Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

There are several factors to keep in mind as you consider which college to attend, such as:

- Overall cost

- Field of study

- Location

- Financial aid

- Student facilities

- Campus culture

- Career services

In addition to these elements, it’s a good idea to think about the return on investment (ROI) — this is the amount of money you can expect to earn in return for your investment in a college degree.

Here’s what Dan Roccato, Credible’s Money Coach, had to say regarding college ROI:

Here’s what you should know about ROI for colleges:

- Top 25 universities based on a 20-year return on investment (ROI)

- Determining a college’s return on investment

- How to offset the cost of college

- Factors to consider when selecting a college

- Tools to evaluate your investment in higher education

Top 25 universities based on a 20-year return on investment (ROI)

Below, we’ve ranked the top 25 universities according to their 20-year ROIs. We’ve also included the total four-year cost for each school along with the average mid-career salary you can expect after earning an undergraduate degree there.

| Ranking | School | Total 4-year cost | 20-year ROI | Average salary |

|---|---|---|---|---|

| 1 | Massachusetts Institute of Technology | $276,000 | $1,182,000 | $167,200 |

| 2 | Harvey Mudd College | $303,000 | $1,164,000 | $166,600 |

| 3 | United States Merchant Marine Academy | $27,200 | $1,153,000 | $145,600 |

| 4 | United States Military Academy | $0 | $1,124,000 | $166,800 |

| 5 | SUNY Maritime College | $103,000 | $1,039,000 | $164,100 |

| 6 | United States Naval Academy | $0 | $1,028,000 | $169,000 |

| 7 | Colorado School of Mines | $138,000 | $1,017,000 | $148,700 |

| 8 | United States Air Force Academy | $0 | $970,000 | $148,600 |

| 9 | California Maritime Academy | $106,000 | $926,000 | $138,700 |

| 10 | California Institute of Technology | $283,000 | $921,000 | $164,600 |

| 11 | Georgia Institute of Technology | $115,000 | $913,000 | $145,300 |

| 12 | Stevens Institute of Technology | $274,000 | $899,000 | $150,900 |

| 13 | Princeton University | $275,000 | $895,000 | $161,500 |

| 14 | Albany College of Pharmacy and Health Sciences | $195,000 | $880,000 | $141,100 |

| 15 | Stanford University | $282,000 | $877,000 | $173,500 |

| 16 | Harvard University | $282,000 | $839,000 | $169,000 |

| 17 | Webb Institute | $280,000 | $834,000 | $153,300 |

| 18 | Babson College | $287,000 | $831,000 | $155,400 |

| 19 | Rose-Hulman Institute of Technology | $266,000 | $830,000 | $146,500 |

| 20 | University of California — Berkeley | $151,000 | $828,000 | $154,500 |

| 21 | Massachusetts Maritime Academy | $106,000 | $822,000 | $123,200 |

| 22 | Kettering University | $234,000 | $817,000 | $138,700 |

| 23 | Worcester Polytechnic Institute | $265,000 | $811,000 | $143,800 |

| 24 | Missouri University of Science and Technology | $89,800 | $806,000 | $132,000 |

| 25 | University of Pennsylvania | $293,000 | $805,000 | $153,100 |

| Methodology | ||||

If you need to borrow for school, you could also consider taking out federal or private student loans.

Before you borrow for school, be sure to consider how much you’ll actually pay for a student loan over time. This way, you can be prepared for any added expenses.

You can find out how much you’ll owe over the life of your federal or private student loans — as well as your estimated monthly payments — using our student loan calculator below.

Enter your loan information to calculate how much you could pay

With a $ loan, you will pay $ monthly and a total of $ in interest over the life of your loan. You will pay a total of $ over the life of the loan, assuming you're making full payments while in school.

Need a student loan?

Compare rates without affecting your credit score. 100% free!

Checking rates won’t affect your credit score.

Learn More: Which Type of College Gives Student Loan Borrowers the Biggest Bang for Their Buck?

Determining a college’s return on investment

It can be more difficult to calculate your ROI on a college degree compared to other investments, such as in the stock market or real estate — especially when you consider how many of the benefits of a college education are unrelated to money.

