Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

If you want the best deal on your home purchase, then comparing loan offers is critical. But loan estimates are filled with many facts, figures, and calculations which can be complicated — particularly if you’re a first-time homebuyer.

Don’t let all those numbers overwhelm you, though. As long as you understand the mortgage rate you’re getting, then you have a good foundation on which to compare your loan offers.

Here’s what you should know about mortgage rates:

- What is a mortgage rate?

- How are mortgage rates now?

- What mortgage rates are determined by

- Mortgage rates are personal and can change between lenders

What is a mortgage rate?

A mortgage rate reflects how much you’ll pay to take out the loan. It’s the interest you’ll owe annually which will be a percentage of your loan’s total balance.

There are both fixed-rate and adjustable-rate mortgage loan options. With fixed rates, your interest is consistent throughout the entire course of your loan.

If you have an adjustable-rate loan, your interest rate can fluctuate after a certain amount of time, sending your monthly payment up or down with it. The 5/1 ARM is one of the most popular forms of adjustable-rate mortgages. This gives you a set interest rate for the first five years, then the rate adjusts once per year after that.

Credible can help you compare multiple lenders.

Learn More:

How are mortgage rates now?

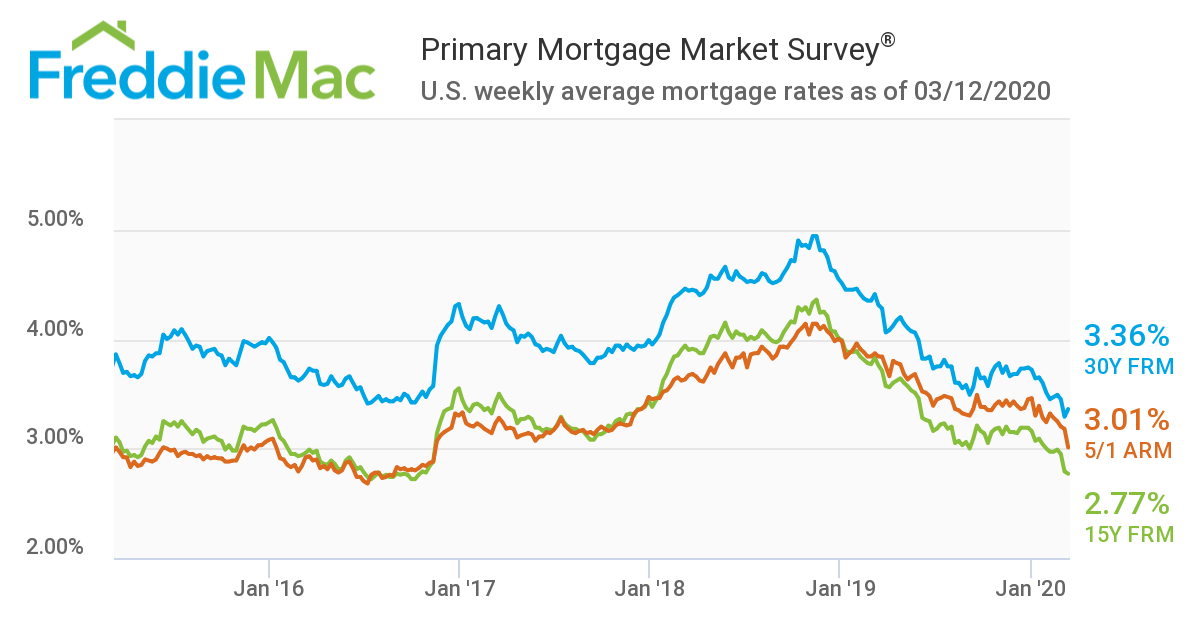

As of March 5, 2020, mortgage rates were at all-time lows. Rates on 30-year, fixed-rate mortgages are around 3.36%, while 15-year, fixed-rate loans hover at 2.77%. Rates on 5/1 ARMs are in the low 3% range, as well.

Rates have been steadily declining since late 2018. Check out these average mortgage rates over the years:

Keep Reading: 30 Mortgage Terms to Know: Ultimate Glossary for Homebuyers

What mortgage rates are determined by

Lenders set mortgage rates on a borrower-by-borrower basis. They take into account larger economic factors, as well as the borrower’s personal financial situation.

Here’s a breakdown of what is typically considered:

| Larger economic factors | Personal economic factors |

|---|---|

|

|

Larger economic factors

The bigger financial picture plays a big role in what rates mortgage lenders are able to offer. The strength of the economy, inflation rates, employment numbers, and things like consumer spending, construction, and the stocks and bonds markets all play a role. The 10-year Treasury yield, which is how much investors make on federal bonds and notes, also plays a role. As yields rise, so do fixed-rate mortgage rates (and vice versa).

Learn More: Mortgage Rate Lock

Personal economic factors

It’s not all external, though. Your own personal financial scenario will also impact what mortgage interest rates you’ll be offered. Your credit score will be a big influencer, as will things like your down payment size, the amount of money you’re borrowing, your income, and more.

Generally, to get the lowest interest rate, you should have a:

- Credit score of 760 or above

- Down payment of 20% or more

- Low loan-to-value ratio (low loan balance compared to the home’s value)

- Low debt-to-income ratios (low total debts compared to your total household income)

Whether or not you choose to buy discount points will also impact your rate. Discount points work as sort of a tradeoff: You pay your lender an upfront fee and, in exchange, they give you a lower interest rate on your loan.

Learn More: APR vs. Interest Rate: Understanding the Difference

Mortgage rates are personal and can change between lenders

Mortgage rates aren’t cut and dry. While economic conditions and your own personal finances play a role, so does the lender you choose. Keep in mind that you can also influence your rate by paying points, so be sure to factor this in when comparing your loan options.

If you want the best mortgage rate, it’s critical that you compare loan offers from multiple mortgage lenders. Credible makes this fast and easy: Just fill out some information, and you’ll be able to compare lenders without it affecting your credit score.

Find Out: How to Negotiate a Better Mortgage Rate