.

Check the lender's reputation

Look at customer reviews on third-party websites like Trustpilot and the Better Business Bureau (BBB). In particular, check if different reviewers are reporting similar issues.

Look for discounts and perks

Some lenders offer rate discounts for autopay or direct pay. In the case of some banks, you might get same-day funding if you’re already a customer.

Review customer service options

Make sure you’ll be able to reach the lender in a way that's convenient for you in case there are any issues with your loan. Many online lenders offer a live chat feature in addition to phone and email contacts.

Learn More: How To Compare Personal Loans: A Step-by-Step Guide

Good to know

The most common purposes for loans approved via the Credible marketplace in September 2025 were debt consolidation (43%), credit card refinancing (24%), home improvement (9%), and major purchases (7%).

How to apply for a personal loan online

- Check your credit report for errors: You can get a free copy at AnnualCreditReport.com.

- Check your credit score: Credible offers credit score and monitoring tools that let you check your credit score for free.

- Prequalify with multiple lenders: Compare estimated rates and terms to find the best loan for you.

- Gather application documents: You’ll typically need a photo ID and proof of income and employment.

- Submit your application: Be prepared to authorize a hard credit check at this stage.

- Review the loan agreement: If you’re approved, make sure the loan agreement meets your expectations. It could be different from the prequalification quote you received.

- Sign documents and await funds: Your lender can send directly to your bank account, often within 1 business day, or to your creditors if consolidating or refinancing debt.

Learn More: How To Apply for a Personal Loan

Online loans for bad credit

If you have a FICO score below 580, getting approved for a loan may be difficult. And if approved, your rate will likely be higher than 30% APR. Start by prequalifying with lenders that offer personal loans for bad credit, like Avant, Reprise, or OneMain Financial, and try the following:

- Secure the loan with collateral: Some online lenders, like OneMain Financial, offer secured personal loans for bad credit, which may be easier to qualify for and offer a lower rate.

- Apply with a cosigner or co-borrower: Applying with a co-borrower or cosigner who has good or excellent credit can improve your chances of getting an online loan. With a joint personal loan, you and your co-borrower have access to the funds and share responsibility for repayment. With a cosigned loan, your cosigner has no access to the funds and will be responsible for repayment only if you fail to repay.

- Take out a credit-builder loan: Some banks, credit unions, and online lenders offer credit-builder loans for borrowers with bad credit or no credit history. Instead of funding the money upfront, a credit-builder loan puts the money in an account that you "unlock" by making all your monthly payments.

- Improve your credit: Making on-time payments, paying down debt, and limiting applications for new credit can positively impact your score. These measures can take time. However, you may be able to get a quick score boost by using a tool like Experian Boost.

Editor insight: “High credit card balances increase your credit utilization, which can drag your score down. But if you consolidate or refinance credit card debt with a personal loan, you can quickly reduce your credit utilization and might significantly increase your score — often within one month.”

— Meredith Mangan, Senior Loans Editor, Credible

How to avoid predatory lending

To protect yourself from predatory lenders, look out for red flags such as:

- Pressure tactics that urge you to sign up immediately

- Lenders that advertise “guaranteed” approvals or "guaranteed" low rates

- Lenders that don’t check your credit

- Lenders that request upfront fees before approval

- Signs of a non-secure website, such as an address that begins with "http" instead of "https"

Check out the rates and terms of multiple lenders before you commit to a loan, and make sure you’re comparing APRs. If one lender has a rate that seems out of line with the others and too good to be true, it probably is.

Also, look for ratings or reviews from the lender’s customers on sites like Trustpilot and the Better Business Bureau (BBB).

Learn More: 8 Signs of Personal Loan Scams

Methodology

Credible evaluated 32 lenders across 1,216 data points to determine the best online loans. We chose the best lenders based on the following weighted categories:

- Rates and fees: 18.75%

- Eligibility and options for bad and no credit: 17.5%

- Availability: 12.5%

- Loan amounts and terms: 10%

- Customer satisfaction: 10%

- Customer service: 10%

- Efficiency and fund delivery: 10%

- Discounts: 7.5%

- Credible proprietary data: 3.75%

Credible's team of experts gathered information from each lender’s website and from our partners directly. We also considered each of our partner lenders' statistics over a 12-month period — including average funding times, average credit scores for approved applicants, and average rates. Each data point is verified by a senior editor to make sure it's accurate at the time of publication.

Learn more about how Credible rates lenders by exploring our personal loans lender rating methodology.

Where we get our data

Why trust Credible

FAQ

Are online loans safe?

Open

Where can I get a loan online?

Open

What is the easiest loan to get online?

Open

What are some legit online payday loans?

Open

How to get a fast loan online?

Open

What can you use a personal loan for?

Open

Disclosure: Some lending partners that participate in Credible’s comparison marketplace offer loans to borrowers with scores as low as 550. Borrowers with low scores will have fewer lending options than borrowers with higher credit scores.