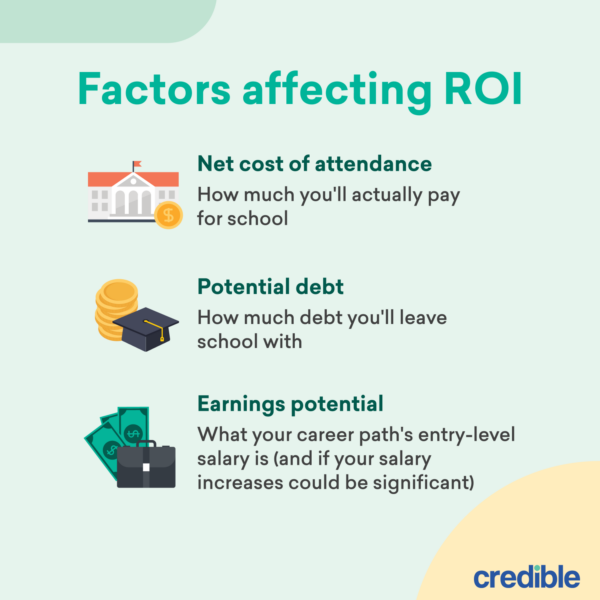

However, taking the time to consider each of the components that make up ROI could help you figure out which institution will offer the biggest bang for your buck. Here are the three major factors that affect ROI:

- Net cost of attendance: This is how much you’ll pay for school, including tuition, college textbooks, housing, and any other expenses. While the published sticker price of a school might seem high, your net cost (how much you’ll actually pay) could end up being much lower after you’ve claimed the federal, state, and institutional financial aid available to you.

- Potential debt: Even if you’re able to take advantage of scholarships, grants, and other financial aid that doesn’t have to be repaid, you might still need to take out student loans to help cover your college costs.

- Earnings potential: Before you choose a school or program, it’s important to research how much you can generally expect to make following graduation as well as how much your salary could be later on. Your expected earnings can also help you determine how much student loan debt you’ll be able to afford. For example, in career paths where salary increases are usually significant (such as law or medicine), taking out higher amounts of debt could be worth it. But for other lower-paying careers, it will be more important to minimize your debt as much as possible to maximize your ROI.

Check Out: College ROI: 6 Tools to Gauge the Return on Your Degree

How to offset the cost of college

While attending college can be expensive, there are thankfully several options that can help to offset the overall cost.

If you need to pay for college, follow these four steps:

1. Submit the FAFSA

Your first step in paying for college should be filling out the Free Application for Federal Student Aid (FAFSA). Your school will use your FAFSA results to determine what federal student loans and other federal financial aid you’re eligible for.

Also keep in mind that some federal aid is given on a first come, first serve basis — so it’s a good idea to submit the FAFSA as early as possible if you have high financial need.

Learn More: Every College You Might be Interested in Should be on Your FAFSA

2. Apply for scholarships and grants

Unlike student loans, college scholarships and grants don’t have to be repaid — which makes them a great way to pay for college. They can also help improve your ROI.

There’s no limit to how many scholarships and grants you can get, so it’s a good idea to apply for as many as you can. You might also be eligible for school-based scholarships depending on your FAFSA results.

- Nonprofit organizations

- Local and national businesses

- Professional associations in your field

You can also use sites like Fastweb and Scholarships.com to quickly search for scholarships that you might be eligible for.

Check Out: How to Pay for College With No Money Saved

3. Take out federal student loans

If you need to borrow for school, it’s usually best to take out federal student loans first. This is mainly because these loans come with federal benefits and protections — such as access to income-driven repayment plans and student loan forgiveness programs.

After you fill out the FAFSA, your school will send you a financial aid award letter detailing the federal loans and other aid that you’re eligible for. You can then choose which aid you’d like to accept.

- Direct Subsidized Loans, which are available to undergraduate students with financial need

- Direct Unsubsidized Loans, which are available to both undergraduate and graduate students regardless of financial need

- Direct PLUS Loans, which are available to students who want to pay for grad school as well to parents who want to help pay for their child’s education

It’s typically a good idea to rely on subsidized loans first since the government will cover the interest on these loans while you’re in school.

Learn More: Subsidized vs. Unsubsidized Student Loans: Know the Difference

4. Use private student loans to fill any gaps

After you’ve exhausted your scholarship, grant, and federal student loan options, private student loans could help fill any financial gaps left over. These loans are offered by private lenders and don’t come with federal protections. However, they do offer some benefits of their own, such as not having an application deadline and sometimes providing higher loan amounts compared to federal loans.

You’ll typically need good to excellent credit to qualify for a private student loan — a good credit score is usually considered to be 700 or higher. There are also some lenders that offer student loans for bad credit, but these loans usually come with higher interest rates compared to good credit loans.

A cosigner can be anyone — such as a parent, another relative, or a trusted friend — who is willing to share responsibility for the loan. Just keep in mind that this means they’ll be on the hook if you can’t make your payments.

