Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Student loan refinance interest rates have decreased by 0.03 percentage points for 10-year fixed rates, while 5-year variable rates have dropped by 0.92 percentage points.

Here are the latest trends in private student loan interest rates from the Credible marketplace, updated weekly.

During the week of Apr. 15, 2024:

- Rates on 10-year fixed-rate loans averaged 7.40%, down from 7.43% the week before and up from 6.96% a year ago. Rates for this term hit their lowest point of 2023 during the week of July 24, when they were at 5.63%.

- Rates on 5-year variable-rate loans averaged 5.88%, down from 6.80% the week before and up from 5.69% a year ago. Rates for this term hit their lowest point of 2023 during the week of March 6, when they were at 4.79%.

Private student loan historical rate trends

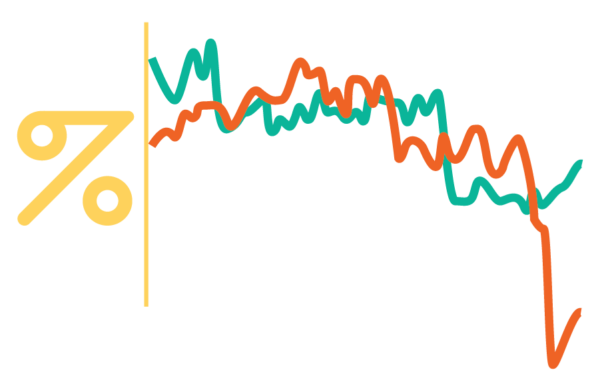

The chart above shows average selected prequalified rates for borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender. The chart lists weekly rates for the last two years.

As in most other types of borrowing, private student loan rates began to trend upward in March 2022 after the Federal Reserve approved its first rate hike in three years. Since then, the Fed has continued to slowly increase rates in an effort to tamp down inflation. As of October 2023, the Fed’s benchmark rate is the highest it’s been in more than 20 years, though signs indicate that the rate hikes may be slowing.

While the Fed’s rate increases can significantly affect the cost of private student loans, federal student loans are generally more stable. That’s because federal loans come with fixed rates that are set annually by Congress. For the 2023-24 school year, federal loan rates are:

- Direct Subsidized Loans and Direct Unsubsidized Loans (undergrads): 5.50%

- Direct Unsubsidized Loans (professional or graduate students): 7.05%

- Direct PLUS Loans (professional or grad students, or parents of undergrads): 8.05%

However, not everyone is eligible for federal student loans, or borrowers may have reached their maximum borrowing limits. In that case, private student loans can provide a convenient source of funding for college.

In addition to general economic conditions, rates on private student loans depend on factors including the borrower or cosigners’ credit, income, and loan term. Because each lender is likely to offer you a different rate, it’s important to research and compare lender offers to see which can offer you the best deal.

See Your Rates

Checking rates will not affect your credit

Current private student loan interest rates by credit score

If you qualify for a private student loan, the interest rate offered to you depends on many factors, including:

- Your credit. One of the most significant factors that determines your interest rate is your credit score and credit report. If you have weak credit, consider adding a cosigner to your application. Doing so can help you get approved or qualify for better rates than you would have alone.

- Your debt-to-income (DTI) ratio. Your DTI represents how much of your monthly income goes to paying off your debt. The lower your debt-to-income ratio, the lower rate you can likely qualify for.

- If you choose a fixed or variable rate. Fixed rates stay the same over the life of your loan, while variable rates can fluctuate according to market conditions. It’s common for variable rates to start out lower than fixed ones, but it’s possible that variable rates could increase in the future, making your loan more expensive.

- The loan repayment term. Lenders typically view longer term loans as riskier. Because of this, you may get a lower interest rate if you agree to pay off your loan more quickly. Note that this will make your monthly payments higher than a longer loan term would.

Every lender has its own methods of evaluating borrowers, so it’s a good idea to request private student loan rates from multiple lenders and compare your options. Through Credible, you can compare rates from the lenders below without affecting your credit score.

| Lender | Fixed Rates From (APR) | Variable Rates From (APR) |

|---|---|---|

| 3.09%+10 | 4.31%+10 | |

|

||

| 3.24%+1 | 4.95%+ | |

|

||

|

3.19%+2,3

| 4.24%+2,3 | |

|

||

| 3.24%+ | 4.15%+ | |

|

||

| 4.59%+8 | 6.76%+8 | |

|

||

| 3.29%+ | N/A | |

|

||

| 3.190%9 - 16.99%9 | 4.37%9 - 16.490%9 | |

|

||

Lowest APRs reflect autopay, loyalty, and interest-only repayment discounts where available. Prequalified rates are not an offer of credit. | 10Ascent Disclosures | 1Citizens Bank Disclosures | 2,3College Ave Disclosures | 11Custom Choice Disclosures | 7EDvestinU Disclosures | 8INvestEd Disclosures | 9Sallie Mae Disclosures |

||

About Credible

Credible is a multi-lender marketplace that empowers consumers to discover financial products that are the best fit for their unique circumstances. Credible’s integrations with leading lenders and credit bureaus allow consumers to quickly compare accurate, personalized loan options ― without putting their personal information at risk or affecting their credit score. The Credible marketplace provides an unrivaled customer experience, as reflected by over 6,600 positive Trustpilot reviews and a TrustScore of 4.7/5.