Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

While the average cost of attendance at California schools is slightly less compared to the national average, you might still need the help of scholarships, grants, or California student loans to cover all of your costs.

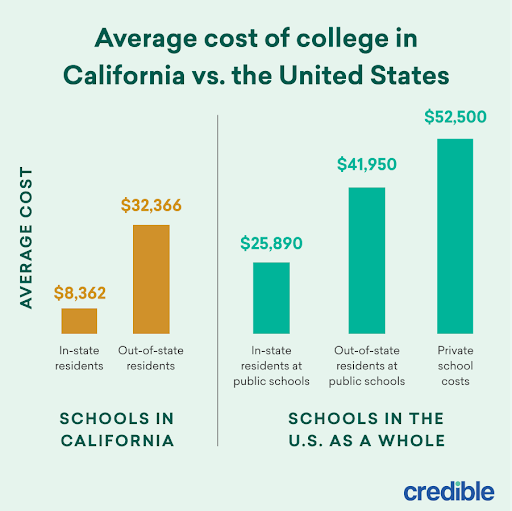

If you plan to attend the University of California Los Angeles, Santa Ana College, or any of California’s other schools, here’s what you can expect to pay according to EducationData.org compared to the national average cost of college for the U.S. as a whole:

Here are three ways to pay for school in California:

- Start with scholarships and grants for California students

- Apply for federal student loans

- Use private student loans to fill in the gaps

1. Start with scholarships and grants for California students

College scholarships and grants are a good place to start when it comes to paying for school — mainly because they don’t need to be paid back, unlike student loans. Plus, there are plenty of scholarships and grants available specifically for California students.

Here are a few options to consider:

- Cal Grants are available to students who have lived in California for at least one year and who are attending a University of California, California State University, California Community College, or another qualifying California school. These grants can be worth up to $14,226, depending on the type of school you attend.

- California Teachers Association (CTA) Scholarships range from $3,000 to $5,000 and are available to CTA members and their dependent children as well as to student Student CTA members.

- eQuality Scholarships are worth $6,000 and are available to students in northern or central California who have demonstrated service to the LGBTQ+ community.

- Pine Cone Foundation (PCF) Scholarships are geared toward California students with learning disabilities who are attending community college. These scholarships are worth up to $3,500 over three years.

Some colleges and universities also offer school-specific grants and scholarships, which are generally awarded based on your FAFSA results. Some state-based grants, such as Cal Grants, use FAFSA results as part of their application process, too.

If scholarships and grants don’t fully cover your college costs, you could also consider using federal or private student loans to cover your other expenses. Just be sure to think about how much a student loan will cost you in the future before you decide to borrow.

You can find out how much you’ll owe over the life of your federal or private student loans using our student loan calculator below.

Enter your loan information to calculate how much you could pay

With a $ loan, you will pay $ monthly and a total of $ in interest over the life of your loan. You will pay a total of $ over the life of the loan, assuming you're making full payments while in school.

Need a student loan?

Compare rates without affecting your credit score. 100% free!

Checking rates won’t affect your credit score.

Learn More: Is My College Housing Covered by Financial Aid?

2. Apply for federal student loans

If you’ve pursued scholarships and grants but still need to borrow money for school, federal student loans are generally a good place to start.

This is mainly because these loans come with federal benefits and protections, such as access to income-driven repayment and student loan forgiveness programs.

There are the types of federal loans you might qualify for as a California student:

- Direct Subsidized Loans are available to undergraduate students with financial need. The interest on these loans is paid for by the government while you’re in school, meaning you’ll have less to repay later.

- Direct Unsubsidized Loans are available to both undergraduate, graduate, and professional students, regardless of financial need. Unlike subsidized loans, interest continues to accrue on unsubsidized loans while you’re in school.