If you decide to take out a private student loan, be sure to consider as many lenders as possible to find the right loan for you. Credible makes this easy — you can compare your prequalified rates from our partner lenders in the table below in two minutes.

| Lender | Fixed rates from (APR) | Variable rates from (APR) | Loan amounts | Loan terms (years) | Cosigners allowed |

|---|---|---|---|---|---|

| 3.79%+10 | 5.99%+10 | $2,001* to $400,000 | 5, 7, 10, 12, 15, 20 (depending on loan type) | Yes |

|

|||||

| 4.24%+1 | 5.99%+ | $1,000 to $350,000 (depending on degree) | 5, 10, 15 | Yes |

|

|||||

|

3.99%+2,3

| 5.59%+2,3 | $1,000 up to 100% of the school-certified cost of attendance | 5, 8, 10, 15, 20 | Yes |

|

|||||

| 4.24%+ | 5.44%+ | $1,000 to $99,999 annually ($180,000 aggregate limit) | 7, 10, 15 | Yes |

|

|||||

| 4.8%+8 | 7.75%+8 | $1,001 up to 100% of school certified cost of attendance | 5, 10, 15 | Yes |

|

|||||

| 5.75%+ | N/A | $1,500 or $2,000 up to school’s certified cost of attendance (depending on school type and minus other aid received) | 10, 15 | Yes |

|

|||||

| 4.150%9 - 15.49%9 | 5.37%9 - 15.70%9 | $1,000 up to 100% of school-certified cost of attendance | 10 to 20 | Yes |

|

|||||

your credit score. 100% free! Compare Now |

|||||

Lowest APRs reflect autopay, loyalty, and interest-only repayment discounts where available | Read our full methodology | 10Ascent Disclosures | 1Citizens Disclosures | 2,3College Ave Disclosures | 11Custom Choice Disclosures | 7EDvestinU Disclosures | 8INvestEd Disclosures | 9Sallie Mae Disclosures |

|||||

Factors to consider when selecting a college

In addition to ROI, there are also several other factors to keep in mind when choosing where to go to school, including:

- In-state vs. out-of-state tuition: Attending a public school in your state will generally be much less expensive than going to an out-of-state school. You might also be able to save even more if you’re able to live at home compared to living on campus.

- Cost of living: On top of tuition, fees, and books, you’ll also need to consider the cost of living in the school’s area, which includes basic living expenses like rent, groceries, and healthcare.

- Starting at community college: To keep your college costs as low as possible, you might consider completing your general education requirements and other prerequisite courses at a community college before transferring to a traditional four-year school.

- Nontraditional alternatives to college: Not every career field requires you to earn a degree at a traditional four-year school. In this case, a nontraditional program might be a less expensive option. For example, you might consider getting your education at a trade school, via an online program, or at a coding bootcamp.

- Prestige factor: Some colleges are highly regarded for certain programs or fields of study. Graduating from one of these prestigious institutions might lead to career and salary opportunities that you wouldn’t have otherwise. This could make attending one of these programs worth it, even if it’s more expensive than other options.

However, it’s important to set these emotions aside — this way, you can do your research and come to the most logical and cost-effective conclusion for your individual situation.

Tools to evaluate your investment in higher education

There are multiple tools available that can help you evaluate the ROI for various schools, such as:

- U.S. Department of Education: The Department of Education offers several resources for prospective students. For example, the College Affordability and Transparency Center can help you compare programs, costs, and student outcomes. And the College Navigator details graduation rates, job placement, and student loan defaults for colleges and universities.

- College Scorecard: This federal website provides a variety of financial statistics from colleges and universities, such as graduate salaries and the average student loan debt per student.

- JA Build Your Future app: Junior Achievement USA created this app to help students figure out what level of education for their chosen career field as well as to compare the cost of a degree to their potential income.

- Launch My Career: Previously known as College Measures, Launch My Career is an interactive tool created by the American Institutes for Research (AIR) to help prospective college students identify fields of study that offer high ROIs on a state-by-state basis.

- PayScale: This salary comparison tool offers lists of schools ranked by income potential. PayScale compiles the average earnings of alumni from over 1,000 schools, relying on self-reported surveys to determine the salaries.

Methodology

The ROI calculations in this article were determined by:

- Adding the out-of-pocket cost of attendance and the amount of income the student would forgo by attending college

- Subtracting this from the total amount of income the graduate would receive over the following 20 years

Jimmy Karnezis contributed to the reporting of this article.