Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

Are you getting the most value out of your credit card rewards?

Our mission at Credible is to bring simplicity, choice, and unbiased support to all of life’s financial decisions. There are seemingly countless credit card options with varying interest rates, sign-up bonuses, rewards, and exclusive offers. While these are all enticing benefits, determining what benefits are most valuable to you requires an assessment of your current financial position and personal preferences.

Credible has taken a comprehensive approach to help our users navigate the credit card selection process. One component of this analysis is estimating the dollar value, a “Credible Rewards Point Value”, of each reward point earned through a credit card program.

Approach to Determining a Card’s “Credible Rewards Point Value”

Credible’s Analytics Team assessed each of the credit cards available on our platform based upon their primary rewards category, e.g. airline travel, hotel stays, and cash back rewards.

Please note that the Credible Rewards Points Value is just one aspect of Credible’s approach to assessing credit cards and helping Credible users find the best credit card for them. It’s important to remember to review the credit card issuers terms and conditions and assess your own personal financial goals, before selecting and applying for a credit card.

Credible Rewards Point Value for Airline Travel

Some credit cards primarily focus on offering their cardholders rewards for airline travel. To calculate the Credible Rewards Point Value of rewards for credit card points redeemed for flights, Credible first determined the prices of the most commonly flown domestic and international flights. Then, we searched to find the price of those very same flights if purchased by redeeming points from an airline travel rewards card.

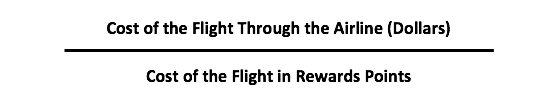

The Credible Rewards Point Value for airline travel rewards cards is determined by dividing the cost of the flight purchased through the airline by the cost of the flight if redeeming with credit card rewards points:

For example, if the cost of a flight from San Francisco to New York is $500 purchased through an airline, and the same flight costs 50,000 rewards points when redeeming with rewards points from an issuer, then the rewards points value is $0.01 for that flight. To ensure that each credit card is valued as accurately and equitably as possible, these calculations are based on the price of main cabin seats, for flights on the same day, at the same departure time.

To arrive at a final Credible Rewards Point Value for each card, we take the average of the rewards points value for each flight that we analyzed as part of this assessment.

Credible Rewards Point Value for Hotel Stays

To calculate the value of rewards for credit card points redeemed for hotel stays, Credible determined the price of a room in a 3, 4, and 5-star hotel in the most popular domestic and international travel destinations for American travelers. Then, we searched to find the price of the same rooms if purchased by redeeming points from a hotel stay rewards credit card. In the same way we assessed each airline travel rewards credit card as accurately and equitably as possible, the calculations for each card use standard room rates at the same hotels, on the same nights.

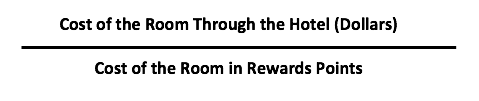

The Credible Rewards Point Value for hotel stay rewards cards is determined by dividing the cost of the room purchased through the hotel by the cost of the room if redeeming with credit card rewards points:

For example, if the cost of a hotel in Chicago is $250 purchased through a hotel, and the same room costs 20,000 rewards points when redeeming with rewards points from an issuer, then the average rewards points value is $0.0125 for that hotel stay.

To come to a final Credible Rewards Point Value for each card, we take the average of all rewards points values for each hotel room that we analyzed as part of this assessment.

Credible Rewards Point Value for Gift Cards and Merchandise

Determining the Credible Rewards Point Value for credit cards that offer gift cards or merchandise as rewards is similar to the process used for airlines and hotels. To calculate the Credible Rewards Point Value for credit cards in these categories, we take the average of the Credible Rewards Point Value for cash back and the redemption of rewards for things such as gift cards and merchandise.

To determine the Credible Rewards Points Value for Gift Cards and Merchandise, we compared the value of the gift card to how many rewards points must be redeemed for that gift card. For example, if a credit card issuer offers a $100 gift card in exchange for the redemption of 10,000 rewards points, the Credible Rewards Point Value for this card would be $0.01.

Credible Rewards Point Value for Transferable Rewards

Some credit card issuers offer their cardholders the opportunity to transfer rewards to another program, such as a hotel rewards program. To calculate the Credible Rewards Points Value for these credit card programs, we first determine the ratio at which points can be exchanged (1-to-1, 2-to-1, etc.). This helps us determine the exchange rate for the transferable rewards. For example, if a credit card issuer offers a 2-to-1 redemption rate for hotel rewards, 50,000 in credit card rewards would transfer to 25,000 in hotel rewards. Therefore, the exchange rate for points between these two programs would be 0.5.

Once the exchange rate of the program has been determined, we then multiply the exchange rate by the Credible Rewards Points Value for that program. Using the example above, if the Credible Rewards Points Value for that hotel group is $0.0095 and the exchange rate is 0.5, then the Credible Reward Points Value is $0.00475 when transferring points between programs.

Conclusion

The Credible Rewards Points Value that we use on our website is based upon the primary purpose or benefit offered by the credit card. If a credit card is primarily focused on rewards for redemption through a particular airline, we will use the Credible Rewards Points Value when redeemed through that airline. For general credit card rewards programs, we will take the average Credible Rewards Points Value across the card’s various offerings.