- Direct PLUS Loans come in two types: Grad PLUS Loans for students who want to pay for grad school and Parent PLUS Loans for parents who want to cover their child’s education. Keep in mind that the interest rates on PLUS Loans are typically higher than on subsidized and unsubsidized loans. They also require a credit check.

| Loan type | Who qualifies? | Interest rates | Loan limits |

|---|---|---|---|

| Direct Subsidized Loans | Undergrad students with financial need | 5.50% | $3,500 to $5,500 per year |

| Direct Unsubsidized Loans | Undergrad, graduate, and professional students | Undergrad: 5.50% Graduate and professional: 7.05% | Dependent undergrad: $5,500 to $7,500 per year ($31,000 total limit) Independent undergrad: $9,500 to $12,500 per school year ($57,500 total limit) Graduate and professional: $20,500 per year ($138,500 total limit) |

| Direct PLUS Loans | Parents, graduate students, and professional students | 8.05% | Cost of attendance minus any other financial aid received |

There are also student loan limits that apply depending on the type of federal student loan. For example, you might be able to borrow up to $5,500 per year in Direct Subsidized Loans as an undergraduate student.

PLUS Loans, on the other hand, could cover up to your school’s cost of attendance minus any other financial aid you’ve received.

Check Out: Low-Interest Student Loans

3. Use private student loans to fill in the gaps

After you’ve exhausted your scholarship, grant, and federal student loan options, private student loans could help you fill any financial gaps left over.

- Higher borrowing limits: You might be able to borrow up to your school’s cost of attendance.

- Potentially lower interest rates: You might qualify for a lower interest rate than you’d get on a federal loan, depending on your credit.

- Might be available for other types of schooling: Depending on the lender, you might be able to use a private loan to pay for non-traditional schooling options, such as coding bootcamps or trade schools.

You’ll typically need good to excellent credit to qualify for a private student loan. Some lenders offer student loans for bad credit, but these generally come with higher rates than good credit loans.

If you decide to take out a private student loan, be sure to consider as many lenders as possible to find the right loan for you.

Credible makes this easy — you compare your prequalified rates from our partner lenders in the table below in two minutes. Plus, all of these lenders are available in California.

| Lender | Fixed rates from (APR) | Variable rates from (APR) | Loan terms (years) | Loan amounts |

|---|---|---|---|---|

| 3.79%+10 | 5.99%+10 | 5, 7, 10, 12, 15, 20 (depending on loan type) | $2,001* to $400,000 |

|

||||

| 4.24%+1 | 5.99%+ | 5, 10, 15 | $1,000 to $350,000 (depending on degree) |

|

||||

|

3.99%+2,3

| 5.59%+2,3 | 5, 8, 10, 15 | $1,000 up to 100% of the school-certified cost of attendance |

|

||||

| 5.75%+ | N/A | 10, 15 | $1,500 or $2,000 up to school’s certified cost of attendance (depending on school type and minus other aid received) |

|

||||

| 4.150%9 - 15.49%9 | 5.37%9 - 15.70%9 | 10 to 20 | $1,000 up to 100% of the school-certified cost of attendance |

|

||||

your credit score. 100% free! Compare Now |

||||

Lowest APRs reflect autopay, loyalty, and interest-only repayment discounts where available | Read our full methodology | 10Ascent Disclosures | 1Citizens Disclosures | 2,3College Ave Disclosures | 11Custom Choice Disclosures | 7EDvestinU Disclosures | 8INvestEd Disclosures | 9Sallie Mae Disclosures |

||||

Learn More: How to Get a Student Loan for Online College

Students in California have plenty of options to pay for college

When it comes to covering education costs, you’ll likely need to cobble together multiple payment options. Remember to start with scholarships and grants that don’t have to be repaid before moving on to federal student loans and finally private student loans.

If you decide to take out a private student loan, compare as many lenders as you can to find the right loan for your needs. Credible makes this easy — you can compare your prequalified rates from multiple lenders in two minutes.

See Your Rates

Checking rates will not affect your credit

Keep Reading: